Despite the unfavorable macroeconomic condition during the past few quarters, driven by high interest rates, high inflation rates, and low economic growth, Blackstone Mortgage Trust (NYSE:BXMT) paid a full-year dividend of $2.48 per share in 2022, flat YoY, while its dividend coverage ratio improved from 106% in 2021 to 116% in 2022. In the first quarter of 2023, the company paid a quarterly dividend of $0.62, flat YoY, while its dividend coverage ratio improved significantly from 100% in 1Q 2022 to 127% in 1Q 2023. Driven by a well-invested portfolio, continued performance, and higher base rates, and despite macroeconomic challenges that have hurt the performance of a lot of REITs, BXMT’s distributable earnings in the first quarter of 2023 grew 27% YoY. The company has a forward dividend yield of 12.40%, significantly higher than the sector median of 3.89%, and its dividend coverage ratio is more than 100%. Its Board of Directors may not face serious challenges to maintain the quarterly dividend of $0.62 per common share. Also, if BXMT’s current dividend yield decreases as a result of higher stock prices (as in the current market, a dividend yield of 12.40% is attractive), the company’s Board of Directors has enough room to increase the dividends. At prices around $20 per share, BXMT can reward its shareholders with both high dividends and higher stock prices. Despite the company’s improved net income, distributable earnings growth of 27% (YoY), and attractive coverage ratio of 127% in the first quarter of 2023, which are the first things that might gain your attention, in the company’s 1Q 2023 financial results, there was a thing that worried investors: higher current expected credit losses (CECL). Explaining two important things about BXMT’s loan portfolio, I conclude why you should not be worried about the company’s increased CECL, and why the stock is still a buy.

Two important things about BXMT

In the first quarter of 2023, BXMT reported an income from loans and investments of $17 million, up 30% YoY, driven by higher interest and related income, partially offset by higher interest and related expenses. The company’s net income and net income per diluted share increased by 19% YoY and 16% YoY, to $119 million and $0.67, respectively. However, these numbers do not say a lot about the company’s future and are just a representation of BXMT’s past performance. You cannot buy BXMT for its past strong performance, and you cannot expect BXMT to continue paying its attractive quarterly dividends because it did so in the past quarters. On the other hand, the company’s higher current expected credit losses can make you worry about BXMT’s future, making you get to the conclusion that the stock’s high dividend yield is not worth the risk. However, because of two reasons, you shouldn’t be worried about BXMT’s current expected credit losses: First, the company’s loan portfolio diversification in the past year, and second, the company’s stable risk ratings.

1 – Loan portfolio diversification

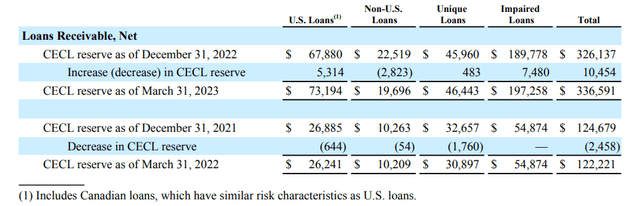

As of 31 March 2023, BXMT had 199 loans with a principal balance of $25220 million and a net book value of $24560 million, compared with 203 loans with a balance of $25160 million and a net book value of $24692 million on 31 December 2023. The weighted average maximum maturity of the company’s loans decreased from 3.1 years on 31 December 2022 to 2.9 years on 31 March 2023. According to Figure 1, as of 31 March 2023, BXMT has current expected credit losses of $337 million, decreasing its net loan receivable by 1.4%. As of 31 December 2022, BXMT’s CECL reserve was $326 million (decreasing its net loan receivable by 1.3%, and as of 31 March 2022, the company had a CECL reserve of $122 million (decreasing its net loan receivable by 0.5%).

When it comes to BXMT’s CECL, one might argue that the company’s significantly higher CECL in the first quarter of 2023 compared with the same period last year, is a sign of bad performance. Yes, higher CECL means that compared with a year ago, a greater part of the company’s loans might be defaulted. However, due to hiked interest rates, higher CECL was expected months ago. While tracking the amount of BXMT’s CECL has its specific importance, in the current market condition, while all REITs expect higher credit losses due to high interest rates, we should focus on BXMT’s measures to manage its credit losses. First, you should know that in the first quarter of 2023, BXMT recorded no default. Also, you should take into account that BXMT has taken significant steps toward diversification of its loan portfolio in the past year, which can limit the company’s losses due to its high exposure to office loans.

