Historically, the biggest complaint amongst Uber (NYSE:UBER) detractors in the investment community has been that the company doesn’t make any money.

Countless think pieces, blog posts, and media articles circulated around the time of the company’s 2019 IPO, talking about “profitless unicorns” and how the glut of VC funding throughout the latter 2010’s was delivering massive, bloated companies to public investors that had fundamentally unprofitable business models.

4 years and one global pandemic later, and Uber has transformed itself from a heavily VC-subsidized taxi service into a global mobility powerhouse, with tentacles spanning mobility, freight, and delivery across 6 continents. While the company has some competition in select markets and faces some legal challenges, we are confident in Uber’s ability to navigate issues with Dara Khosrowshahi at the helm.

Here’s the bottom line: There is still a massive growth opportunity in front of Uber, as delivery, freight, and logistics digitization is still in its early innings globally. As individuals and businesses continue to place higher and higher value on convenience, Uber is positioned well to capitalize on this.

Best of all? The company is now free cash flow positive, which means that the massive dilution that shareholders have suffered up until this point should finally be coming to an end. The company will now be able to begin returning capital to shareholders or begin compounding at high internal IRR’s.

Effectively, the sky is now the limit.

Financial Results

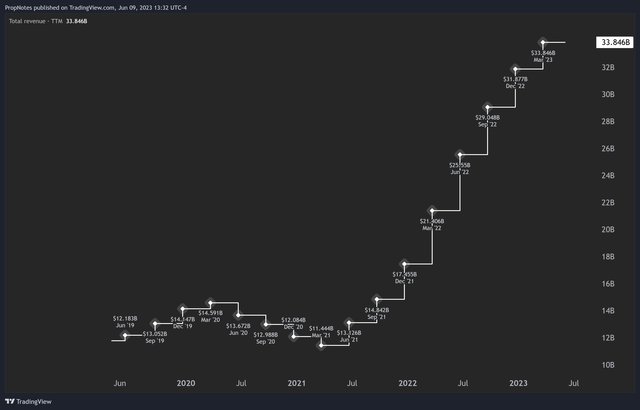

People are often shocked when we tell them how big Uber has gotten over the last few years. The in the last twelve months, Uber brought in $33.8 billion in revenue, which is a far cry from the $11 billion the company reported around the time of its IPO:

TradingView

This meteoric growth is a result of strength in MAPC, or “Monthly Active Platform Customers”.

But what is a Monthly Active Platform Customer?

According to Uber, a MAPC is:

A unique consumer who completed a Mobility ride or received a Delivery order on our platform at least once in a given month.”

Seems simple enough.

It’s the secret to Uber’s success, though.

As the pandemic crushed the mobility segment and competitors like Lyft saw drastic declines in bookings and revenue, Uber was able to buttress its business somewhat with Uber Eats. While the revenue from Eats wasn’t enough to offset the losses from mobility, it did give customers another reason to download the app – and this is the key thing.

Over time, Uber’s delivery offerings have become as robust as its mobility ones, which has meant that consumers who already have the app can begin doing more and more with the platform:

Uber

Over time, pulling up Uber for food or transportation of any kind becomes a sticky, convenient habit for consumers, one not easily let go.

As a result, Uber is now in a great position. It’s no longer a ridesharing app; it’s the ultimate in convenience with a large (and growing) customer base who are accustomed to spending on a regular basis.

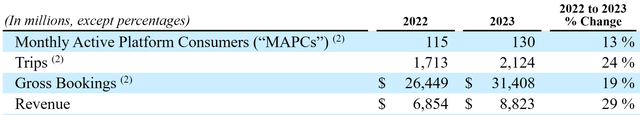

This pattern can be seen in the company’s financial reports, as well:

Uber’s 10Q

Here, you can see the 13% YoY increase in MAPC’s. However, trips increased by 24%, which means that each individual customer was using the app more and more, on a per-user basis. Additionally, gross bookings were up 19%, also an increase.

