DOOR Carefully Chooses Its Strategy In A Tepid Market

Masonite International (NYSE:DOOR) designs and markets doors and door systems for the new construction, repair, renovation, and remodeling of residential and non-residential buildings. The US housing and residential market appears to stagnate, while its European counterpart is going through a volume shrinkage. In this scenario, Masonite looks to manage its operating margin through various corrective measures. Network optimization and fixed cost reduction projects have become its priority. It restructured its North American Residential and Architectural segments and corporate functions, which can result in reasonably strong cost savings in FY2023. It has also pushed up average pricing. In January, it acquired Endura to accelerate its “Doors That Do More” strategy.

While signs of improvements and latent demand are growing in the US, the European residential market can continue to stay benign in 2023 primarily because of higher inflation and material cost hikes. Also, demand in the Architectural segment is expected to contract slightly in Q2. The company’s cash flows increased impressively over the past year through a significantly improved working capital management policy. Higher cash flows also allowed it to repay debt and repurchase shares. The stock is relatively overvalued versus its peers. Based on low growth and a steadying margin prospect, I suggest investors “hold” DOOR stock before the situation improves.

A Look At The End Markets

The new privately-owned housing units in the US are returning to the pre-pandemic level. From April 2022 until January 2023, it dipped by 25%. Since then, it has shown signs of consolidation and increased by 4.6% until April. However, the point of sales in the residential market was down by “low double digits” in Q1. The fall was steeper than the company estimates of a “high single-digit” decrease in FY 2023.

In the UK, the housing market fall was even steeper. Many builders estimated that building completions could decline by 30%-40% in 2023. Despite that, the billings score in March increased above 50 in March but dipped again below 50 in April (a score below 50 means a drop in firm billings).

Cost Minimization And Restructuring

Seeking Alpha

So, in a volatile market, the company focuses on reducing costs, including network optimization and fixed cost reduction projects. Over the past year, the average unit price increased by 10% in Q1 as the company looks to maintain price cost discipline. The strategy was important, considering the wage and rent hike and other related cost-push. DOOR plans to expand its operating margin in 2H 2023. By the end of Q1, the ocean freight started trending lower while some raw material costs decreased. So, the company looks to match its variable costs to order volumes. The company’s North America Residential segment reduced direct labor headcount by 16% and SG&A by 10% in Q1 2023.

In Q1, the company restructured its North American Residential and Architectural segments and corporate functions. This delivered $3 million in benefits in Q1 and is expected to produce $15 million to $20 million of annualized cost savings. While volumes keep low, these initiatives would hold the margin steady. On top of it, the company will focus on ensuring a reliable supply process. In March, they completed an interior door production line startup in South Carolina while closing a less efficient door facility in California. In January, it acquired Endura to accelerate its “Doors That Do More” strategy and maximize growth potential.

The company targets growth through a better mix of solid core doors in its total interior door sales. It has launched Barn door kits, which retail for $200 to $300, and has given a fillip to its average pricing. In addition to organic growth, the company has started joint business planning initiatives with several of its largest partners.

Analyzing Segment Outlook

DOOR’s Filings

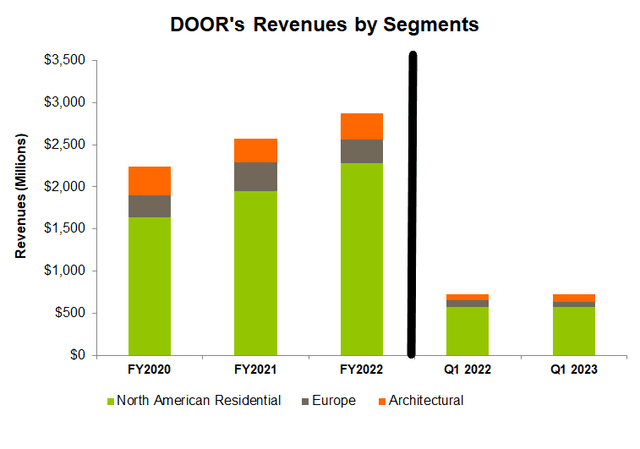

Demand softened in the new construction end market in the North American Residential segment. So, it has adopted a strategy of cost optimization and strategic growth to increase production with minimal incremental fixed costs. There are signs of improvements in single-family, and the possibility of latent demand continues to grow. There appears to be room for additional for-sale inventory when the interest rate stabilizes.

Europe appears to have a more stringent challenge ahead as inflation strikes a blow to spending and growth. It has improved the supply chain issues, leading to better lead times. It promotes high-value door kits to enhance its sales mix.

In the Architectural segment, demand is expected to contract slightly in Q2, although customer sentiment remains positive. In Q1, the company began assessing the strategic alternatives, including the possibility of divesting all or part of the business.

