Canadian intermediate oil producer Gran Tierra Energy (NYSE:GTE)(TSX:GTE:CA) continues to be weighed down by the uncertain outlook for oil and heighted geopolitical risk in Colombia where its operations are located. The plans of Colombia’s first leftist president Gustavo Petro, himself a former guerilla, to cease awarding new hydrocarbon exploration contracts and ban hydraulic fracturing in Colombia are weighing heavily on energy companies operating in the country. Gran Tierra is a hotly followed high risk high return small-cap oil stock which has gained around 1% since I last wrote on the driller after it had completed its 10-for-1 reverse split and rated it as a strong buy. The driller experienced a deep sell-off after announcing disappointing first quarter 2023 numbers on the back of a sharp increase in geopolitical risk. While the market perceives it to be a high-risk investment, latest events and news support the investment case outlined in my earlier articles.

Operational update

An important development for investors in Gran Tierra to note is the driller’s emerging ability to consistently grow oil production. In the past, the company earned a reputation for overpromising and under delivering when it came to petroleum production volumes. The inability to deliver the budgeted production volumes has weighed heavily on Gran Tierra’s share price. There are signs that the driller is capable of consistently boosting production, particularly as it ramps up the tempo of operations at the Acordinero and Costayaco Blocks onshore Colombia.

Indeed, since the 2020 pandemic Gran Tierra has been consistently growing production with the latest numbers supporting that trend. First quarter 2023 production grew 8% compared to a year earlier to an average of 31,611 barrels per day, while second quarter 2023 rose 6% month over month and a notable 10% year over year to 33,600 barrels daily. This was the highest petroleum production reported by Gran Tierra since the second quarter 2019 when the driller pumped 35,340 barrels per day.

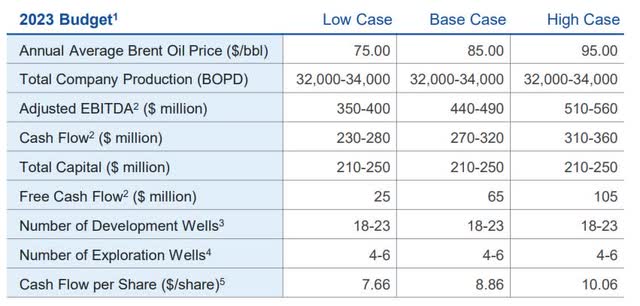

Gran Tierra’s push to ramp-up production is progressing well with average output for the last 2 weeks of May 2023 reaching an average of 36,800 barrels per day. Year to date 2023 average production, for the period of January 1, 2023, to May 28, 2023, was 32,400 barrels per day which is within the annual forecast range of 32,000 to 34,000 barrels per day, as per the chart below.

Gran Tierra 2023 Budget (Gran Tierra Energy June 2023 Corporate Presentation)

Source: Gran Tierra Energy June 2023 Corporate Presentation.

This solid production is a promising development which if maintained will act as a powerful catalyst to boost Gran Tierra’s share price. The company drilled 19 wells, split between 12 production wells and 7 water injection wells, between January 1, 2023, and May 30, 2023. Those represent the majority of the 18 to 23 wells planned for the year, meaning that any financial pressures will not impact Gran Tierra’s drilling program and planned production volumes. These latest numbers highlight that Gran Tierra will meet and even potentially beat its forecast 2023 average annual production of 32,000 to 34,000 barrels per day. These developments certainly bode well for the company’s annual revenue, EBITDA, cash flow and net income.

The key concern at this time is the muted outlook for oil prices, which remain soft even after Saudi Arabia vowed to slash another one million barrels daily off its oil production. Gran Tierra needs Brent to average $85 per barrel to achieve its base case 2023 budget. Every day, that appears less and less likely with Brent currently trading at $75 per barrel and only averaging $80.45 for the year to date, at the time of writing. The current poor outlook for oil which is being impacted by fears of a recession and weaker than anticipated economic data in China is weighing on Gran Tierra’s performance and financial outlook.

Financial update

Based on current Brent prices and a softer forecast with the U.S. EIA predicting that the international benchmark will average $79.54 per barrel for 2023 Gran Tierra will likely only achieve the low case forecast where it needs an average price of $75 a barrel. This will significantly impact Gran Tierra’s financial position at a time when it is struggling to build free cash flow and reduce looming debt maturities. According to the driller’s 2023 budget it will only generate $25 million in annual free cash flow if Brent fails to rally and average $75 per barrel for the year.

This is a worrying development because of the company’s debt profile with $272 million of outstanding notes maturing in 2025, as the chart shows.

Gran Tierra Debt Profile (Gran Tierra Energy Corporate Presentation June 2023)

Source: Gran Tierra Energy June 2023 Corporate Presentation.

The $272 million in outstanding notes, which falls due in February 2025, will move to current liabilities during early 2024 placing greater stress on Gran Tierra’s already somewhat fragile balance sheet. If Gran Tierra generates 2023 free cash flow of $25 million which is then added to $105.6 million of cash, at the end first quarter 2023, it will be insufficient to meet that obligation even after accounting for $20 million of inventory and $13.6 million of accounts receivable. This indicates that the driller will need to refinance that obligation by taking on additional debt, likely at less favorable terms, adding to the company’s financial burden. That is clearly weighing on Gran Tierra’s market value.

