Overview

Finally, we get an update on the Live Nation tracker spinoff as well as the conversion of the Liberty Braves segment (BATRK, BATRA, BATRB) into a normal asset backed stock. A special meeting of shareholders is slated to take place on July 17th, where shareholders can vote on the completion of the transaction. The company also provided pro forma asset lists to what will be attributed to each stock after the spinoff. I wanted to dive a little further into the details to get a better understanding of what this means for Liberty SiriusXM (NASDAQ:LSXMK, NASDAQ:LSXMA, NASDAQ:LSXMB) shareholders, assuming this spinoff gets approved. If you are not familiar with the tracking stock or the spinoff, I did cover and attempt to value the Liberty SiriusXM tracking stocks in my previous article.

The Live Nation Tracker

The Live Nation tracker spinoff is going to be an amalgamation of a number of assets and $100 million in cash currently attributed to Liberty’s Formula One Group segment tracker (FWONK, FWONA, FWONB), and Liberty SiriusXM’s 30% stake in Live Nation (LYV). This will be offset by $920 million in debt. LSXMX holders will be giving up a portion of Live Nation to FWONX holders, as both segments will be getting LYV tracking stock. Of note, approximately 11% of the Live Nation tracker will be attributed to FWONX holders, while 89% will be attributed to LSXMX holders.

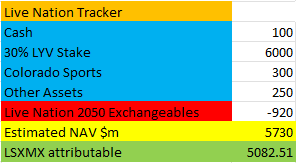

I initially felt a little annoyed by this, as LYV is pretty close to a vertically integrated monopoly on ticketing and live events, and I didn’t really want to give up ownership. As far as I can tell, the tradeoff is probably fair, but further clarification from management would be nice on valuations of the underlying businesses. Below is my estimate of the NAV attributable to the Live Nation tracker, including dilution of LSXMX’s stake by FWONX holders. The easiest FWONX asset to estimate the value of is the Kroenke Arena Company, which also includes a 7% profit interest if the Colorado Avalanche or Denver Nuggets are sold. The others are mostly a mystery to me, but I assumed the company would want to keep contributions from LSXMX and FWONX to be proportionally equal. My estimate of NAV is demonstrated below:

This writer’s estimates and company data

The Sirius XM Tracker

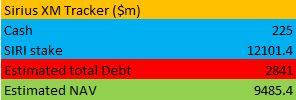

Not much has changed here. Management has made it clear that the 3% intergroup interest in the Liberty Braves group would be used to pay down parent level debt. This does not give LSXMX holders the potential upside of the Atlanta Braves post spin-off. The estimated NAV of the tracker based on current SIRI market price is shown below, giving a total NAV attributable to holders of LSXMX of $14.5 billion post spin-off.

This writer’s estimates and company data

Musings on Liberty Segments

So far, LSXMX appears to be the least popular segment of the Liberty Media conglomerate, as FWONX and BATRX have continued to perform well. I can easily see why people would be interested in purchasing BATRX stock. Trading at around $2 billion, with an impending spinoff to an asset backed stock, could help re-rate the sports team towards its estimated value of $2.6 billion. It may also make a sale of the segment easier and more tax efficient. For whatever reason, owning a sports team seems to be a popular pastime for the uber rich, so minimal cash generation may not be an issue.

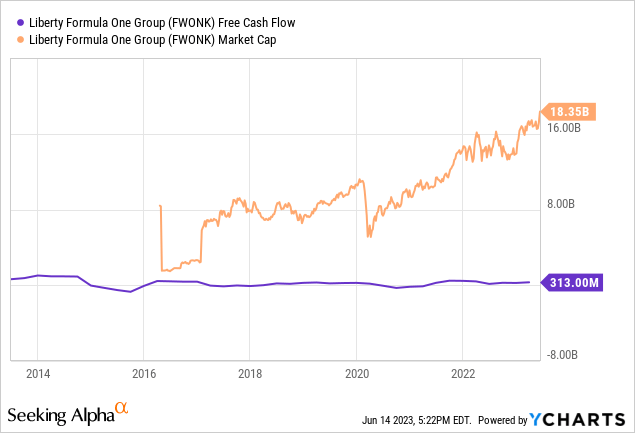

FWONX, on the other hand, I am a bit more skeptical of. Cash generation has not grown significantly over time, though market cap has, and it is currently trading at a p/fcf of 58. I suppose a lot is being paid for the moat of owning such a popular franchise, and there will likely not be anyone replacing F1’s niche.

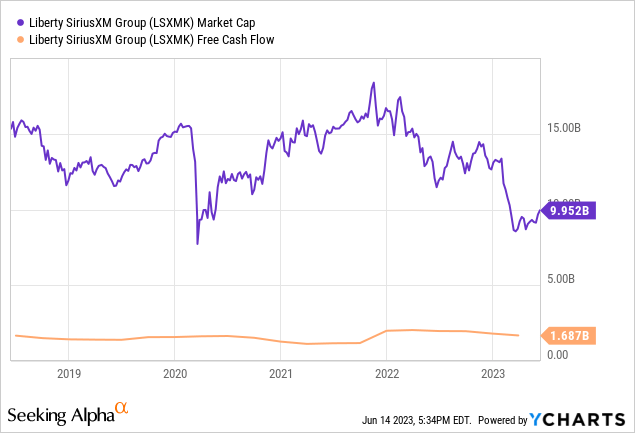

LSXMX continues to be the most hated, and the best reason I can think of is the relative unpopularity of Sirius XM (SIRI). Though once a monopoly, audio streaming from large players continues to eat into market share and could erode shareholder value further. This doesn’t seem like an imminent threat, though, and SIRI continues generating large amounts of cash.

I also believe the ownership structure to be a little bit odd. It is pretty clear to most investors that purchasing SIRI does not make a lot of sense given the heavy discounts on the assets of LSXMX. This may create downward pressure on the stocks, as LSXMK in turn closely tracks the performance of SIRI. Liberty’s high ownership in SIRI also keeps float low and probably makes the stock more volatile. Hopefully, the spinoff will help close the NAV gap.

Pre-spinoff, though, the LSXMX segment trades at a P/FCF of 6, making it by far the cheapest part of Liberty to buy on a cash flow basis. After reviewing each part of the Liberty, I still think LSXMX is the best segment to buy at current prices pre-spinoff, given its 40% upside to assumed post spinoff NAV and cash generating capabilities.

Conclusion

There is some uncertainty about the exact value LSXMX holders are receiving to compensate for their loss of about 11% of their stake in LYV with the new tracker spinoff. They are receiving about 300 million in easy to value assets from FWONX, including cash and the Kroenke Arena Company assets, which include a 7% profit interest if the Denver Nuggets or Colorado Avalanche sports teams are sold. I assumed the rest of the FWONX assets might be valued at approximately $250 million to be fair to both parties, but that is to be seen.

Investors may want clarity from management on more concrete estimates of fair value on assets like the 33% interest in Associated Partners L.P., the 80% interest in Liberty Technology Venture Capital LLC, and the other numerous assets getting spun off from FWONX into the Live Nation tracker. After reviewing each tracking segment of Liberty Media, I still believe LSXMX offers the best risk/reward at current market prices. The calculated 40% upside to NAV and cash generation potential offers what I believe to be a good margin of safety. Long term investors interested in owning SIRI and LYV could instead buy LSXMX to get these assets at a discount, and the impending spinoff could help the assets realize their full market potential.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here