Q1 Performance And Drivers

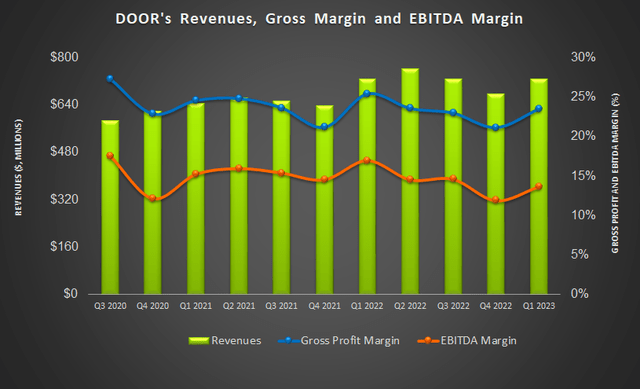

Despite the hike in average pricing, the company’s revenues remained nearly unchanged over a year ago in Q1 2023. Its topline also increased by 8% due to the benefit from the Endura acquisition. A decline in volume, particularly in Europe, and the adverse changes in foreign exchange mitigated the positive effects.

Gross profit in Q1 2023 decreased by 7% year-on-year. The combined impact of volume deleveraging and inflation more than offset higher pricing. Material costs have increased by “high single digits” and have remained a headwind for DOOR. On top of that, factory and distribution costs also went up due to volume deleveraging. However, the company’s management expects inflation levels to moderate in Q2. FY2023 may even lead to a “low to mid-single-digit” cost deflation.

Cash Flows And Debt

In Q1 2023, DOOR’s cash flow from operations (or CFO) turned strongly positive compared to negative CFO a year ago. Although revenues remained unchanged over the past year, lower working capital requirements following lower inventory after the supply chain improved led to an improvement in CFO. Free cash flow (or FCF) (excluding acquisition) also turned positive in the past year. In January 2023, DOOR acquired Endura for $408 million.

DOOR has put in rigorous effort to improve its working capital. Its actions include standardizing components, increasing vendor-managed inventory, utilizing centralized warehousing, and normalizing safety stocks. These measures will enhance accounts receivable and accounts payable management. The company’s debt-to-equity (1.4x) is slightly lower than its competitors (TGLS, GFF, and PGTI). During Q1, it repaid $100 million of debt and repurchased $15 million worth of common stock.

Analyst Rating And Relative Valuation

Seeking Alpha

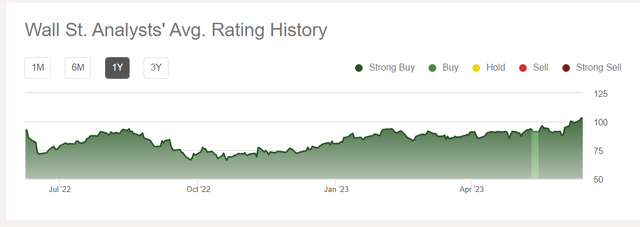

According to data provided by Seeking Alpha, seven sell-side analysts rated DOOR a “buy” in the past three months (including “Strong Buy”), while one rated it a “hold.” None rated it a “sell.” The consensus target price is $113.3, suggesting a 10% upside at the current price.

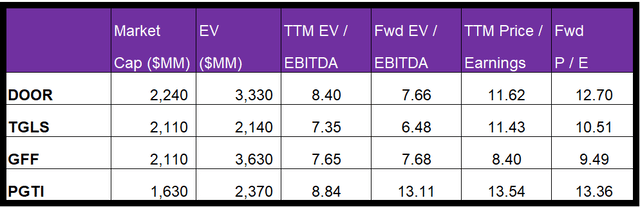

Author created and Seeking Alpha

DOOR’s forward EV/EBITDA multiple contraction versus its current EV/EBITDA contrasts with a rise for its peers. This typically results in a much higher EV/EBITDA versus its peers’ multiple because its EBITDA is expected to increase compared to a fall in EBITDA for its peers. The company’s EV/EBITDA multiple (8.4x) is marginally higher than its peers’ (TGLS, GFF, and PGTI) average (8.0x). So, the stock appears to be slightly overvalued versus its peers.

What’s The Take On DOOR?

Seeking Alpha

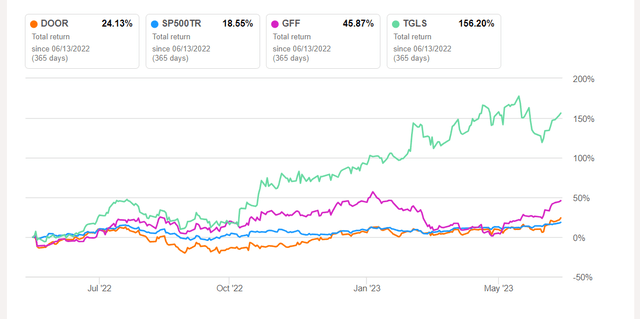

Masonite has stressed various operating margin corrective measures to counter the sales volume drops in the residential housing market. Network optimization and fixed cost reduction projects have become its priority. It has also aggressively promoted new products, including door kits, to increase the average pricing. So, the stock outperformed the SPDR S&P 500 ETF (SPY) in the past year. It strives to ensure a reliable supply process by engaging its partners more intensively in planning.

DOOR’s European business has been critically challenged, primarily because of higher inflation in 2023. Also, lower demand in the Architectural segment would direct it to look for alternative strategic actions. The company’s cash flows improved as it pursued a strategy of components standardization, vendor-managed inventory, centralized warehousing utilization, and safety stock normalization. Nonetheless, given the stock’s rich valuation multiples, investors would do better to “hold” the stock.

Read the full article here