Investment thesis: In regard to the global energy markets outlook, in the past week, all eyes were on the latest OPEC+ meeting. The results did not disappoint investors who are betting on a higher oil price (CL1:COM) going forward, with a Saudi pledge to cut 1 mb/d in production. The next logical place for the conversation to turn to has been whether or not the cut will be enough to keep the global oil market from experiencing a surplus, given stagnating economic growth signals flashing red all around the world. My own view is that despite a global economic stagnation scenario, there is a growing chance that we will see a massive energy price spike, starting this fall and going into next year, with both oil & gas prices set to rally and potentially set new all-time highs, and there are a number of compelling arguments to be made in favor of such a potential outcome.

OPEC + cuts may be more than just about price support.

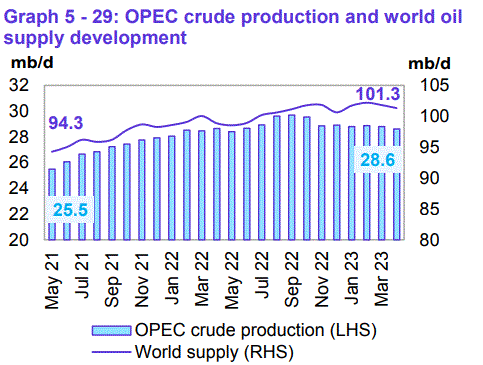

In theory, oil prices should not even be declining at the moment, if inventory trends as well as other factors were to be the driving force behind prices. Based on the EIA’s latest inventory numbers, US total liquids stocks are down by just under 5%, or about 83 million barrels compared with last year. Based on OPEC’s latest monthly report, in the fourth quarter of this year, we can expect the average global liquids demand to be 103.3 mb/d, while the last month for which data was available, namely April, supply stood at 101.3 mb/d.

OPEC

A gap of 2 mb/d needs to be closed in the last quarter of this year in order to balance the market. Yet Saudi Arabia decided to cut production by a further 1 mb/d, widening that gap that everyone else will have to close either through new supplies, demand destruction, or a combination of both, to 3 mb/d.

Within the context of an impending tightening in the global supply/demand balance for liquid fuels, it seems somewhat odd for Saudi Arabia to wish to cut its production for the foreseeable future, and do so as deep as it went. Given that it arguably makes no fundamental sense for oil prices to be as low as they are currently, the market eventually does catch up to fundamentals, therefore Saudi Arabia is seemingly just being impatient. Or perhaps there is more to it.

My personal view is that Saudi Arabia’s ability to pump high volumes of crude for a sustained period of time is limited. Its largest field Ghawar has seen a drastic reduction in capacity based on reports that surfaced a few years ago and while there is not much information out there since those reports came out, chances are that the field’s ability to produce a steady volume of oil has been further reduced since then. Saudi Arabia is now looking to sell less oil at a higher price.

The recent announcement that it raised prices for its Asian customers seems to me to be a ploy to let Asia buy discounted (sanctioned) Russian & Iranian oil, while Saudis will pivot to selling more to Europe at a higher price since the Europeans are increasingly out of options since they broke economic ties with Russia.

US shale drilling is collapsing.

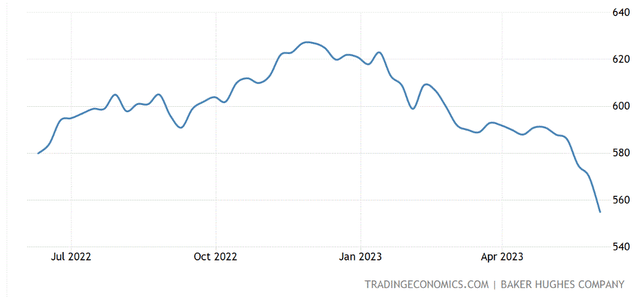

Based on the latest data from Baker Hughes, US oil & gas rig counts are plummeting. The explanation for natural gas rigs is simple enough, given that the HH spot price is at near-decade lows. The explanation for the decline in rigs that target oil is a bit harder to attribute to prices, given that the current WTI spot price is over $70/barrel and has been hovering in this range for most of the year.

US oil rigs (Trading Economics)

Zeroing in on rig activities that target crude oil, in particular, suggests that there is a much bigger underlying problem that is causing companies to drastically reduce their drilling activities. My personal view is that there is an industry-wide deterioration in prime drilling acreage availability. Some companies may be outright running out, while others are just looking to preserve their remaining inventory in order to prolong the life of their shale plays.

A recent Exxon statement on fracking highlights in my view the rather dire situation faced by shale drillers. It is basically a call to shift the focus on getting more out of each well, rather than continuing to rely on drilling in order to replace production lost from fast-declining shale wells. Re-fracking existing wells seems to be the next step, as the drilling of new wells is seemingly starting to collapse.

