This article is part of a series that provides an ongoing analysis of the changes made to Chase Coleman’s Tiger Global Management 13F stock portfolio on a quarterly basis. It is based on Tiger Global’s regulatory 13F Form filed on 5/15/2023. Please visit our Tracking Chase Coleman’s Tiger Global Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves in Q4 2022.

Chase Coleman’s 13F portfolio value increased from $8.16B to $10.99B this quarter. Recent 13F reports have shown 100+ positions. There are 33 stakes that are significantly large (more than 0.5% of the portfolio each) and they are the focus of this article. The largest five positions are Microsoft, Meta Platforms, JD.com, Amazon.com, and Alphabet. Together, they add up to ~57% of the entire 13F portfolio.

Prior to founding Tiger Global Management in 2001, Chase Coleman was the technology analyst at Tiger Management from 1997 to 2000, making him a bona fide “tiger cub”. To know more about Julian Robertson and his legendary Tiger Management, check out Julian Robertson: A Tiger in the Land of Bulls and Bears.

Note: Tiger Global gained 7.3% during Q1 2023. They lost ~56% last year.

New Stakes:

Taiwan Semi (TSM), Apple Inc. (AAPL), and XP Inc. (XP): TSM is a 1.34% of the portfolio position established this quarter at prices between ~$74 and ~$98 and the stock currently trades well above that range at ~$107. The 1.28% AAPL stake was purchased at prices between ~$125 and ~$165 and it now goes for ~$184. XP is a small 0.79% position established at prices between $10.65 and $18.11 and it is now at $21.14.

Stake Disposals:

AppLovin Corp. (APP), Match Group (MTCH), and Qualtrics International (XM): These very small (less than ~0.75% of the portfolio each) stakes were disposed during the quarter.

Stake Increases:

Microsoft Corporation (MSFT): MSFT is currently the largest position at 15.55% of the portfolio. It was established in Q4 2016 at prices between $57 and $63 and increased by ~400% in Q2 2017 at prices between $65 and $72. Q1 2018 also saw a ~38% stake increase at prices between $85 and $97. Q4 2019 saw a ~30% selling at prices between $135 and $159 while in Q1 2021 there was a ~15% stake increase at prices between ~$212 and ~$240. The three quarters through Q2 2022 saw a ~60% selling at prices between ~$242 and ~$343. The stock is now at ~$337. There was a ~13% increase this quarter.

JD.com (JD) & Calls: JD was a ~5M share position first purchased in Q4 2014 at prices between $23.50 and $27. The next two quarters saw the position built up to a huge ~70M share position (~25% of the 13F portfolio at the time) at prices between $24 and $38. H2 2018 also saw a ~42% increase at prices between $19.25 and $39.50. Q2 2022 saw a ~37% selling at prices between $48.70 and $66.50. That was followed with a ~27% reduction last quarter at prices between ~$37 and ~$60. It is their third largest 13F position at 9.61% of the portfolio (24.08M shares). The stock is now at $38.64. This quarter saw a ~10% increase.

Amazon.com, Inc. (AMZN): AMZN is now a large (top five) 9.10% of the portfolio stake. The position was established in Q2 & Q3 2015 at prices between ~$19 and ~$27. Q1 2016 had seen a two-thirds reduction at prices between ~$24 and $34. The following quarter saw a ~40% increase at prices between ~$29 and ~$37. There was a ~38% selling in Q4 2018 at prices between ~$67 and $101. Q4 2019 and Q1 2020 saw another ~22% reduction at prices between ~$85 and ~$109. The three quarters through Q2 2022 had seen the stake sold down by ~75% at prices between ~$102 and ~$185. Last quarter saw the position rebuilt at prices between ~$82 and ~$121. The stock is now at ~$126. There was a ~13% increase this quarter.

Alphabet Inc. (GOOG): GOOG is a ~8% of the portfolio position purchased during Q2 2022 at prices between ~$106 and ~$144 and the stock currently trades at ~$124. This quarter saw a ~125% stake increase at prices between ~$87 and ~$109.

