Inflation is moving in the right direction, but will core inflation remain stubborn?

Headline inflation has come down sharply and is widely expected to continue to fall over the months ahead. The decline in natural gas prices has been remarkable over recent months, and while it would be naïve to expect the energy crisis to be completely over, this will result in declining consumer prices for energy. The passthrough of market prices to the consumer is slower on the way down so far, which means that there’s more to come in terms of a downward impact on inflation.

For food, the same holds true. Food inflation has been the largest contributor to headline inflation from December onwards, but recent developments have been encouraging. Food commodity prices have moderated substantially since last year already, but consumer prices are now also starting to see slowing increases. In April and May, month-on-month developments in food inflation improved significantly, causing the rate to trend down.

Historical relationships and post-pandemic shifts

As headline inflation looks set to slow down further – at least in the absence of any new energy price shocks – the question is how sticky core inflation will remain. There are several ways to explore the prospects for core inflation.

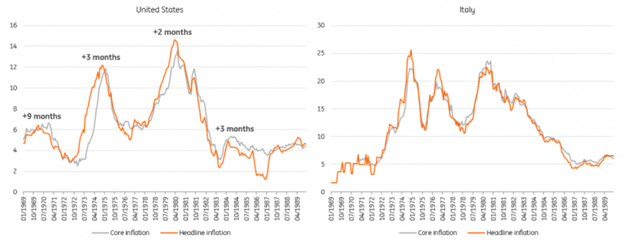

Let’s start with the historical relationships between headline and core inflation after supply shocks. Data for core inflation in the 1970s and 80s are not available for many countries – but the examples below for the US and Italy show that an energy shock did not lead to a prolonged period of elevated core inflation after headline inflation had already trended down. In fact, the peaks in headline inflation in the 70s and 80s saw peaks in core inflation only a few months after in the US and coincident peaks in Italy. We know that history hardly ever repeats, but it at least rhymes – and if this is the case, core inflation should soon reach its peak.

During previous supply-side shocks, core inflation did not remain elevated for much longer than headline inflation

Macrobond, ING Research

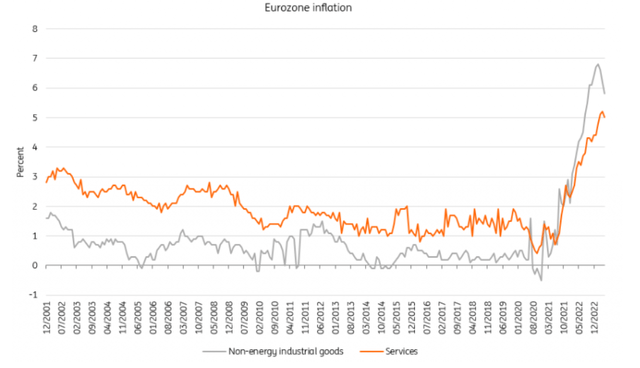

History is one thing, the present another. Digging into the details of current core inflation in the eurozone shows a significant divergence between goods and services, regarding both economic activity and selling price expectations. Judging from the latest sentiment indicators, demand for goods has been weakening for quite some time already. At the same time, easing supply chain frictions and lower energy and transport costs have taken away price pressures, leading to a dramatic decline in the number of businesses in the manufacturing sector that intend to raise prices in the months ahead.

The services sector, however, is still thriving, enjoying the post-pandemic shift from goods to services. Services most affected by lockdowns are currently experiencing much faster price growth than other services or goods. The upcoming summer holiday period could still fuel service price inflation.

Last month saw a drop in services inflation, but this drop was largely due to cheaper public transportation tickets in Germany, and it seems too early to call for a significant improvement in services inflation at the moment. Finally, services inflation traditionally shows a much stronger correlation with wage growth than goods inflation. With wage growth trending up and probably coming in at around 5% year-on-year in the eurozone this year, services inflation remains the largest problem for core inflation and the European Central Bank.

