Deal Overview

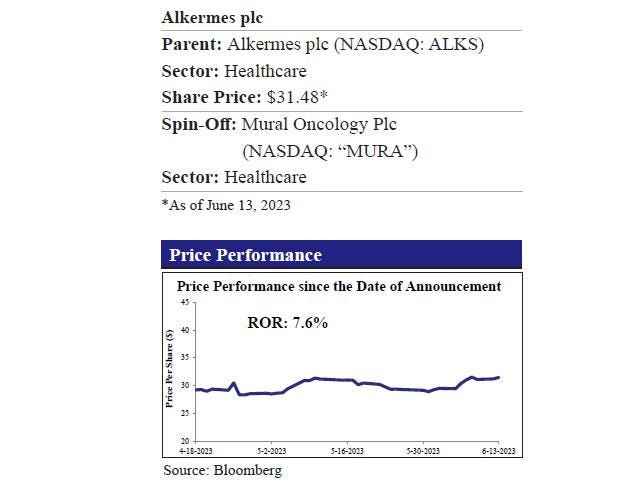

On April 18, 2023, Alkermes

ALKS

Post-spin-off, Alkermes (RemainCo) will retain its focus on significant unmet needs within neuroscience and driving the growth of its proprietary commercial products, and Richard Pops would continue as Chief Executive Officer and Chairman of Alkermes. Mural Oncology (Spin-Off) would focus on the discovery and development of cancer therapies, including the continued development of nemvaleukin alfa and the Company’s portfolio of novel, preclinical engineered cytokines, comprised of tumor targeted split interleukin-12 (IL-12) and interleukin-18(IL-18). On 6/1, Alkermes announced the appointment of Caroline J. Loew, Ph.D., as the CEO designate of Mural Oncology plc. Dr. Loew has joined Alkermes as a strategic advisor and will transition to CEO of Mural Oncology upon completion of the separation. Alkermes will continue to carefully manage the cost structure of each business in preparation for potential separation. Moreover, the Company has retained Morgan Stanley

MS

On 4/26, Alkermes released its 1Q23 results, with total revenues for the quarter rising 3.3% YoY to $287.6 million, compared to $278.5 million 1Q22, driven by the strong performance of proprietary product sales. The Company reported a GAAP net loss of $41.8 million in 1Q23 (1Q22: $35.9 million) or a basic and diluted GAAP loss per share of $0.25 versus $0.22 in 1Q22.

Deal Rationale

As noted in our potential announcement report dated November 9, 2022, the Board of Directors, working closely with management and external financial and legal advisors, had commenced an evaluation of a broad range of potential strategic options for the Company’s non-core assets in December 2020, including an evaluation of strategic partnerships and other opportunities for its oncology business. Alkermes Board and management team undertook concrete actions to create and execute the Company’s shareholder-supported December 2020 Value Enhancement Plan, which included board refreshment, profitability targets, and strategic options evaluation, and the stock had rallied ~30.8% since November 2, 2022, when ALKS had announced the potential spin-off of Oncology business. Moreover, in February 2023, the Company accelerated its long-term profitability targets to reflect the anticipated financial benefit of the planned separation of the oncology business in 2H23 and announced its commitment to achieving the FY24 non-GAAP net income equal to 25% of total revenues and EBITDA margin of 20% of total revenues and FY25 non-GAAP net income equal to 30% of total revenues and EBITDA margin of 25% of total revenues.

It should be noted that the neuroscience business represents an established commercial enterprise with multiple growing products, a unique place in a complex market, and an early-stage pipeline expected to serve as the next growth phase. Moreover, the Company’s move to separate businesses is supported by its belief in the blockbuster potential of the schizophrenia and bipolar disorder drug Lybalvi. Separating its oncology sector – in the development stage – will allow Alkermes to focus on the commercialization of Lybalvi, which it launched in October 2021. In contrast, the oncology business includes a differentiated late-stage clinical candidate and a pipeline of preclinical biologics. Each business has its compelling investment thesis, and the Company believes the separation could unlock value for shareholders and yield several benefits for both businesses.

Alkermes believes separating the oncology business into Mura Oncology would drive a sharp strategic focus for each business. It will also establish separate, distinct management teams with relevant therapeutic expertise based on each business’s unique strategic priorities and opportunities. The separation will simplify capital allocation decision-making and increase flexibility to pursue growth and investment strategies more directly aligned with each business’ respective goals, enable the capital markets to assess each business’ value, better performance, and potential, and attract a long term shareholder base suited to each business.