Apollo Global (APO), Intuit (INTU) and Take-Two Interactive (TTWO): These three stakes saw large increases this quarter. The 1.50% APO stake saw a ~315% increase this quarter at prices between ~$56.50 and ~$74. The stock currently trades at $76.15. The 1.82% INTU position was primarily built this quarter at prices between ~$376 and ~$452 and it is now at ~$446. TTWO is a 2.60% position built during the last two quarters at prices between ~$94 and ~$126 and it now goes for ~$137.

Datadog Inc. (DDOG): DDOG is now at 1.75% of the portfolio. A large stake was built in H1 2020 at prices between ~$29 and ~$90. H1 2022 saw a roughly two-thirds reduction at prices between ~$82 and ~$175. Q3 2022 saw a ~200% stake increase at prices between ~$86 and ~$118 while the last quarter saw the position reduced by ~85% at prices between ~$67 and ~$95. There was a ~175% stake increase this quarter at prices between ~$63.50 and ~$89. The stock is now at ~$96.

Zoominfo Technologies (ZI): ZI is a 1.68% of the portfolio position established last quarter at prices between ~$26 and ~$49 and the stock currently trades at $27.65. There was a ~20% increase this quarter.

Confluent, Inc. (CFLT): The 1.26% CFLT stake was built during the last two quarters at prices between ~$18 and ~$29 and the stock currently trades at $34.57.

NU Holdings (NU): NU had an IPO in December 2021. Shares started trading at ~$12 and currently go for $7.35. There was a ~90% reduction in the last three quarters at prices between ~$3.25 and ~$8. The position is now very small at 1.10% of the portfolio. There was a marginal increase this quarter.

Stake Decreases:

Meta Platforms (META), previously Facebook: The large (top three) 14.37% META stake was established in Q4 2016 at prices between $115 and $132. The buying continued through Q2 2019 at prices up to ~$200. Q4 2019 saw a ~25% selling at prices between $175 and $208. The three quarters through Q2 2021 had seen another ~42% selling at prices between ~$246 and ~$356. That was followed with a ~23% reduction in Q1 2022 at prices between ~$187 and ~$339. The last two quarters saw a stake doubling at prices between ~$89 and ~$183. The stock currently trades at ~$273. This quarter saw a minor ~6% trimming.

Note: Meta has seen a previous roundtrip in the portfolio. A pre-IPO investment of ~54M shares was sold out by Q4 2012. The trade generated over $1B in profits.

Workday, Inc. (WDAY): WDAY is a 4.73% of the portfolio stake built in 2020 at prices between ~$114 and ~$258 and the stock currently trades at ~$217. H1 2022 saw a ~68% selling at prices between ~$137 and ~$264. There was a ~135% stake increase in the next quarter at prices between ~$138 and ~$180. The last two quarters saw a ~20% trimming.

Sea Limited (SE): The 2.65% position in SE was first purchased in Q2 2018 at prices between $10.25 and $16.50. The next few quarters also saw further buying. Q4 2019 saw a ~40% selling at prices between $26.70 and $40.25 while in the next six quarters there was a ~60% stake increase at prices between ~$91 and ~$358. There was a ~40% selling in Q2 2022 at prices between ~$57 and ~$133. That was followed with a ~63% reduction last quarter at prices between ~$41 and ~$65. The stock is now at $63.64. There was a minor ~5% trimming this quarter.

Snowflake Inc. (SNOW): The 2.60% SNOW stake was built over the six quarters through Q1 2022 at prices between ~$180 and ~$392. There was a ~70% reduction in the next quarter at prices between ~$113 and ~$241. Q3 2022 saw a ~22% stake increase while this quarter saw a similar reduction. The stock currently goes for ~$181.

Kanzhun Ltd. (BZ): The 1.48% BZ stake was built over the three quarters through Q3 2022 at prices between ~$15.50 and ~$37. There was a ~52% reduction in the last two quarters at prices between ~$10.75 and ~$26. The stock currently trades at $16.82.

