Investment Thesis

Back on August 6, 2020, with the Guidewire Software, Inc. (NYSE:GWRE) share price at $119.07, I published an article, “Guidewire Software: ‘Leaky Equity Bucket’, Time To Abandon Ship.”

One year later, on Aug. 17, 2021, with the share price down to $110.01, I decided to take another look, and published article, “Guidewire Software: No Fix To The ‘Leaky Equity Bucket‘”.

Around eight months on, and with the share price down by a further $17.28 to $92.73 at close on Apr. 13, 2022, I published article, “Guidewire Software: No Safety Net For This Stock”, with a Strong Sell rating.

Almost twelve months later, with the share price down by a further $19.58 to $73.15 at Mar. 6, 2023, I published article, “Guidewire Software: Burning Cash And Unfavorable Sales Mix Trend – Avoid”, with a Strong Sell Rating.

Immediately following publication of that Mar. 6 article, Guidewire Software released their Q2-2023 EPS of -$0.11, a beat of $0.28 against analysts’ consensus estimates, together with a revenue beat of $9.38M. Following this announcement, the share price climbed fairly steadily to a high of $83.51 by June 1, 2023. Post market close on June 1, 2023, Guidewire Software released Q3-2023 EPS of -$0.08, a beat of $0.06, but with a revenue miss of $6.52M. Despite the third quarter EPS beat, the market appears to have reacted adversely to the revenue miss. GWRE stock price closed down 14.43% to $70.89 on June 2, 2023 and is currently at $72.93.

The Narrative Needs To Be Matched By Performance –

The narrative surrounding Guidewire Software is one of strong growth opportunities. Excerpts from a recent article here on Seeking Alpha,

… provides software systems to the Property and Casualty [P&C] insurance market, with a focus on an underserved area that is ripe for growth… While the transition to the cloud has weighed on GWRE’s profitability in the short term, it is likely to lead to revenue growth in the long term by migrating its existing customer base to the cloud. At the current valuation (forward revenue) of 6x, which is a 2x discount to its average, I believe investors’ expectations are low…

And from the company’s Q3-2023 earnings release,

“The third quarter was highlighted by eight cloud deals and significantly better than expected subscription and support gross margins. We are raising our overall profitability expectations for the year as higher cloud margins and ongoing cost discipline outweigh lower services revenue and margin,” said Mike Rosenbaum, chief executive officer, Guidewire. “Our continued momentum is driven by the product leadership we have established with InsuranceSuite and Guidewire Cloud.”

For the most part, I can agree with the sentiments expressed above. And based on those sentiments, it is easy to see why a miss on revenue growth would dampen sentiment towards the stock. What does concern me is a reliance solely on revenue growth to ultimately generate positive earnings. Reliance on revenue multiples as a method to determine valuation reigned supreme at the time of the dot.com boom. Many share investors incurred losses as a result, and we are still seeing that today with businesses such as Guidewire Software. These growth businesses must have a definable path to profitability, as well as strong revenue growth.

My conclusions in previous articles were that reported non-GAAP losses are significantly understated due to exclusion of employee stock compensation, and while the company is presently financially sound this is only due to large amounts of capital raised. $446 million of the cash stockpile of $1.13 billion at July 2019 has been utilized through end of April, 2023, and debt has increased by $79 million over the same period. While $416 million of the cash was used to repurchase 5.2 million shares, an additional 4.8 million shares were issued to employees as stock compensation, so there was minimal change in outstanding shares. I believe it is quite conclusive in the case of Guidewire Software that employee stock compensation is a real cash cost, and there is no justification for excluding in determining non-GAAP earnings and EPS. On that basis, despite growing revenues quite strongly, the company has a way to go before it can even get out of loss making mode, let alone generate profits at a level to justify the current share price. With two quarters of results released since my last article, I decided to take another look at the numbers to see if there is anything to change my opinion. I find there is good growth emerging in the Cloud area and the previously declining high margin License revenue has stabilised, and is expected to show modest increases. The Services segment is weighing on earnings, and Sales and Marketing and General and Administrative expenses are not showing the benefit of increasing scale of operations that might be expected. This is a company necessarily focused firstly on the needs of customers and the growth that is occurring is likely causing some growing pains internally. The problems mentioned are likely fixable and Services segment profitability is already being addressed. On balance, I believe an upgrade to Hold is likely appropriate, pending seeing progress over the next couple of quarters. My detailed analysis that brings me to this conclusion appears below.

