Summary

Now that the Fed has decided to keep rates steady after their much awaited June 14th meeting came and went, just what does this mean for bank stocks like PNC Financial (NYSE:PNC)?

In today’s analysis, I discuss why PNC should have a Buy Rating as it will continue to benefit from the current rate environment, but also is a strong dividend play, has a reasonable valuation, priced right, has a solid capital and liquidity position. A potential risk is its exposure to uninsured deposits.

Company Brief & Story

My first experience with the PNC brand was actually in the summer of 1999, when I walked into a branch to open up my first student checking account.

Today, as an analyst writing about that same bank, it is evident that the PNC brand has matured long past just small town bank accounts and debit cards, yet has retained its iconic orange and blue logo.

Ranked #8 among largest banks in the US, this Pittsburgh-based firm with company roots going back to 1845, is today in 2023 a financial giant that crosses several business segments including personal, small business, corporate and institutional banking, as well as advisory services… not to mention having its name on a baseball stadium.

Rating Methodology

To rate this bank stock, I am breaking the larger rating down into 5 categories, each worth 20 points:

- Is it a good dividend opportunity? (20 points).

- Is it reasonably or undervalued? (20 points).

- Does the price show buying opportunity? (20 points).

- Is there strong Capital & Liquidity? (20 points).

- Is the Interest rate environment in its favor? (20 points).

20 points are deducted if this firm’s risk exposure shows a lot of commercial real estate risk tied to office properties, as well as the risk of a large uninsured deposit base.

My rating is based on the cumulative score:

(Strong Sell: 0 points, Sell: 20 points, Hold: 40 to 60 points, Buy: 80 points, Strong Buy: 100 points).

A Dividend Opportunity with Near 5% Yield

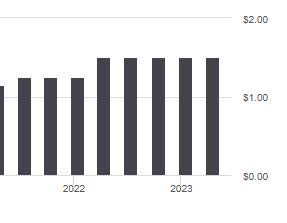

Based on dividend info from Seeking Alpha, this stock currently offers a dividend yield of 4.66%, with a dividend payment of $1.50 each quarter.

Also, the dividend has grown steadily since 2021, going from $1.15 in April 2021 to $1.50 in April 2023, a 30% increase, with a history of regular quarterly payments:

PNC – dividend growth (Seeking Alpha)

How does their yield compare with its banking peers?

For example, US Bancorp (USB) has a dividend yield of 5.98%, Capital One (COF) has a yield of 2.14%, and Wells Fargo (WFC) has a yield of 2.85%.

So, PNC being near a 5% yield makes it competitive in this sector I think, and an opportunity for a dividend-income investor to diversify their bank sector portfolio.

A Reasonable Valuation

The following data is from valuation info from Seeking Alpha, based on P/E ratio and P/B ratio.

This stock has a forward P/E of 9.26, which is 1.47% below the sector median.

Its forward P/B is 1.13, which is over 16% lower than its own 5-year average.

I should point out that its peer, US Bancorp, does present a better valuation at 7.62 P/E and 1.00 P/B.

However, in prior articles my standard to weigh against was 1.0 for P/B ratios and 14.93 for P/E ratios, the May 2023 median ratio for the S&P 500.

In this case, PNC has a P/E below that median, and a P/B slightly above the 1.0 benchmark I set.

I would call it a reasonable valuation, then, for value buyers.

A Favorable Price Opportunity for Value Buyers

The following is the price chart for this stock on June 14:

PNC – Price Chart on June 14 (StreetSmart Edge trading platform)

In this chart, which runs from 2022 through June 2023, I am tracking the 50-day SMA (dark blue solid line) vs the 200-day SMA (dark red solid line).

After a death cross (red circle shown) forms in April 2022 where the 50-day crosses below the 200 day, it indicates a bearish period for this stock price, which continues until a rebound above the 200 day, followed by the steep price dip around the time of the regional bank failures in March 2023.

