Belite Bio (NASDAQ:BLTE) is a small company with multiple phase 3 trials targeting retinal degenerative eye diseases. The stock looks interesting, with late-stage trials in indications without approved drugs. There are reasons, discussed later, which precludes my taking a more bullish stance. However, the stock is certainly worth watching. The pipeline looks like this:

BLTE Pipeline (BLTE website)

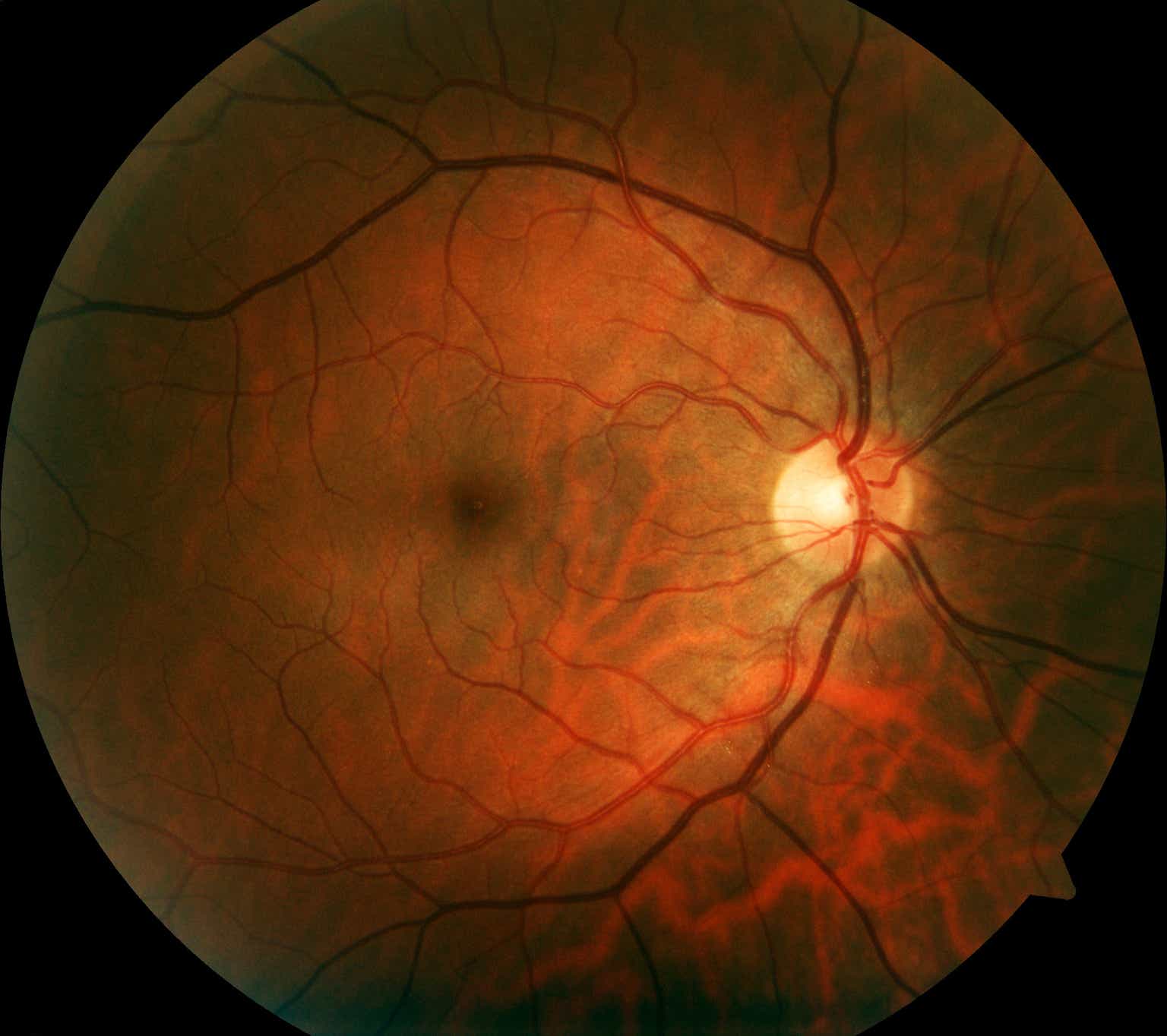

Lead asset Tinlarebant is an oral therapy that can “reduce the accumulation of toxins in the eye that cause STGD1 [Stargardt macular dystrophy, or Stargardt Disease] and contribute to GA, or advanced dry AMD.” Tinlarebant’s mechanism of action reduces and maintains the levels of serum retinol binding protein 4 (RBP4). RBP4 carries retinol (Vitamin A) from the liver to the eye. Retinol is part of the normal visual cycle, but it can also produce toxins harmful to the eye. Tinlarebant reduces the formation of these toxins by modulating the amount of retinol entering the eye. In clinical trials, Tinlarebant has demonstrated target potency and specificity.