Guidewire Software: Detailed Financial Analysis

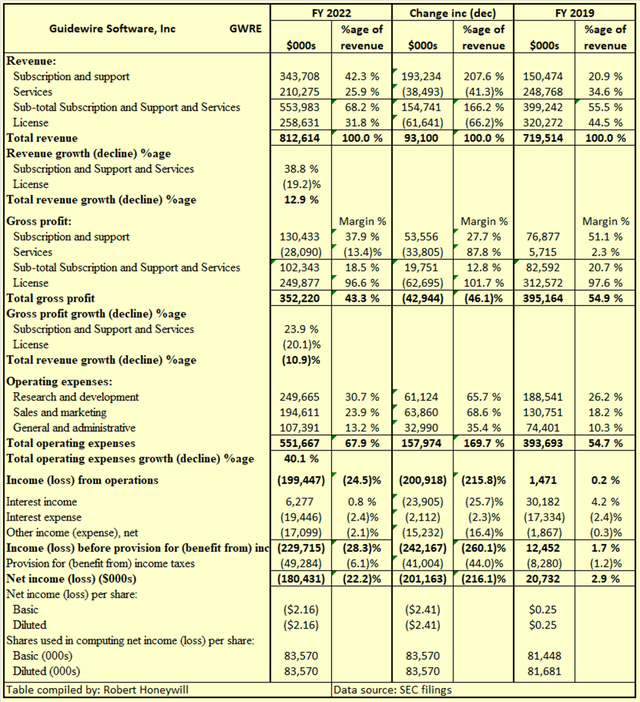

In my previous article, I provided extensive analysis back to 2019 to show how performance is trending. Table 1 from that article appears below.

Table 1

SEC filings

What I see from Table 1 above, is a business undergoing adverse structural change. Total revenue is growing, but the revenue mix is changing. From 2019 to 2022 total revenue grew 12.9% – that is a modest 4.1% average yearly revenue growth rate. But the high margin (close to 100%) License revenue has declined by (19.2)%, resulting in gross profit decline of (10.9)% despite the 12.9% increase in total revenue.

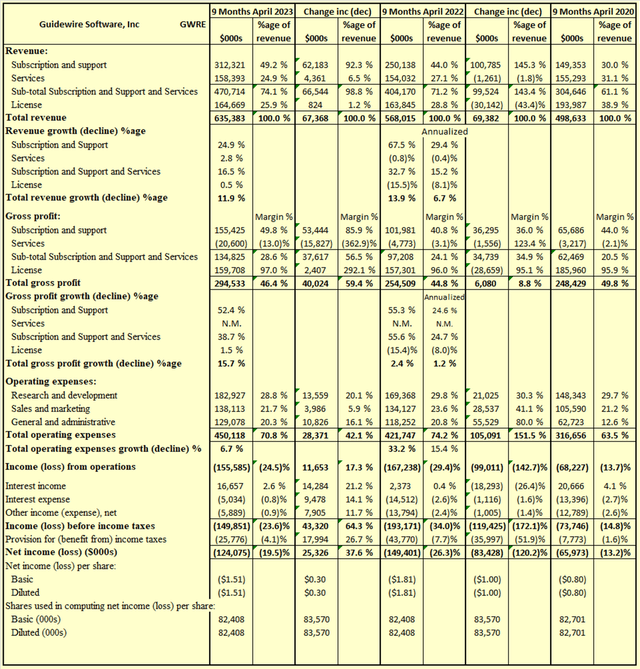

For my current review I looked to more current figures to determine trends. I have updated Table 1 analysis to show data for the latest nine months ended April 30, 2023, with comparisons to prior corresponding periods. The results are set out in Table 2 below.

