Resideo Fights Back

Resideo Technologies (NYSE:REZI) offers energy management, safety, and security products and solutions. These include temperature and humidity control, water and indoor air quality solutions, fire suppression, security panels, sensors, wire and cable, communications devices, video cameras, other home-related lifestyle convenience products, cloud infrastructure, and installation & maintenance tools. REZI appears to have some relief as the supply chain issues related to semiconductor components and electronics dissipate. Structural value creation associated with new products, facility restructuring, and value engineering has also added to its strength. Pricing optimization and the strategy of marketing exclusive brands moderated the effect of cost inflation. All the factors should hold it operating margin steady in the medium term.

On the other hand, it continues to face challenges due to the volume decline in residential categories, including AV (audio-visual) and intrusion. The other critical issue for the company has been the delinquent backlog. Although REZI’s cash flows remained negative in Q1 2023, improvement in inventory management can improve its cash flows in FY2023. The stock appears to be slightly undervalued versus its peers. Investors might want to “hold” the stock with an expectation of higher returns in the medium term.

Supply Chain Strategies

One of REZI’s key strategic decisions revolves around responding to the supply chain challenges it faced over the past year. The availability of semiconductor components and electronics has recently improved compared to about a year and a half earlier. As a result of supply easing, it now relies less on broker buy activity and expects to reduce the dependence even more for the remainder of the year.

The other critical issue for the company has been the delinquent backlog. With the supply chain normalizing, the company can shift resources from short-term tactical initiatives. So, it can focus its operations and engineering resources on structural value creation associated with new products and value engineering.

New Products

In this context, it would be interesting to learn the new products and innovations that the company plans to introduce that can potentially grow its market share. Under the First Alert-branded connected devices, it has brought in L1 WiFi Water Leak, Freeze Detector, and L5 WiFi Water Shutoff Valve.

In the EMEA market, it has promoted DT4 digital thermostats related to heat pumps, hybrids, zoning, and underfloor heating solutions. The company’s management estimates that the EMEA (Europe, Middle East, and Africa) heat pump market is growing fast. It has also recently launched a VX1 video doorbell.

Restructuring And Acquisitions

Under the manufacturing facility optimization plan, the company plans to close its San Diego castings facility, which is expected to be completed in early 2024. Although it recorded restructuring charges on this account, it is expected to produce $12 million in annual savings once completed. The company also plans to consolidate El Paso, Texas, distribution center in connection with the First Alert acquisition.

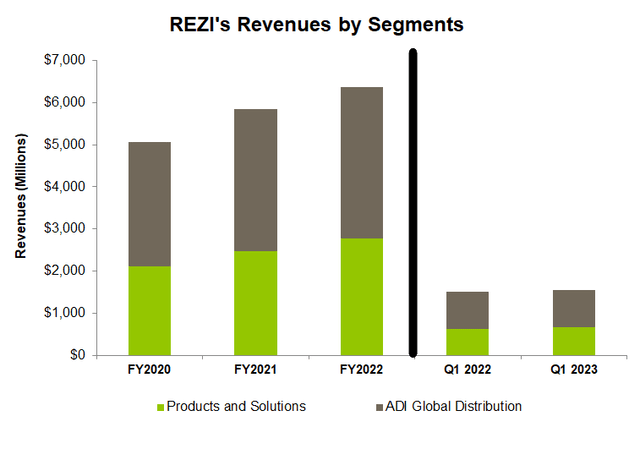

Investors may note that in March 2023, it acquired First Alert, a leading provider of home safety products. It targets to achieve approximately $30 million of annualized synergy. In Q1, First Alert contributed $98 million in additional revenue to the Products & Solutions segment.

FY2023 And Q2 2023 Outlook

The end markets are expected to remain mixed in FY2023. Going by the trend, the residential demand will likely remain soft. The new privately-owned housing units in the US are returning to the pre-pandemic level. From April 2022 until January 2023, it dipped by 25%. Since then, it has shown signs of consolidation and increased by 4.6% until April. Also, the improving supply chain dynamics will likely positively impact the Products & Solutions segment’s gross margin and working capital.

Seeking Alpha

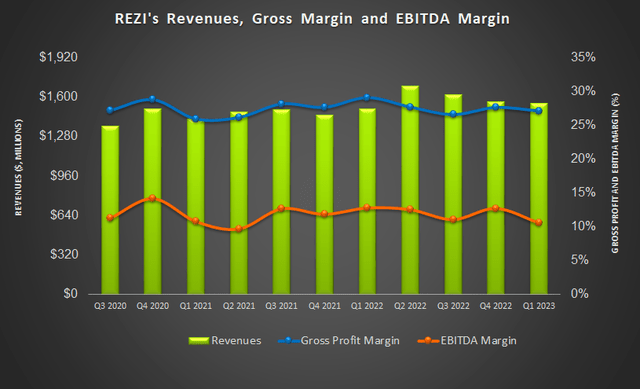

In FY2023, REZI’s management expects revenues to remain unchanged at the guidance mid-point. The forecast assumes “mid-single digit volume declines in the Products & Solutions segment. Its ADI segment can see “low single-digit” revenue growth. Commercial-focused categories can see marginal growth, while residential categories, including AV and intrusion, can see a moderate volume decline. Overall, the company’s gross margin is expected to be in the range of 26.8% to 27.8%, while the operating profit is expected to be in ~$650 million (at the guidance mid-point).

