India’s March quarter GDP print came in well ahead of expectations at +6.1% YoY, accelerating from +4.5% YoY last quarter on the back of a strong fiscal impulse from government spending, as well as increased investments and net exports. In contrast with the rest of the world, the GDP report also showed positive manufacturing growth, reversing the negative growth seen in prior quarters and validating the broad-based PMI strength in recent months. On another positive note, the stronger growth hasn’t stoked inflationary pressures, so barring any weather-related surprises (the India Meteorological Department currently forecasts monsoon rainfall ~4% below its long-term average), headline consumer inflation should decelerate well below 6% through the rest of the year. This should, in turn, keep the monetary policy stance neutral, offering support to consumption and equity valuations.

The catch with Indian equities (as always) is the pricey valuation – having re-rated since I last covered the fund, the Franklin FTSE India ETF (NYSEARCA:FLIN) portfolio is currently on offer at ~26x underlying earnings. Still, relative to the quality and attractive earnings growth runway of its holdings, FLIN isn’t priced unreasonably; alongside its industry-low expense ratio, the fund remains a great option to ride the Indian growth story.

Fund Overview – Ultra Low-Cost, Diversified Indian ETF

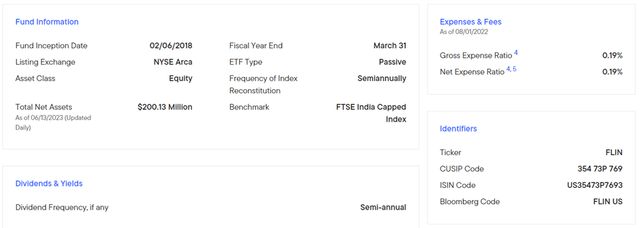

The US-listed Franklin FTSE India ETF seeks to track (pre-expenses) the performance of the market-capitalization weighted FTSE India Capped Index, comprising a basket of Indian large and mid-cap stocks subject to single-stock concentration limits. The ETF maintains a 0.2% expense ratio (gross and net), despite its net asset base growing to $200m over the last quarter (up from ~$98m prior), making it one of the lowest-cost single-country Indian ETFs available to US investors. A summary of key facts about the ETF is listed in the graphic below:

Franklin FTSE India ETF

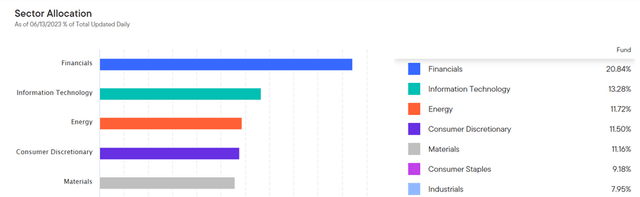

From a sector allocation perspective, the fund is well spread out. Though the Financials sector remains the largest holding at 20.8% (up from ~19% prior), the rest of the top three have seen their % contribution cut over the last quarter – Information Technology now stands at 13.3% (down from ~15% prior) and Energy at 11.7% (slightly down from ~12% prior). Consumer Discretionary is now the fourth-largest portfolio allocation at 11.5% (up from ~11% prior), followed by Materials at 11.2% (unchanged). In line with prior reporting, no other sector crosses the 10% threshold. On a cumulative basis, the top five sectors have a ~%1pt higher contribution at ~69% of the total portfolio.

Franklin FTSE India ETF

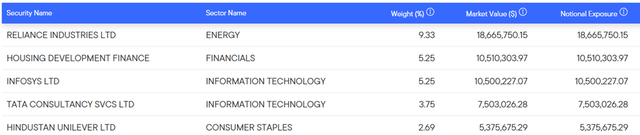

Like the FTSE India Capped Index it tracks, the ETF is spread across >200 holdings. The portfolio composition remains broadly similar to last quarter, with the largest single-stock exposure still Indian multinational conglomerate Reliance Industries Limited (OTC:RLNIY) at 9.3%. The key change is Indian private development finance institution Housing Development Finance Corporation taking over from multinational tech services company Infosys (INFY) as the second largest holding at 5.3%, following the latter’s underperformance post-earnings. Rounding up the top five are Indian information technology services and consulting giant Tata Consultancy Services (OTCPK:TTNQY) at 3.8% and Indian consumer goods company Hindustan Unilever at 2.7%. With the top five holdings contributing ~26% of the overall portfolio, FLIN remains a well-diversified ETF from a single-stock perspective.

