Introduction

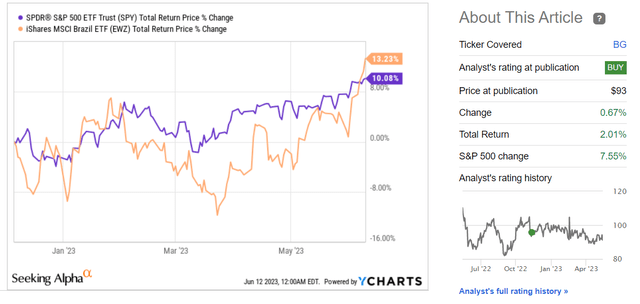

Late last year, I initiated coverage of Bunge Limited (NYSE:BG), Brazil’s largest agri-food company, with a Buy rating. I expected: a) further improvement in the company’s financial performance due to the favorable business environment and b) continued growth in the Brazilian market. I can’t say I was wrong – the Brazilian market, represented by the iShares MSCI Brazil ETF (EWZ), actually outperformed the S&P 500 Index (SPY) in terms of total return. However, shares of BG went up relatively little – only +2% against the backdrop of SPY rising by 7.55% over the same period:

Seeking Alpha, YCharts

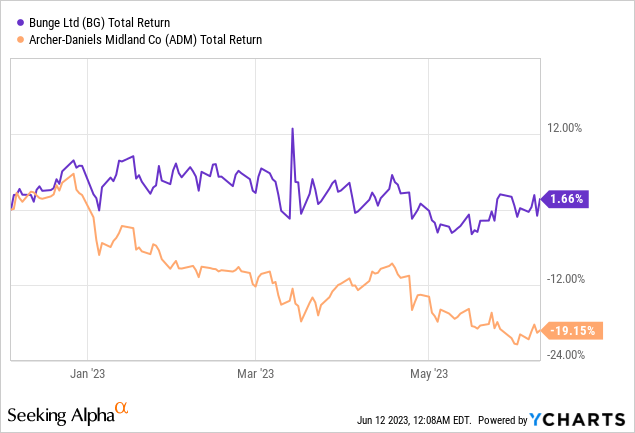

Everything is relative. Bunge’s main competitor, Archer-Daniels-Midland Company (NYSE:ADM), has fallen by more than 19% over the same period, including dividends, and is far behind its Brazilian rival:

Given the circumstances surrounding these events, I’ve decided to fulfill the request of one of my dedicated readers and dive into an analysis of ADM’s growth prospects. In the process, I’ll be drawing a comparison with BG, thereby providing an updated version of my earlier thesis. So, let’s dive right in.

Archer-Daniels-Midland vs. Bunge: Business Models And Financials

Let’s start by comparing the business units of the two companies:

| Main business segments (based on the latest 10-Qs, links below) | |

| ADM | BG |

| Ag Services and Oilseeds (77.2% of total revenue) – generates revenue from the sale of commodities, service fees for the transportation of goods, products manufactured in its global processing facilities, and structured trade finance activities. | Agribusiness (70.8% of total revenue) – both inputs and outputs being agricultural commodities (high volume and low margin). |

| Carbohydrate Solutions (14.7%) – generates revenue from the sale of products manufactured at the company’s global corn and wheat milling facilities around the world. | Refined and Specialty Oils (25.37%) – involves the processing, producing, and marketing of products derived from vegetable oils. |

| Nutrition (~8%) – sells ingredients and solutions including plant-based proteins, natural flavors, flavor systems, natural colors, emulsifiers, soluble fiber, polyols, hydrocolloids, probiotics, prebiotics, enzymes, botanical extracts, edible beans, formula feeds, animal health and nutrition products, pet food and treats, and other specialty food and feed ingredients | Milling (3.36%) – processing, production, and marketing of products derived primarily from wheat and corn. |

| Other | Sugar and Bioenergy (0.42%) – 50% interest in BP Bunge Bioenergia, a joint venture with BP PLC (BP). |

| Other | |

Source: Author’s compilation

In general, it can be seen from the description that both companies compete in the same markets. Although ADM has only 3 segments [BG has 4], the American company looks more diversified – the sale of commodities, service fees for the transportation of goods, and the sale of products manufactured in the company’s worldwide corn and ADM wheat mills account for about 91.9% of total revenues, while BG’s approximately the same activity accounts for 99.5% of revenues.

