Editor’s note: Seeking Alpha is proud to welcome Value Oriented Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Investment Outline

Humana Inc. (NYSE:HUM) is a reputable health and well-being company headquartered in the United States, offering a range of services through its two primary segments, Insurance and CenterWell. Humana is known for its provision of commercial and unique health insurance benefit plans, catering to the needs of its customers. As shown by the steady increase in memberships over the last quarters.

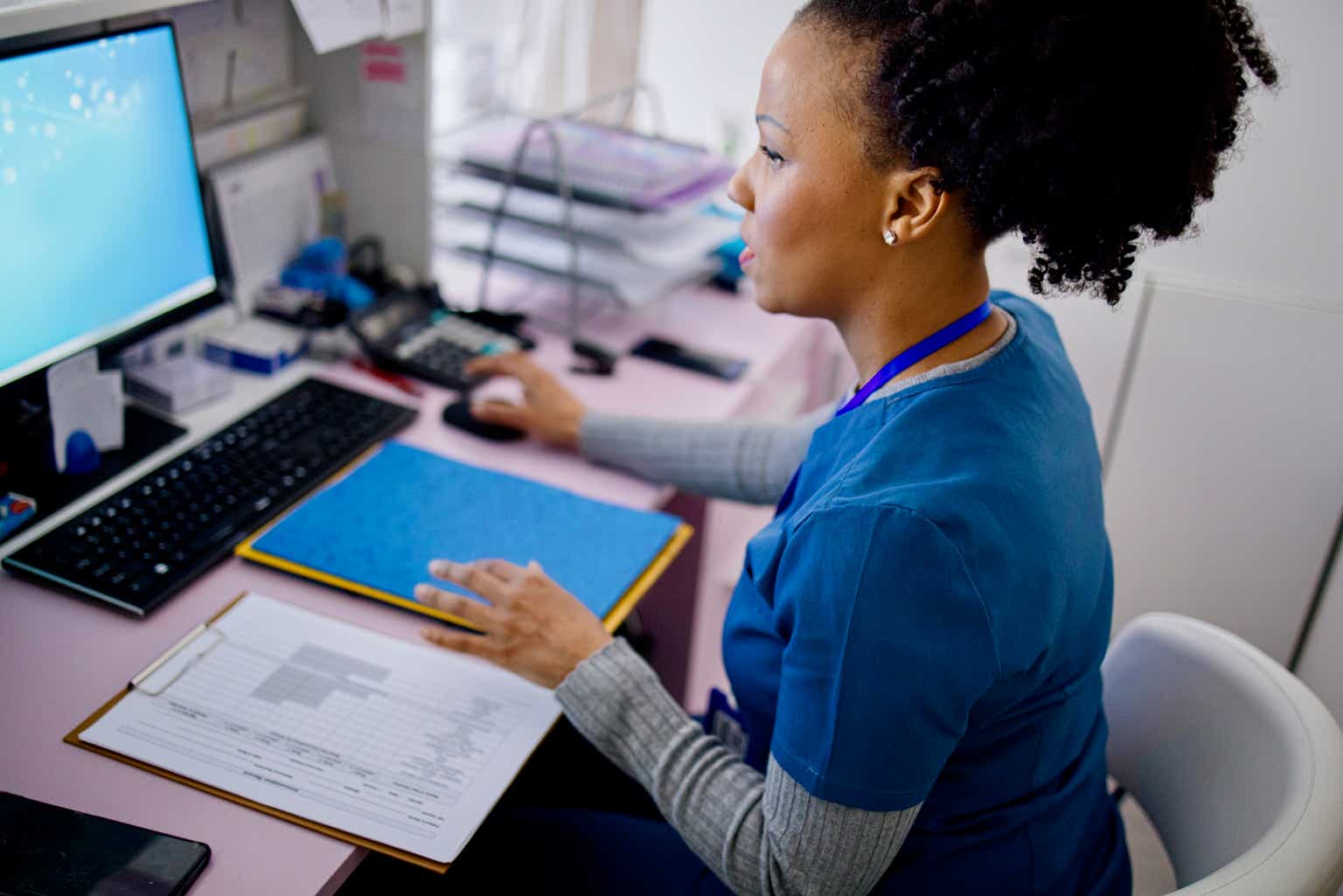

MA Membership Growth (Investor Presentation)

