Yesterday the Federal Reserve decided not to change its policy rate of interest. Take a month or so off, they said and see what the data are telling us.

Well, following the meeting of the Federal Open Market Committee, following Chairman Powell’s talk with the press, the S&P 500 stock index went up and the NASDAQ went up. Only the Dow Jones Industrial Average declined.

Today, Thursday, June 15, 2023, all three stock measures rose, and not insignificantly.

The S&P 500 index was up 35 by noon; the NASDAQ was up 96: and the DJIA was up 345.

What kind of a response was this to the inaction on the part of the Federal Reserve?

To Greg Ip, writing in the Wall Street Journal, this market response indicated that investors were not satisfied with the decision of the Fed.

The Fed took the pause from raising its policy rate any further to see if its monetary stance was tight enough to produce the results it wanted, to reduce the rate of inflation down to 2.0 percent.

But, as Mr. Ip noted, stocks were entering a new bull market, there was a rebounding housing market, and long-term Treasury yields were well below the inflation rate.

“The premise behind the Fed’s pause is suspect.”

“Monetary policy simply isn’t very tight.”

And, this explains why the economy remains stronger than analysts expected it to be and why inflation is not falling as quickly as wanted.

The title of Mr. Ip’s column:

“Stock Market to Fed: You Haven’t Done Enough!”

Even Chairman Powell, as mentioned in his remarks, sees two more increases in the Fed’s policy rate of interest this year.

So, the stock market is rejoicing.

How Tight Is The Fed?

I have raised this question many times before in quite a few posts.

Mr. Ip provides another interpretation pointing to the fact that the Federal Reserve has not been tight enough.

Mr. Ip emphasizes the fact that although the Federal Reserve has increased the federal funds rate from near zero to a range between 5 percent and 5.25 percent.

But, the increase in consumer prices excluding food and energy in the past 12 months has been 5.3 percent. Thus, actual inflation is roughly the same as the nominal rate of interest…the real rate of interest is somewhere around zero.

Using inflation-protected Treasury bond yields, analysts say that the comparable financial market estimate of the real interest rate is about 1.4 percent.

A real rate of 1.4 percent isn’t that restrictive, although it is above zero.

In other words, to be more restrictive, the nominal rate of interest would have to be a lot higher than the actual inflation rate. Businesses can still borrow money and pay the interest on the borrowed money by means of rising prices.

An Interesting Point

Mr. Ip does make an interesting point, however.

“Typically, when the Fed raises short-term rates, stock prices fall, and long-term bond yield and the dollar rise. It’s this tightening of financial conditions more broadly, not the rise in short-term rates, alone, that slows the economy.”

“That’s what happened for the first six months of Fed tightening in more or less textbook fashion.”

Please note, this takes us from March 2022, when the Federal Reserve began tightening up on monetary policy, through to September 2022.

“But since October, all have changed direction….”

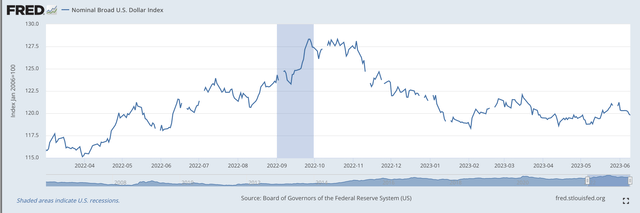

Notice what happened to the value of the U.S. dollar.

Nominal Broad U.S. Dollar Index (Federal Reserve)

On September 27, 2022, the value of the U.S. dollar topped out. It stayed around this peak for a while but has declined since. This is not an indication of “tight” money.

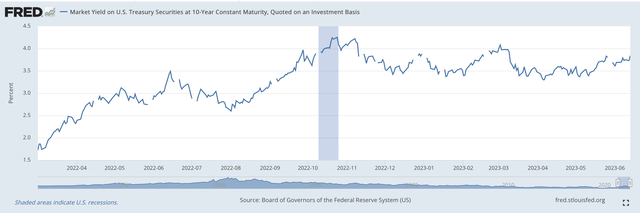

Bond yields……

10-year U.S. Treasury Yield (Federal Reserve)

Again, we see the peak being reached in the last five days of September 2022, with the yield falling since then. This movement contributed to the inversion of the Treasury yield curve during this time period.