Finally, Uber was able to juice more revenue from these MAPC’s, indicating that the company still has pricing power and room to improve take rates as well.

For Uber, as long as they can get someone into the ecosystem, they’re able to begin the convenience flywheel.

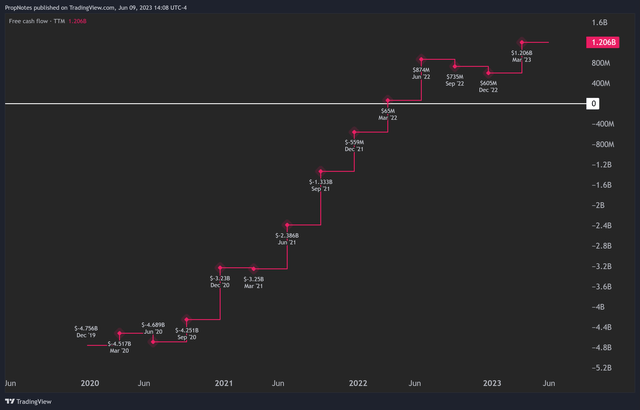

Unsurprisingly, this has led to surging free cash flows, most recently reported at 1.2 billion, a record for the company:

TradingView

It’s clear from this growth that this cash flow is no fluke – it’s here to stay as Uber continues to grow.

Global Growth

Perhaps the most interesting thing about Uber is the company’s international opportunity.

Year-over-year, the company’s global revenue has been growing like a weed:

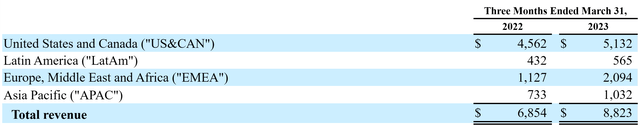

10Q

While North America did well, EMEA revenues were up from $1.1 billion to $2.1 billion in the span of 12 months, growth of more than 90%. APAC also performed well, growing from $733 million to $1 billion in sales, growth of ~40%.

Increases like this showcase Uber’s strong market presence and ability to convert activity to revenue.

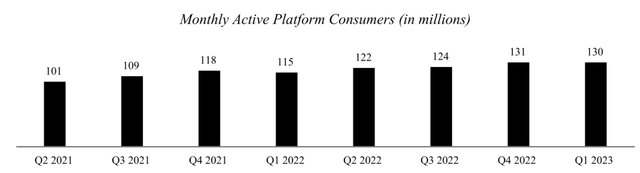

In terms of overall growth potential, the company currently has about ~130 million monthly active platform customers. Historically, this has fluctuated somewhat, but grown at a rate of about 3.7% per quarter:

10Q

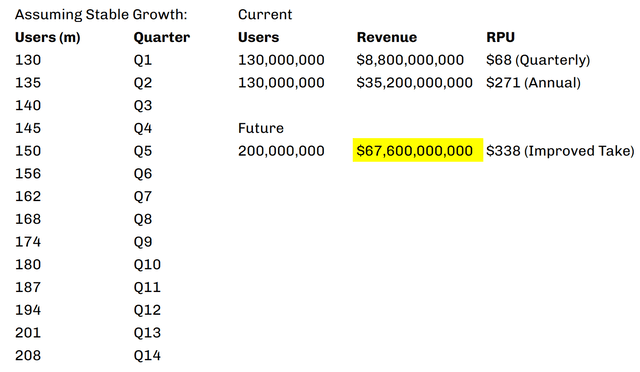

Should this continue apace, we think the company could reach 200 million MAPC by the end of 2026. Given the global growth, increased per-user trips, gross bookings, and improved monetization, it’s possible we could see revenue double again to ~$67 billion:

Author’s Own Calculations

The biggest weakness of this model is that it assumes stable growth in users. However, the RPU models in no increased per-user demand, only increased take. That way, we think it’s a fair balance of what could happen to revenue over the next 36-42 months.