Re-fracking has been practiced throughout the last decade, but never on a very significant scale, until recently, as companies are increasingly looking to boost production from existing wells, given a lack of new wells being drilled. It remains to be seen how much of an immediate as well as long-term impact it can have on shale production, in the absence of sustained drilling of new wells. My own view is that we will see the results of the recent steep plunge in rig activity in the fall of this year, in the form of declining oil & gas production in the US. Re-fracking can help to slow the decline in production, but it will not reverse the trend.

100 days before a potential start of a global energy crisis, starting with Europe’s precarious natural gas situation.

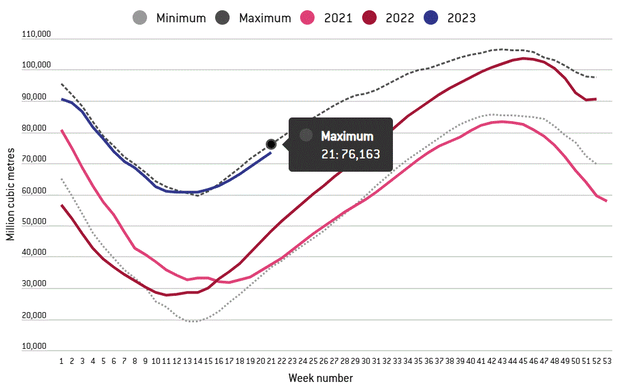

Following a very mild winter that allowed the EU to avert a disastrous shortfall in natural gas supplies, it entered the spring season with a massive surplus in storage, prompting a near consensus paradigm that suggests Europe does not need Russian natural gas.

EU gas storage (Bruegel)

At week 11, as Europe was going into the spring season, in 2022, EU storage levels were critically low standing at only 27.74 Bcm. By comparison, for the same week of this year, it was at 61.04 Bcm. Since then, in other words, between weeks 11 and 22, current storage levels increased by 14.81 Bcm, while in 2022 the increase was 23.72 Bcm. Current storage levels are at 75.85 Bcm, which suggests the EU is still on track to enter the next heating season in a relatively healthy shape. Last year, maximum storage levels were achieved in the 45th week, at 103.55 Bcm. This year, it does not look as promising, given the far slower pace of inventory builds.

Not only is the rate of EU storage build lagging far behind last year’s increase levels, as well as the five-year average, but all indications are that once the heating season drawdown will start if this year’s temperatures will be normal or below normal, the rate of storage draw-down will be higher than normal. In other words, the path to a major EU energy crisis likely started a few months ago, it is just that the market is yet to fully grasp the situation. As Bloomberg recently noted, the market may have just started to react, although it is not yet clear whether a relatively short-term market reaction is a sign of a sobering up to the ongoing shortfall in gas supply builds. The market still seems to believe in the narrative that the slower pace of inventory buildup is due to an already high inventory level. My view is that the market will only start to react at the end of this summer at the earliest.

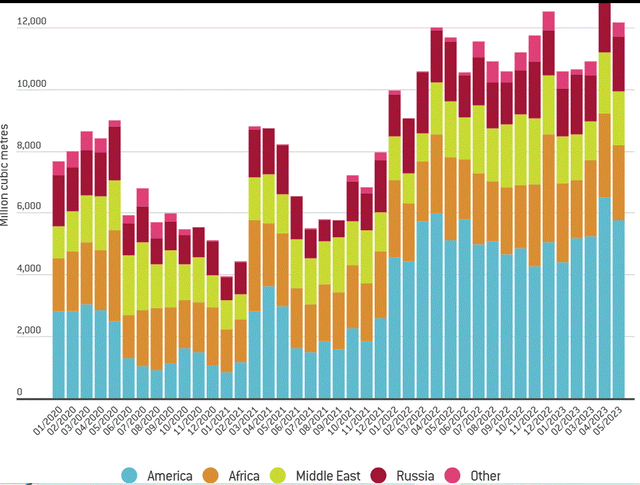

As I already touched on, US drilling activities are plummeting, making it very likely that we will see the start of US oil & gas production declines this fall. This will not mean that US consumers will consume less. It will mean that LNG exports will start to decline in the fall and through the winter. This spells serious trouble for Europe which is now heavily dependent on those US LNG exports.

EU LNG imports by source (Bruegel)

We should note that LNG flows to Europe are now much higher for the past few months, compared with the corresponding months from a year ago, yet the rate of storage filling is running at about 2/3 of the rate from a year ago. For instance, in May of 2022, the EU imported about 8 Bcm of LNG, while last month it imported 12 Bcm. The assumption that the EU will be able to improve on its storage volume trends at some point, for instance when volumes will match that of the previous year, is highly questionable.