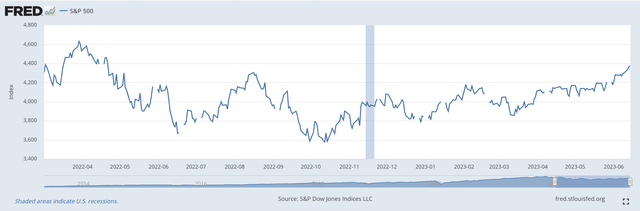

Furthermore, the S&P 500 stock index began falling in March 2022, but around the beginning of October 2022, the index began to move up again. It is up 22 percent from last fall’s low.

S&P 500 Stock Index (Federal Reserve)

These are certainly not signs of a very tight monetary policy.

And, as mentioned above, the stock market “seems to be chugging along.”

My View

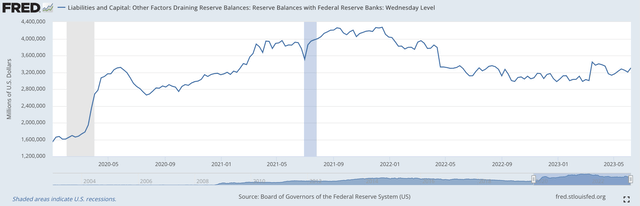

The view I have been presenting has to do with the Fed’s policy measure, Reserve Balances with Federal Reserve Banks. This, as I have written about over and over again, can be used as a proxy for excess reserves in the banking system. The higher the “excess reserves” run, the easier is the Federal Reserve policy

Let’s take a look at the performance of Reserve Balances from before the Federal Reserve began its fourth application of quantitative easing, the one that was in response to the spread of the Covid-19 pandemic.

Reserve Balances With Federal Reserve Banks (Federal Reserve)

Note that before the recession connected with the spread of the Covid-19 pandemic, the Reserve Balances with Federal Reserve banks were around $1.6 trillion.

After the initial injection of reserves into the banking system, which took place during the recession, the Federal Reserve began a program of “quantitative easing.”

The period of quantitative easing continued for more than a year.

Reserve Balances with Federal Reserve banks exceeded $4.0 trillion.

That is, during this time period, the Federal Reserve pumped more than $2.4 trillion of “excess reserves” into the banking system.

On March 16, 2022, excess reserves in the commercial banking system totaled $3.9 trillion, or, $3,893.4 billion.

On June 7, 2023, excess reserves totaled just $3.3 trillion, or, $3,306.2 billion.

The Fed’s tightening efforts reduced the excess reserves in the banking system by $0.7 trillion from its peak amount, and by $0.6 trillion or $587.2 billion from its March 16, 2022 level.

So, in the Fed’s efforts to tighten up on monetary policy to fight inflation, the Fed removed a pretty large amount of “excess reserves” from the banking system.

However, this reduction since March 16, 2022, a decline of $0.6 trillion, is only a minor part of the $2.4 trillion the Fed pumped into the banking system over the past three and one-half years.

My question has always been about whether or not the Federal Reserve is tightening up sufficiently to really be able to reduce the rate of inflation in the U.S. to the 2.0 percent level it is shooting for.

Whatever the Fed was doing, it always seemed to me that it was only reversing the situation by not even one-half of what it injected before the date the Fed began the current fight against inflation.

Me and Mr. Ip

In my view, Mr. Ip is just giving us another way to gauge how well the Federal Reserve is doing in its fight against inflation.

I believe that Mr. Ip and myself have concluded the same thing.

The Federal Reserve is nowhere close to being as “tight” as it needs to be to get inflation back down to around 2.0 percent.

And, the investment community is “calling it out”!

Mr. Ip:

“If the Fed had hoped to tighten financial conditions with Wednesday’s warning of higher rates to come, it failed.”

By 3:00 pm, the S&P 500 index was up by 63 points; the DJIA was up by 490 points; and the NASDAQ is up by 190 points.

If Chairman Powell and the Federal Reserve believe they are on the right track to bring down inflation, they are going to have to do a lot more toward convincing the investment community.

Read the full article here