Macroeconomic stage setting

The first half of 2023 is over, and who would have thought: the economy seems to be resilient despite much higher interest rates. Even housing appears less affected than most market participants expected. Inflation is slowly declining, and the market is steadily climbing the wall of worry as no disruptions continue to impact the economy.

Interestingly, mainstream media is starting to declare the beginning of a new bull market, with AI as a new narrative to feed the masses. Investor sentiment has shifted from overly bearish to neutral, and significant short-covering began last week.

Despite all that, virtually every yield curve is still inverted, pointing towards turmoil in the not-so-distant future – the point where they steepen into positive territory. Beneath the surface, market breadth suggests that the recent rally is short-lived, as most investors flock to only the largest and safest companies. Credit conditions remain unfavorable, as banks have tightened loan standards, limiting future investment opportunities and impeding growth.

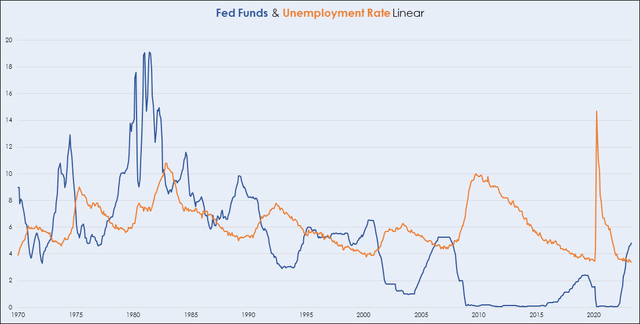

We are entering a phase of flatlining Fed funds at restrictive levels, which will only reverse if the unemployment rate increases significantly. Historically, this is not a positive sign in the grand scheme of things.

Fed Funds (blue) / Unemployment Rate (orange) (Author using Excel)

This month, I will release another article focusing on these macroeconomic and cyclical factors in much more detail. I wanted to include a short summary in this article as they have a significant impact on crypto assets too.

A Review of My Expectations for Crypto in 2023

With the recent allegations made by the Securities and Exchange Commission (SEC) against Coinbase (COIN) and Binance (BNB-USD), I believe it is important to provide an update on my outlook for crypto and Bitcoin (BTC-USD).

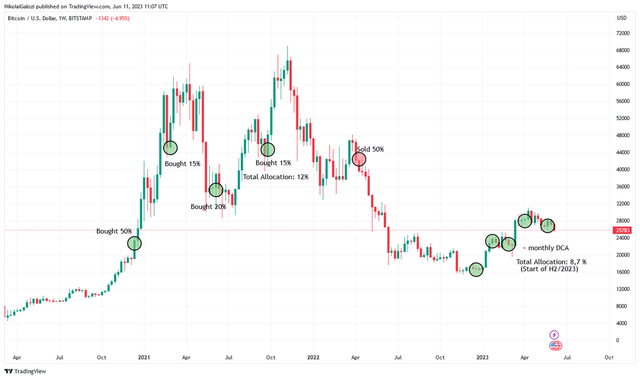

In my previous article on January 17 titled “Bitcoin: Boredom Is Bullish in 2023,” I strongly argued in favor of positioning for a prolonged accumulation phase throughout 2023. Personally, I sold all of my crypto assets in April 2022, except for some Bitcoin. The idea behind this decision was that a period of boredom and disinterest would present a good opportunity to Dollar-Cost Average and gradually build up a position again, aiming to profit from the next liquidity cycle, which I believe to start in 2024 – 2025. I have adhered to this plan for now, solely accumulating Bitcoin.

Entries & Exits by the Author (Author using Tradingview.com)

The risk of further contagion in the crypto industry has not yet manifested itself in terms of additional bankruptcies. However, with the recent SEC lawsuit against Binance and Coinbase, it can be argued that the shoe is starting to drop:

The contagion risks for the Crypto Industry still pose a threat after the Luna-Terra failure initiated a collateral crash, and several Crypto Lenders, Miners, and Exchanges went bankrupt. Only a few people know about the liquidity levels of the currently operating businesses. Most of the time, it’s a black hole (e.g. Binance). Time will tell if there is another shoe to drop. – Jan 17. 2023, Nikolai Galozi

The silent rise in Bitcoin dominance continues

At the start of the year I also suggested that Bitcoin should outperform the Altcoin market. Usually, during a downturn of the crypto market, the safest assets outperform on a relative basis. The Bitcoin dominance (market cap of Bitcoin / market cap of all crypto assets) increases during a bear market due to the heightened downside risks associated with smaller, riskier, and more centralized projects. As anticipated, the Bitcoin dominance, excluding stablecoins, saw a significant increase from around 46% at the start of 2023 to approximately 54% as of last week.