I believe that this price chart still presents a buying opportunity one can take advantage of, and I like the stock at $125 to $129, well below the current 200-day SMA. I would get in on the lower end of that range, and ride it up until it goes past its 200-day SMA again.

Capital & Liquidity Position

The bank has a CET1 ratio above both the 4.5% Basel III standard as well as the additional 2.9% stress capital buffer:

PNC Financial – capital ratios (PNC Financial – quarterly presentation)

At the end of the first quarter, PNC also had over $32B in cash balances held at the Fed.

Keep in mind, according to a June 2022 article on Seeking Alpha, that PNC became subject to the 2.9% capital buffer requirement starting in Q4 2022.

This is a well-capitalized bank and is continually subject to stress tests, which I think is a good thing systemically speaking.

The Rate Environment Continues to be Favorable

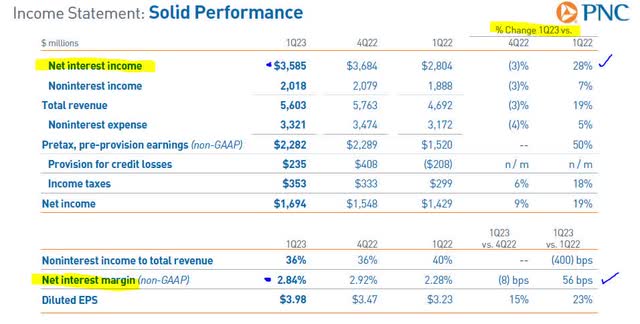

The current interest rate environment has continued to benefit this firm:

PNC – quarterly results – NII and NIM (PNC Financial – quarterly results presentation)

With a 28% YoY growth in NII, and 56bps growth in NIM, as shown above, PNC continues to reap the harvest of what the Fed is sowing.

And since the Fed has just decided to hold steady, as well as the potential for one more rate hike next month, according to the sentiment of rate traders surveyed by CME FedWatch, which is predicting over 60% probability of a rate hike at the July 26 Fed meeting, we should continue to see good NII and NIM numbers looking forward to the next earnings release.

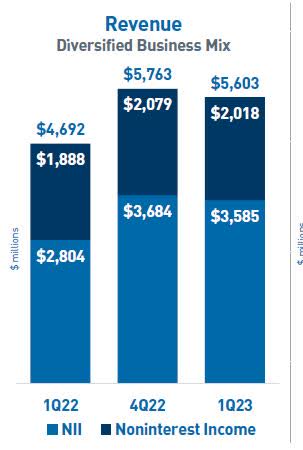

Although interest income is not the bank’s only source of revenue, as the chart below shows, it certainly is a major component of it:

PNC Financial – quarterly presentation (PNC Financial – quarterly presentation)

In fact, in the most recent quarter NII made up 64% of the revenue mix, so well over half, based on the above chart.

As far as further rate increases by the Fed, a June 14th article in the Wall Street Journal mentioned, “They are leaning towards raising them next month if the economy and inflation don’t cool further.”

Risk Exposure Managed Well

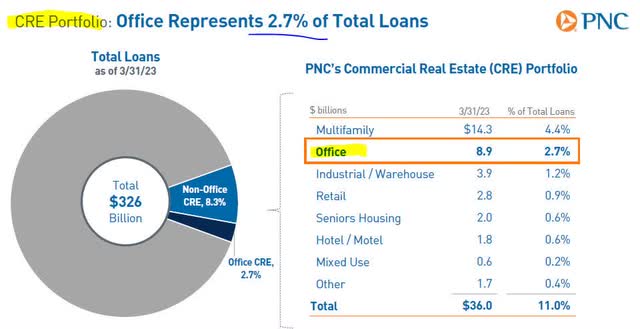

A common question I get is what is this bank’s exposure to commercial real estate, particularly office space.

If you look at the data below from their quarterly results presentation, the office category is less than 3% of total loans.

