TELUS Corporation (NYSE:NYSE:TU) has demonstrated strong and consistent growth over the past few decades along with a consistent and large dividend over the years. With strategic acquisitions driving growth into new revenue segments and a relative undervaluation, I rate TELUS as a hold. This is due to their large share dilution and payout ratio which creates FCF strains and risk in a time of macroeconomic uncertainty.

Business Overview

TELUS is a Canadian telecommunications company that provides a range of communication services to customers across the country. The company was founded in 1990, and today, it operates one of the largest telecommunications networks in Canada, offering a wide range of services such as mobile, internet, voice, and television.

TELUS has over 15 million customer connections across the country, and the company has a strong presence in both urban and rural markets. It has invested heavily in developing its infrastructure, and as a result, it boasts one of the most advanced 4G LTE networks in North America.

In recent years, TELUS has expanded its services to include healthcare and digital solutions. It launched TELUS Health in 2014, which has become one of the largest healthcare technology companies in Canada. The company also offers a range of digital solutions such as security, smart home services, and cloud services.

TELUS is committed to corporate social responsibility and has been recognized as one of Canada’s most sustainable companies. It supports community initiatives and has launched numerous programs to support vulnerable communities, including the TELUS Friendly Future Foundation, which provides funding to support local grassroots initiatives.

TELUS Reach (2022 Annual Report)

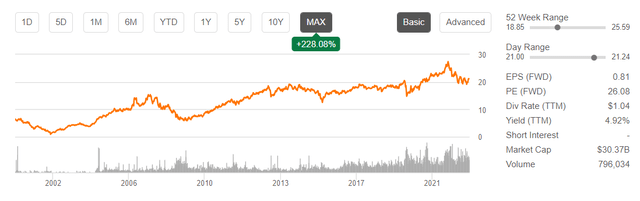

TELUS currently holds a market capitalization of $41.242 billion, with a ROIC of 5%. Its 52-week high and low are $32.57 and $25.94, respectively, while its current trading price of $28.72 is in line with its 200-day moving average. Additionally, its P/E is at 24.82, indicating that the market factors in the moat that TELUS holds, as is typical among many Canadian telecommunication companies.

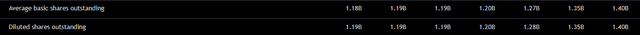

TELUS also pays a dividend of 4.81% representing a risky payout ratio of 116.9% meaning the company issues shares to payout their high dividend which will hurt the company’s share price and returns in the long run through lack of FCF to scale. With such a high payout ratio, it is not surprising that TELUS has issued a large number of shares as displayed below indicating that their dividend is too expensive and should see a slowdown in growth or even a cut in macroeconomic troubles.

Seeking Alpha TELUS Share Dilution Over the Years (Trading View)

With Q4 2022 results missing expectations on the top and beating on the bottom line with a 19.1% miss on earnings per share ($0.28 compared to $0.23) and a 0.53% beat on revenue ($5.03 billion compared to $5.06 billion), the company is displaying troubles in a time of moderate economic headwinds. With disappointing recent earnings, TELUS was able to partially rebound due to their positive 2023 guidance of Operating revenues growth of 11 to 14%, adjusted EBITDA growth of 9.5 to 11%, CapEX of approximately $2.6 billion, and FCFs of $2.0 billion. There was also a 7.2% increase in the dividend YOY which further hinders TELUS’ ability to stop diluting shareholders and maintain a stable FCF that can create stability within the company.

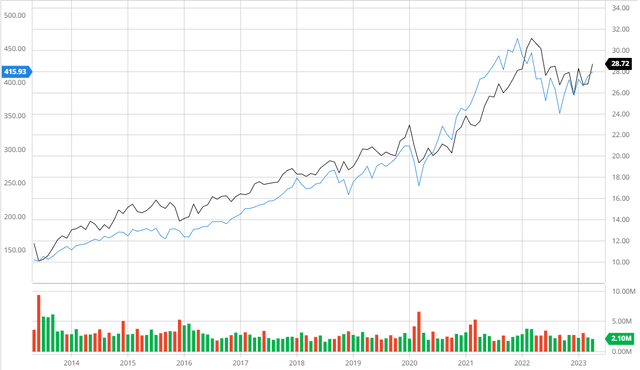

In Line With the Broader Market

TELUS’ performance in the last 10 years has remained in line with the S&P 500 when adjusting for dividends. This displays that TELUS holds the ability to grow through its acquisitions and organically through network expansion.

TELUS Compared to S&P 500 (Created by author using Bar Charts)

Strategic Acquisitions Achieving Compounding Growth

TELUS Health announced the completion of its acquisition of LifeWorks in 2022, which brought in 7,000 highly skilled team members to the TELUS Health family. This strategic move resulted in the creation of an unparalleled end-to-end, digital-first employee healthcare platform that focuses on primary and preventative care, mental health, and wellness. The combined platform provides services to clients across 160 countries, covering a staggering 68 million lives.

