Thesis

In this article, I’ll explore the financial metrics, operational strategies, growth indicators, and potential risks associated with Motorcar Parts of America, Inc. (NASDAQ:MPAA) Despite facing headwinds like increasing interest expenses and supply chain disruptions, the company presents an intriguing investment opportunity backed by robust sales growth, efficient cost control, and a promising financial outlook.

Company Overview

Headquartered in Torrance, California and boasting a robust history since its inception in 1968, MPAA wears many hats – it is a manufacturer, remanufacturer, and distributor of indispensable replacement parts. Their geographic reach spans the United States, delivering solutions that cater to the diverse needs of heavy-duty truck, industrial, marine, and agricultural applications.

Motorcar Parts of America, Inc.’s portfolio is comprehensive and dynamic. It extends beyond the boundaries of typical offerings, providing a cornucopia of rotating electrical products, such as alternators and starters. It also covers wheel hub assemblies and bearings, constituting the linchpins of vehicular stability. The company’s brake-related offerings are also commendable, ranging from brake calipers, brake boosters, and brake rotors to brake pads and brake master cylinders.

Peering further into their diversified product range, we discover their turbo chargers – an important technology for enhancing engine efficiency. They’ve also made a mark in the realm of test solutions and diagnostic equipment. Interestingly, they’re not just confined to conventional combustion engine vehicles; their solutions extend to the burgeoning field of electric vehicles. With software emulation of power systems applications, the company is boldly carving out its niche in the electrification of various transport modalities.

In a bid to cater to heavy-duty needs, the company provides non-discretionary automotive aftermarket replacement hard parts. These are designed for heavy-duty truck, industrial, marine, and agricultural applications – sectors where downtime is costly, and the need for durable, reliable parts is paramount.

Their customer base is equally diverse. It includes automotive retail chain stores and warehouse distributors, in addition to various automobile manufacturers. The company isn’t just supplying for aftermarket programs but also stands as a reliable partner for warranty replacement programs across North America.

In essence, Motorcar Parts of America, Inc. is more than a seasoned player in the automotive and industrial parts industry. It is a diversified powerhouse that delivers a multitude of solutions to address a wide array of customer needs. Their commitment to both conventional and emerging transport technologies reflects their adaptability and foresight in a rapidly evolving industry landscape.

Expectations

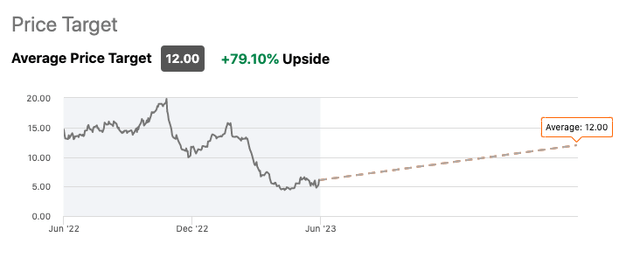

As of this writing, only one Wall Street analyst covers MPAA stock and they have a “buy” rating with a very generous upside projection of nearly 80%.

Seeking Alpha

Performance

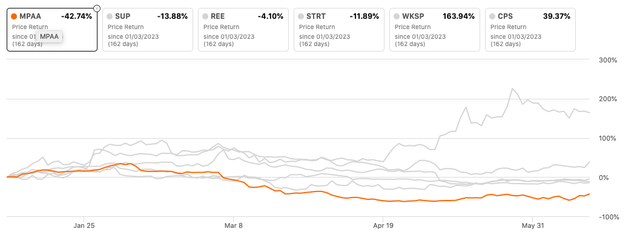

However, relative to its peers year-to-date, MPAA has been having significant difficulties getting its engine started and lags behind the pack in last place with a -42.74% price return.