Table 2

SEC filings

Compared to Table 1 data, there are some encouraging signs emerging in the data in Table 2 above. In the last twelve months the high margin License revenue has stopped decreasing, and shows a 0.5% uptick, with a 1.5% increase in gross profit. The loss making Services segment revenues have remained flat throughout, although disappointingly, is showing increasing losses. The great hope for the company is the shift to the cloud, the revenues for which are included under Subscription and Support. Here we can see revenues grew at an average 29.4% per year between April 2020 and April 2022. A slightly lower growth rate of 24.9% was achieved for the year between April 2022 and April 2023. Encouragingly, Gross profit for Subscription and Support grew at a rate of 52.4% per year between 2022 and 2023, more than double the revenue growth rate of 24.9%, and more than double the Gross profit growth rate of 24.6% per year between April 2020 and April 2022. While the foregoing is encouraging at the Gross profit level, the significant increase in Operating expenses between 2020 and 2023 has resulted in Net loss increasing from $65.9 million for nine months ended April 2020 to $124.1 million loss for nine months ended April 2023. The nature of a services company such as Guidewire Software is it relies heavily on its employees, individually and collectively for its success. To better understand what is happening with Guidewire Software’s profitability I decided to make an assessment of employee productivity, as reflected in Table 3 below.

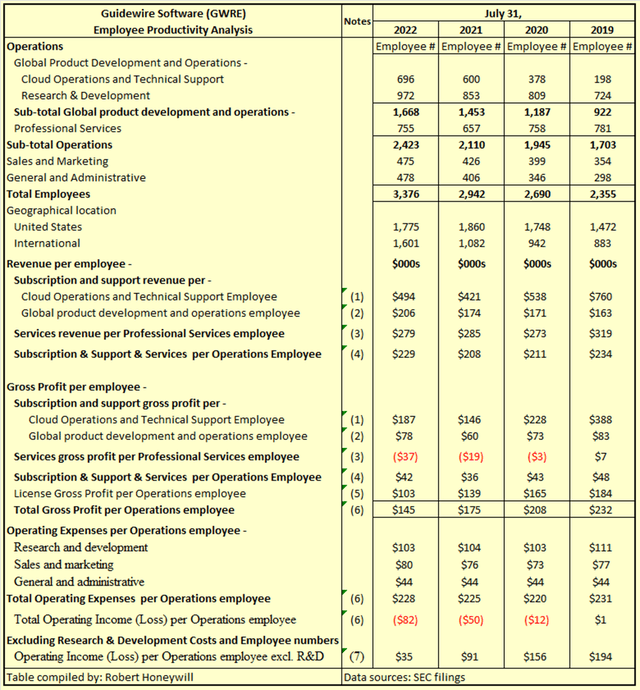

Table 3

SEC filings

Comments on Table 3 –

Since 2019, a little over 1,000 employees have been added to the headcount, an increase of ~43%. The focus being on shifting to the Cloud, it is not surprising to see almost 50% of the increase being in Cloud Operations and Technical Support, with another ~25% of the increase in R&D to support the shift. Increases in Sales and Marketing and General and Administrative are more than might be expected as discussed in more detail below. Comments by numbered note in Table 3 follow.

(1) Cloud Operations and Technical Support employees – Declining revenue and gross profit per employee are concerning, and need to be arrested and reversed. There is some evidence this may already be happening with increases per employee for both revenue and gross profit between 2021 and 2022. Full details of employee numbers are only available at year end, so comparison of 2023 to 2022 will have to await the 2023 10-K.

(2) Global product development and operations employees – This comprises the employees per (1) above plus R&D employees who are also supporting the shift to the Cloud. The R&D employee numbers have grown at half the rate of the Cloud Operations and Technical Support employees, and the combined numbers result in revenue per employee numbers increasing between 2020 and 2023. From a gross profit perspective, gross profit per employee has remained fairly flat, decreasing from $83,000 per employee in 2020 to $78,000 in 2023.