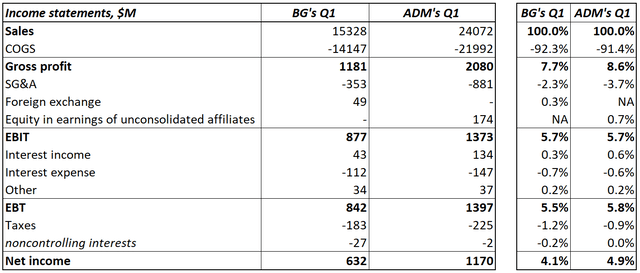

ADM’s business looks more stable and higher margin at first glance – what I already described in the article on BG continues to this day, as we can see from the vertical analysis of the income statements:

Author’s calculations, the companies’ 10-Qs

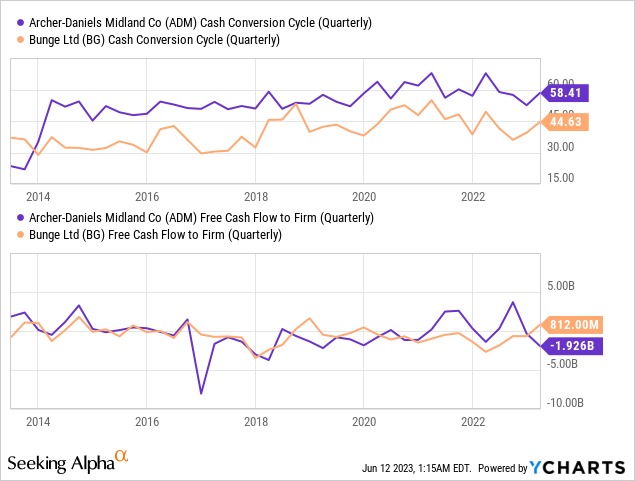

However, this dominance of the “paper profit” of ADM continues until we turn to the cash flow statements. In Q1 FY2023, ADM reported an operating cash flow outflow of ~$1.6 billion, which is 1/3 worse than the same period last year. At the same time, Bunge reported a cash inflow of $931M, which is a huge improvement over last year’s huge cash outflow of $2.7B. But why does one company have improvements in operating cash flow and another doesn’t? It’s all about Bunge’s superiority in terms of the cash conversion cycle:

The cash flow reports show that the biggest drag on the CFO of ADM was the QoQ decrease in trade payables [-$1.6 billion], while BG increased this item on its balance sheet by as much as $802 million [QoQ].

Why This Matters

A decrease in trade payables can create liquidity constraints for a company because it indicates that payments are being made to creditors, which can impact the company’s ability to generate FCF, support liquidity levels, and make current expenditures. The free cash flow to the firm [FCFF] I superimposed above demonstrates the most recent impact.

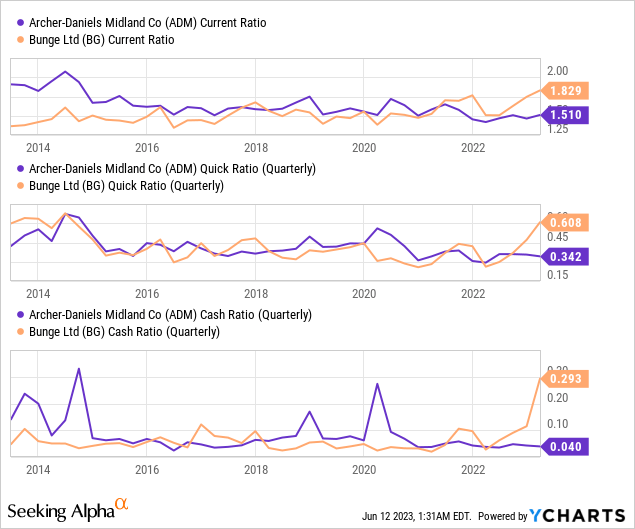

In terms of liquidity, BG seems to be a much more stable company at the moment, as far as I see it:

However, this may just be temporary – BG appears to be improving its liquidity to complete the acquisition of Viterra and create an agribusiness giant valued at more than $30 billion, including debt, Seeking Alpha News reported recently. The Viterra acquisition should bring Bunge’s sales of $67.2 billion in 2022 in line with Archer Daniels Midland’s sales of $102 billion last year and strengthen Bunge’s grain export and oilseed processing businesses. That’s why I think my comparison today should be very important – in the future, the competition between the two companies will only intensify. Investors will likely be choosing the market leader.

Based on Viterra’s latest financials, Bunge will acquire a very low-margin company that generates only ~$2 billion in gross profit on $54 billion in sales [3.82% in GP margin]. At the same time, one has to give Viterra credit for having a net debt to EBITDA ratio of only 0.4x, which I think is a relatively healthy number. If the deal goes through, Bunge will have to do a lot of cost optimization work to get back to current margin levels. In my opinion, that’s kind of a wild card that can work to investors’ advantage as well as disadvantage. However, after the news was announced, the market reacted in favor of BG – the stock rose sharply, reaching a high of $95 per share on June 7. On June 9, it closed at $93.62 per share.

