Back in April, I wrote that Annaly Capital Management (NYSE:NLY) looked well positioned for when the MBS market turns. From a total return perspective, the stock is up about 5% since then. Let’s take a closer look.

Company Profile

As a quick reminder, NLY is mortgage REIT that invests in agency mortgage-backed securities (MBS) that are collateralized by residential mortgages that are guaranteed by government or government-sponsored agencies. It also invests in residential credit, mortgage servicing rights (MSR), commercial real estate, and corporate debt.

The firm has three investment groups, that largest of which is its Agency Group, which purchases MBS, TBA (to-be-announced) future contracts, and agency commercial MBS. Its Residential Credit Group invests in residential MBS not backed by agencies, while its Mortgage Servicing Right Group invests in mortgage servicing rights.

At the end of Q1 2023, NLY’s investment portfolio was valued at $85.5 billion, with $77.6 billion of that Agency MBS. Approximately 91% of its portfolio was in agency-backed MBS at quarter end, while ~2% was in MSRs and over 2% in non-agency mortgage assets.

Book Value Improvement

Similar to other mortgage REITs, declining book value was the big story for NLY in 2022, with the firm seeing it drop -35% from $31.88 at the start of the year to $20.79 at the end of the year. As fixed income investors are well aware, a rise in interest rates causes the value of fixed income securities to drop to help close the gap in yield between legacy securities and newly issued securities. While there are certainly different dynamics between Treasuries and the agency MBS that NLY invests in, the underlying principals are similar, and rising mortgage rates have hampered the book value of mortgage REITs. In addition, mortgages have also seen their spreads versus Treasuries widen.

NLY saw a reversal in Q4, with its book value rising 4% sequentially. In Q1, the company saw its book value per share stay relatively flat at $20.77. It paid out a dividend of 65 cents, and its economic return for the quarter was 3%. That was better than the -0.7% return for rival AGNC Investment (AGNC) and -3.6% for Two Harbors Investment (TWO). Book value was down about another -1% in April after the quarter as well.

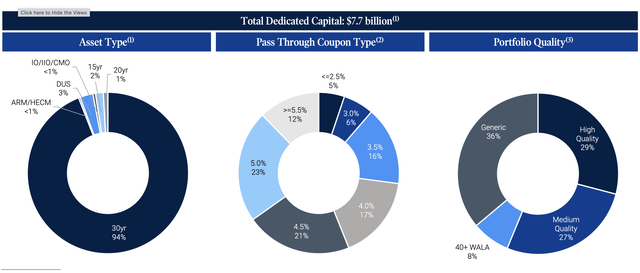

Company Presentation

NLY credited its outperformance to its portfolio make-up and hedge book. On its Q1 call, CEO David Finkelstein said:

“Over 50% of our portfolio is in what we define as intermediate coupons, 3.5s to 4.5s, which remain more insulated from potential bank sales while avoiding the supply pressure higher up the coupon stack. This dynamic drove investors to shift into these coupons, leading to marginally positive hedge performance within this portion of our portfolio despite headline MBS spreads widening over the quarter. Looking forward, we continue to favor these intermediate coupons, and we’ll also opportunistically invest up the stack into 5s and higher as these assets provide historically attractive nominal spreads. In addition to our balanced positioning across the agency market, our duration management and hedging decisions were critical in helping us navigate the volatility in March. Over [7] consecutive trading sessions beginning on March 9, the 2-year note moved in excess of 20 basis points per day. And throughout this period, our portfolio was well positioned and we were able to take advantage of the outside moves by adding short-end hedges at attractive levels, which replaced swap runoff experienced over the quarter. And furthermore, we continue to rotate hedges out of treasury futures in the SOFR swaps, which we see as a more efficient hedge and more closely tracks our repo funding costs.”

During difficult times, mortgage REITs are only as good as their management teams and how they position their portfolio and hedges. On that front, NLY looks to be doing a good job. It continues to raise the coupon rate of its portfolio, looking mostly at medium rate coupons, which are less volatile than the more abundant low coupon MBS.

Similar to AGNC, NLY also issued stock in Q1 through an at-the-market program. The firm raised $563 million selling common stock during the quarter through its ATM program. Based on its net proceeds, it looks like NLY was able to sell the shares at an average price of around $22.20, which is nicely above its end-of-quarter book value of $20.77.

Raising equity for mortgage REITs above book value helps increase book value per share, while issuing shares below book value decreases book value per share. Given how NLY has traded, these sales look to have been at an opportune time. It can also funnel the proceeds into higher coupon MBS than most of its portfolio.

NLY hasn’t gotten the same spread lift as AGNC, and in fact it has drifted lower from 1.73% a year ago to 1.62% in Q1. However, the company, as noted above, has done a better job of protecting book value. And book value is the real key for these stocks going forward.

Just like AGNC and others, NLY saw the same Q1 headwinds because of strong economic and jobs data as well as bank failures. This caused a lot of volatility, as Silicon Valley Bank and Signature sold off their MBS portfolios.

Meanwhile, mortgages rates have continued to move higher. While the Fed looks poised to pause its interest rate hikes, the continued solid jobs data could mean more hikes later this year. Economists are generally looking for two more rate increases, but think the Fed could begin to lower rates in 2024.

NLY has done a good job of protecting book value with its shift to intermediate coupons, as well as diversification into MSR and non-agency loans. If it can continue to do so, the stock should hang in there despite potential rate hikes. Mortgage rates also may not move as much with additional rate hikes given the already wide spread between mortgages and Treasuries.

Conclusion

After rough year and a half for mortgage REITs due to rising interest rates and widening spreads, the Fed tightening cycle should be coming closer to an end. NLY has done a good job playing defense the past couple of quarters, and it should benefit once the cycle shifts.

MBS spreads remain wide, so the combination of spreads narrowing and the potential of the Fed reversing course and lowering rates next year could be huge boost to a name like NLY and other mortgage REITs. For mortgage REITs, I usually look at a price to book as the best way to value them. On that front, NLY trades at 0.96x. By comparison, AGNC trades at 1.05x book while ARMOUR (ARR) is at 0.94x. TWO trades at 0.83x.

NLY is a well-run company, so the discount to book with its book value settling into a range is becoming attractive. While it may be a little early, I’m going to raise my rating on NLY to a “Buy” as it has strong upside once the Fed shifts its tactics.

Read the full article here