Investment thesis

Dropbox (NASDAQ:DBX) is the cloud service that I have used for more than ten years and I don’t plan to switch to other providers. I know lots of people who are the same big fans of the app. I feel it indicates a strong Dropbox brand and a very loyal customer base. But these are only feelings, and when we talk about investing in stocks, we shall consider numbers first. The company demonstrated solid profitability metrics expansion as the business scaled up, which is a sign of strong management for me. Dropbox is a rockstar in generating free cash flow and the stock is substantially undervalued, according to my valuation analysis.

Company information

Dropbox was founded in 2007 and was a pioneer in cloud storage featured with cross-platform synchronizing. The company offers its users a single organized place where individuals and teams can create content, access it anywhere, and share it with collaborators. According to the latest 10-K report, at the end of FY 2022, the company had about 17.8 million paying users.

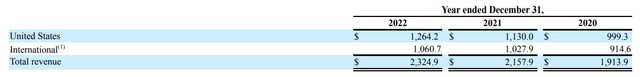

The company’s fiscal year ends on December 31. More than half of the company’s sales in FY 2022 were generated in the U.S.

DBX’s latest 10-K report

Financials

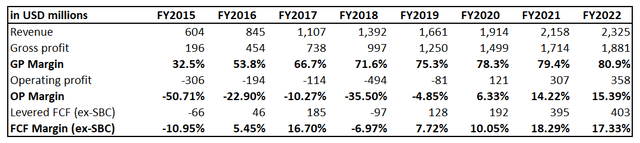

The company delivered a substantial 21% revenue CAGR between 2015 and 2022, which is impressive. I like very much that profitability metrics expanded as the business scaled up. Gross margin more than doubled, from 33% to 81%. The operating margin and free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] also demonstrate confident double digits.

Author’s calculations

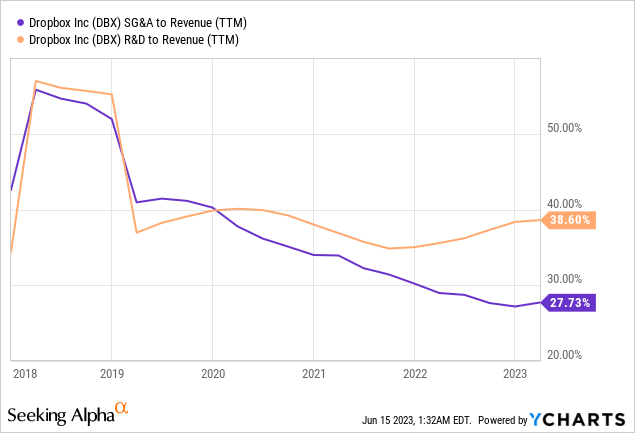

I like that the company significantly decreased SG&A to revenue ratio, from above 50% to the current 28%. It means that aggressive promotion in prior years created solid word-of-mouth which fueled revenue growth. The current SG&A to revenue ratio is also rather high, meaning that there is still room for improvement and further operating margin expansion. The company reinvests a substantial 39% of its revenue to R&D, meaning a strong commitment to innovation and plans to bring new features and offerings to customers.

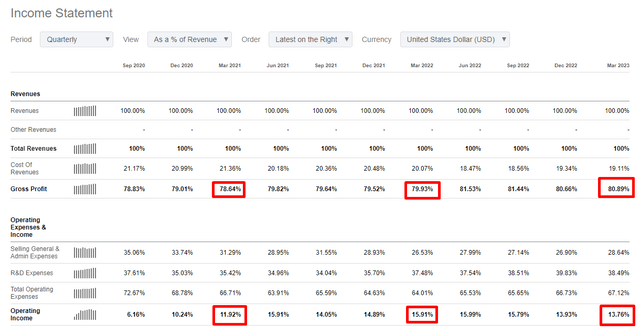

Now let me narrow my financial analysis to recent quarters to assess the strength of momentum, which is crucial for growth companies like DBX. Last quarter, DBX delivered about 9% revenue growth which outpaced growth in the cost of revenue meaning the gross margin expanded YoY. On the other hand, both SG&A and R&D increase was more considerable than the top line in Q1. Thus, operating profit suffered. The levered FCF improved significantly, but this was due to the disposal of marketable securities, i.e., it was a one-off event. Overall, the business faces temporary headwinds due to the current harsh environment. On the other hand, both gross and operating margins improved notably since Q1 2021, meaning the management effectively addressed adverse events in the macro environment which happened since early 2022. I believe that in the upcoming quarters, expenses growth will decelerate because in April 2023, the management made a difficult decision to cut about 16% of the workforce.

Seeking Alpha

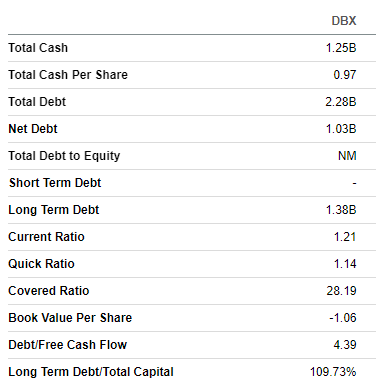

I cannot say that the balance sheet is a fortress, though it is not weak either. The company is in a net debt position, though a significant part of this debt is long-term. Moreover, DBX is generating positive FCF, and the covered ratio looks solid. Liquidity metrics are also in good shape.