Nonetheless, management has done a reasonable job of reducing debt and strengthening Gran Tierra’s balance sheet since oil prices crashed at the start of the 2020 pandemic, which saw the market price the company for bankruptcy. Long-term debt at the end of the first quarter 2023 totaled $581.4 million compared to $786.6 million at the end of the same period in 2020. The company is focused on reducing its long-term debt repurchasing $8 million of the 6.25% February 2025 notes during the first quarter 2023. This not only delivered a $1.1 million gain for Gran Tierra but also reduced the driller’s financing costs. The steady reduction of debt is not only strengthening Gran Tierra’s balance sheet but also boosting the company’s net asset value and will eventually lead to a higher valuation.

Another important development is the steady reduction of Gran Tierra’s share count. By the end of the first quarter 2023, the driller had 333,069,042 common shares outstanding which is nearly 10% lower than the 368,898,619 common shares outstanding on 31 December 2022. The number of outstanding shares was reduced to 33,306,904 after Gran Tierra completed a 10-for-1 reserves split on May 4, 2023. The driller continues to buy back stock and has purchased 36 million shares between September 2022 and March 31, 2023. The steady buyback of outstanding shares will also strengthen Gran Tierra’s financial position and lift the company’s after-tax NAV per share.

Valuation update

Without any further financial data being made available by Gran Tierra the valuation I calculated for the May 6, 2023, article using the following inputs stands:

- An after-tax net present value with a 10% discount, known as an NPV-10, of $1.3 billion for 1P reserves.

- An after-tax NPV-10 of $1.8 billion for 2P reserves.

- A stock count of 333,069,000 outstanding common shares, which after the 10-for 1-reverse split changes to 33,306,904 common shares;

- Long-term debt of $581,391,000.

- Cash and cash equivalents of $105.7 million as per Gran Tierra’s first quarter 2023 results.

Using that information I determined in my earlier May 6, 2023, article that Gran Tierra had an after-tax 1P net asset value of $2.56 per share and $4.08 per share for its 2P after-tax NAV. After allowing for the 10-for-1 reverse split completed on May 4, 2023, those values are $$25.60 and $40.80 per share respectively. It is worth noting that Gran Tierra’s after-tax NPV10 was calculated using a five-year forecast Brent price of $80.56 per barrel. Just as higher oil prices, as well as discoveries, can lead to a higher NPV-10 softer prices will cause the value of Gran Tierra’s oil reserves to fall. While the five-year average price used to calculate the NPV-10 is slightly higher than the EIA’s short-term 2023 forecast of $79.54 per barrel there is every likelihood the Brent price will exceed the five-year average used for Gran Tierra’s NPV-10.

On the basis of Gran Tierra’s after-tax 2P NAV of $40.80 per share, which is seven times the current share price of $5.56 at the time of writing, the driller is heavily undervalued offering a solid margin of safety. The last time Gran Tierra traded at around or close to that value was in September 2018 when Brent was trading at between $76 and $86 per barrel. Since then, the geopolitical risks associated with operating in Colombia have intensified, especially after the 2022 presidential election with former leftist guerilla Gustavo Petro emerging victorious.

Country specific risk update

In my earlier articles I have discussed those risks and related headwinds at length with the primary hazards being:

- November 2022 tax hikes which increased the effective tax rate for oil companies operating in Colombia from 36% to around 50%.

- Petro’s plan to end awarding contracts for hydrocarbon exploration, although existing agreements will be respected and remain in force, making the impact on Gran Tierra at this time negligible.

- Petro’s plan to ban hydraulic fracturing, which is currently being considered by Congress and will likely be approved, although Gran Tierra is not impacted because the company doesn’t own any unconventional acreage.

- Heightened security risk due to ongoing conflict between various illegal armed groups notably dissident factions of the Revolutionary Armed Forces of Colombia who did not accept the 2016 peace agreement the National Liberation Army, known as the ELN, and largest organized crime group The Gulf Clan. Nonetheless, a ceasefire between the government and ELN was recently declared.

- Rising tensions between Colombia’s public forces and the president which saw the threat of a coup d’état made by the former president of Colombia’s retired and reserve military forces association ACORE.

- The outbreak of a political scandal concerning the former ambassador to Venezuela and Petro’s chief of staff where allegations of illegal wiretaps, lie detector tests and police coercion have emerged. As a result, Colombia’s Congress has frozen any consideration of Petro’s proposed reforms causing the peso to soar, which likely will only be temporary.

Final thoughts

The chaos and considerable uncertainty which has emerged in Colombia during the first year of Petro’s presidency is weighing heavily on energy companies operating in the country. It is those risks which are feeding the market’s overblown perception of risk that is weighing heavily on Gran Tierra’s market value. Due to the headwinds buffeting Gran Tierra the company remains substantially undervalued and its share price will remain under pressure for some time yet. There are, however, positive catalysts emerging which will act as tailwinds. These include higher oil prices because of Saudi Arabia’s production cuts and growing demand as we enter the summer driving season. There are also indications that Petro may be forced to abandon his plan to bring hydrocarbon exploration in Colombia to an end.

Read the full article here