Seeking Alpha

Valuation

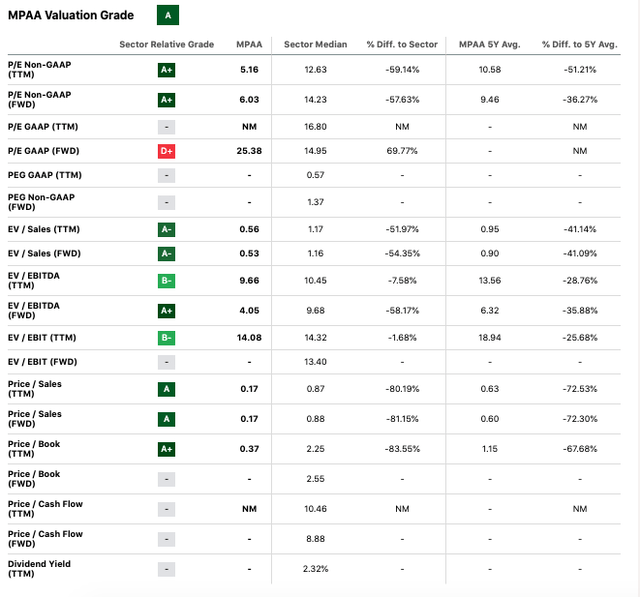

The P/E Non-GAAP (TTM) and P/E Non-GAAP (FWD) metrics, both with an “A+” grade (see below), are significantly lower than the sector median and the company’s five-year average, by 59.14% and 51.21%, and 57.63% and 36.27% respectively. This suggests that Motorcar Parts of America, Inc. is trading at a price which is potentially undervalued based on its earnings, offering potential upside for value-oriented investors.

The EV/Sales (TTM and FWD) also demonstrates an attractive picture. With a relatively low valuation of 0.56 and 0.53, the company is trading at about half the valuation of the sector median and significantly lower than its five-year average. This underlines the efficiency with which the company is turning sales into enterprise value, offering another compelling reason for value-based investment.

Seeking Alpha

Even though the EV/EBITDA (TTM) is relatively in line with the sector median, with a minor discount of 7.58%, the forward EV/EBITDA (FWD) paints an optimistic picture with a 58.17% discount to the sector median. This low multiple indicates a strong earnings potential relative to its enterprise value.

Furthermore, the Price/Sales (TTM and FWD) ratio, much like the EV/Sales ratio, is significantly below both the sector median and its five-year average, suggesting that Motorcar Parts of America, Inc.’s sales are not yet fully reflected in its stock price.

However, the P/E GAAP (FWD) metric stands as an outlier with a “D+” rating, clocking in at 69.77% above the sector median. This might suggest some risks or potential overvaluation based on GAAP earnings.

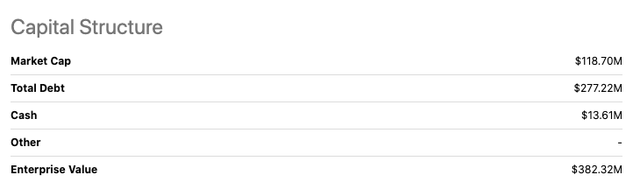

Seeking Alpha

A look at the company’s capital structure (see above) reveals a market cap of $118.70M and a somewhat elevated total debt figure of $277.22M. Despite the high debt, the company’s enterprise value of $382.32M suggests a strong business base. Nevertheless, managing this debt level will be crucial for the company moving forward.

Q4 2023 Earnings Bullish Takeaways

Let’s first delve into sales growth. The company has experienced a substantial net sales growth of 18.8%, escalating to a record-breaking figure of $194.7 million. This isn’t a mere coincidence but reflects the burgeoning demand for their products and strategic price augmentations. When we talk about increased product demand, we are implicitly referencing the company’s proficiency in addressing customer needs and staying competitive in the market.

Meanwhile, their ability to successfully hike up prices is indicative of their growing pricing power-a characteristic of industry leaders and a strong competitive advantage. This amalgamation of flourishing demand and pricing power hints at a strong market position and the potential for sustained growth.

Switching gears to gross profit, there has been a significant 40.3% surge, reaching $36.2 million compared to $25.8 million the previous year. A gross profit uptick of this magnitude doesn’t happen in isolation-it’s a testament to a well-orchestrated operational efficiency strategy. When gross profit margin expands at such a rate, it points towards the company’s improved cost control over direct materials and labor, and possibly towards increased production efficiency. Therefore, the current gross profit increase underscores the company’s success in implementing streamlined and cost-effective operations, making it a lucrative investment from an operational standpoint.

Now, moving on to the cost reduction initiatives that Motorcar Parts of America has undertaken, the $8.6 million decrease in operating expenses for the quarter and the forecasted $5 million annual run-rate expense reductions are certainly worth noting. Any company’s capacity to rein in costs while maintaining or growing revenue is a positive indicator of fiscal responsibility and operational efficiency. The company’s conscious effort to reduce expenses speaks volumes about its dedication to improving its bottom line. The implemented cost reduction strategies could lead to expansion in profit margins, a critical component for future earnings growth and shareholder value enhancement.

