Investment Thesis

Cameco Corporation’s (NYSE:CCJ) share price has finally caught a bid. Why? Yes, one could say that it was because Cameco is attractively priced. And yes, Cameco does have compelling near-term prospects.

But it’s more than this, too. Indeed, I argue that the news flow in the past few days has improved, with the U.S. Senate providing the signal that the political tide is finally turning more positive for the uranium sector.

In the analysis that follows, I describe why to consider investing in the uranium sector. Why a short squeeze is not in your interest. And finally, why Cameco stock itself is compelling.

Why Invest in Uranium?

Deep Value Returns’ members know my vision for Future Energy. This marries up the confluence of 3 different dynamics, I call them the Three Ds:

- Deglobalization

- Decarbonization

- Digitalization.

Uranium falls, as do most of my stocks, into these dynamics. Although I don’t own Cameco, I have another uranium peer. But the fundamental idea remains basically the same. I’ll soon describe why Cameco could be a preferred investment vehicle for some investors. But I get ahead of myself. Let’s get some context.

Most investors have come to understand the need for electric vehicles (“EVs”) rather than internal combustion engines (gas-powered tanks, or “ICE”). Some may even be familiar with household heat pumps (maybe you own one?). However, I believe that nobody reading this has failed to at least to some extent pondered over the use of artificial intelligence (“AI”).

Why do I bring this up? Because every single one of those devices/engines/servers needs electrical power. A lot of power! And we are unlikely to get all the power we need from just renewable energy sources.

So, as we strive to decarbonize our energy sources, we must replace this energy with something. It’s not good enough to declare that we’ll reduce our carbon fuels if we don’t supplement this energy with something else. Notice that I said supplement rather than replace. Why?

Because I believe that we are going to need a lot more energy in the next several years than many investors realize.

Our aspirations to reduce our dependency on fossil fuels are likely to fail to get much traction. Consequently, here enters nuclear energy.

Nuclear power plants fueled by uranium can provide a constant and reliable source of electricity, which unlike renewable energy sources such as solar or wind, which are intermittent and dependent on weather conditions.

Simply said, aspirations aside, the U.S., as a leading superpower, can’t seek to flourish depending on favorable weather conditions. Uranium-based nuclear power plants provide reliable baseload power generation.

Additionally, nuclear energy is cheap, highly scalable, and flexible. Again, it’s important to understand, I’m not arguing for the displacement of natural gas or thermal coal with nuclear energy. I’m simply arguing for supplementing our energy supply with this highly dense energy source.

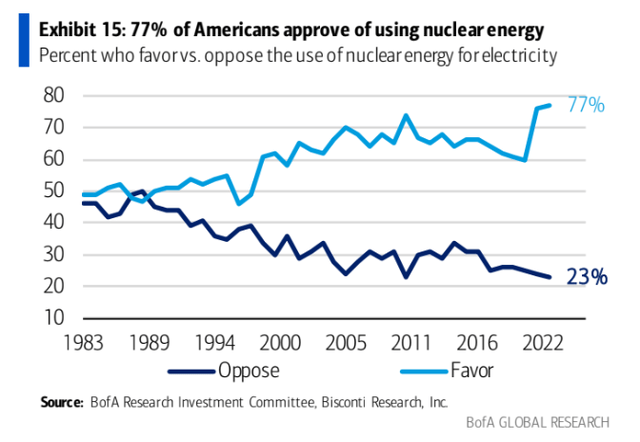

Bank of America

Now that we understand the background demand for uranium, as Delaware Democrat Tom Carper declared, that uranium is the middle ground between domestic energy security and the threat posed by climate change if we stick with carbon-based energy sources, allow me to contextualize what you don’t wish to happen, a uranium squeeze.

Why You Do Not Want a Uranium Squeeze

A lot of uranium bulls like to talk about the ”imminent” uranium squeeze. If you permit me, I will explain, how an investment squeeze happens. It happens when investors don’t expect it. The simple fact that everyone hopes something happens in the market, often means it doesn’t happen.

That being said, I wish to make it clear, one does not need a uranium price squeeze to be rewarded. In fact, I declare that aside from amateurs, serious investors don’t welcome a squeeze in a financial asset. Why?

Firstly, the obvious, because it’s unhealthy for the sector. You can think about the semiconductor chip shortages of 2021-2022 as suitable comparisons and the ramifications they had on many other industries.

Secondly, and less obvious, what do you do when the squeeze comes? Do you sell for a 15% pop? Do you buy more? It messes around with the whole investment process.

Why Cameco? Why Now?

Finally, we reach the crux of the analysis. Why Cameco? This is the core of the bull case. Cameco’s contract book reached 215 million pounds of uranium in 1Q23, the strongest it’s been since 2014.

In other words, the demand for Cameco’s uranium is now the highest in nearly 10 years. Before we go further allow me to highlight a recent quote from Cameco’s management,

[…] on the fixed contract side, we’re now seeing $53, $54 per pound. Remember, it’s really important to remember that the term price is not influenced by market related term contracts. […] So as we enter the term market with market related exposure, with each contract we’ll crank up the floors that are escalated. We’ll crank up the ceilings that are escalated. The term contract gives you — the term contract price gives you a very good idea where those escalating floors are from. That’s incredible downside protection with a lot of upside participation.

In the quotes above we see the other side of the argument. That is that Cameco contracts out its uranium book. That means that there’s a ceiling to the price it’s able to sell its uranium at.

For investors that want a relatively low-risk uranium investment, I believe that Cameco is a very suitable choice. For investors that want something with higher risk/higher return, I believe that Uranium Energy Corp. (UEC) makes sense.

The Bottom Line

Cameco’s share price has gained momentum due to attractive pricing, positive news flow, and strong uranium demand.

Investing in uranium is crucial for supplementing renewable energy, as nuclear power provides reliable electricity.

While a uranium squeeze is not desirable, Cameco offers a low-risk investment option with a robust contracted book. For higher risk and potential returns, Uranium Energy Corp. is a viable alternative. Overall, Cameco Corporation stock presents a compelling investment opportunity in the uranium sector.

Read the full article here