(3) Services revenue per Professional Services Employee – The analysis shows a reduction in revenue per employee of $40,000 from $319,000 to $279,000 between 2020 and 2023, and a reduction in gross profit per employee of $44,000 from $7,000 profit to $37,000 loss over the same period. Unless these increasing losses can be arrested/reversed they will continue to hinder a return to profitability for the company. The company fosters a community of Software Integration system SIs developers. These might provide some of the answer, with lower cost structures giving the ability to provide services that would be unprofitable for Guidewire Software. Excerpts from Q3-2023 earnings call,

…this is a community that is increasingly leading cloud deployments, and I’m pleased to see it continue to expand. SIs now have over 22,000 Guidewire consultants… up 27% year-over-year. Moreover, the number of cloud certified consultants increased 67% year-over-year to approximately 7,300... important stats because a healthy partner ecosystem helps to drive customer success... also because it is critical to providing ever-increasing predictability and cost efficiency to our customers and prospects... committed to enabling SIs to serve increasingly as the prime integrator on cloud projects… will inevitably lead to Guidewire services revenue growth slowing relative to the growth of the total services ecosystem... allows us to focus on a more scaled services model that drives expert services in coordination with the SIs and retains the scale required for delivery of new products and strategically important projects. This approach will provide us with a more durable and profitable service model. The services revenue shortfall we saw in the quarter speaks to the importance of this. Earlier in our cloud journey, we took on complex fixed fee arrangements where we leveraged SIs as subcontractors. This was both to actually deliver the work but also to fuel the SI cloud ecosystem. For the past year and going forward, we are limiting subcontracting and fixed fee arrangements, and we are seeing DSIs step into the prime role on most cloud projects. As this portfolio of early projects are completed … the services margin burden associated with these early cloud customers will lessen…. there has been increased scrutiny on services statements of work that has caused some streamlining of scope or pushing more services work to lower-cost partners…

(4) Subscription & Support & Services per Operations employee – Operations employees includes all employees excluding Sales and Marketing and General and Administrative. Revenue and Gross Profit excludes License segment which is assumed to require minimal ongoing employee involvement. On this basis, revenue per employee is fairly flat, decreasing from $234,000 for 2019 to $208,000 for 2021, before increasing to $229,000 for 2023. Similarly Gross profit per employee declines from $48 in 2019 to $36 in 2021, before increasing to $42 in 2022.

(5) License Gross Profit per Operations employee – It goes without saying that License segment is the overwhelming contributor to Gross profit for the present.

(6) Total Gross Profit per Operations employee – Increasing numbers of employees to support the shift to the cloud is having a dilutionary effect on total gross profit per Operations employee. This could be expected to also have an offsetting dilutionary effect on Operating costs, but this is not the case. The effect of scale on operating cost overheads should reduce the unit cost per Operations employee. But this is not the case, with these costs behaving like variable costs. General and Administrative Expense has increased directly in line with increases in Operations employee numbers, resulting in a cost of $44,000 per Operations employee throughout the period 2019 to 2023. Similarly, Sales and Marketing has averaged in a narrow range between $73,000 and $80,000 per employee between 2019 and 2022. Add that $44,000 for G&A and $80,000 for Sales & Marketing to the Gross loss of $37,000 per Professional Services employee and the loss per employee for that segment in 2023 is $161,000. The Cloud will need to do a lot of work to offset this segments increasing losses per employee unless these costs are addressed.

(7) Operating Income (Loss) per Operations employee excl. R&D – There will be those who will say that losses are contributed to greatly at this stage by Research and Development costs, the revenue benefits from which will flow at a future time. I cannot argue with that. But let us exclude R&D expense and employee numbers from the calculations altogether and see what the impact is. On this basis, Operating income per employee decreases progressively from $194,000 in 2019 to $91,000 in 2021 to $35,000 in 2022. Admittedly, a large part of that is the dilutionary effect on static income from License segment, while employee numbers increase significantly due to the shift to the Cloud. Increasing profits from Subscription and Support segment will likely slow and eventually reverse the trend in future periods.

Summary and Conclusions

The analysis above might appear to paint an overall gloomy picture, but I do see some rays of hope. The strong and increasing growth trend for the Cloud segment reflected in Table 2 should start to offset the downside in other areas. The Services segment is obviously contributing heavily to losses at both the Gross profit and Operating profit levels. Management is obviously aware of this and is addressing the issue. I would prefer to wait another quarter or two, to see continuing progress before becoming too positive on Guidewire Software at the present share price. In the meantime, I believe an upgrade to Hold is likely appropriate.

Read the full article here