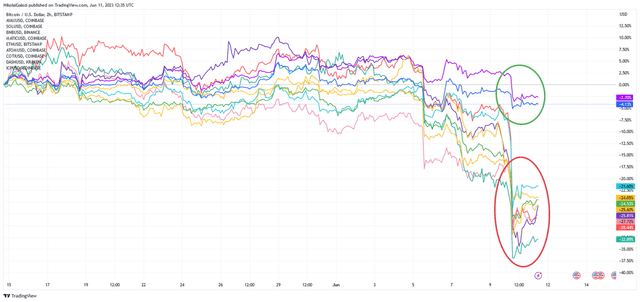

Bitcoin Dominance ex Stablecoins (Author using Tradingview.com)

The significance of this move should not be underestimated because Bitcoin managed to outperform while moving higher in Dollar terms. As of now, Bitcoin is up 55 % YTD vs. the US-Dollar. The crypto market can be thought of as Bitcoin on leverage, most of the time. As a result, Altcoins tend to outperform on the way up but underperform on the way down. However, the significant underperformance of Altcoins in the first half of 2023 occurred alongside Bitcoin’s sharp rise, indicating a high level of uncertainty priced into the markets. This is akin to the negative market breadth dynamics observed in stocks and bonds. The flight to safety is evident in the outperformance of the largest capitalized assets.

The Bitcoin dominance reached its peak at approximately 72% in September 2019, following the bursting of the Initial Coin Offering (ICO) bubble in 2018. Historical trends suggest that the dominance gradually recedes over time as new projects unlock different use cases (although this is debatable). In this cycle, I believe a reasonable target for the peak of Bitcoin dominance remains within the range of 60-65%. Altcoins are expected to continue underperforming from this point forward, especially considering the new regulatory risks stemming from the SEC.

The SEC charges solidify the Altcoin underperformance

Last week, the Securities and Exchange Commission (SEC) filed charges against Coinbase, alleging that it operated as an unregistered securities exchange, broker, and clearing agency. The forthcoming lawsuit will determine whether the majority of Altcoins listed on Coinbase are considered securities or commodities.

In my opinion, the SEC has compelling arguments to classify many Altcoins as securities and subject them to regulation. Applying the Howey Test from 1946, which defines a security as a transaction involving a) an investment of money, b) in a common enterprise, c) with an expectation of profit, and d) derived from the efforts of others, it appears that points a), c), and d) are applicable to almost every crypto asset.

Point b) can be ruled out if sufficient decentralization exists, which is why the SEC has clarified that Bitcoin is not considered a security. However, I believe that most Altcoins are centralized enough to be defined as securities in the United States, with some grey areas such as Ethereum (ETH-USD). On the other hand, it is very questionable whether a test from 1946 is suitable for evaluating blockchain technology, and ideally, a completely new regulatory framework should be established.

Similar allegations of operating as an unregistered securities exchange, broker, and clearing agency have been made against Binance. However, Binance also faces more serious charges, including commingling customer funds, diverting customer assets, and market manipulation. While Binance remains a black hole, I find it unlikely that the SEC would make such charges without substantial evidence. I believe the significance of Binance as a crypto exchange and platform will diminish going forward, and it remains to be seen if Binance has sufficient liquidity to accommodate all investor withdrawals. In the long run, a default cannot be ruled out.

As an investor, I do not hold a personal opinion on the charges. However, they represent an additional risk factor, particularly for Altcoins. Regulatory scrutiny from the United States was predictable following the downfall of FTX (FTT-USD) in 2022. The underperformance of Altcoins in a bear market, irrespective of news flow, should not come as a surprise. The risks associated with holding crypto assets directly on unregulated exchanges are well-known. By overweighting Bitcoin and implementing proper risk management during the current crypto winter, the majority of the drawdown in crypto assets during the last week could have been avoided.

Returns of various Coins during the last month (Author using Tradingview.com)

Green: Ethereum and Bitcoin. Bitcoin is classified as a commodity and Ethereum remains in a grey area.