Core inflation has been falling recently, but services inflation has been subdued by German public transport tickets

Eurostat, ING Research calculations

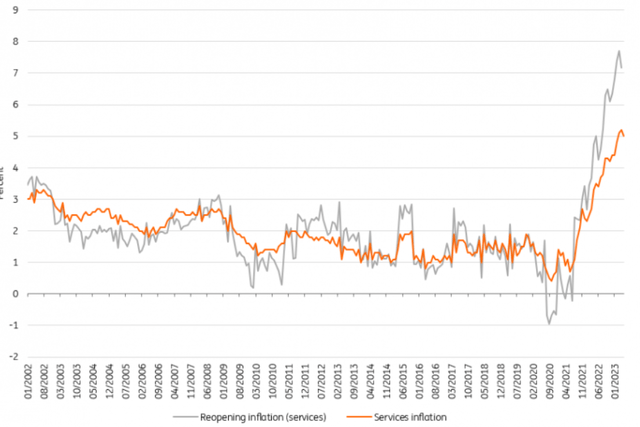

Still, a key question remains over how long the divergence between goods and services inflation can last. Historically, we don’t see much evidence of a significant difference between the two. Goods inflation actually leads services inflation by approximately six months, which means that the peak for goods from February historically suggests that services inflation is unlikely to remain elevated for the rest of the year. If we are right and the post-pandemic shift ends after the summer holiday period, we could see services inflation starting to come down before the end of the year.

Goods inflation historically leads services inflation by six months

Eurostat, ING Research calculations

Overall, core inflation seems set to trend down from here on

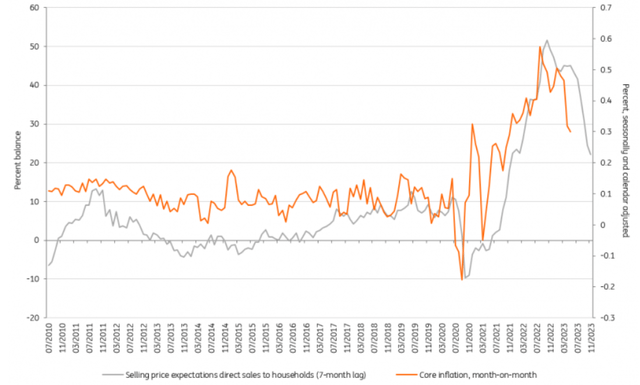

While services inflation continues to see some upside risk for the months ahead, core inflation overall looks set to trend down on the back of slowing goods prices. Even services inflation could already be trending down, but perhaps not as fast as policymakers would like. When looking at selling price expectations for sectors that sell most to consumers, we see that there has been a steady downturn in the number of businesses intending to raise prices. This generally correlates fairly well with core inflation developments seven months later, which would point to a significant slowdown in core inflation.

At the current juncture, experts and central bankers will be hesitant to make an outright call for a sharp drop in inflation. The latest track record of inflation forecasting is simply not on their (or our) side. Nevertheless, as much as it was once obvious that the era of low inflation had to end at some point, it’s now clear that the short period of surging inflation will also cease sooner or later. Historical evidence and the latest developments in both goods and services give enough comfort to expect both headline and core inflation to decline.

We currently expect core inflation to drop below 4% at the end of the year, and for it to be at 2.5% by mid-2024. The risks to that outlook seem to be fairly balanced, as stubborn core inflation on the back of faster wage growth and a quicker drop on the back of weak goods inflation remain decent possibilities.

Business expectations point to moderating core inflation over the second half of the year

ECB, European Commission DGECFIN, ING Research calculations

Could the ECB fall behind the curve again?

For the ECB, this isn’t to say that tightening is over. In fact, the central bank can’t – and won’t – take a chance on this kind of core inflation forecast. Why? Because they’ve simply been wrong too often in previous years. To put it into ECB language: inflation forecasts are currently surrounded by an unprecedented amount of uncertainty. This is one of the reasons why the central bank has put more emphasis on current inflation developments and less emphasis on its own inflation forecasts for one or two years ahead.

While such a strategy supports the ECB’s credibility, by definition it runs the risk of falling behind the curve. Given the time lags with which monetary policy operates and affects the economy, central banks should be forward-looking, not now-looking. This is the theory. In practice, however, the ECB will not change its tightening stance until core inflation shows clear signs of a turning point. Taking all of the above into consideration, this implies that it will not only hike at this week’s meeting but could continue to do so at least until September – at the risk, by that point, of having gone too far.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original Post

Read the full article here