This article was first posted in Outperforming the Market on June 6, 2023.

I shared with members of Outperforming the Market there was an excellent opportunity to buy SentinelOne, Inc. (NYSE:S) after the post-earnings plunge and sent out an earlier trade alert for this. That position in SentinelOne has generated more than 20% returns since then. I also shared with members of Outperforming the market my deep dive into the SentinelOne’s FY1Q24 quarter, as well as the guidance that was provided.

In this article, I will share with you why I think that this is an excellent opportunity to buy SentinelOne and provide an in-depth competitive analysis, looking into how SentinelOne compares to CrowdStrike (CRWD) and Microsoft (MSFT).

FY1Q24

Revenues for the FY1Q24 quarter came in at $133 million, up 70% from the prior year but missing market expectations by 2%. International revenues grew 84% year-on-year in the quarter and made up 35% of SentinelOne’s revenues. Total ARR reached $564 million in the quarter, as SentinelOne added $42 million in net new ARR.

Both ARR and revenues for FY1Q24 came in softer than expected, as a result of a more difficult operating environment for the company as deal sizes became smaller and budgets were tightened. This worsened sentiment for the company, but I argue that the plunge in the share price is not justified by this slight miss in revenues for the quarter nor the lower guidance which I will elaborate in the later section.

That said, the bad news stops there, as SentinelOne met or exceeded expectations for its costs, margins and profitability targets.

Despite the lower revenue growth than expected, SentinelOne generated record gross margins of 75%, a significant seven percentage points improvement from the prior year. To be clear, this is a huge milestone for SentinelOne, as they set a long-term gross margin target between 75% to 80% two years ago and they are already operating within that range. This improvement and achievement come from its improving scale, lower data processing costs and cross-selling abilities.

I am of the view that SentinelOne accelerated their profitability plans and this undoubtedly has some impact to its revenue growth but sets it up for long-term, sustainable growth.

In FY1Q24, SentinelOne also improved operating margins by 35 percentage points to negative 38% in the quarter. This comes as the company has been aligning its cost structure to its growth profile.

Free cash flows in FY1Q24 also improved from an outflow of $55 million last year to $31 million in the quarter, which is an improvement of 46 percentage points to its free cash flow margins.

Finally, FY1Q24 Non-GAAP EPS came in at negative $0.15, beating market estimates by 12%.

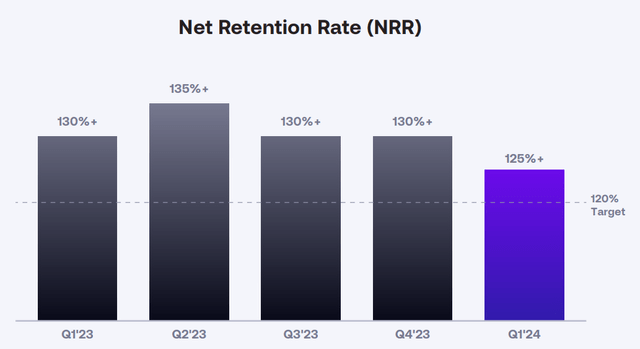

In addition, SentinelOne’s net retention rate continues to be above 125%, above its target, and the per customer ARR rose by more than 20% compared to the prior year as adoption of SentinelOne’s Singularity platform grows and business momentum amongst large customers continue.

Net retention rate (SentinelOne)

Guidance

The disappointment in guidance resulted in a huge share price plunge as guidance was cut.

Looking ahead to the second quarter of FY2024 and the full year FY2024, management sees that a difficult macro environment in terms of selling as enterprise budgets tighten and sales cycles elongate. As a result, they are expecting lower conversion from their pipeline for the rest of FY2024 and also downsizing of deals.

That said, management reiterates that this assumption does not affect SentinelOne’s competitive position or long-term opportunity as a platform that provides both leading security protection as well as value. At the same time, the company continues to maintain solid competitive win rates, pricing remains stable, and the company is still generating strong momentum in its pipeline.

For FY2Q24, revenues of $141 million is expected, which is up 38% from a year ago. This is a 7% miss compared to market expectations.