Either way, it seems like the business has significant upside from a top line standpoint.

Valuation

So the business is executing well – but how much is the market asking us to pay for it?

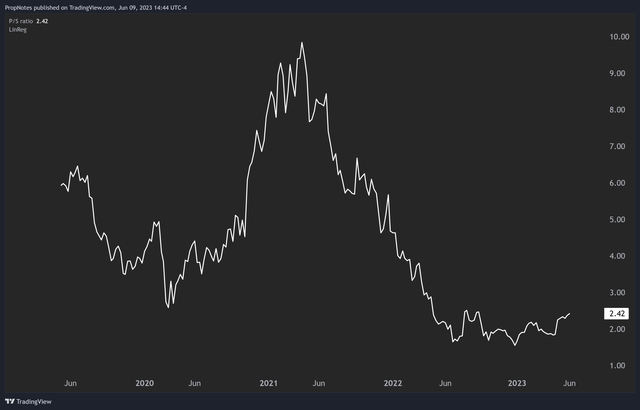

Right now, Uber is trading at 2.4x Revenue:

TradingView

Not only is this historically cheap, but it’s also cheap on a nominal basis compared to other high-quality companies around the market.

Google (GOOG) trades at 5.4x revenue, and Microsoft (MSFT) trades at 11.7x. Why are these apt comparisons? In short, all three companies provide a dominant, flywheel-led technology platform to an enormous number of users while charging a toll in the middle. Microsoft profits off of Windows, Office, Productivity, and Enterprise products. Google takes a cut most times users interact with their family of apps. Uber is the food and transportation king.

Sure, Uber doesn’t have the margin and scale of those businesses…yet. However, progress is being made on both of those fronts.

As an asset-light tech and logistics platform, it seems like Uber is being priced well below its potential.

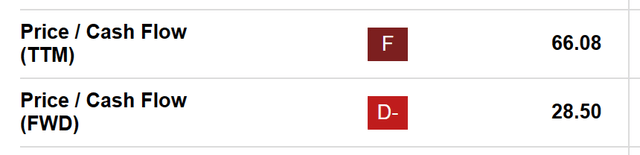

One could point to Uber’s high P/CF ratio at 66x, but factoring in growth it seems actually seems more than reasonable at sub-30x:

Seeking Alpha

All in all, we feel the valuation is not properly reflecting the continued growth opportunities of Uber, and buying at the current price looks advantageous.

Risks

While we like the stock and think it’s well positioned to climb much higher in the coming months and quarters, there are some risks to this thesis.

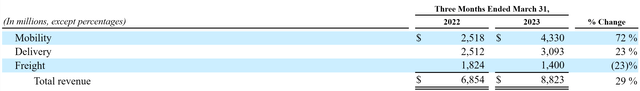

Macro: The macro environment is by far the largest risk. Freight is the business segment that we haven’t covered up to this point, but it’s actually run into a slowdown as a result of the broader economic issues currently present:

10Q

Mobility and delivery have done well, but freight actually saw a $400 million slowdown. If a weak economy causes consumers to have less disposable income, then that could hurt Uber’s other lines of business as well.

Competitors: Grab, Lyft (LYFT) and Didi remain relevant in the global market for ridesharing and on demand logistics. Grab is even trying to branch out into financial services to further engrain users in its ecosystem.

As a result, Southeast Asia and China look like they are “all locked up” with respect to Uber’s ability to grow there. If these competitors expand to other markets where Uber is dominant, then it could cause a price fight, which may lower margins considerably.

Summary

There are some risks to investing at Uber at this moment in time. Competition could spring up at any time, the macro environment is challenging, and the company remains embroiled in lawsuits over driver classifications. However, net of these risks, Uber looks attractively priced, especially compared to its long-term potential, strong flywheel economics, and growing brand loyalty. We rate Uber a Strong Buy.

Read the full article here