Where Humana is setting itself apart is the solid growth in memberships they are having. Over the last 5 years, Humana has an industry-leading growth in their Medicare Advantage franchise, averaging a 10.8% CAGR. This has helped Humana grow their FCF immensely and just in the last 12 months they have generated over $10 billion in levered FCF, which goes to show the flexibility the company has financially after paying down all their obligations. Humana has proven itself dedicated to its shareholders and continuously raised the dividend as a result of the growing cash flows. This sort of priority creates in my opinion a very solid investment case for the long term. Humana will be able to capture growth and grow memberships because of the market position they have, but also the growing number of seniors in the US. In times of slow growth, investors can still benefit from the buybacks the company is doing and collect the dividend too.

Recent Developments

Perhaps not that recently, but worth mentioning is that Humana won a very important contract with the Defense Health Agency of the U.S. Department of Defense (DoD). The TRICARE healthcare program will be a significant tailwind for the company as it could help add around $70 billion in revenues for the company in the coming 9 years. The contract has one base year with eight annual option periods. The contract gets Humana exposure and access to 4.6 million beneficiaries. With Humana having just over 17 million in total memberships, these additions will add momentum to the company’s earnings. Going into the coming quarters, it will be especially important to watch the membership growth and retention Humana is able to have. That will indicate whether or not we are on the right path here and whether strong cash flows can be maintained.

Financials

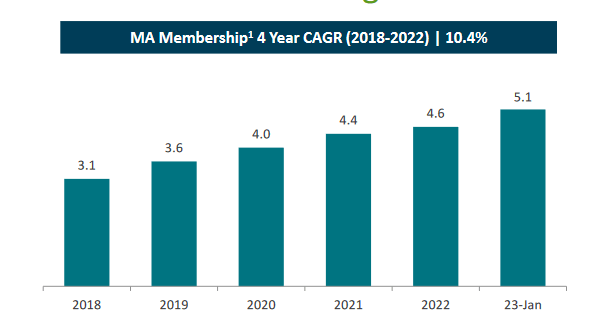

Right now, I think that Humana’s financials are in fantastic shape. They have made meaningful steps to develop their balance sheet into a state of strength and flexibility. With almost $14 billion in cash, the company has the potential to continue making solid acquisitions as they have before. Much thanks to the growing cash flow the company has, the cash position managed to grow from the $5 billion Humana had at the end of 2022. Going forward, I don’t really need to see an increase in the cash position. In my view, Humana has enough cash here to be financially stable, as they could pay off all their long-term debts if they so choose.

Balance Sheet (Q1 Report)

With the cash position increasing like this, the company has grown in a better position financially as I mentioned, which is highlighted by the lowering of the debt-to-total capitalization the company has, which sits around 41.1% right now. Paying off the short-term debt, the company would be left with around $12 billion in cash. I think the company has the potential right now to then double its share repurchase funds to around $6 billion in total. I don’t see that it would put Humana in any danger, and it would solidify its commitment to bringing value to shareholders.

Value For Investors

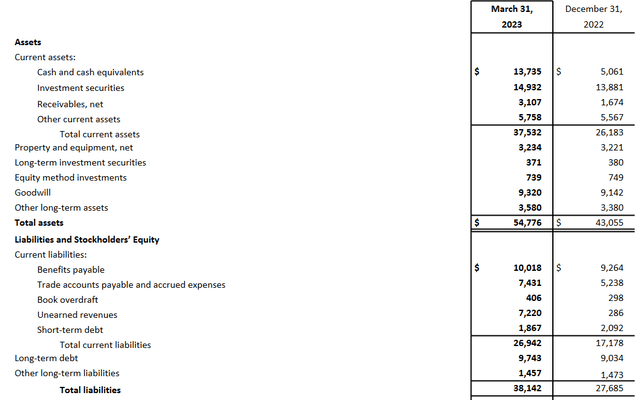

One of the great benefits of owning Humana right now is not just the benefit from the company being able to grow its EPS at a fast rate, and even raising the guidance for it too, as they see it reaching at least $28.25 in 2023. Humana also has a solid history of buying back shares, and I think the tempo at which they do it can increase a good amount, as they are generating more cash flows now than ever before.