Franklin FTSE India ETF

Fund Performance – Steadily Compounding Through the Cycles

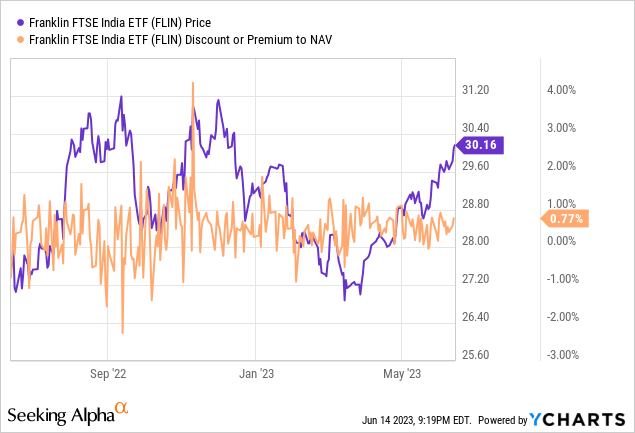

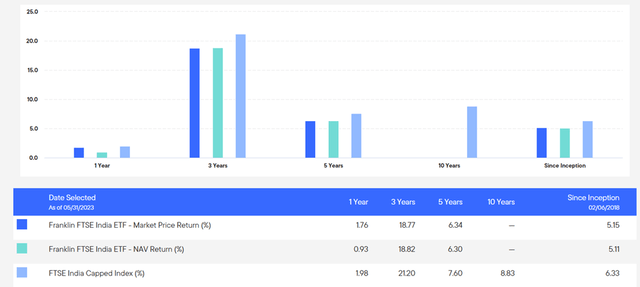

On a YTD basis, the ETF has returned 0.4% in market price terms and 0.5% in NAV terms. Zooming out, the fund has compounded at a steady ~5% pace (in market price and NAV terms) since its inception in 2018. While the performance over the last year has been a drag (one-year annualized total return at +1.8%), the fund’s strong 2020 and 2021 returns have pulled up the three and five-year annualized figures, which stand at +18.8% and +6.3%, respectively. Of note, FLIN’s tracking error vs. its benchmark is concerning at >1%pt annualized since inception, though this delta has shrunk materially over the last year.

Franklin FTSE India ETF

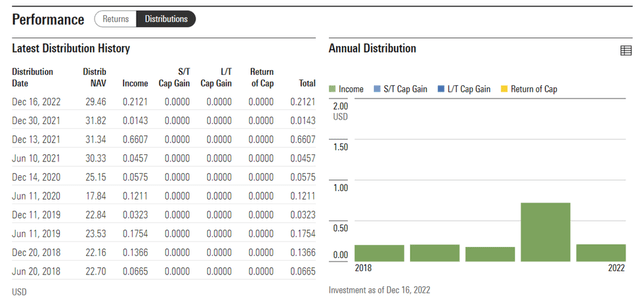

The fund’s semi-annual distribution has been less than stellar, with the income portion of the yield consistently running below 1% and fluctuating through the cycles. Given FLIN’s portfolio consists mostly of high-growth companies with attractive reinvestment runways, I don’t see the distribution being raised anytime soon. So while growth investors will find a lot to like here, income-focused investors should probably look elsewhere.

Morningstar

Attractive Setup as the GDP Growth Premium Widens in Q1

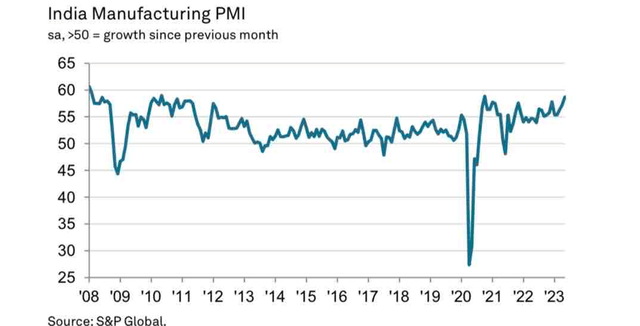

Among the biggest highlights from India’s blowout Q1 GDP report was the net export boost – given this came despite weakening demand conditions globally, India’s growth here was particularly impressive. Another key surprise was the increased contribution from fixed investment at +8.9% YoY (vs. +8.0% YoY in Q4), while the boost from public spending (+2.3% YoY) was positive, albeit well-telegraphed post-budget. As encouraging as the return to YoY growth in manufacturing may have seemed, the recent rise in the S&P Global India manufacturing PMI to a multi-year high of 58.7 in May (up from 57.2 in April) indicates the best is yet to come.

S&P Global

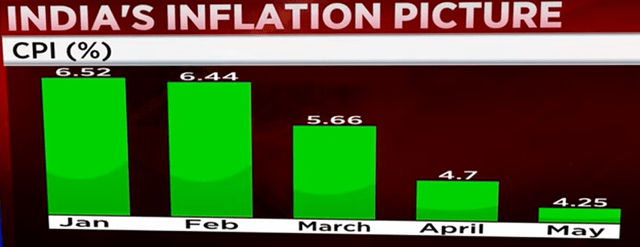

A period of stronger investment-led growth and lower inflation bodes well for the monetary policy outlook as well. In contrast, consumption continues to lag, so the risks of rising core inflationary pressures seem well contained. This should, in turn, push the RBI to a neutral stance for the year, though any easing bias will be tempered by the surplus banking system liquidity post-demonetization of INR2k banknotes. Barring cost-push inflationary pressures from external commodity prices or an El Niño weather event later this year, I would expect headline CPI inflation to trend well below 6% for the rest of the year, offering support to consumption in H2.

CNBC

Poised for Outperformance as Indian Growth Gains Momentum

India’s latest real GDP report (+6.1% YoY) raised quite a few eyebrows, given the deteriorating global economic backdrop. Of note, the sequential acceleration (recall Q4 growth was +4.5% YoY) was largely down to investment growth and robust government spending. In turn, manufacturing is gaining traction after consecutive quarters of slowdown, with the latest PMI at 58.7 (led by the output and new orders sub-indices), indicating further expansion into Q2 and a robust demand environment. Expect this growth impulse to broaden out on the consumer side as well, with headline CPI inflation continuing to cool and the RBI policy stance turning neutral.

FLIN’s diversified portfolio should benefit from India’s growth premium; though valuations screen richly at first glance, the P/E is more than justified by the underlying earnings growth potential, in my view. With the risk of an El Niño weather event later in the year, though, investors may also want to keep some dry powder available to capitalize on any one-off dips.

Read the full article here