HubSpot, Inc. (HUBS): HUBS is a 1.19% of the portfolio position purchased during Q3 2022 at prices between ~$264 and ~$407 and the stock currently trades at ~$504. There was a ~62% selling in the last two quarters at prices between ~$256 and ~$429.

Pagaya Tech. (PGY): PGY came to market through a SPAC transaction with EJF Acquisition. Tiger Global invested through the PIPE at $10 per share. The stock is now at $1.20. The last two quarters saw a ~40% reduction.

Block, Inc. (SQ), DLocal Limited (DLO), Freshworks (FRSH), MongoDB (MDB), Ozon Holdings (OZON), SentinelOne (S) and Toast (TOST): These small (less than ~1.5% of the portfolio each) stakes were reduced during the quarter.

Kept Steady:

ServiceNow, Inc. (NOW): NOW is a 3.42% of the portfolio position that saw a stake doubling in Q3 2020 at prices between ~$402 and ~$500. The two quarters through Q1 2021 had seen another ~45% stake increase at prices between ~$475 and ~$595. Q2 2022 saw a ~55% reduction at prices between ~$412 and ~$575. There was a similar increase during Q3 2022 at prices between ~$370 and ~$516. The last quarter saw a ~50% reduction at prices between ~$342 and ~$426. The stock currently trades at ~$567.

Mastercard (MA): The 2.39% MA stake was kept steady this quarter.

CrowdStrike Holdings (CRWD): CRWD is now a 1.12% of the portfolio stake. A large stake was established in Q2 2020 at prices between ~$55 and ~$105. Q3 2020 saw a ~50% stake increase at prices between ~$97 and ~$144. There was another ~17% stake increase in Q1 2022 at prices between ~$157 and ~$227. The two quarters through Q3 2022 saw a ~90% reduction at prices between ~$137 and ~$240. The stock currently trades at ~$154.

Atlassian Corp. (TEAM) and Grab Holdings (GRAB): These two very small (less than ~0.65% of the portfolio each) stakes were kept steady this quarter.

Note: In July 2018, it was reported that Tiger Global has taken a ~$1B stake in SoftBank (OTCPK:SFTBY). The stock was at ~$20 (split-adjusted) at the time and currently trades at $23.61.

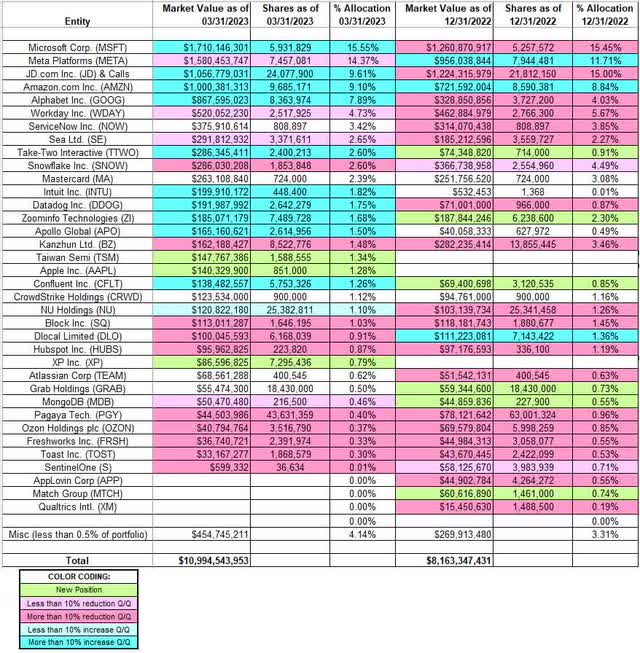

Below is a spreadsheet that shows the changes to Chase Coleman’s Tiger Global Holdings 13F portfolio holdings as of Q1 2023:

Chase Coleman – Tiger Global’s Q1 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Tiger Global’s 13F filings for Q4 2022 and Q1 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here