In Q2, the management expects revenues to increase by 4.6% compared to Q1. The gross margin is expected to remain nearly unchanged at 27.3%. EPS can stay between $0.41 and $0.51, which, at the guidance mid-point, represents a 21% increase compared to Q1.

Analyzing Products & Solutions Segment Results

REZI’s Filings

The company’s Products & Solutions segment revenues increased by 6% year-over-year. Although security and energy product volume decreased, revenue addition from the First Alert acquisition and continued price realization led to a rise in the top line. It also improved inventory by managing the distribution channel of the HVAC (heating, ventilation, and air conditioning). Order activity also appeared to have stabilized at the historical level.

However, the gross margin in this segment contracted by 530 basis points year-over-year in Q1 2023. Labor and material input cost inflation, the adverse effects of reduced volumes on fixed cost absorption, and the impact of lower-margin First Alert products lowered the margin.

Analyzing ADI Global Distribution Segment Results

In the ADI Global Distribution segment, total revenues remained nearly unchanged in Q1 2023 compared to a year ago. E-commerce and digital capabilities remain the segment’s primary drivers. Touchless sales and e-commerce accounted for 39% and 20% of the segment revenues, respectively. However, sales in residential AV and security categories remained soft. On the other hand, commercial fire and video surveillance saw inventory levels improving.

Gross margin also remained unchanged over the past year in Q1. The initiatives around pricing optimization and exclusive brands moderated the effect of cost inflation. Also, restructuring activities, including facilities rationalization and slower investment spending, are expected to affect the near-to-medium-term margin positively.

Cash Flows And Shareholders’ Returns

In Q1 2023, REZI’s cash flow from operations (or CFO) remained negative but improved considerably compared to a year ago. Although revenues remained nearly unchanged over the past year, improving working capital following better inventory management in the Products and Solutions segment improved CFO. So, free cash flow (or FCF) (excluding acquisition) remained negative.

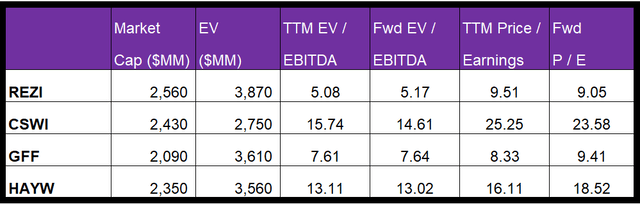

Investors may recall that in FY2022, REZI acquired First Alert, Electronic Custom Distributors, and Teknique Limited for an aggregate acquisition cost of $633 million. The company’s debt-to-equity (0.54x) is much lower than its competitors (CSWI, GFF, and HAYW). It also has $792 million in liquidity as of March 31.

Analyst Rating And Relative Valuation

Seeking Alpha

According to data provided by Seeking Alpha, two sell-side analysts rated REZI a “buy” in the past three months (including “Strong Buy”), while four rated it a “hold.” None rated it a “sell.” The consensus target price is $22.5, suggesting a 29% upside at the current price.

Author created and Seeking Alpha

REZI’s forward EV/EBITDA multiple expansion versus its current EV/EBITDA contrasts a marginal fall in EBITDA for its peers. This typically results in a lower EV/EBITDA versus its peers’ multiple because its EBITDA is expected to decline compared to a moderate rise in EBITDA for its peers. The company’s EV/EBITDA multiple (5.1x) is much lower than its peers’ (TGLS, DOOR, and PGTI) average (12.2x). So, the stock appears to be mildly undervalued versus its peers.

What’s The Take On REZI?

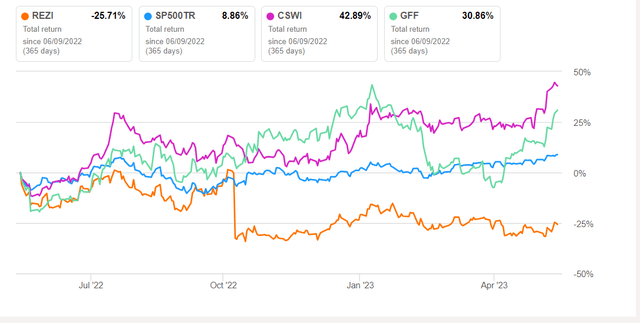

Seeking Alpha

The ease of supply chain issues related to semiconductor components and electronics has freed up company resources dedicated to broker buy activity. It has adopted a manufacturing facility optimization plan to boost margin, which should provide annual savings once completed. As part of inorganic growth, it acquired First Alert in March 2023, which can also provide $30 million in annualized synergy.

But the company continues to face a volume decline in residential categories and delinquent backlog. So, the stock underperformed the SPDR S&P 500 ETF (SPY) in the past year. In Q1 2023, REZI’s cash flows remained negative but improved considerably compared to a year ago. Its inventory management in the Products and Solutions segment improved, which can further enhance its cash flows in FY2023. Given the balance between the positive and adverse factors and the company’s relative undervaluation, I would suggest investors “hold” the stock.

Read the full article here