PNC – quarterly presentation – CRE portfolio (PNC Financial – quarterly results presentation)

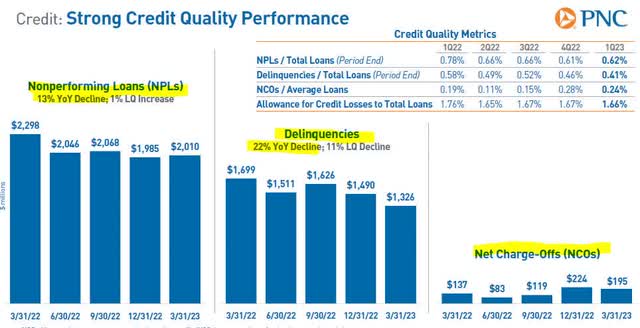

The other metrics to look at are nonperforming loans, delinquencies, and net charge-offs:

PNC Financial – loan performance (PNC Financial quarterly presentation)

With a 13% YoY decline in NPLs, 22% YoY decline in delinquencies, and just a slight YoY increase in net charge-offs, it appears to me that PNC is heading in the right direction in terms of asset risk exposure.

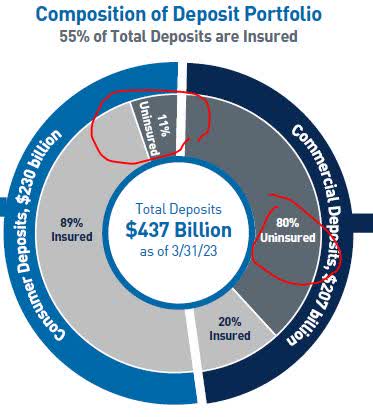

One other risk to banks that just does not seem to go away is the amount of uninsured deposits vs insured deposits they hold for their customers.

The choppy waters of the March regional bank failures still casts a shadow over this sector, and another question I get asked is what is this bank’s exposure to deposits beyond the FDIC insured limit.

In this category, although just 11% of consumer deposits are insured, 80% of commercial deposits are uninsured!

PNC Financial – insured vs uninsured deposits (PNC Financial – quarterly presentation)

This is a risk worth keeping track of from a forward-looking perspective, and so I will deduct from the score as I think that figure of 80% uninsured commercial deposits could pose a risk.

Consider that, as mentioned in a Time article in March discussing Silicon Valley Bank’s failure, “more than 85% of the bank’s deposits were uninsured, according to estimates in a recent regulatory filing.”

When it comes to PNC, however, also keep in mind all the tools it can deploy in the event of a serious liquidity issue, such as borrowing from the Fed, overnight loans from other banks, and from the FHLB.

In his last quarterly earnings remarks, PNC Chairman and CEO Bill Demchak struck a positive tone for this year.

According to him… “looking ahead, PNC remains well positioned to deliver for all stakeholders through the current environment and beyond.”

Risks to My Bullish Rating Outlook

A risk to my bullish outlook for PNC could be unrelated to its own fundamentals, but rather another depositor run at regional banks that run into trouble due to their risk exposure. An analysis of what kind of exposure these smaller banks have will have to be continual.

We saw in March that an entire sector’s stock can start getting dumped by panicky investors, if panicky depositors start pulling out funds.

The central bankers will need to continue to instill a language of confidence in this sector, as they have attempted to do after the March turmoil, and I think will continue to do so, which should give PNC enough breathing room to recover in the event of another run on bank stocks.

Conclusion

In conclusion, I reiterate my Buy Rating.

The 5 positive points include a competitive dividend yield, strong capital levels, reasonable valuation, value price opportunity, and a favorable rate environment going into the rest of 2023.

A potential risk, which is unique to the banking sector and not present in tech companies, for example, is the risk of uninsured deposits.

Holistically, though, this could be a nice addition to a portfolio of existing financial-sector stocks, most of all for the dividend income.

Read the full article here