Red: Some of the biggest Altcoins mentioned in SEC charges against Binance and Coinbase and labeled as securities. Avalanche (AVAX-USD), Solana (SOL-USD), Binance Coin (BNB-USD), Polygon (MATIC-USD), Cosmos (ATOM-USD), COTI (COTI-USD), Dash (DASH-USD), Internet Computer (ICP-USD).

The significant underperformance is self-explanatory.

I’d be cautious about the major Ether outperformance, as the relative risk in comparison to Bitcoin given the price performance is much higher, in my opinion. Therefore I will continue to simply accumulate Bitcoin for the remainder of 2023, as long as the Bitcoin dominance continues to rise.

The Alleged “Halving Cycle”

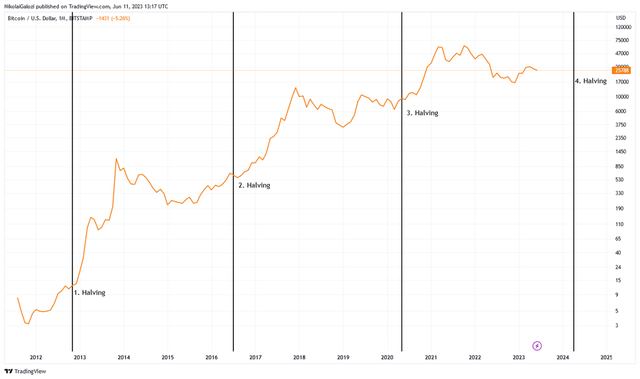

Traditionally, the recurring four-year cycles observed in Bitcoin and the broader crypto market were attributed to the halving of the mining reward. Initially, miners were rewarded with 50 BTC per block. The rate at which new Bitcoin is mined is halved approximately every four years or every 210,000 blocks, until the total supply of 21 million Bitcoins is reached.

It’s important to note that the difficulty adjustment ensures that, regardless of the amount of computing power connected to mining, an average block will be mined every 10 minutes, which is why the timing of the cycle remains predictable. It is a common misconception that increased computing power results in more BTC being mined. The amount of Bitcoin mined is programmed and cannot be influenced by computing power in the long run.

The previous halving events occurred in 2012, 2016, and 2020. Each time, the mining reward was halved from 50 BTC to 25 BTC in 2012, then to 12.5 BTC in 2016, and further reduced to 6.25 BTC in 2020. The next halving is expected to take place in 2024, reducing the mining reward to 3,125 BTC per block.

Bitcoin Halvings (Author using Tradingview.com)

The impact of halvings is a reduction in the supply of Bitcoin, which, according to the common narrative, increases its rarity and acts as a catalyst for the rise in Bitcoin’s price. Increasing prices stimulate speculation, and during the bubble phase of the cycle, the Altcoin market tends to outperform. Eventually, the bubble bursts, crypto is deemed as dead, and Altcoins underperform. Rinse and repeat.

Each halving gets less relevant each time, as more Bitcoin come into existence with each block and the gap between already mined Bitcoin and the cap of 21 million BTC closes. That is one way of explaining the diminishing returns.

However, the halving theory only considers the supply side. In my opinion, the demand for Bitcoin is far more important as halvings become progressively less significant. While halvings may act as a catalyst, they do not significantly alter the fundamental supply and demand dynamics going forward. The depreciation of the denominator, or the decline in the value of traditional fiat currencies, is much more important as it drives the demand for Bitcoin.

Bitcoin is not money. Bitcoin is not a currency. Bitcoin is not scalable. Bitcoin is not the Crypto Industry with all its useless financial schemes and stupid leverage. Bitcoin is a decentralized monetary debasement hedge. An opportunity to leave the vicious cycle that is the long-term debasement of the currency without the possibility of government interventions (e.g. Gold in 1933 under Roosevelt). It is no coincidence that Bitcoin appeared just after the global financial crisis, when the monetary debasement circus started getting out of hand.- Jan 17. 2023, Nikolai Galozi

If central banks buy government debt en masse to fund the deficit and keep real rates in negative territory, the denominator gets devalued and asset price inflation elevates not only bonds, but stocks, house prices, et al. Bitcoin was designed to act as a hedge in this scenario.