The company has a two-year phase 2 study running and they have also started a two-year phase 3 study (the DRAGON study) in adolescent STGD1 patients. DRAGON is a randomized, placebo-controlled study. BLTE also plans to begin enrolling patients in a two-year Phase 3 study (PHOENIX) of Tinlarebant in Geographic Atrophy (GA’) in mid-2023.

There are no FDA-approved treatments for STGD1, and no FDA-approved oral treatment for GA. The molecule has Fast Track and Rare Pediatric Disease designation in the US and Orphan Designation in both the US and EU for STGD1. STGD1 is the most prevalent form of inherited retinal dystrophy with 30,000 US patients and 146,000 Chinese patients.

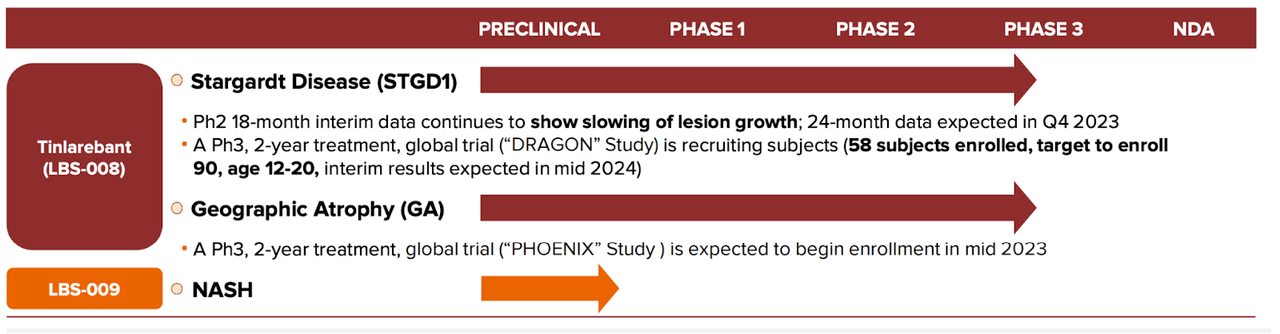

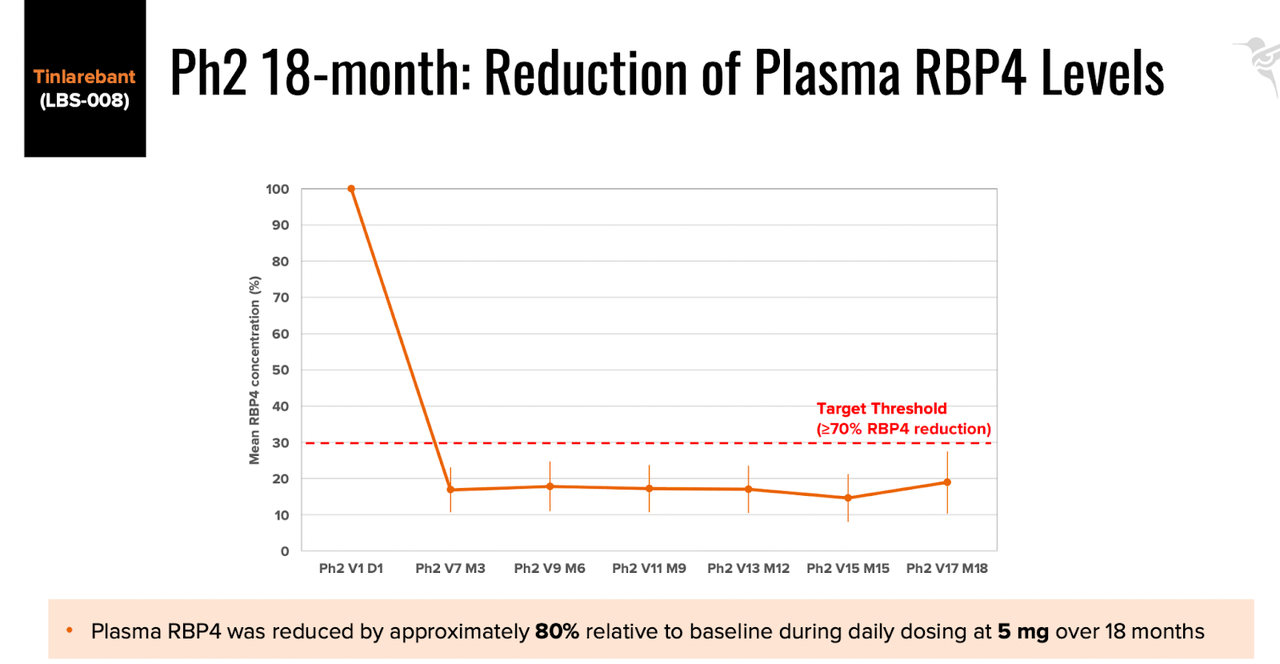

The company completed a phase 1b/2 study of the molecule in adolescent STGD1 patients, and saw a mean RBP4 reduction of > 70% without severe adverse events in the Ph2 portion of the study, comprising 13 patients in Taiwan and Australia. See below:

Efficacy data (BLTE website)

In STGD1, there are two types of retinal lesions, QDAF lesions, which can be rescued, and DDAF lesions, which cannot be rescued, and which form through worsening of QDAF lesions. Together, these two lesions are called decreased autofluorescence (DAF). In the phase 2 trial, comparison of mean DAF lesion growth rates between historical data from Georgiou et al. (2020) and subjects in LBS-008-CT02 showed a 60% reduction in LBS-008 patients. There were some mild and transient AEs, notably loss of night vision. Topline data from the phase 2 trial is expected in Q4.

The company initiated a global phase 3 study in 58 enrolled subjects from June 2022, and the primary endpoint is reduction in Lesion Growth Rate as measured by Retinal Imaging. This is an FDA-accepted Primary Endpoint in STGD1 and Geographic Atrophy (GA). Interim data is expected in mid-2024. The other phase 3 trial in GA will begin enrollment in mid-2023. It has the same endpoint as this first trial.

Financials

BLTE has a market cap of $373mn and a cash balance of $38mn. In May, the company filed a $300mn mixed shelf offering, and then filed a $30mn secondary offering. For the three months ended March 31, 2023, research and development expenses were $5.7 million, while general and administration expenses were $1.2 million. With that sort of expense, and the cash balance plus the money from the offering, BLTE has a cash runway of 8-9 quarters.

Nearly 80% of the company is held by Lin Biosciences, a Hong Kong company which was the early fund provider of BLTE. There is no insider transaction data available.

Risks

BLTE is a very small company with very early stage assets. While the data is good, this data is ex-US, generated in Taiwan and in Australia. This was a question they were asked at the earnings call:

The additional enrollment in these patients, I’m wondering so far, can you breakdown where those patients are coming from in terms of the clinical trial sites, and especially those I think 16 more patients this quarter. Where are those patients coming from?

The company said they are coming from Taiwan, Australia, and Europe – which could mean Eastern Europe or Western. We know how impatient the FDA is getting these days about ex-US trials being used for US approvals.

The same question was asked again by another analyst:

My first question is, does the FDA require a certain percentage of the patients in the DRAGON trial to be recruited from the U.S.?

The company said:

But there is nothing in the guidance and nothing certainly in a regulatory statute that says you have to have X number of patients for an international Phase III study to be considered for an NDA in the U.S., you have to have some U.S. representation. The percentage on that is a little vague.

I think if they don’t have US patients at all, they will be in for a surprise.

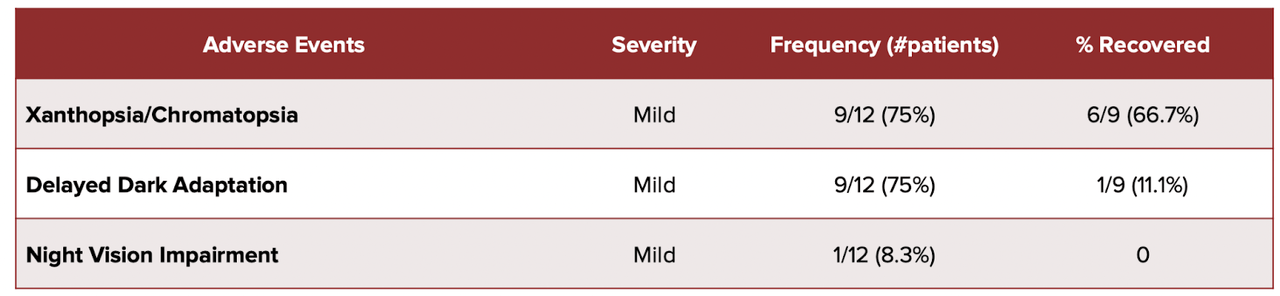

There is also some small concern about the safety profile of Tinlarebant, because the data presented seems to show that some of the AEs seen were not resolved:

AE data (BLTE website)

Note that last column, which says % Recovered. Should we assume that 3 out of 9 Xanthopsia AEs did not recover?

Bottom Line

BLTE has some interesting stuff going, and I want to keep watching this company more closely for a while more. There is really very little coverage on the company.

Read the full article here