TELUS Health’s strong domestic and global presence has been bolstered by the expertise of the TELUS International team. Their proven track record of excellence in digital transformation and client service has further fortified the company’s position in the market. With this acquisition, TELUS Health has expanded its capabilities and offerings, cementing its status as a leader in the digital health space.

The diversification of revenue streams through acquisitions is crucial for TELUS to enhance its resilience during challenging times. However, the significant issuance of shares suggests that the success of these acquisitions will depend on TELUS’s ability to integrate them seamlessly and achieve substantial long-term growth. To achieve this, TELUS needs to strike a balance between retaining shareholder value, sustaining a decent dividend payout, and creating more FCFs for future acquisitions.

Given TELUS’s high payout ratio, it would be prudent to slow down dividend growth in the short term to facilitate a smoother transition toward generating more FCF for acquisitions. This approach will allow TELUS to build upon its existing strengths, while also focusing on strategic acquisitions that will drive long-term value for the company and its shareholders.

2022 Annual Report

Analyst Consensus

Analyst consensus rates TELUS as a “buy”. The stock holds great long-term growth as recognized by analysts through organic network upgrades and introductions into new segments through acquisitions. TELUS has an expected upside of 9.22% with an average 1Y price target of $31.37.

Analyst Consensus (Trading View)

Valuation

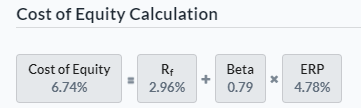

Before creating my assumptions and calculating my DCF, I will calculate the Cost of Equity and WACC for TELUS using the Capital Asset Pricing Model. Factoring in a risk-free rate of 2.96%, I was able to conclude that the Cost of Equity was 6.74% as displayed below.

Cost of Equity Calculation (Created by author using Alpha Spread)

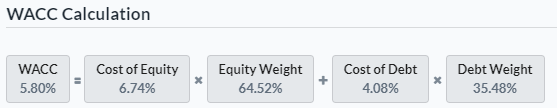

Assuming this Cost of Equity value, I was able to calculate the WACC to be 5.8% as shown below, which is under the industry average of 6.57%.

WACC Calculation (Created by author using Alpha Spread)

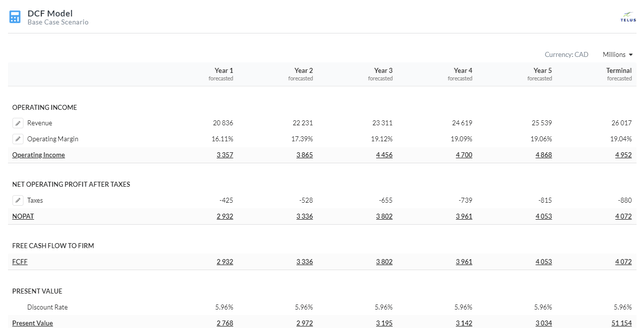

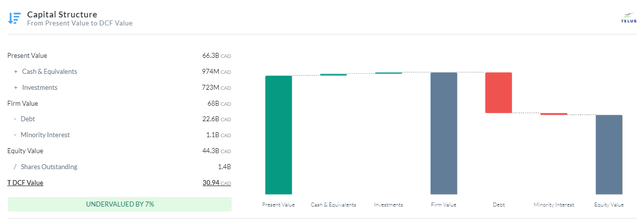

Using a Firm Model DCF analysis based on FCFF without CapEX, it has been determined that TELUS is currently undervalued by approximately 7%, with a fair value estimate of $30.94. The analysis involved applying a discount rate of 5.96% for a five-year period, which reflects a risk premium of 0.16%. To forecast future revenue growth, a mid-single-digit growth rate was estimated beyond 2023. Additionally, it was assumed that the company’s margins would improve in the future, as a result of TELUS’s acquisitions and network expansions, which would allow for the spreading of fixed costs and an expansion of margins.

DCF Assumptions 5Y (Created by author using Alpha Spread) Capital Structure (Created by author using Alpha Spread)

Risks

Regulations: TELUS operates within various industries that are subject to strict regulations, both domestically and internationally. These regulations encompass a wide range of laws and policies that may impact their operations, strategic decision-making, and financial performance, including revenue and free cash flow.

Economic Headwinds: Global economic conditions, such as the possibility of a recession and shifting inflation expectations, may affect TELUS’s ability to achieve its corporate objectives, and financial results. TELUS has stated that their team has been proactive at mitigating such headwinds by mitigating risk such as maintaining cash reserves and lowering discretionary spending within the company.

Conclusion

In summary, I believe that TELUS is currently a hold. Although the company has shown robust growth, a substantial dividend, and potential relative undervaluation based on my assumptions, its high payout ratio and significant share dilution suggest caution toward purchasing the stock at present.

Read the full article here