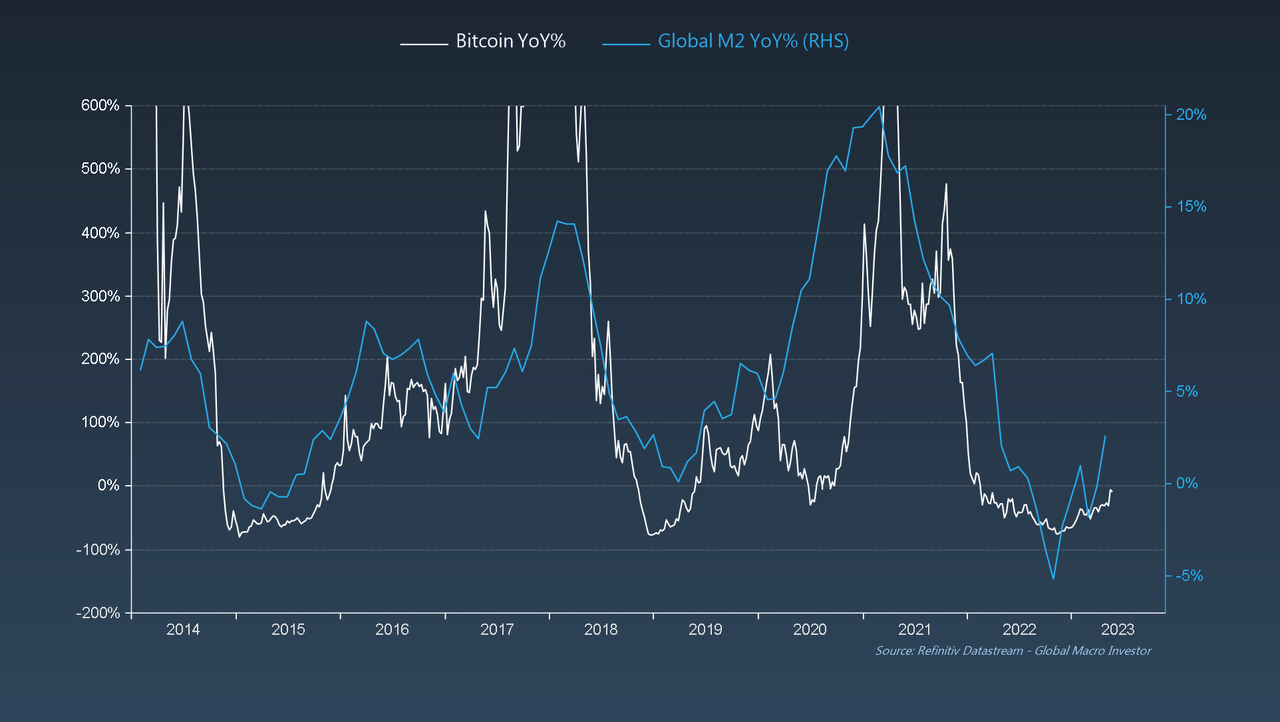

When plotting the Year-over-Year returns of Bitcoin against the Global growth of M2, the correlation is strikingly accurate.

Bitcoin & Global M2 (refinitiv.com)

Bitcoin was created in January 2009, but it wasn’t until 2012 that a liquid market for BTC emerged. Given its limited price history of only eleven years, it is challenging to attribute Bitcoin’s price performance solely to the halvings. Additionally, monetary expansion coincided with the halvings. To my belief it was the monetary expansion and the debasement of the currency which fueled demand for risk assets, i.e. increased asset price inflation. With the programmed scarcity of Bitcoin and the purpose of hedging asset price inflation it profited the most from the debasement. In my opinion, the halvings are an increasingly unimportant catalyst for price discovery.

However, it is worth noting that the next major upswing in global M2 money supply could potentially align with the halving in April 2024 again, as the leading macroeconomic data suggests a slowing of the economy and therefore consumer price inflation.

Key Takeaways

My base case for 2023 remains unchanged. I expect a dull year with neutral returns for Bitcoin. Therefore I expect a deeply red H2/2023. I continue to stack Sats and avoid any Altcoins during this bear market. I don’t believe we have reached a major inflection point for monetary debasement as global central banks should be hindered by receding (but still ‘too elevated’) consumer price inflation. A capitulation event seems likely if unemployment rapidly picks up.

The last crypto tourists are surely gone now, after the major drawdown of Bitcoin and the devasting returns of Altcoins (more like destruction). They will likely be back in a few years from now, when liquidity has improved, and asset price inflation is ramping up again. In the meantime, I will continue to accumulate my positions.

Read the full article here