Higher interest rates have resulted in competition for perceived slower growing asset classes such as REITs. While it may be tempting to park substantial capital in a 4-5% high yield savings account, there’s no telling for how long the high interest rate may last.

Plus, it seems as if the Fed is starting to cool on rate hikes, with the Fed Chairman recently pausing rate hikes in June, and calling for just 2 rate hikes later this year.

A moderating interest rate environment may be just what net lease REITs need, and this brings me to Alpine Income Property Trust (NYSE:PINE), which is one of the highest yielding REITs in this sector. I last covered PINE here in April last year, highlighting its transition towards retail properties. In this article, I provide an update and discuss why the current price and yield are appealing for value investors.

Why PINE?

Alpine Income Property Trust is a net lease REIT that’s externally managed by CTO Realty Growth (CTO). At present, it carries 145 properties across 34 states, and doesn’t carry risks of office properties as it now has a 100% pure-play retail portfolio.

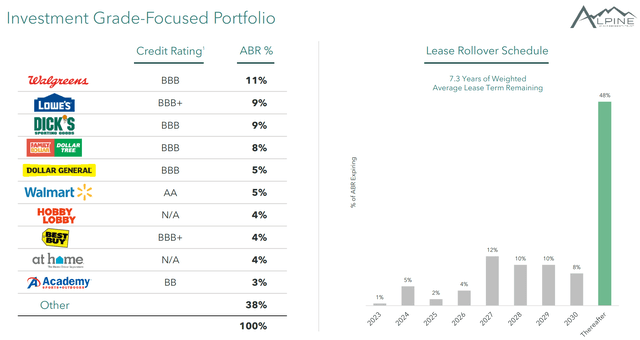

PINE enjoys strong occupancy of 99.5% with 62% of its annual base rent coming from investment grade rated tenants. It’s worth noting that net lease REITs generally try to balance IG and non-IG rated tenants, as the latter category pays higher rents. This is no different from what peers Realty Income Corp (O) and NNN REIT (NNN), as they also have around ~50 exposure to IG rated tenants.

PINE’s portfolio is well-located, as 48% of its ABR comes from metropolitan statistical areas with over one million people. The total portfolio weighted average 5-mile average household income sits above the national median household income of $70,784, at $97,500 with a healthy 5-mile population density of 113,500 people.

Notable names that are generally e-commerce resistant such as Walgreens (WBA), Lowe’s (LOW), Dick’s Sporting Goods (DKS), Dollar Tree (DLTR), and Walmart (WMT) make up PINE’s top tenants. It also has well-staggered lease maturities, with just 1% of ABR expiring this year, and 5% and 2% expiring over the next 2 years, as shown below.

Investor Presentation

Given the smaller size of PINE’s portfolio, investors should expect more volatile results. This is reflected by AFFO per share declining by 25% YoY to $0.36 during the first quarter. Nonetheless, this still provided healthy dividend coverage with a 76% payout ratio, after the recent 1.9% YoY dividend increase to $0.275 per share.

The decline in AFFO/share was due to $165,000 worth of non-repeating percentage rent that was received in the Q1 of 2022, revenue drag from first quarter asset sales for which the proceeds have not yet been deployed, and the YoY negative investment spread from PINE selling its sole remaining office property, enabling it to become a pure-play retail REIT.

The good news is, however, that PINE currently has plenty of dry powder on hand to invest in assets with potentially attractive cap rates, as it has more than 10% of its assets in cash and restricted cash to take advantage of market dislocation. Management has demonstrated its capability in accretive asset recycling, generating over a 110 basis point spread between asset dispositions and acquisitions in recent years.

At the same time, PINE is rather immune to higher interest rates on its existing debt in the near-term, as it has no debt maturities until May 2026 and has no floating rate interest exposure. Management has also made good progress in deleveraging, with the net debt to pro forma EBITDA declining from 7.1x at the end of last year to 6.4x as of Q1 2023.

Lastly, PINE trades at a meaningful discount to its peers at the current price of $16.23 with a forward P/FFO of 10.7, sitting below the 14 to 17 range of peers Realty Income Corp, NNN REIT, and Agree Realty (ADC), resulting in a well-above average 6.8% dividend yield. While PINE is externally-managed, it does have strong alignment of interest from CTO Realty Growth, its external manager, which holds a 15% interest in PINE.

Moreover, it’s not uncommon for smaller REITs to be externally managed until they build the scale necessary to internalize. PINE currently pays CTO a 0.375% quarterly management fee (calculated on equity), and this arrangement is terminable with payment of a one-time fee of 3x the annualized average management fee for the preceding 24 months.

As such, believe PINE’s discount to peers is excessive, and investors could see double-digit returns should it return to a more reasonable P/FFO of just 12x. Analysts who follow the company have an average price target of $19.88, representing a potential 22% upside based on price appreciation alone.

Investor Takeaway

Overall, I believe PINE is an attractive pick for value investors given its current 6.8% dividend yield, and the potential upside should it return to a more reasonable multiple of just 12x P/FFO. The discount to peers is excessive given there are no near-term debt maturities and its externally managed structure is not uncommon in smaller REITs. PINE also has plenty of dry powder thanks to its 10%+ cash balance, to take advantage of attractive pricing. As such, patient value investors may want to take a hard look at this high yielding stock at current levels.

Read the full article here