Share Buybacks (Q1 Report)

In the last 5 years, the company has bought back around 8.5% of the outstanding shares, which amounts to a yearly decrease of about 1.72%. But with $10 billion in levered FCF, I think Humana is in an excellent position to start increasing this. So far it seems the cash generated has been stashed away and Humana has built its cash position from $5 billion in 2022 to nearly $14 billion as of the last report. With the current authorized capital for repurchase, Humana could buy back around 4% of their outstanding shares, but I think it’s reasonable to argue that with the cash the company has, they should be raising this budget. I think an announcement like that could potentially be a catalyst for the share price. With that said though, the company has taken steps recently to bring further value to shareholders, like raising the dividend by 12.4% for example.

Risks

Perhaps the most prominent risk facing a company like Humana is competition. There are many other companies in the same industry and while Humana has been growing quickly, behemoths like Elevance Health, Inc. (ELV) do pose a challenge. But I think with Humana winning contracts like the TRICARE, they are offsetting some of the risks for investors as they are securing revenue streams for the government instead.

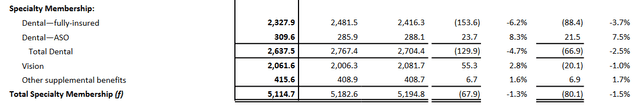

Company Memberships (Q1 Report 2023)

Looking at the balance sheet, there are no signs in my opinion that are substantial enough that they would pose a risk. From the last report, a worrying sign I spotted was the decrease in specialty memberships the company saw. A 1.5% decrease YoY was seen, which is a concern as the segment makes up around 5 million memberships. A substantial amount of the revenues for Humana comes from here, and reversing this trend will be important to help support the bull case I have for Humana.

Company vs Peers

Comparing Humana to some other companies in the industry like Centene Corporation (CNC) and Molina Healthcare, Inc. (MOH) I think the biggest benefit that investors get with Humana is the strong balance sheet they have. Even though Centene has a stronger cash position at over $15 billion, the long-term debt diminishes it as CNC couldn’t pay down all their debts if they wanted, which is something I mentioned Humana could.

Looking at Molina, they have about twice as much cash as long-term debt, but it would take a long time to build it back up once again. MOH generates just above $330 million in levered FCF, whereas Humana could essentially spend all their cash, and have the same amount a year later if they dedicated all their FCF to it.

Moving over to margins, Humana takes the lead here with their gross margins sitting at 18.5% compared to 17.4% and 12.8% for CNC and MOH respectively. With Humana also having the largest FCF margin at over 10% I think investors will be able to extract more value from an investment in Humana compared to the other two as Humana is able to divert more capital to share buybacks and dividends all while building up their balance sheet continuously.

Valuation-wise, however, Humana does not take the number one spot. The FWD p/e for Humana is over 18x, whereas CNC and MOH sit at 10 and 14. But I think the benefits investors get with Humana are the reason for this higher multiple, and in my opinion, it’s a fair premium to pay right now. The company has proven itself able to grow revenues at a strong rate whilst also growing margins.

Where HUM further wins out against CNC for example is the less leveraged balance sheet they have. This certainly helps contribute to the higher multiple you are seeing with HUM, and in fairness that is something worth paying for. HUM has a debt/cash ratio of 0.7 whilst CNC has 1.13. CNC also has a debt/FCF ratio of 2.46 which I find a little high when compared to HUM having just 0.97 instead. The stability of the balance sheet is worth the premium you have to pay for HUM compared to CNC. The lower ratios will make HUM have an easier time managing their balance sheet and instead place focus on diverting capital to shareholders rather than debt. This in the long-term makes HUM a better investment, I think.

Investor Takeaway

Right now, I think Humana is a buy. The valuation is neither overvalued nor undervalued but instead at a very fair price. Paying 18x forward earnings for a company able to generate over $10 billion in FCF is supported by the vast increase Humana has seen with their memberships over the quarter and also the last 12 months. The company sits very comfortably financially, and I think we aren’t far off from the company announcing they are raising both the dividend and the share buyback funds. With Humana keeping a solid market position, I think investors will be able to benefit from an investment at these prices over the long term. Going into the coming quarters, membership growth will be in the spotlight and so will the margins. If none of the fundamentals of Humana shift, they will continue to be a buy from me.

Read the full article here