Net new ARR is expected to be in the low $40 million range, similar to what we saw in FY1Q24. The net new ARR is expected to be higher in the second half of 2024 as seasonality effects kick in. Thus, full year ARR is expected to grow in the mid-30s percentage range compared to the prior year’s $522 million ending ARR.

For the full year FY2024, management expects revenue to come in between $590 million to $600 million, which implies a 41% growth from the prior year at the midpoint. This guidance is a 6% revision downwards from their prior guidance for FY2024 revenue and a 7% miss compared to market expectations.

Management highlighted that despite the lower guidance, they expect to continue to grow and progress more rapidly towards their profitability targets.

I am of the view that the management team is attempting to balance growth and profitability here, with growth taking a backseat in the near-term while they prioritize profitability given the importance of profitability in today’s market.

In terms of margins, FY2Q24 gross margins are expected to improve 10 percentage points compared to the prior year to 74.5% in the next quarter, and this gross margin is expected to be maintained through the other quarters in FY2024.

Thus, management is increasing their gross margin guidance for FY2024 up two percentage points at the midpoint to the range of 74% to 75%. This is improvement in gross margins comes as a result of efficiencies from data processing and improving scale.

Operating margins were also reiterated despite the cut in revenue guidance. FY2Q24 operating margins are expected to come in at negative 36%, an improvement of 20 percentage points from the prior year, and FY2024 operating margins are expected to be in the range of negative 29% and negative 25%, which is an improvement of about 22 percentage points compared to the prior year.

I think that SentinelOne may be able to beat on its profitability metrics in the subsequent quarters. This is because they seem to be taking incremental actions to improve on its profitability and the focus on execution there leads me to think that the company will be able to exceed expectations in this front.

Management is looking to reduce headcount by 5%, slow hiring in the future, lower variable spend and cloud hosting costs, all to help bring the cost structure in-line with the rate at which SentinelOne is growing. The focus for management continues to be that each dollar invested has to generate a positive return.

These steps being taken to improve operating efficiency will lead to $40 million in cost savings and will lead the company towards achieving its target of breakeven profitability in FY2025.

SentinelOne has a $1.1 billion in cash on its balance sheet which management describes as a “substantial war chest” that is able to provide it more than sufficient liquidity to reach its profitability targets.

All in all, while revenue guidance disappointed as a weaker guidance was announced, this was balanced, in my view, with the higher gross margin guidance and reiterated operating margin guidance, which highlights management’s priorities in the near-term. I am of the view that the company will continue to deliver growth that is balanced with discipline in profitability in the near-term.

There are two key reasons for the weakness in revenue and ARR growth in the quarter, which also resulted in lower expectations for the quarters ahead.

The first headwind comes from the longer sales cycles and smaller deal sizes as a result of the macroeconomic environment. Companies are increasingly scrutinizing their budgets that are resulting in changes to deal sizes for SentinelOne’s new and existing customers. These challenges were more pronounced for SentinelOne in the first quarter of FY2024 even though they have been highlighted in earlier quarters.

Second, there was some slippage in execution by the SentinelOne team that led to a few deals slipping to the next quarter. This was a result of poor execution on the part of SentinelOne as they look to streamline their closing process and improve their go-to-market approach.

These factors, smaller deal sizes, lower conversion of its pipeline and the impacts of a challenging macroeconomic environment was incorporated into the guidance provided by the company.

As a result, I think that the next quarter and full year FY2024 guidance may have already been de-risked with the share price movement and downward guidance.

In addition, management also noted that their guidance also incorporates an increased priority for efficient growth, which also supports my thesis earlier that management seems to be focused on accelerating profitability.

Growing customer base

SentinelOne grew total customer count by 43% from the prior year in FY1Q24.

Larger customers with more than ARR of $100k grew by 61% from the prior year and the customers with more than $1 million ARR grew even faster.

In the quarter, SentinelOne also added another new Fortune 10 customer and thus, the company has been chosen by half of the Fortune 10 companies today.

I think that this highlights that while companies of different sizes see the benefit of the SentinelOne platform, the company is growing its larger customers in particular, which is encouraging.

Competitive position

It seems that SentinelOne is thus far still maintaining its competitive position despite the lowered guidance, as management states that their pricing remains stable as evident from its gross margins.

