Investment Rundown

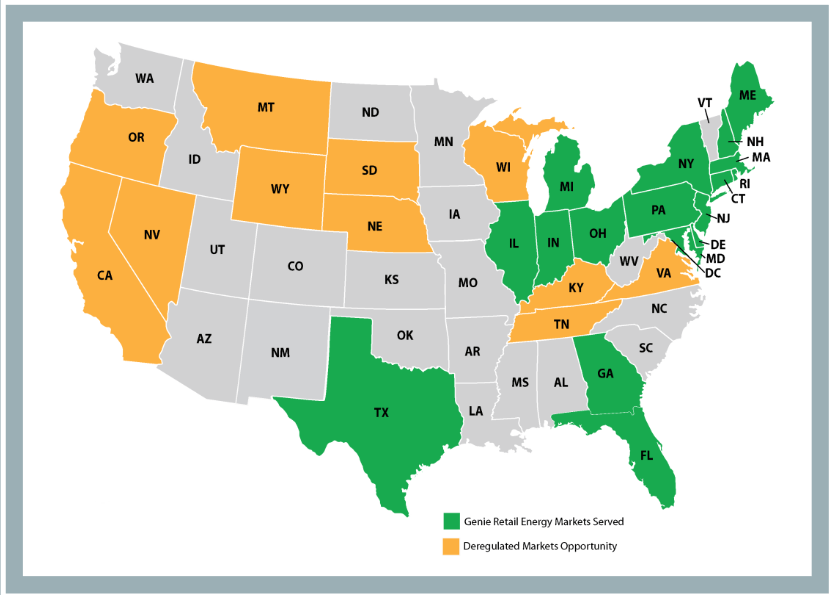

Genie Energy Ltd. (NYSE:GNE) has been able to impressively grow its margins over just the last few years and sits now at around 42% in gross margins, up from around 28% just 3 years ago. GNE has a p/e right now just around the 7 mark, and I think it offers little risk when viewing GNE as a long-term play. The company is operating as an electricity and natural gas seller in deregulated markets across the US.

Market Overview (Investor Presentation)

This niched industry is actually seeing some tailwinds, with plenty of additional states considering deregulating. Right now, GNE is barely serving half the states which are deregulated. That in my opinion means GNE still has plenty of room to grow. With no debt on the balance sheet, much of the profits can be diverted to shareholders instead. Over the last few years, this has come in the shape of dividends primarily but also buybacks of shares. With still plenty of markets to be served and a solid margin maintenance and improvement, I think GNE is a buy at these price levels.

Company Segments

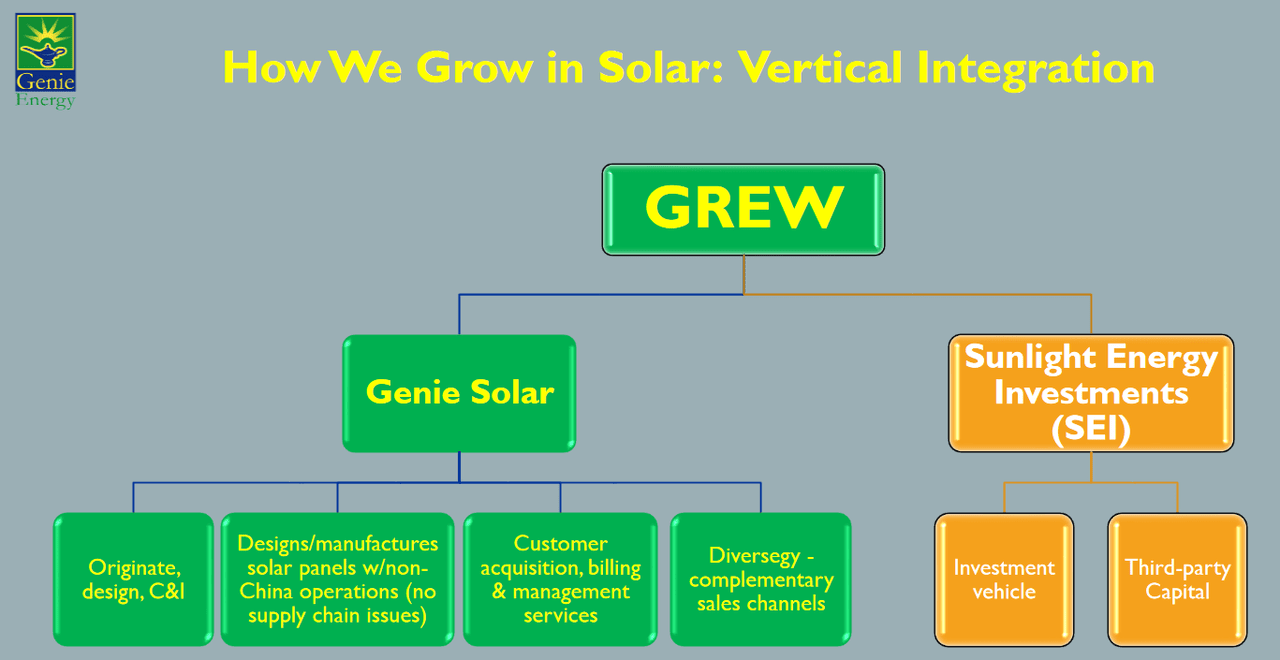

Engaging in the energy sector, GNE has exposure to both electricity and natural gas demand, seeing as they are retailers of both in some states in the US. Looking at the last report by the company, they saw most of the growth in the electricity part of the business, where revenues grew 25% YoY. But even though GNE has a solid position in these industries, they also have a new and exciting project where they focus on renewables. There the revenues increased massively, YoY, but still don’t make up a significant amount of the revenues.

