Life sciences software company Veeva Systems (NYSE:VEEV) has good long-term growth prospects, but near-term deceleration and a pricey valuation make the stock a hold.

Slowing growth

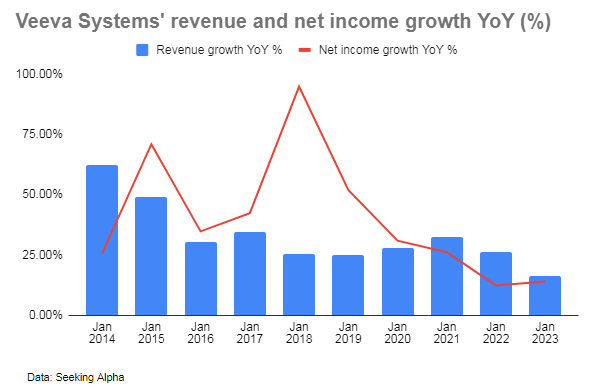

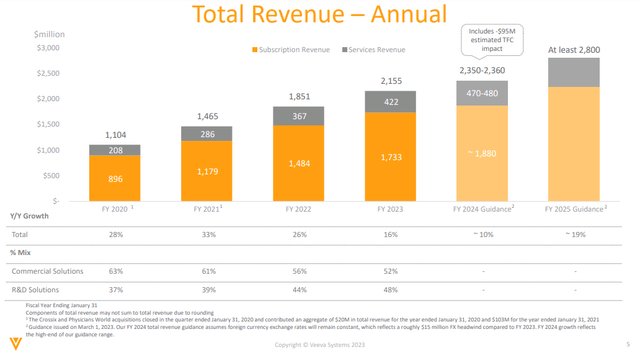

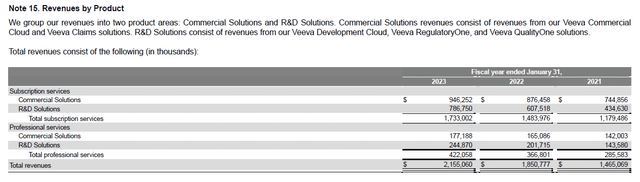

Cloud-based life sciences software company Veeva Systems reported strong but slowing performance for FY 2023 (year ended January 2023), partly attributed to forex headwinds (USD 35 million impact to revenues); customers were up 15% YoY to 1,388 customers as at January 2023 from 1,205 in January 2022 (slower than the 21% YoY growth in customers recorded the previous year), revenues were up 16% YoY to USD 2.16 billion while net income rose 14% to USD 488.7 million.

The company’s revenue and net income growth was among the slowest recorded over the past decade, but was still higher or comparable to some of its major rivals; IQVIA reported full-year 2022 revenue growth of 3.9% YoY to USD 14.4 billion and net income was up 12.9% to USD 1 billion on a reported basis, while Dassault Systemes reported revenue growth of 9% YoY to EUR 5.67 billion in 2022 while net income rose 20% to EUR 1.5 billion.

Author

Near term, the slowing momentum is expected to continue in FY 2024 partly attributable to forex impact and a one-time impact from Veeva Systems standardizing their customer contracts to include termination for convenience (TFC) rights. Revenue growth is expected to slow to 10% YoY in FY 2024, only slightly ahead compared to rivals such as IQVIA (IQV) (5.1% – 6.9% revenue growth on a reported basis for FY 2023), and Dassault Systemes (OTCPK:DASTY) (OTCPK:DASTF) (8%-9% on a constant currency basis). Normalizing for the impact from TFC and forex, Veeva’s revenue growth for the coming year is expected to be around 15%).

Focusing on the medium term, growth is expected to pick up in FY 2025 projected at “at least 15%”. Factors that could support this include revenue opportunities from cross-sales of new products to existing customers, particularly in the areas of clinical data (which according to company management is just 5% penetrated) and operations (30% penetrated).

