Will

Cava

Group be the next Chipotle,

Shake Shack,

or

Sweetgreen

?

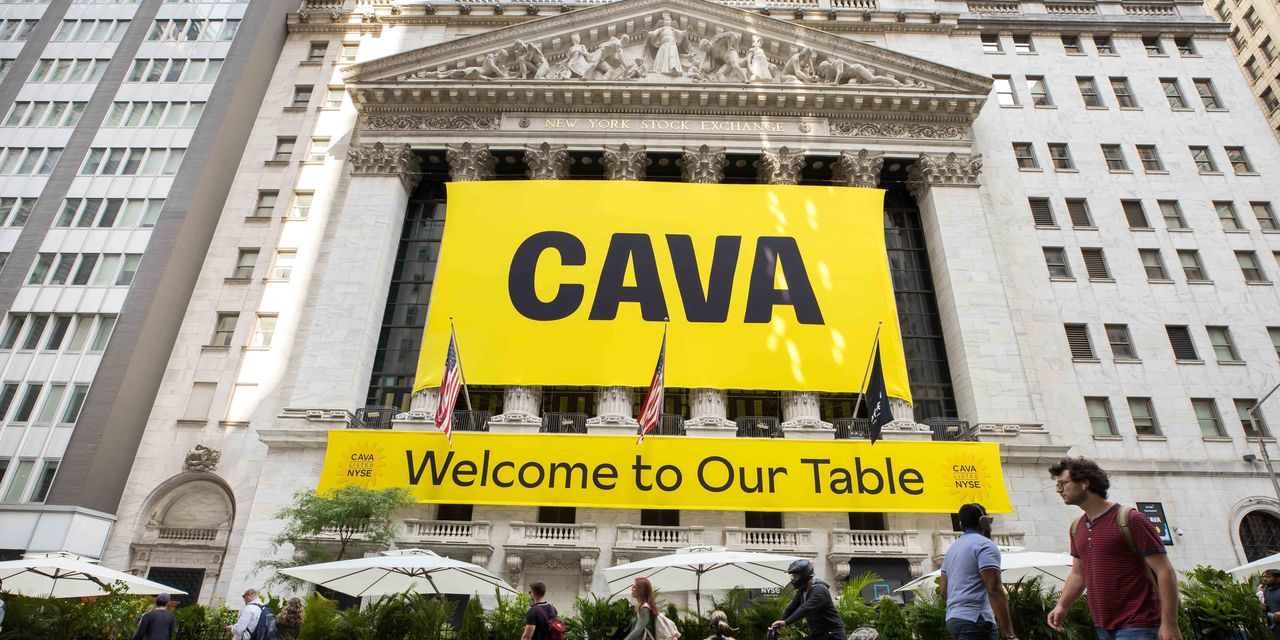

The popular Mediterranean fast-casual restaurant chain had an impressive debut Thursday after its initial public offering. Its share price nearly doubled to $42.38, valuing the unprofitable company at $4.7 billion.

The company went public Wednesday at $22 a share, selling 14.4 million shares—and possibly as much as 16.6 million if underwriters, as is likely, sell additional shares in an overallotment option. Cava is one of the hottest deals in what has been a lackluster IPO market this year.

The history of hot restaurant IPOs ought to make investors cautious on Cava Group (ticker: CAVA).

Sweetgreen

(SG), the salad chain, got a roaring reception when it went public in 2021. Its IPO was priced at $28 and the stock popped to above $50, but now trades around $10.

Shake Shack (SHAK) has done better. It went public at $22 a share in 2015, immediately rose to $45, and now trades at $72. The stock, however, is little changed over the past five years, and the chain is expected to be only marginally profitable this year.

Chipotle Mexican Grill

(CMG) has been one of big winners in the restaurant space. It went public at $22 in 2006, and the stock is up nearly 100-fold to $2,060, giving the fast-casual burrito chain a market value of more than $55 billion.

The 12-year-old Cava, however, looks richly valued based on traditional financial metrics.

The company, which operates 263 restaurants in 22 states, had $624 million in revenue in 2022 and a net loss of $59 million. The situation got better in this year’s first quarter, but the company still operated in the red. Cava had $205 million in sales during the period, up 15% year over-year, and a net loss of $2 million—better than the $20 million of red ink in year-earlier period.

Even using a favorite Cava metric, adjusted Ebitda—earnings before interest, taxes, depreciation, and amortization—the company’s valuation is expensive, considering it had $17 million of adjusted Ebitda in the first quarter.

With a $4.7 billion market cap, Cava is valued at a steep $18 million per restaurant, nearly three times that of Shake Shack.

The bull case is that Cava is the “only national player in the fast-growing Mediterranean category,” with twice the number of restaurants as its nearest competitor, according to its IPO prospectus.

The company is hoping to capitalize on healthy eating trends and continue its expansion, with 300 total restaurants planned by year-end. In its prospectus, Cava says it has “significant whitespace opportunity.” Some of its popular dishes include avocado salads, chicken pitas, and falafel sandwiches. It offers an array of bowls, salads. and sandwiches.

Cava Chief Financial Officer Tricia Tolivar told Barron’s earlier Thursday that the company is in a strong position, and this is an ideal time to go public.

“We’ve invested in infrastructure that allows us to grow. We’ve had tremendous growth over the past few years and continue to expect to grow into the future, and we feel like we’re well-positioned to be able to do that,” Tolivar said in the interview. “This was a perfect time for us to be able to go public, and it appears that the market was receptive to it.”

In its prospectus, Cava highlighted attractive unit economics, saying that it can achieve 35% cash-on-cash returns on investments in new restaurants within two years on capital expenditures of more than $1 million per restaurant. It pegs restaurant profit margins at 20%.

The company’s goal is to bring “heart, health and humanity to food.”

Things invariably look good at IPOs as investors extrapolate growth trends. But there is a lot of growth—and success—discounted in Cava’s stock price. The Sweetgreen experience shows that it can be tough to deliver on elevated investor expectations in the highly competitive restaurant industry.

Write to Andrew Bary at [email protected]

Read the full article here