Lanxess Aktiengesellschaft (OTCPK:LNXSF) has had some recent activity that signals value for the business on private markets. They created a J.V with Advent by spinning off one of its businesses, and this has shown that private markets might value the rest of Laxness’ businesses, which have become increasingly specialty and less commodity over the last couple of years, at a much higher multiple than where it currently trades.

The issue is that the direction for LANXESS’ markets is bad, with them being especially cyclical, and there are dominoes yet to fall. The economy is not doing well. While it is falling slower than expected as of now, it will have to see a long decline, and there are actual deflation risks for Lanxess’ while they still lag with expensive inventory. We wouldn’t consider Lanxess at the moment because there are other cheaper ideas whose fortunes are more likely to be incrementally positive, although the Advent deal really makes Lanxess interesting once we come closer to a likely bottom in the cycles still some quarters away.

Q1 2023 Notes

To the credit of the Lanxess management, they don’t sugarcoat things.

And here, we have a big exposure to — in Inorganic Pigments to construction and construction is really ugly across the board. It’s the first time that I see China construction negative. Europe is also extremely soft. It’s not as bad in the United States. But overall, construction, which has an underlying positive trends, 2023 will definitely suffer.

Matthias Zachert, CEO on Lanxess.

Sadly, we have to agree with the assessment. The Chinese property market situation disappoints to the downside, with major falls in development activity. While you might argue that’s just the markets finding new equilibrium, developers are also not raising as much funds. Sales of properties are up but not because of demand for housing, but because of demand for liquidity, highlighting the quite pronounced deleveraging risk that China faces. The situation has spurred a rate cut, and while it is helpful it also is evidence of the dangers of the Chinese market right now, a major market for construction and for Lanxess.

Lanxess management believes this quarter and Q2 will be troughs, as they try to offload inventory that has been subject to inflation. Destocking trends may reverse, but the destocking issue is here as a result of the poor demand situation. Ultimately, while on a technical basis the inventory inflation lag will pass through the system, we believe things can get worse, including deflation of Lanxess chemicals, since even management acknowledges that markets tend to pause and wait out price declines once the possibility of deflation and a deflation spiral arrive. That will prolong the pain. Furthermore, there are other shoes that still need to drop, including automotive and electronic exposures that have been benefiting from an increasingly exhausted pool of pent-up demand.

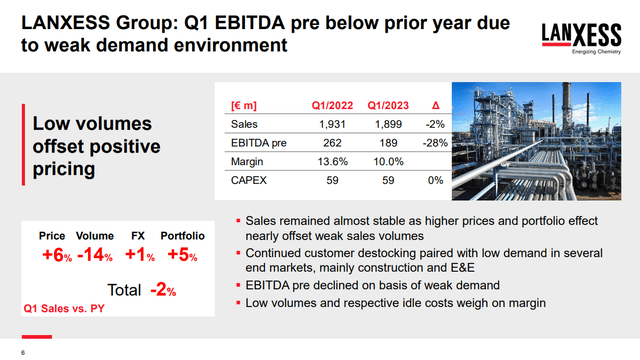

Group Results (Q1 2023 Pres)

Utilization is 65%, below averages of 75%, and the major volumes shortfall, not even fully offset by prices while they liquidate costly inventory, means meaningful loss in industrial economy. Hence, the 28% declines in EBITDA driven by commodity products but also specialty products that face construction, Laxness’ key end market.

Bottom Line

The Advent deal was great. The 1.2 billion EUR or so in proceeds mean a 33% reduction in leverage, a real boon to shareholders delivered by an accretive multiple, above Lanxess’ comprehensive multiple. Moreover, the value of the Lanxess stake in the J.V with an option to exit creates latent value for Lanxess, for now another 1.2 billion EUR in value, but possibly more if synergies in that deal can be delivered.

However, while there is a precedent transaction argument to make for the business right now, and the 5.4x EV/EBITDA multiple is not high (given management estimates and assuming the J.V value as a non-operating asset), we are still aware of businesses that have less headwinds and trade cheaper, all in industrial sectors as well. Lanxess AG is an interesting play, one that we will watchlist, but with the earnings direction being certainly negative, just uncertain to what extent, we think there are other more direct ways to make money in stocks right now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here