Veeva Systems Investor Presentation, Q4 2023

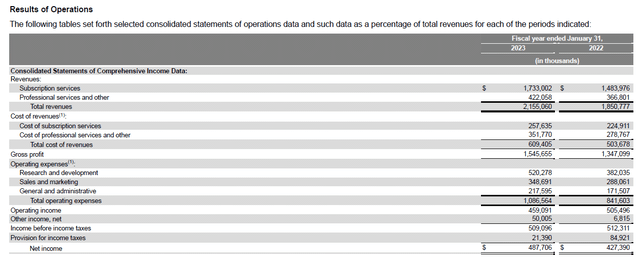

Meanwhile, Veeva Systems’ shift of its CRM platform away from Salesforce (CRM) and towards its own in-house Vault platform in 2025 could cut costs, improve margins and profitability (Veeva Systems pays Salesforce for Veeva customers’ use of the Salesforce platform as part of an agreement that expires in 2025). For perspective, Veeva’s costs related to providing subscription services which include computing infrastructure costs provided by Salesforce and Amazon Web Services among other costs) amounted to USD 257 million in FY 2023 or around 12% of revenues.

Veeva Systems, FY 2023 10-K

Optimistic long-term prospects

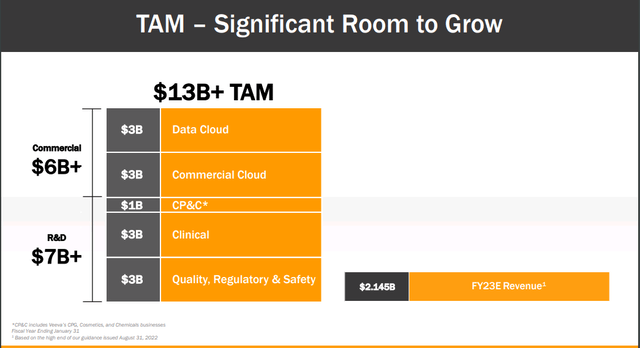

Longer term, Veeva Systems management has highlighted a USD 13 billion addressable market in the areas of data, clinical, and quality among others which suggests enormous room for growth going forward.

2022 Veeva Analyst Day Presentation

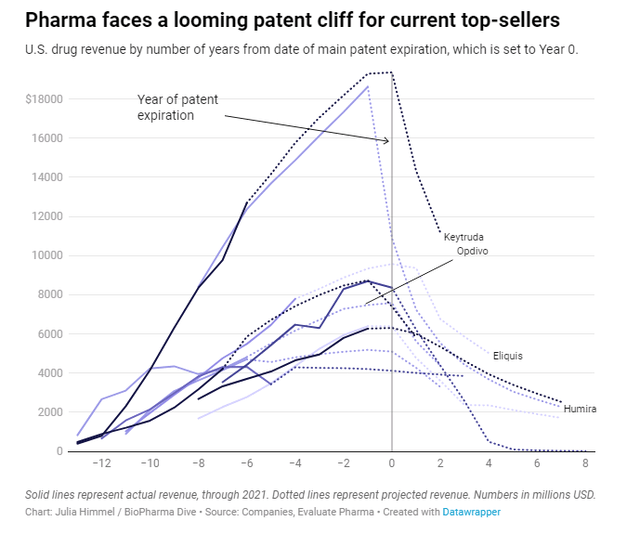

Moreover, the company is positioned to benefit from several positive structural growth drivers in the healthcare industry. An aging population, rising incidence of chronic diseases, increasing penetration of healthcare insurance is driving demand for innovative drugs. Moreover, a looming patent cliff could spur pharmaceutical companies to ramp up in-house R&D efforts as part of an overall strategy to replenish their pipelines.

Biopharma Dive

R&D productivity and returns however have been declining over the past decade according to data by IQVIA and Deloitte, necessitating productivity enhancing solutions like life sciences software. Veeva Systems, a market leader in this space, is positioned to benefit.

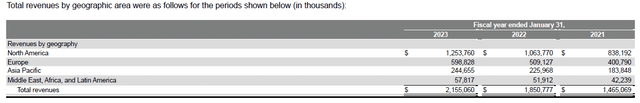

International expansion opportunities could further add to Veeva Systems’ growth prospects. Currently, about 58% of revenues are derived from North America, 27% from Europe, and just 11% of revenues from Asia Pacific.