Ordinarily, one would think that in the spirit of solidarity, American LNG will be allowed to continue flowing to Europe, at least at current levels, in the event of a dire need. We should keep in mind that 2024 will be an important year in the US electoral cycle, therefore I doubt that the current incumbent political elites will be willing to see a major spike in natural gas prices. Adding it all together, it is very plausible to assume that Europe will enter a natural gas price crisis at some point in early fall, in other words about 100 days from now, which will be the first stage of a broader global energy price crisis. It should be noted that this will also likely put further pressure on oil prices, given that there is some European spare capacity in place to burn oil for electricity generation. The continent’s only saving grace would be an exceptionally mild winter not only in Europe in order to keep demand low, but also an exceptionally mild winter in North America in order to keep gas volumes available for export high.

After the potential start of a natural gas crisis in the EU, there is a very high probability of a global oil & gas price crisis by year-end or in early 2024, on top of it.

With the Saudi production volume cut of 1 mb/d and an already-existing gap between current global liquid fuels production volumes and expected demand levels in the fourth quarter of this year, something dramatic is set to happen to the global economy within the next few months. My personal view is that policymakers as well as other concerned factions would prefer to see a non-related global economic growth suppression event take place, rather than be faced with an event where insufficient supplies will meet a surge in demand that will lead to a massive oil price spike, followed by a price-induced demand destruction event.

The latter scenario risks shattering confidence in future global economic growth prospects, due to severe energy limitations, which makes it arguably worse on many levels. It is an impending potential event, which in my view, in the absence of the COVID crisis, as well as the Russian invasion of Ukraine, which plunged the world into a period of global economic stagnation, for this year and next, it would have already happened a few years ago.

In the absence of yet another dramatic event that will cut oil & other energy demand, we will probably see the start of a very significant oil price spike at some point towards the end of this year, possibly culminating at some point in 2024. This will come on top of a massive spike in LNG prices, with Europe likely to bid up the price in desperation to attract as much volume as possible, as it will try to cope with a significant natural gas supply shortfall. The combination of the two events, working through the global economy has the potential to push us into a severely damaging stagflationary trap going into next year.

Investment implications:

In a follow-up article, I recently reiterated my original end-of-2022 position that the S&P 500 (SP500) will finish this year at 4,200 points, furthermore, I extended my 4,200 outlook for the end of 2024. Breaking down the trajectory further, I expect the next 100 days or so to be a mostly optimistic period in the markets, which will drive the S&P to perhaps as high as 4,500 by the fall. There may even be some exceptional circumstances that can push the market into a somewhat irrational mood that can see the S&P test previous all-time highs, in other words, move towards 4,800 points by the end of the summer.

Rising energy prices will probably deflate that wave of optimism in the fall, meaning that we will probably see a retracement back to about 4,200 by year-end, leading to a net gain on the year of just a few percentage points. In the event that the summer market rally will materialize and perhaps even surprise on the upside, I intend to start reducing my stock positions in a number of companies, depending on their performance. I currently have about 25 stock positions to choose from. Energy stocks will probably not see a reduction in my portfolio this summer or in the fall if my bullish outlook on energy remains intact going forward.

For 2024, I see no prospects for a gain in the stock market indices within a stagflationary environment. On one hand, nominal revenues and profits might improve. Profits will gain far less than revenues. On an inflation-adjusted basis, revenues will probably stagnate at best, while profits will decline in inflation-adjusted terms. Needless to say that I do not share the current optimistic forecasts of inflationary pressures continuing to decline toward normal. Energy costs will start to push inflation higher again by early 2024 at the latest as it works through the supply chains. If energy prices will do what I currently expect them to do, 2024 will likely be when I will reduce my exposure to energy stocks, seeking to sell into an energy price spike, before high energy prices will hammer economic growth. Currently, Suncor (SU) has an outsized weight in my portfolio, making up about a fifth of the entire value of my stocks, which will make it my main target when I will seek to reduce my energy stock holdings.

There is of course always a chance that things will not work out the way I expect them to. Another milder-than-normal winter in both Europe & North America could potentially let the EU off the hook once more in terms of natural gas supplies. Oil supply volumes could potentially surprise to the upside and close the emerging supply/demand gap we are seemingly headed for towards the end of the year. Another dramatic event with the potential to grind the global economy to a halt could still intervene between now and the end of the year. Peace in Ukraine could always suddenly break out, followed by swift EU-Russian rapprochement that would see a return to Russian energy flows Westwards. The latter is by far the most unlikely to pan out in my view.

On the other hand, Russia for instance could find an energy price spike to be a convenient time to cut its own production in order to put pressure on Western leaders who are keen to maintain harsh economic sanctions. Europe is arguably due for another harsh winter since it has been a few years since such a weather event last occurred. These are just some of the examples that could exacerbate what seems like an impending energy supply crunch situation, which is likely to be sustained for the foreseeable future, as long as the global economy continues to need growing energy supplies to meet growing needs. I most certainly could be wrong, but in about 100 days, I do believe we will have an answer to whether I am or not. If I am correct, this will be a dramatic long-term shift in investment conditions, with the very minimal goal of at the very least preserving one’s wealth by matching one’s investment gains every year with inflation rates becoming more and more difficult to achieve.

Read the full article here