After separation, Alkermes will continue building on the heritage of innovation and excellence in neuroscience. With a strong topline driven by the growth of its proprietary products, a specialized commercial infrastructure in neuropsychiatry and addiction, and proven drug development capabilities, the standalone neuroscience business represents a compelling opportunity to capture operating leverage, drive growth and profitability, and advance new potential medicines for neurological disorders. The oncology business’s nemvaleukin is now in two potential registrational studies. The business has a convincing standalone investment thesis anchored by the potential medical and economic value of the reportedly potential first-in-class cancer therapy.

The Company believes separating the oncology business at this time will best support and position nemvaleukin for success, create value for shareholders and enable efficient advancement of its preclinical pipeline of engineered cytokines.

Other Key Developments

i) On 5/31, Alkermes received the final award from the arbitral tribunal in its arbitration proceedings regarding two license agreements with Janssen Pharmaceutica N.V. (Janssen), a subsidiary of Johnson & Johnson

JNJ

VEGA

ii) Despite the Company’s positive momentum and strong performance, Sarissa notified Alkermes in February 2023 of its intent to nominate three director candidates for election at the Annual Meeting. Interestingly, this is the third year in a row Sarissa has submitted nominations to the Company, following a settlement in 2021 that resulted in the appointment to the Board of a Sarissa-designated director (who continues to serve on the Board) and Sarissa’s abandonment of its previous proxy campaign in 2022. Following the committee’s evaluation, the Board determined that the key attributes and experience of the three Sarissa nominees were neither additive to the Board at this time nor consistent with the skillset previously identified by the Board as important in a new director. The Board, therefore, determined that appointing Sarissa’s nominees as directors would not be in the Company’s and its shareholders’ best interests. Notwithstanding the foregoing decision, the Alkermes Board has made numerous attempts to resolve with Sarissa, and a number of the Company’s independent directors have continued to discuss with Sarissa ways to prevent a proxy contest.

Company Description

Alkermes plc (Parent)

Alkermes plc (NASDAQ: ALKS) is a fully-integrated, global biopharmaceutical company developing innovative medicines in the fields of neuroscience and oncology. The Company has a portfolio of proprietary commercial products focused on alcohol dependence, opioid dependence, schizophrenia, and bipolar I disorder and a pipeline of product candidates in development for neurological disorders and cancer. Headquartered in Dublin, Ireland, Alkermes has a research and development center in Waltham, Massachusetts; a research and manufacturing facility in Athlone, Ireland; and a manufacturing facility in Wilmington, Ohio. In FY22, the Company reported total revenue of $1.1 billion.

After separation, Alkermes will focus on significant unmet needs within neuroscience and on driving the growth of its proprietary commercial products: LYBALVI, ARISTADA/ARISTADA INITIO, and VIVITROL. The Company will also focus on advancing the development of pipeline programs focused on neurological disorders, including ALKS 2680, an orexin 2 receptor agonist for the treatment of narcolepsy. Alkermes expects to retain manufacturing and royalty revenues related to its licensed products and thirdparty products using the Company’s proprietary technologies under license. Alkermes would expect to benefit from enhanced profitability and continued balance sheet strength following a separation of the oncology business. Richard Pops will continue as Chief Executive Officer and Chairman of Alkermes.

Mural Oncology Plc (Spin-Off)

Mural Oncology Plc (Spin-Off) (NASDAQ: “MURA”) will include the Company’s oncology business. Mural Oncology will focus on discovering and developing cancer therapies, including the continued development of nemvaleukin alfa (nemvaleukin), a novel, investigational, engineered interleukin-2 (IL-2) variant immunotherapy. Nemvaleukin is currently in potential registration enabling studies in two difficult to- treat tumor types: platinum-resistant ovarian cancer and mucosal melanoma. By selectively targeting the IL-2 pathway, nemvaleukin has broad potential clinical utility in a variety of tumor types and offers the potential for significant value creation as the development program advances. The assets subject to separation are also expected to include a portfolio of novel, preclinical, engineered cytokines, including tumor-targeted split interleukin-12 (IL-12) and interleukin-18 (IL-18).

Read the full article here