Veeva Systems, FY 2023 10-K

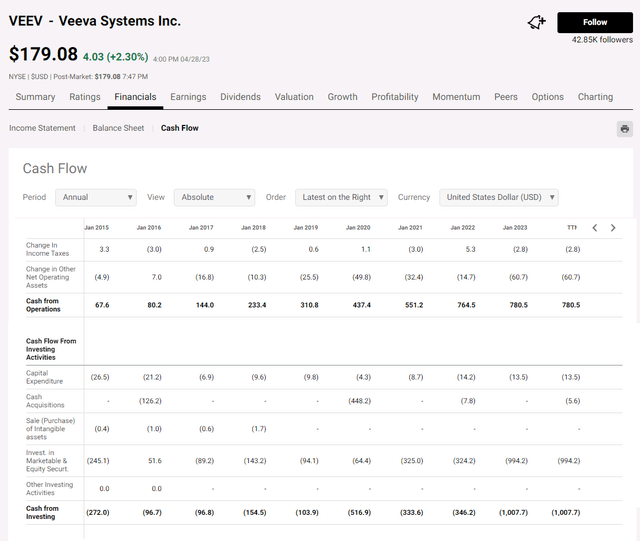

Company management has highlighted international expansion as part of their growth strategy. The company is financially solid and has balance sheet flexibility to fund growth plans; Veeva Systems has barely any debt (debt to equity of 1.64%), and consistently positive operating cash flows and for most years, positive free cash flows as well.

Seeking Alpha

Risks

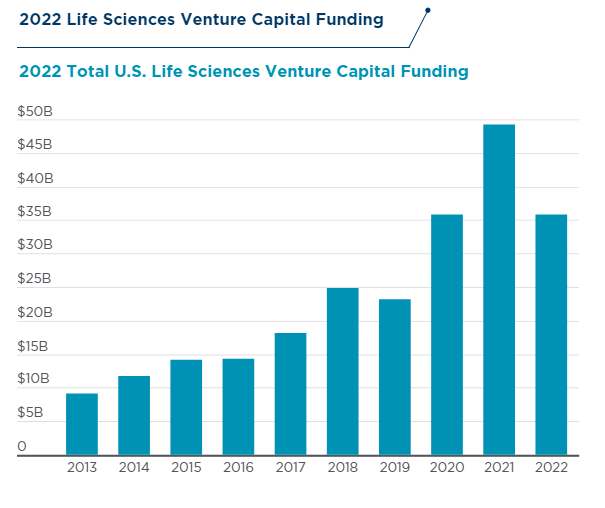

Although Veeva Systems is recession-resilient, it is not entirely recession-proof and a weak macro environment could pressure customers who may be forced to downsize their sales teams and R&D projects. Venture capital funding to the life sciences sector in the U.S. moderated in 2022 after a spike in 2021, and with interest rates expected to remain elevated, funding to the sector may see further pressure near term which may contribute to cost optimization.

Cushman & Wakefield

A shrinking salesforce could impact Veeva Systems’ Commercial Solutions business (which accounts for more than half of Veeva Systems’ revenues), while moderating R&D activity could affect the company’s R&D Solutions business (which accounts for 47% of revenues).

Veeva Systems, FY 2023 10-K

Conclusion

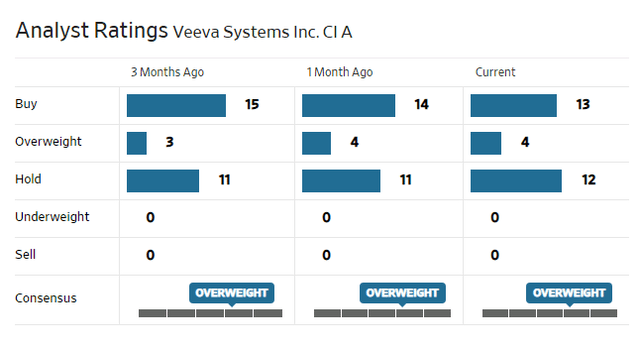

Analysts are split between buy and hold.

WSJ

With a P/E of 41.5, Veeva Systems is quite pricey but could be considered fair for a company with good long-term growth prospects and no meaningful competition. However, considering decelerating growth and near-term headwinds, investors may prefer to wait on the sidelines and the stock may be viewed as a hold.

Read the full article here