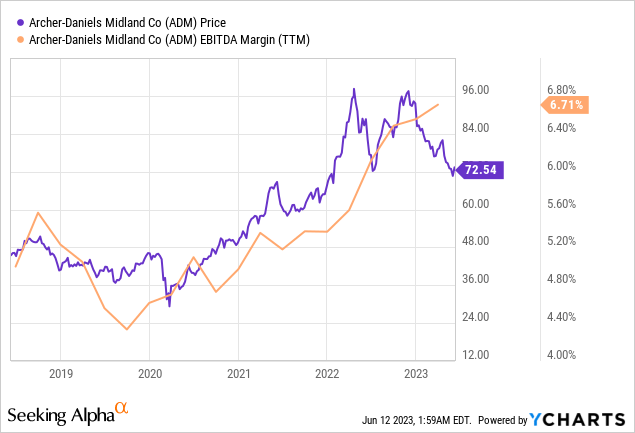

As for ADM, I like the productivity efforts the company is making. At the last earnings call, the CEO cited a few examples, including automation in key operations that should result in significant savings. He also emphasized the company’s path to decarbonization, highlighting its position in alternative fuel production and plans for carbon capture and sequestration in Decatur that will enable the supply of low-carbon feedstocks. In the long term, I think ADM’s margin will, if not increase, at least remain relatively stable at current levels.

The focus on decarbonization in the Decatur complex is unlocking value for customers, and ADM expects EPS in the range of $6 to $7 in FY2023.

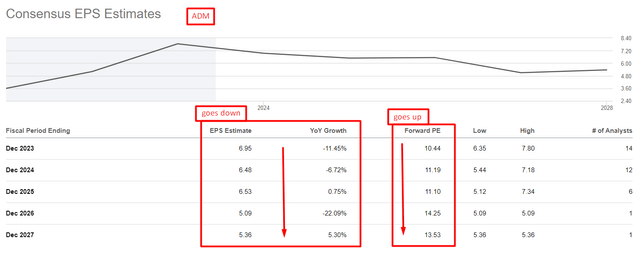

Based on recent sales and margin trends, Argus Research’s analyst, Taylor Conrad, has raised the 2023 adjusted EPS estimate to $6.95 from $6.75 [May 1, 2023 – proprietary source]. However, this estimate still implies a 12% decline for the year due to expectations of lower grain prices compared to 2022. The adjusted EPS estimate for FY2024 has also been raised to $6.70 from $6.50 to reflect a higher expected base in FY2023, despite further anticipated declines in grain prices.

But we mustn’t forget Bunge’s results either. According to the CEO Greg Heckman during the latest earnings call, Q1 FY2023 results showed performance among the best in Bunge’s history, even though they were down from last year’s record results due to market dislocations. Core segment-adjusted EBIT benefited from record results in Refining and Specialty Oils, while other core segments reported lower results. The processing segment reported better results in North America and Brazil, offset by lower results in Argentina, Europe, and Asia. Trading segment results were lower due to lower margins compared to the previous year. Refined and specialty oils performed well in all regions, with notable improvements in North America and South America. Milling results were impacted by a small Argentine wheat crop, but this was partially offset by higher margins in Brazil. The company reaffirmed its guidance for full-year adjusted EPS to be at least $11, based on market conditions and forward curves.

I believe in the peaceful coexistence of these agricultural giants after possible mergers and a cleanup of the situation with global demand. But which company is more attractive based on the valuation?

Valuation Of ADM And Bunge

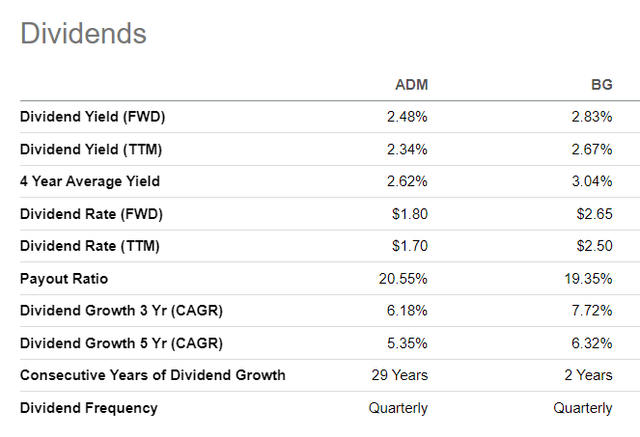

Both companies are about equally attractive in terms of dividend yield, but ADM’s dividend certainly looks more stable due to the company’s phenomenal ability to consistently increase it over the past decades:

Seeking Alpha Premium data

As you can see, the distributions of both companies are similar, which tells me that the companies would increase their distributions at about the same rate in the future if it weren’t for a possible acquisition of Viterra by BG. Again, it’s hard to say what will happen to BG’s dividends in the next few years, but I think they’ll stay the same and even increase a little.