Win rates continue to be strong as SentinelOne continues to win against other legacy and even next generation vendors in “significant majority of competitive evaluations,” which they expect will continue in the future.

Use of AI

For those unaware, SentinelOne has been known since the beginning to provide a fully automated AI-based security platform without needing human intervention, which differentiates itself from CrowdStrike.

SentinelOne’s Singularity platform is powered by a single proprietary security data lake to protect multiple attack surfaces and it integrates neural networks to fight against cyber threats.

The company’s AI-based strategy has led to industry leading autonomous protection, which has been assessed by third parties like Gartner.

SentinelOne also launched Purple AI, similar to CrowdStrike’s Charlotte AI, which is meant to help security analysts with an AI engine to improve security outcomes and lower costs. Purple AI was tested in a cybersecurity event, and it received positive feedback, with the media naming SentinelOne as an innovator in AI, and Purple AI as one of the most interesting products in the event.

Competitive landscape

Third party evaluations

SentinelOne is noted to have achieved excellent results MITRE ATT&CK Phase 4 evaluations of the first quarter of 2022, which demonstrates the company’s ability to detect all attacks and provide full details of techniques and tactics used. The company has used acquisitions to expand its product portfolio and on top of that, it has expanded its network of MDR partners over the last year.

However, it seems that SentinelOne has a lower brand awareness compared to other leaders like Microsoft and CrowdStrike and its XDR product is still evolving compared to the other leaders in the space.

There was also some limitations in SentinelOne’s ability to support on-premises deployment and systems that were not connected to the internet because it offers full featured support for cloud-facing systems.

CrowdStrike has strong suites in market understanding and innovation and is known to score consistently high for customer experience, overall viability and innovation. The company continues to deliver on its MDR services to its clients and its acquisition of humio helps to provide CrowdStrike with a solid base for expansion into XDR.

CrowdStrike showed less tactic and technique coverage in its 2022 MITRE ATT&CK phase 4 test results when compared to SentinelOne, and the company’s pricing strategy has been regarded as poor compared to other Leaders in the Magic Quadrant.

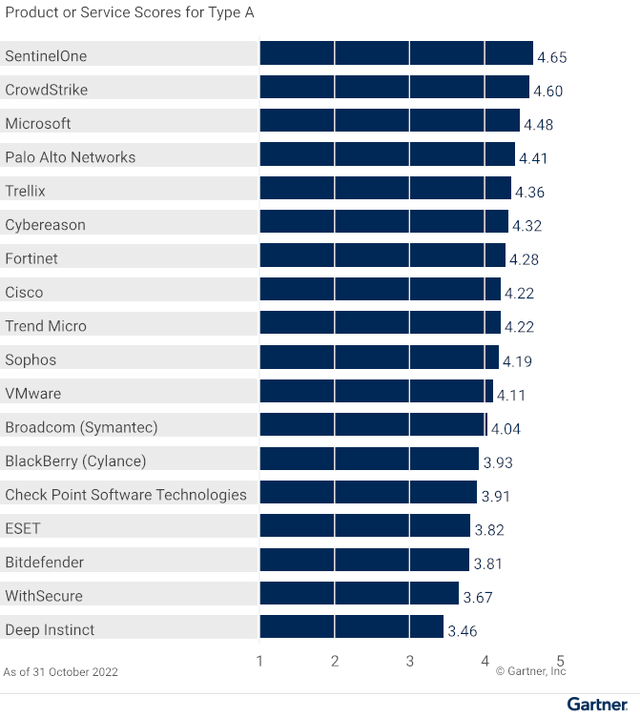

Endpoint security protection platform magic quadrant (2022 Gartner Report)

There is also a Gartner report that looks at endpoint protection platform’s prevention, protection and detection capabilities and determine which player’s offerings is most suitable for Type A (mature and aggressive), Type B (mainstream) and Type C organizations (least mature and aggressive). Based on this Gartner report, SentinelOne is actually ranked the top suitable choice for all of Type A, Type B and Type C organizations. I show the scores for Type A organizations below, but as mentioned earlier, SentinelOne is actually ranked the top by Gartner for both Type B and Type C organizations.

