In October 2022 I profiled Good Times Restaurants (NASDAQ:GTIM) at $2.20/share, whereas today it trades at $3. What has changed for them in the past 8 months?

Legal Victory Now On Appeal

Good Times is dogged by a 2019 lawsuit with White Winston Select over the failed divestiture of their drive-thru vertical. GTIM was awarded a win without counterclaims earlier this year, but White Winston has appealed the decision. Given the appeal, I doubt the situation will be resolved before the end of the year and wouldn’t expect a release of their $332k reserve for expected losses until the suit is finally settled. The maximum exposure for GTIM is $5m (GTIM_Proposal_Of_Findings.pdf – $4.8m write-down and $215k out of pocket – p.32), for those seeking to handicap the maximum downside scenario. Alternatively, GTIM could end up being awarded counterclaims on appeal and receive reimbursement for their court costs. Time will tell.

Joint Venture Interest Buyout

GTIM utilized their cash balance to repurchase JV interests from 5 Bad Daddy’s locations for $4.4m, about 5x TTM EBITDA. Increasing exposure to 5 established locations at a 20% yield seems like a shrewd move compared to investing in new locations.

The JV buyout valued the Bad Daddy’s locations at $4.4m/2.4 net locations = $1.8m each. For the 42 company-owned locations, this is almost an $80m valuation. With 11.7m outstanding shares, this is almost $7/share before adding the value of net cash and the drive-thru (“Good Times”) side of the business.

Continued Buybacks

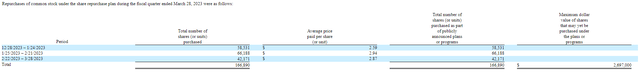

GTIM Buybacks (GTIM 10-Q)

GTIM has continued retiring shares at a steady rate, repurchasing about 25% of daily volume (max allowed under 10b-5 plan in place). Around 600k shares have been retired since my October piece. They concluded March with $2.7m of remaining buyback authorization and seem intent on exhausting it as soon as possible. Assuming remaining shares are bought around $3, that could reduce outstanding shares to approximately 10.8m.

Cash Flows

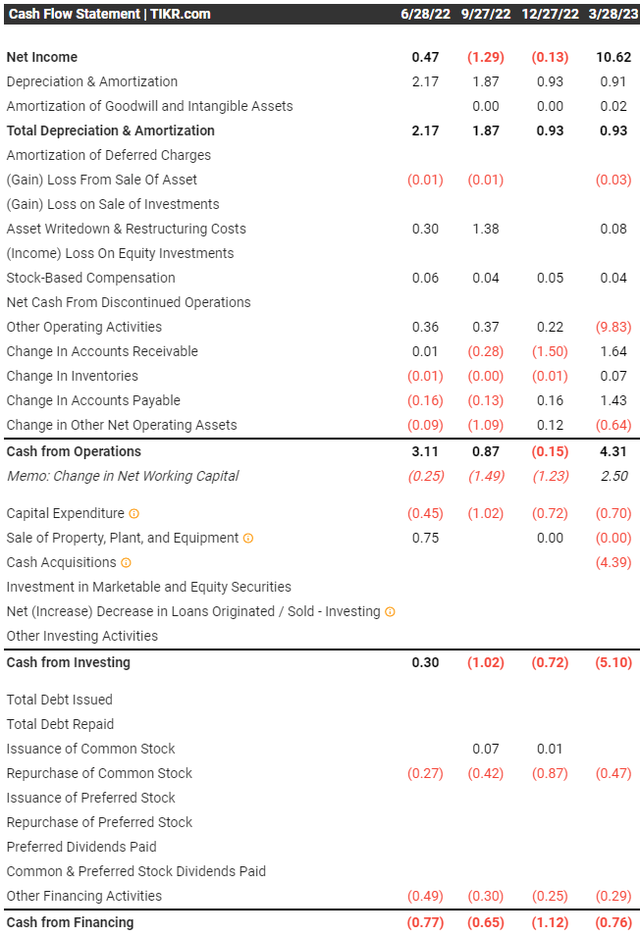

GTIM Cash Flows (TIKR)

TTM cash from operations is $8.1m, a healthy number for a business trading at a $35m market cap. Less $2.9m of CapEx (including growth spend) and $1.3m of JV distributions (of which ~$800k curtailed via buyout) this is about $4.7m of FCF after removing TTM JV distributions that have been internalized. The company also maintained over $5m of net cash at the end of the latest quarter. So GTIM trades about 6x EV/TTM FCF, a ~17% yield.

Exit Strategy

My expectation is the GTIM management will seek to resolve the White Winston suit, complete their buyback authorization, and reaccelerate Bad Daddy’s unit growth. Once accomplished, I believe management will liquidate the company. Until that happens, they can continue to devote cash flows to reducing the share count and increasing their payout upon a sale. Insiders own ~20% of the shares with no other major holders, keeping their incentives well-aligned.

Risks

GTIM is small and illiquid, making it difficult to trade in size, but it does have an options chain.

As mentioned above, GTIM has $332K accrued for potential losses due to their legal fight, and a maximum exposure of $5m. Their cash balance should provide them with a decent cushion in the event of an adverse appeal ruling.

Most of the usual risks you would expect for a small restaurant operator are present, and the anticipated restart of student debt payments may cut into consumer discretionary spending.

Conclusion

GTIM is a small, well-managed restaurant operator that has navigated a tough environment during Covid with good results. They have paid off debt, reduced outstanding shares, grown their restaurant ownership, and showed preliminary success defending themselves in court over their failed drive-thru sale. I hope that investors will eventually be well-compensated for their patience through a sale of the business at a favorable price, and I expect the company to continue buybacks while we wait.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here