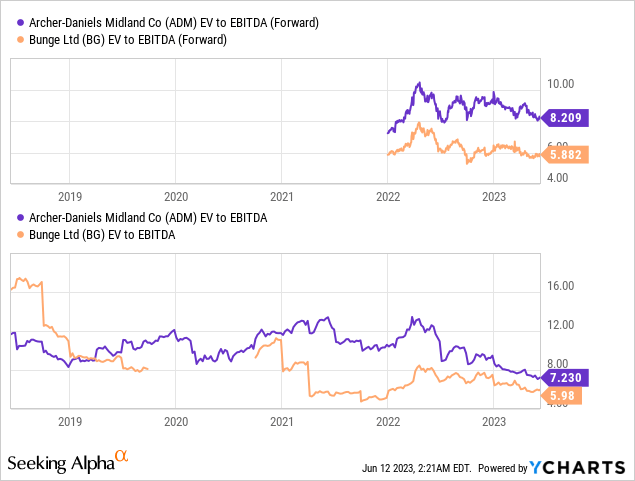

For obvious reasons of jurisdiction, market liquidity, company size, investor awareness, and general superiority in terms of profitability and margins, ADM’s stock has long traded at an enormous premium to BG, which has endured to this day despite the obvious narrowing of that very premium in recent years:

When I talk about a “narrowing premium”, I’m primarily referring to trailing multiples – the market currently values ADM’s EV/EBITDA multiple at only 7.2x, while its peer’s corresponding multiple is ~6x. In terms of FWD multiples, the situation is somewhat different – Mr. Market prices a slight multiple contraction for BG [from 6x to 5.9x] and a multiple expansion for ADM [from 7.2x to 8.2x].

The same multidirectional dynamics can be observed in forwarding P/Es:

Seeking Alpha Premium, author’s notes Seeking Alpha Premium, author’s notes

As far as I can see, both companies seem to be undervalued.

In the case of ADM, the market apparently refuses to take into account its cost optimization efforts and the resulting impact on earnings. I highly doubt that ADM’s EPS will decline by >22% over the next 5 years, as analysts are now forecasting.

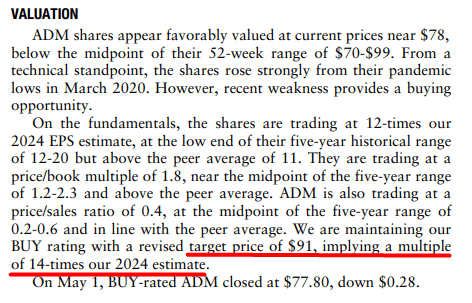

Also, Argus Research goes against the consensus and has a price target for ADM stock of $91 per share, implying a 25.45% upside potential:

Argus Research, author’s notes

In the case of Bunge, I expect that after the Viterra acquisition, if it happens, the company’s EPS will definitely have to be revised upward because Viterra is a profitable takeover target. Yes, interest expenses will increase significantly, but on the other hand, the company has already established a solid liquidity base. Given the potential synergies from this possible merger, I don’t believe that BG’s EPS will increase by only 2.8% over the next 3 years.

I expect BG stock to fairly trade at 10-12 times earnings, giving a price target of $110-132 per share given the low end of the $11 per share forecast range [based on management’s guidance]. This represents an upside potential of 17.5 – 41%.

Conclusion

When I started writing this article, I expected to come to some kind of one-sided conclusion. However, it turned out that I liked both companies despite their rivalry in identical markets.

Of course, my positive conclusions carry some risks. The low valuation we see today could be even lower due to the cyclicality of the companies I analyzed – it’s obvious that the industry is currently going through hard times (companies’ growth is slowing and future performance is becoming questionable). Also, I may not have delved too deeply into the financials of each company – this poses a risk to investors who are limited to reading only this article before making an investment decision. I encourage you to do your own due diligence and read other articles on ADM and Bunge here on Seeking Alpha.

However, if I had to choose between Bunge and ADM, I’d probably choose Bunge. Its valuation discount is narrowing relative to ADM, and if the merger with Viterra goes through, the consolidated company will likely realize massive synergies that aren’t yet quantifiable. The time horizon of my choice clearly needs to be longer than 2 years to see this effect firsthand. ADM in turn, also looks interesting – pessimism in the market provides a unique opportunity to buy a high-quality asset that has fallen sharply in price. However, the potential of the latter story is somewhat lower than the former, so I rate both stocks Buy, but with a more favorable outlook for Bunge.

Thanks for reading!

Read the full article here