We continue to be sell-rated on Advanced Micro Devices, Inc. (NASDAQ:AMD) post the company’s Data Center and A.I. technology Premiere. Despite AMD CEO Lisa Su’s excitement about the company’s MI300 series accelerator family and 4th-generation EPYC processors Bergamo and Genoa X, we don’t expect AMD will see meaningful artificial intelligence (“A.I.”) revenues in 2H23.

Our bearish sentiment is driven by our belief that AMD’s MI300 products will be used on a more case-to-case basis. We don’t expect the MI300 products can effectively compete with Nvidia Corporation’s (NVDA) H100. This is partly due to the superior performance of H100 against AMD’s current MI300 offering. The other part is due to timing; H100 is already nine months old and is being followed by the upcoming Hopper-Next GPU. NVDA has clearly taken the lead in generative A.I. training and inference, so if we cut through market noise driving AMD stock higher, we expect the company to be simply late to the 2023 design cycle.

MI300X is scheduled to hit the shelves in 4Q23 and begin sampling for key selected customers in Q3. In comparison, NVDA is up and running without any wait time before testing and incorporating the product for A.I. servers. Under a limited server capex, we expect the greater bulk of capex dollars spent will favor NVDA. Cloud providers and enterprise customers are definitely looking to secure an alternative to NVDA with A.I. TAM expansion. Still, we don’t see AMD being an alternative in 2H23 and 2024, and hence don’t see this boosting AMD revenues in 2H23 due to the company’s lag behind NVDA’s offerings.

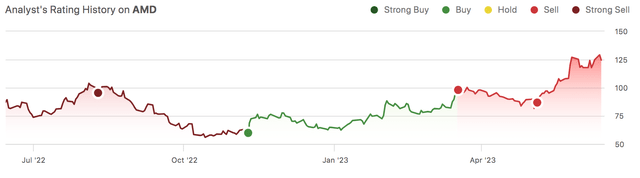

The stock is up 46% since our last note, outperforming the S&P 500 (SP500) by around 38%. YTD, the stock is up 98%, outperforming the S&P 500 by 83%. We believe AMD’s stock has more than captured the expectation of A.I. tailwinds and rode the A.I. sentiment driven by NVDA’s outlook. We see favorable exit points after the stock rally YTD and recommend investors sell the stock.

The following chart outlines our rating history on AMD.

SeekingAlpha

Don’t let the A.I. hype distract from the fundamentals

We believe the A.I. hype around AMD’s capabilities in A.I. acceleration is overshadowing the company’s higher risk profile. Our investment thesis regarding AMD’s moderating share gain against Intel Corporation (INTC) is playing out in PC and data center markets based on the company’s 1Q23 earnings report. The company’s PC Client revenue is also under pressure from the broader PC slump due to weaker consumer spending resulting from macro headwinds; Gartner reported PC shipments dropped 30% in 1Q23.

We also expect AMD to experience an inverse effect from the A.I. boom on its CPU unit sales. We recently downgraded INTC on the same prediction of CPU unit drop. We see CPU units dropping in 2H23 as the nature of A.I. applications requires massive computing power, which requires GPUs. So, the most advanced systems use a higher ratio of GPUs to CPUs; NVDA’s DGX system uses eight GPUs to two CPUs, and even AMD’s Instinct Platforms (supposedly the equivalent to NVDA’s DGX system) uses eight GPUs. We expect A.I. servers to cannibalize compute server capex and, by extension, predict a CPU unit drop. The data point to consider here is the ASP of A.I. servers versus compute servers. A.I. server ASP is ~$200K, while the compute server ASP stands at ~$15K. We’re seeing more demand for A.I. servers and expect the higher ASP of A.I. servers and surging demand to result in lower sales of compute servers. Hence, we predict CPU units to drop in 2H23 and negatively impact AMD.

Valuation

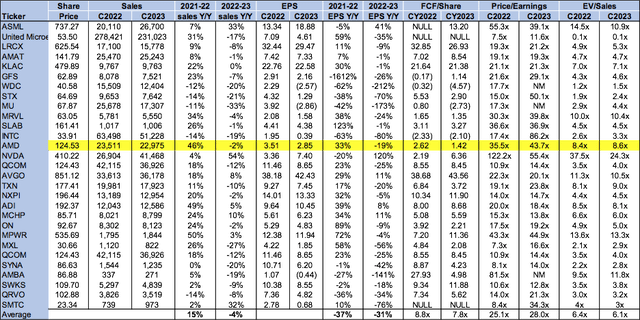

AMD is expensive, trading well above the peer group. On a P/E basis, the stock is trading at 43.7x C2023 EPS $2.85 compared to the peer group average of 28x. The stock is trading at 8.6x EV/C2023 Sales versus the peer group average of 6.1x. We believe AMD is overvalued and recommend investors explore favorable exit points out of the stock at current levels.

The following graph outlines AMD’s valuation against the peer group.

TSP

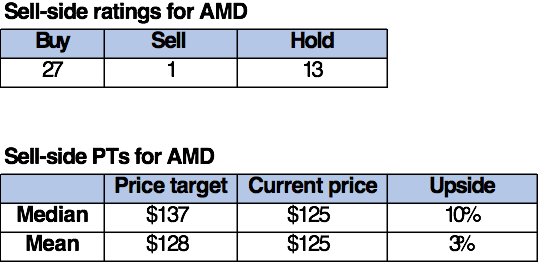

Word on Wall Street

Wall Street is bullish on the stock amid the A.I. boom. Of the 41 analysts covering the stock, 27 are buy-rated, 13 are hold-rated, and the remaining are sell-rated.

The following charts outline AMD’s sell-side ratings and price targets.

TSP

What to do with AMD stock

We remain sell-rated on AMD despite the YTD rally. A.I. is the buzzword of the year and potentially the next couple of years, but we warn investors against jumping into stocks with supposed A.I. growth exposure. In the semi industry, companies need to be either the best or the cheapest; as it stands, NVDA is the best, and in-house ASIC is the cheapest. Everything in the middle won’t matter in the A.I. race for 2H23, and AMD is stuck in the middle. AMD’s Data Center and A.I. Premiere confirmed our belief that the company has nothing meaningful to bring to the space of A.I. acceleration, or at least nothing significant that’ll come in time to compete with NVDA.

We also expect a CPU unit drop ahead in 2H23 as the most advanced A.I. applications will require a higher GPU-to-CPU ratio. Unless the capex is revised up significantly, we see A.I. servers cannibalizing compute server capex in 2H23 and 2024. We see a big blow ahead as the company lags behind NVDA; hence, we recommend investors take advantage of the stock rally and exit AMD stock at current levels.

Read the full article here