Figure 1 – BXMT’s CECL reserve

BXMT’s 1Q 2023 results

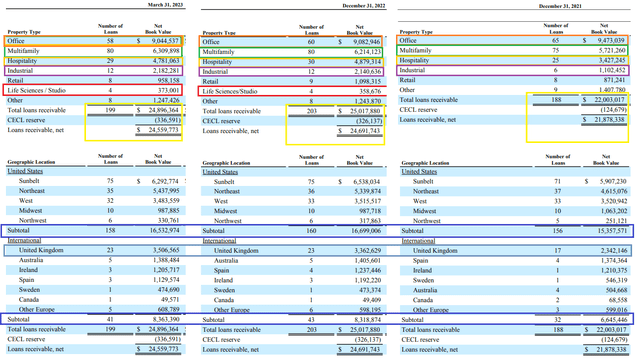

According to Figure 2, BXMT’s office loans decreased by 4.1% ($390 million) from 31 December 2021 to 31 December 2022 and decreased further in the first quarter of 2023. On the other hand, its multifamily loans, hospitality loans, and industrial loans increased significantly from 31 December 2021 to 31 March 2023. It is also worth mentioning that BXMT didn’t have significant life science/studio loans (big enough to be considered as a separate property type) at the end of 2021. All of these means that during the past few quarters, the company has been trying to diversify its portfolio by decreasing the share of office loans and increasing the share of other property types. As a result, as of 31 December 2021, office loans accounted for 43% of BXMT’s net loans receivable, and as of 31 March 2023, this share decreased to 37%.

Furthermore, the company has been trying to expand its international footprint, to limit the effect of losses from U.S. loans. Driven by increased loans in the United Kingdom, BXMT’s international loans increased by 26% ($1.7 billion) from 31 December 2021 to 31 March 2023, meaning that the company is trying to expand its international operations, which means lower dependency on U.S. economic and financial condition.

According to Figure 1, BXMT’s U.S. loans CECL reserve increased by 172% ($46 million) from 31 December 2021 to 31 March 2023. The company’s non-U.S. loans CECL reserve increased by 92% ($9.4 million) in the same period. The conclusion is obvious: By increasing international loans, BXMT escaped partly from the bad economic condition in the United States. If the company hadn’t increased the balance of its non-U.S. loan, and instead of that, would have increased its U.S. loans, its CECL reserve could have been higher on 31 March 2023. Overall, the company’s CECL increase in the first quarter of 2023 is not a big deal and is not expected to hurt BXMT’s profitability in a significant way. “Our CECL increase was therefore modest and more than offset by the earnings we retained in excess of our dividend, maintaining our book value,” the CEO commented in BXMT’s 1Q 2023 investor call.

Figure 2 – BXMT’s loans property type and geographic distribution (in thousands of USD)

BXMT’s financial results

2- Stable risk ratings

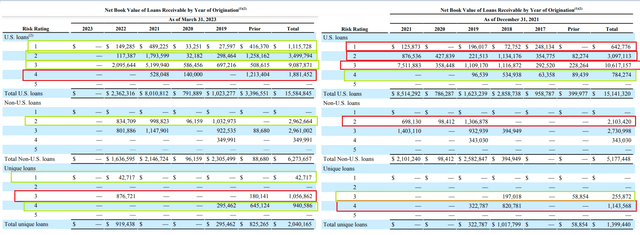

BXMT’s risk ratings show that from 31 December 2021 to 31 March 2023, the company’s total U.S. loans with a risk rating of 1 (very high quality) increased by $473 million, and, its total U.S. loans with a risk rating of 2 increased by $403 million. Furthermore, we can see that BXMT’s U.S. loans with a risk rating of 3 decreased by $1529 million. On the other hand, we can see that the company’s U.S. loans with a risk rating of 4 (low quality) increased by $1100 million. Overall, we can see that the company has been able to manage its U.S. loans credit quality, and compared with 31 December 2021, when interest rates were normal, BXMT’s U.S. loans credit quality didn’t impair in a significant way.

While the company managed its U.S. loans well enough to escape the negative effect of high interest rates and low economic growth in the United States, it managed to increase its non-U.S. loans with a risk rating of 2 (high quality). Overall, BXMT’s weighted average risk rating in the past year remained stable, reflecting that most of the company’s assets continue to show positive performance, offsetting the negative effect of high interest rates and various economic headwinds that has hurt other REIT companies. In a nutshell, I don’t expect the company’s ability to pay dividends and its dividend coverage ratio to get hurt in a significant way because of the higher CECL that the company reported in its 1Q 2023 financial results.

Figure 3 – BXMT’s risk ratings (in thousands of USD)

BXMT’s financial results

Summary

BXMT has a dividend yield of more than 12%, and its 1Q 2023 financial results were attractive. However, the company’s higher current expected credit losses have made investors worried about the company’s future. But, despite higher current expected credit in 1Q 2023, and despite macroeconomic headwinds, BXMT is in a good position and can continue to reward its stockholders.

Read the full article here