Looking ahead, the company doesn’t just seem content with the current financial performance. They anticipate more profitability in fiscal 2024 from the culmination of certain price increases, greater sales volumes, and continued cost reduction initiatives. On this front, CEO Selwyn Joffe elaborated on the June 13 earnings call that:

…we expect sales for fiscal 2024 to be between $720 million and $740 million, representing between 5.4% and 8.3% year-over-year growth, respectively. We expect to see margin accretion from efficiencies related to the higher-volume and cost-cutting initiatives as I noted earlier in my remarks. With respect to cash-flow, our expectation is to continue to make progress to generate cash. Operating income is expected to be between $60 million and $65 million before the non-cash foreign-exchange impact of lease liabilities and forward contracts. The non-cash impact of revaluation of cores on customers’ shelves, and supply chain disruptions.

This forward-looking statement paints a picture of a robust financial outlook with more earnings growth in the offing. Such an optimistic forecast, when it comes from the horse’s mouth, is indicative of the company’s confidence in their strategic initiatives and underlying business model.

Lastly, the company’s liquidity position cannot be ignored. The fact that they ended the quarter with approximately $98.6 million in total cash and availability on the revolving credit facility illustrates their healthy cash position. A strong liquidity profile equips a company with the flexibility to respond to potential challenges or invest in growth opportunities, thereby buffering against unexpected market volatilities and supporting future expansion plans.

Risks and Headwinds

First off, let’s ponder over the elephant in the room – the soaring interest expenses. These costs skyrocketed from $4 million to a staggering $11.9 million within a year, primarily owing to a spike in market interest rates, specifically those linked to customer vendor financing programs. Here, the key question for the company, and for investors like us, is: What if the market interest rates remain elevated or even climb further? A continuation of this trend may impose a heavier financial load on the company, thus impacting profitability and potentially straining its financial health.

Next, the company is also grappling with unrealized price increases. Inflationary pressures have been gnawing at their quarterly performance, mainly due to costs that have not yet been compensated for through price increments. Now, this is a tightrope walk for the company. If it fails to effectively relay these additional costs to customers via increased pricing, the margins could feel the heat. This unaddressed inflation could turn into a profit-eating monster, thereby shaking the foundation of their financial stability.

Furthermore, supply chain issues, which have become somewhat of a global phenomenon, haven’t spared the company either. They reported transitory supply-chain disruption costs amounting to $2.9 million. And here’s the catch – if these challenges extend or become more severe due to wider macroeconomic conditions, it’s not just a question of additional costs. It could ripple through the company’s operations, affecting productivity, timeliness, and ultimately, financial performance. The disruption cost may seem modest for now, but its knock-on effects could be far-reaching.

Perhaps the most glaring issue to address is the net loss for fiscal 2023. Despite registering a surge in sales, the company found itself in the red, reporting a net loss of $4.2 million, which is a stark contrast to the net income of $7.4 million in the prior year. This unfortunate dip into loss territory can largely be traced back to higher non-cash and cash items tied to the aforementioned supply chain disturbances. It’s a grim reminder that heightened sales alone cannot guarantee profitability if expenses aren’t effectively controlled.

Last, but certainly not least, let’s address the issue of the ballooning tax expenses. The company saw its income tax expenses multiply tenfold from $1 million to a hefty $10.4 million within a year. High tax expenses pose a threat to earnings – they can potentially devour a chunk of profits unless the company can counterbalance them with higher revenue generation. The threat of increased taxes looms large and could play a significant role in the company’s future earnings outlook.

Final Takeaway

Despite some notable headwinds, Motorcar Parts of America, Inc. presents a compelling investment case when evaluated through the lens of its robust growth rates, strategic cost reduction initiatives, strong market position, and healthy liquidity profile. The company’s apparent dedication to driving operational efficiency and fiscal responsibility, along with the promise of continued growth, paints a bullish picture for prospective investors. However, potential investors must factor in the challenges of soaring interest expenses, unrealized price increases, supply chain disruptions, and an unfavorable tax scenario. Balancing these considerations, I’m of the opinion that the potential upsides outweigh the downsides, and would thus recommend a buy position on Motorcar Parts of America, Inc. stock.

Read the full article here