Fellow Shareholders:

Perhaps the reason why I spend so much time writing our quarterly shareholder letters and try and provide more transparency and detail than perhaps anyone truly needs is because towards the end of my career at BlackRock, the institution took the “pencil” out of the hands of the portfolio managers. Updating investors became institutionalized as BlackRock wanted a consistent “house view” of the economy and markets. This consistency was accomplished by arranging a standardized question and answer session with each portfolio manager for the perspectives on the macro-environment and I was left to talk solely about what I was doing within the portfolios I managed. BlackRock was concerned its clients would be confused if they received vastly differing views on the macro-environment from its many portfolio managers, so they standardized it. While I completely understood why this worked for large institutions, it was incredibly boring for me. That said, I thought you would enjoy hearing how it would sound if I was interviewed versus what I really would have liked my shareholders to hear if I wrote the answers. As a template for the interview, I borrowed questions from a recent shareholder letter from The Royce Funds (a firm I greatly admire).

How did 180’s public stocks perform in 1Q23 and over longer-term periods?

The Blackrock professional recap would look like this:

We were pleased that the Fund performed well during a very challenging and continued bear market for microcap stocks. After a difficult 2022, 180 was able to achieve a +5.7% gross total return for the quarter versus a -2.9% total return for the Russell Microcap Index. Over the long term and since our inception in 2017, our gross total return of +243.6% compares quite favorably versus the Russell Microcap Index total return of 31.8%.

What I want to say:

Relative to the Russell Microcap Index we did well, but who cares until we recoup last year’s losses. Truth be told, we believe every stock we own has significant upside once we get to a place in the market cycle where fear and indiscriminate selling aren’t at the forefront. I’m so sick of trying to defend what we own when all anyone wants to talk about is interest rates, inflation, recession, and other end-of-the-world scenarios. The market thought the right price for SNCR was $0.50 per share at the end of 2022, until a buyer offered to buy the whole company for $1.15. SCOR trades at 0.75x revenue when Nielsen was sold for 4x revenue. ALTG trades at approximately 5x its enterprise value to estimated FY23 EBITDA after it sold off 30% following an earnings beat, combined with a guidance raise. Yes, I’m happy we were up 5.7% this quarter, but last year left sizable scars on us, and we have a long way to go to recover the losses from 2022. We will get there but coming in every day is pure water torture.

How was performance at the sector level in Q1 2023?

Institutional answer:

From a sector perspective, we generated positive performance from our holdings in the consumer discretionary sector (+$0.44 per share), industrials sector (+$0.22 per share), and information technology sector (+$0.17 per share). On the negative side, we generated negative performance from our holdings in the communication services sector (-$0.45 per share).

What I want to say.

Are you kidding me? Have you read any of our prior 24 shareholder letters? We run a concentrated fund of 7-10 core positions and are agnostic as to what industry or sector these holdings operate in, so long as we believe the individual position has the potential to generate at least a 100% return over a three-year period. The reason we exist to begin with, and in the form we do, is we had a belief that the world did not need another diversified small cap firm with a beta of 1.06 and a standard deviation of 1.4. While we pay attention to the macro-environment, we are not top-down investors. Our portfolio has been, is today, and will always be, a portfolio where performance is primarily dictated by the individual stocks we own. Of course, if a given sector is completely out of favor it will be hard for stocks we own residing in that sector to outperform. That said, our holdings, for the most part, have a very low correlation to the overall market because they are small, barely covered by Wall Street analysts, and have very little presence in ETFs or index funds.

How was performance derived at an industry level in the first quarter?

Institutional answer:

The top contributors at the industry level were restaurants (+$0.43 per share), trading companies & distributors (+0.18 per share) and application software (+0.17 per share). The largest detractor at an industry level was interactive media and services (-$0.47 per share).

What I want to say:

I didn’t really think you could come up with a less relevant and more useless question than your sector question, but you hit gold here. Congratulations, you have learned nothing. Imagine trying to decide if you wanted to make an investment in TURN based on our exposure to specific industries. Does anyone know where I can go to find a fund that has both exposure to trading companies and distributors AND application software? Actually, what on planet earth is a trading company and distributor? Oh wait, TURN also owns a restaurant company? Pass! Look, not to be flippant (I already am, I know, and I truly sound ornery, which I also am!), but these sort of questions and answers aren’t really going to give you an edge in discerning whether or not we are going to be successful in the investments we make. I highly doubt you have a view of trading companies and distributors.

