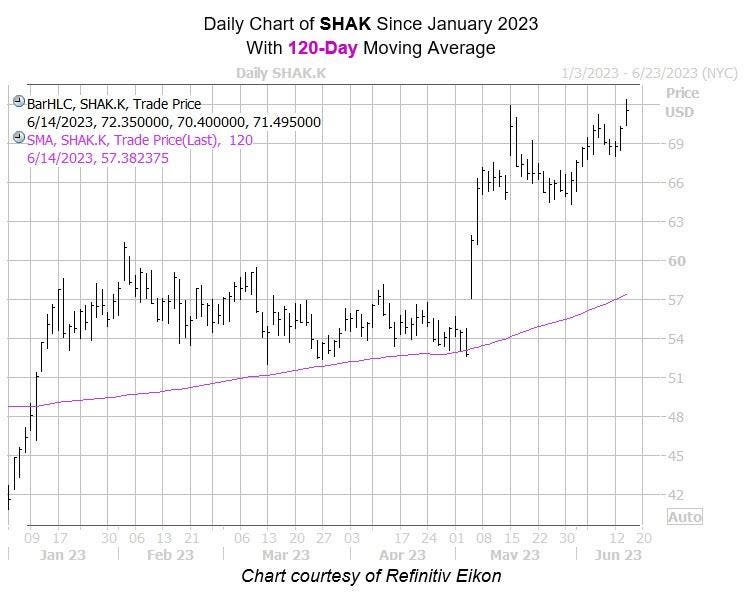

Shake Shack stock is enjoying a boost this afternoon, following a bull note out of Piper Sandler. The analyst initiated coverage with an “overweight” recommendation, citing an expectation that the limited restaurant service sector will continue to take share from full-service peers. At last glance, SHAK is up 2.9% at $72.16, earlier touching a 15-month peak of $72.85. Year-to-date, the fast-food chain has added over 75%, with long-term support appearing at the 120-day moving average. Even more fresh highs could be on the horizon, per historical data.

In fact, while it sits at a fresh 15-month high, SHAK is also seeing historically low implied volatility (IV), which has been a bullish combination in the past. Data from Senior Quantitative Analyst Rocky White shows three other signals during the last five years when the security was trading within 2% of its 52-week high, while its Schaeffer’s Volatility Index (SVI) sat in the 20th percentile of its annual range or lower. This is currently the case with SHAK’s SVI of 33%, which sits in the lowest percentile of its annual range. One month after these signals, the stock was higher 100% of the time, averaging an 18% return.

Shake Shack stock is looking ripe for even more upgrades and/or price target hikes. Heading into Wednesday, nine of the 14 covering brokerage firms sport a “hold” or “strong sell” rating, and the security’s average 12-month price target of $69.73 comes in at a discount to current levels.

Shorts look to be getting rid of their bearish bets already. During the last two reporting periods short interest has backpedaled more than 30%, though it still accounts for 6.9% of the stock’s total available float. At the equity’s average pace of daily trading, it would take shorts just over three days to buy back these bearish bets.

Read the full article here