Growth Plan (Investor Presentation)

Where I will be placing my focus will be the development of the solar part of the business. The trend towards renewables is shaping up quite strongly, and I think it would be healthy for GNE as a business to lean into that and capitalize on it. As GNE is largely a cyclical company, buying when the company looks undervalued to peers is preferable, which right now seems to be the case. This cyclical nature is also responsible for the margins being inconsistent during some quarters, but the uptrend seems strong still for GNE.

Financials

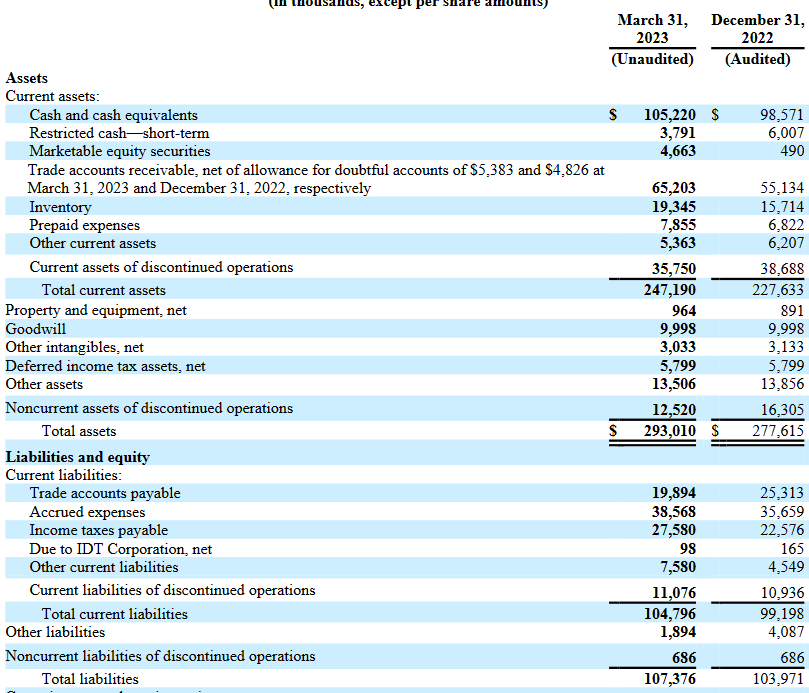

A highlight of GNE has to be the balance sheet that they have. They are still debt free and have kept it like that for the last several years. This means they have been able to use the FCF to boost shareholder value through dividends and buybacks. But looking specifically at the balance sheet, it has meant GNE has built up a strong cash position right now. With over $100 million in cash, it has meant a solid improvement over just the last 3 years of about $70 million.

Balance Sheet (Earnings Report)

Where there might be some concern is that the improvement in the cash balance was due to the sale of two of the business the company owned, both Lumo Sweden and Orbit Energy. The addition to the cash balance is great, but with that said, improvements in the cash flows will be necessary if we are to see a continued trend of this.

With a negative net debt of $108 million, the company seems to be in a phenomenal position right now to manage its balance sheet, and I don’t expect to see any significant challenges facing the company in this way. This position with the balance sheet has ensured GNE has a solid ROC of 25% right now, which I think they will be able to leverage efficiently to help fund further expansion.

Industry Comparison

Right now one of the benefits to owning GNE would be the buybacks they are doing but also the dividends they have. They have a yield right now of about 2.13%, but that is still behind some of the more well-established and larger players in the industry. Some notable ones would be Consolidated Edison (ED) and Duke Energy Corporation (DUK) for example. ED has a yield of 3.5% and DUK has a yield of 4.4%. Just on that metric, they look far more appealing as a dividend opportunity than GNE.

But where the value could be had is that GNE is trading a fair bit below both of these companies, with a p/e of just around 7. Far below the other two which have 19 and 16 respectively. I think if GNE is proving itself able to grow at the rate they are doing and maintain that, then the upside potential in terms of share appreciation seems very favorable. Where GNE actually remains very solid is when comparing the margins between the companies, here, GNE has similar gross margins but wins out in terms of levered FCF margins with their 16%. Looking at both ED and DUK this negative FCF margin has led to share dilution, something that investors haven’t had to experience with GNE. In the long-run, GNE seems to offer the most upside right now out of these three.

Risks

Where I find the risks regarding this company is that they are prone to face regulatory challenges. With their industry not being very popular in the current climate of talking about where our energy should be coming from, they might face pressure from certain governmental ways.

Besides that, entering new markets is capital intense, and it might cause GNE to have to divert capital away from buybacks and the dividend to fund new ventures.

Final Words

Right now, GNE has a very low multiple of just 7 on an earnings basis. Far below many of the larger companies in the sector like DUK and ED that we covered before. I think given the growth prospects of GNE and the opportunity they have to go into new states and markets in the US, the current price presents a solid risk/reward ratio, making it a buy from me.

I expect the earnings and coming reports to be slightly inconsistent, given the cyclical nature of the market they are operating in. But the long-term looks favorable for investors, as GNE has both a strong history of buying back shares and distributing a dividend. This together with a debt-free balance sheet highlights some of the benefits to GNE right now.

Read the full article here