Back in March, I wrote that DoorDash (NYSE:DASH) looked overvalued as growth was starting to slow. Since then, the stock is up over 20%. Let’s catch up on the name.

Company Profile

As a quick reminder, DASH is a third-party logistics platform that connects merchants, consumers, and independent delivery drivers so that consumers can get things such as food from restaurants delivered to their house or other locations in a matter of hours. Consumers will generally place orders for delivery from participating merchants on its app or website. Frequent uses can sign up for DASH’s membership programs to reduce delivery and service fees.

DASH operates its namesake marketplace in 4 countries, and the Wolt marketplace in 23 countries. It also offer services to merchants to set up white-label delivery services through their own apps and websites using the DASH platform and not having to invest in in-house engineers of logistics.

Price Surge

DASH’s stock has been on a steady upward climb since late April, ahead of its Q1 earnings report. While the company reported better-than-expected results and raised guidance in early May, the stock did not initially react, up less than 1% the next trading session. However, it quickly resumed its upward path the following week.

Despite some signs of consumer weakness in the economy, that did not slow people down from ordering food via third-party delivery in Q1. DASH, which holds the #1 market share in the restaurant delivery business in the U.S., saw its orders accelerate slightly compared to Q4, as retention improved and order frequency reached an all time higher. The company said based on third-party data that it also appears to have gained share in the U.S.

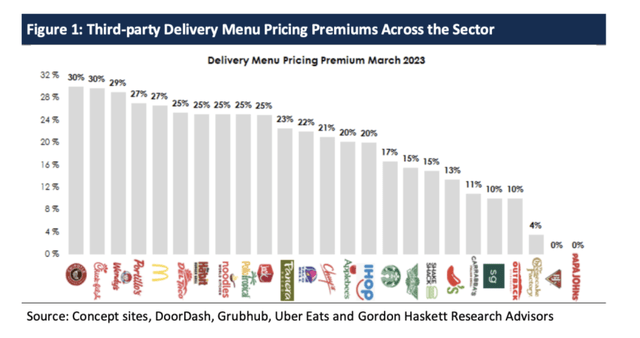

With food delivery services tacking on anywhere from 15-30% for each order, and restaurants often charging higher prices than their in-store menus, it is a bit surprising how orders for food delivery continue to surge in an environment where the consumer in pinching pennies in some areas. CNET broke down the cost of using delivery services earlier this year, although did not include any differences there might be between menu costs.

Meanwhile, according to a study by Gordon Haskett Research Advisors, across 25 popular restaurant brands, the average menu price premium on third party apps was 20% higher than dine-in menu prices. The quick-service industry had the highest price premium at 26% on average, led by 30% price premiums at Chipotle (CMG) and Chick-fil-A. Casual chain restaurants third-party price premiums were more modest at 11%.

Gordon Haskett

Between delivery service fees and menu price premiums, ordering third party delivery can increase the bill by up to 50%. We’ll have to see if consumers cut back on using third-party delivery services if there is a recession. Many might not realize the actual premium it is costing them for this convenience, and for many the price might be worth it. Still when times are tight, this seems like an obvious place to cut back spending on.

The aforementioned Gordan Haskett noted that the resumption of student debt repayments in September could also eat into DASH’s growth. That will hit about 27 million borrowers, or by my quick math about 25% of the Millennial and Gen-Z population, so it will be interesting how this impacts spending across the board.

For its part, DASH CEO Tony Xu thinks the company could continue to push consumers to use the product more, saying on its Q1 call:

“I think sometimes, it’s just important to remember that it’s no different in acquiring users versus getting users who may have tried the product to use the product more often, which is we just have to improve the product. And so whether that means we didn’t have the right selection to attract a customer in that moment or that occasion, the right pricing, the right speed and/or quality of delivery or we messed up on customer support, I mean, those are the building blocks of how we win any customer. And I think the fact that people eat 20x to 25x a week is really, frankly, why I think there’s such a large runway left for growth. It’s not necessarily about can you serve all of the users and where are we on that journey. That’s one part of it, but then you have to multiply that by 20 to 25x per week [and that potential]. And so that’s at least how it works in my brain. And to me, it’s the same of whether we want to go attract a new user or just win a new use case or in an incremental use case of the 20 to 25x occasions per week that a customer is eating. And we know that, that happens all the time.”

Two other growth areas I talked about for DASH were its expansion outside of restaurants and international. Both categories appear to be doing well, with DASH saying new vertical order growth remains significantly higher than restaurant order growth, while international orders grew by double digits sequentially. International revenue is under 9% of total revenue and still small.

Stock-based compensation was one big issue I discussed on my initial write-up and the company didn’t back down on that front. SBC rose to $230 million in Q1 versus $129 million a year ago. That essentially wipes out its adjusted EBITDA of $204 million in the quarter and represents 11% of its revenue.

Valuation

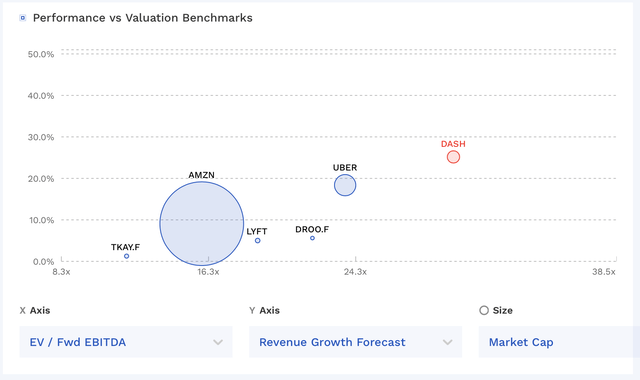

DASH trades at 31x the 2023 EBITDA consensus of $799.1 million. Based on the 2024 EBITDA consensus of $1.14 billion, it is valued at 21.8x.

On a PE basis, it trades at a forward PE of over 76 based on the consensus for EPS of 94 cents.

The company is projected to grow revenue 25% in 2023 and 16% in 2024.

The stock trades at a large premium to its peer group. Its use of SBC as a percentage of revenue is also very high compared to its peers outside of Lyft (LYFT). Based on that ratio, Amazon (AMZN), UBER, and Just Eat Takeaway are all less than half that of DASH, which saw SBC of about 13.5% of its 2022 revenue.

DASH Valuation Vs Peers (FinBox)

Conclusion

If you consider SBC a real expense, then DASH isn’t generating much if any EBITDA this year. And while some may debate that SBC is not a cash expense, the company is buying back $750 million in shares this year just to keep dilution to around 1%, which tells the story right there. So the cash is still being spent, it’s just being excluded from adjusted EBITDA numbers.

I think DASH is doing a pretty good job operationally, although I do wonder if it can continue to do so if the consumer pulls back. The cost of third-party delivery versus its value proposition seems high to me and there really isn’t much of a switching moat.

Overall, DASH’s valuation is high, its use of SBC is pretty egregious, and its business model does not seem like one that deserves a premium in my view.

Read the full article here