Vendors’ Product Scores for Type A Use Case (Gartner)

Customer reviews

When comparing SentinelOne to the other endpoint protection platform leaders, based on the verified reviews from real users, CrowdStrike and SentinelOne seem to have the higher rating, both ranking 4.8 out of five stars.

CRWD vs S vs MSFT (Gartner)

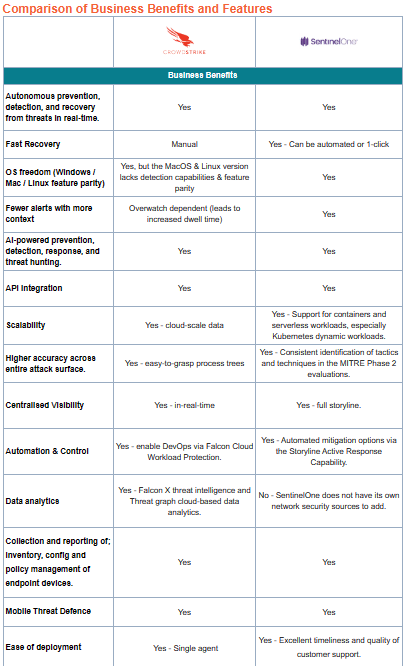

Specifically, between SentinelOne and CrowdStrike, the main difference is that SentinelOne offers prevention, detection and response fully powered by patented AI, while CrowdStrike incorporates human powered protection. As a result, the key debate for CrowdStrike compared to SentinelOne is whether human powered protection adds value or not. SentinelOne also does have a lower pricing compared to CrowdStrike. On the other hand, CrowdStrike is easier to deploy, has fewer false positives, relative to SentinelOne, according to CrowdStrike. I highlight more of the differences between the two below.

CrowdStrike vs SentinelOne (ITHQ)

And then between Microsoft and SentinelOne, the prevention, detection and response of the Microsoft requires extensive tuning and has performed poorer than SentinelOne in MITRE ATT&CK evaluations. In addition, SentinelOne offers automated remediation while Microsoft’s offering only offers automatic remediation for a small number of alerts and there is none available on macOS or Linux.

All in all, I think that the verified customer reviews and third-party evaluations are sufficient to allow me to conclude that SentinelOne is a leader in endpoint security despite the increasing competition in the space. Its product offering is on par, if not more superior than that of the other leaders in the segment and has its own value proposition that will enable it to continue to gain share from legacy and potentially even next-gen vendors.

Valuation

I shared with members of Outperforming the Market my financial forecasts for SentinelOne in the next five year period and my intrinsic value for SentinelOne in the deep dive article, and I reiterate my 1-year price target from that article as shared below.

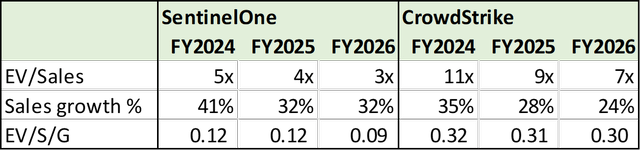

Before I share more about my 1-year price target for SentinelOne, I think the following table illustrates how interesting the opportunity is for SentinelOne today given the drastic difference in valuation between CrowdStrike and SentinelOne.

CrowdStrike vs SentinelOne valuation (Author generated)

My 1-year price target for SentinelOne is $20.50. This is based on a 7.5x EV/Sales multiple applied to the 1-year forward sales forecast for SentinelOne. Thus, the 1-year price target implies 49% upside potential from current levels.

Conclusion

In conclusion, while there were certainly negatives in the recent quarter, I think that the share price plunge is an over-reaction, while the positives in the quarter, including the improving margin and profitability metrics, warrant some merit.

At the end of the day, management is prioritizing profitability over growth, which is reasonable in the current market environment. The negatives, including a tough macroenvironment resulting in smaller deal sizes and longer sales cycle, will likely be a temporary dynamic while the team is working on improving on their sales execution and closing processes to improve pipeline conversion in the long-term.

In addition, the competitive analysis based on third party evaluation and independent customer reviews show the SentinelOne is competitive against other leaders in the segment.

Members of Outperforming the Market can find my intrinsic value and 5-year financial forecasts for SentinelOne in the deep dive article. My 1-year price target for SentinelOne stock is $20.50, which implies 49% upside potential from current levels.

Read the full article here