Seeking Alpha

Overall, I consider DBX’s long-term financial performance robust. Still, there is notable room for margin improvement since SG&A represents a significant portion of revenue. The revenue growth momentum is still solid, though the growth decelerated compared to long-term averages. Moreover, the company faces near-term headwinds due to the challenging environment, but I think headwinds are temporary and not secular.

Valuation

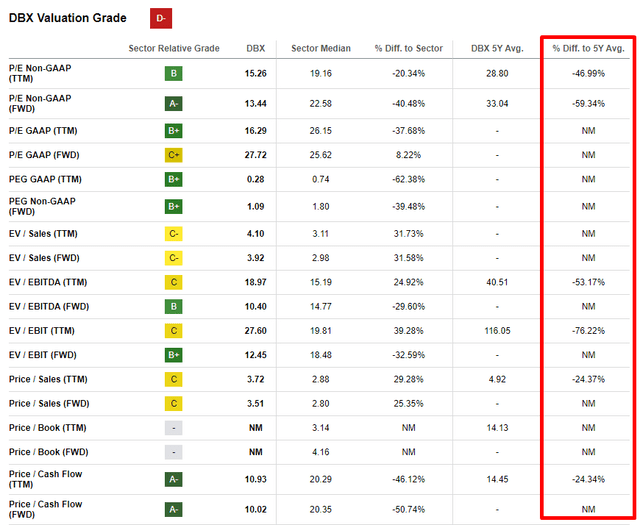

DBX stock price increased about 11% year-to-date underperforming the broad market. Seeking Alpha Quant assigned Dropbox stock a low “D-” valuation grade meaning the stock is overvalued. On the other hand, in the section below, we saw that the company demonstrates stellar profitability, and the premium to sector median looks sound to me. Moreover, current valuation multiples of DBX are much lower than the 5-year average.

Seeking Alpha

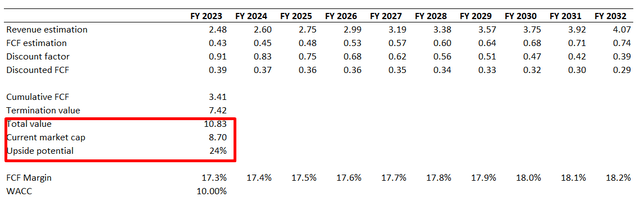

The data from the valuation analysis needs to be more balanced. Therefore, let me perform a discounted cash flow [DCF] valuation exercise. Valueinvesting.io suggests that DBX’s WACC is slightly below 9%, but to be conservative, I prefer to use 10% due to the current uncertain environment. I have revenue consensus estimates, which project a 6% revenue CAGR over the next decade. This growth profile looks very modest to me. I use the one generated in FY 2022, less SBC for the FCF margin. I expect FCF margin to expand by ten basis points yearly. Under these assumptions, we see that the stock is substantially undervalued. DBX has about 24% upside potential, according to my DCF model.

Author’s calculations

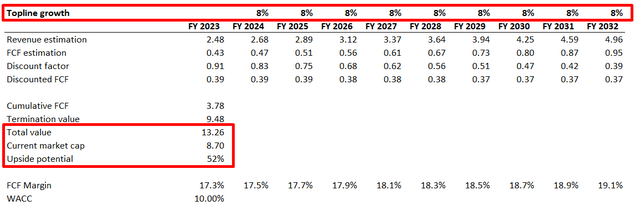

I consider the above assumptions very conservative, so let me simulate one more scenario with a revenue CAGR of 8% over the next decade and an FCF margin expanding 20 basis points per year instead of the ten basis points I used in the base case scenario. Under moderately optimistic assumptions, the stock has above 50% upside potential, according to my calculations.

Author’s calculations

Overall, the stock looks significantly undervalued with massive upside potential, according to DCF. Comparison to historical valuation multiples gives additional confidence regarding the undervaluation.

Risks to consider

Dropbox operates in a highly competitive cloud storage business. The company faces competition from IT giants like Apple (AAPL), Google (GOOG), Microsoft (MSFT), and Amazon (AMZN). These companies are multiple times bigger than DBX and possess much more resources to promote and expand the reach of their cloud-based storage services. Therefore, Dropbox should continue innovating and differentiating its offerings from competitors.

Cloud storage means the company has sensitive data and documents of its customers. Therefore, cybersecurity risks are very high. Any leaks or successful cyberattacks might severely undermine the company’s reputation and might lead customers to switch to other storage options.

Bottom line

To conclude, Dropbox stock is a screaming buy for me. The upside potential is massive, especially given the company’s stellar ability to generate a high FCF margin. The high debt-to-equity ratio might frighten some investors, but it is not a risk given the stable and solid cash flows generated from operations. I assign DBX stock a “Strong Buy” rating.

Read the full article here