We intentionally have a fund that has an asymmetric risk/reward profile and a low correlation to the broad indices. We maintain a Graham and Dodd value focus and use an activist approach when appropriate in an attempt to have a say in the eventual outcome for owners of a business. We are squarely focused on valuation and every aspect of the financial statements of the companies we own. Many of our positions are 8% or more of the total assets of the fund, so any movements one way or the other for positions of that size will have a meaningful impact on our net asset value per share (NAV). Can we provide information for you regarding performance from an industry perspective? Of course. I just don’t know what one would do with it when making a decision to invest in TURN or not.

What were the portfolio’s top contributors and detractors at the position level for the quarter?

Only answer which would be the same:

Thank you for asking. This is truly what I want to talk about as it is the most relevant question pertaining to how our NAV is going to move each and every quarter!

Material Increases in Value

- Potbelly Corporation (PBPB): PBPB pre-announced strong results for Q4 2022, across all financial and shop-level metrics that exceeded expectations and guidance. PBPB also announced the refinancing of its short-term debt facility to a 5-year term loan. PBPB announced expansion plans in New York City with a new development agreement and its first refranchise deal. 180 sold ~11% of its position in PBPB at an average sale price of $7.91 per share. For the quarter, PBPB increased NAV by $0.42 per share, or $4.3 million.

- Alta Equipment Group, Inc. (ALTG): ALTG’s stock began 2023 with a substantial increase in value into its earnings report for Q4 2022, with the stock closing at an all-time high of $19.86 on March 8, 2023. 180 sold ~92% of its position in ALTG in Q1 2023 for an average sale price of $17.58 per share. While ALTG reported strong results along with positive guidance and commentary that it has not seen any weakness in demand, ALTG’s stock has since declined materially from its highs and from our average sale price. For the quarter, ALTG increased NAV by $0.18 per share, or $1.9 million. We will absolutely look to add to the stock on the weakness.

- Synchronoss Technologies, Inc. (SNCR): SNCR’s stock started off 2023 increasing materially from its 2022 lows to over $1 per share before declining to $0.83 per share following its Q4 2022 earnings report that was below estimates. Subsequent to the earnings report, B. Riley Financial publicly issued a non-binding letter of intent to acquire SNCR for $1.15 per share. Diligence remained ongoing as of the end of Q1 2023. For the quarter, SNCR increased NAV by $0.17 per share, or $1.8 million.

- Intevac, Inc. (IVAC): IVAC continued its positive momentum from Q4 2022 when it announced a deal with Corning that could lead to at least $100 million in revenue over five years, if IVAC’s tool is qualified successfully in 2023. IVAC is also exploring the use of its coating tools for applications outside of consumer electronics where Corning would have exclusivity with that level of purchasing. 180 sold ~29% of its position in IVAC at an average sale price of $7.08 per share. For the quarter, IVAC increased NAV by $0.08 per share, or $0.9 million.

Material Decreases in Value

- Arena Group Holdings, Inc. (AREN): AREN continued to collapse in 2023 following the acquisition of Men’s Journal financed by a new debt facility from B. Riley. AREN reported overall positive results for Q4 2022 and provided positive guidance for 2023, but investors remain concerned with the company’s balance sheet and over $100 million of debt to B. Riley that matures at the end of 2023, along with increasing interest rates of the bridge loan used for the acquisition. Existing investors provided $11.5 million in a registered direct offering at $3.80 per share in the quarter. For the quarter, AREN decreased NAV by $0.47 per share, or $4.9 million.

- D-Wave Quantum (QBTS): QBTS entered 2023 with substantial doubt about the company’s ability to continue as a going concern due to its low cash balance and limited access to its equity line of credit due to the precipitous decline of its stock price. QBTS reported its Q4 2022 results while issuing lower than expected revenue guidance along with a new debt facility from its largest shareholder, PSP, to provide operating runway for at least a year based on current cash levels and burn. 180’s stock was subject to a lockup agreement, so it was not able to trade or hedge this position until February 5, 2023. From the expiration of the lockup through the end of the quarter, QBTS decreased NAV by $0.08 per share, or $0.8 million.

Other Notes:

The fair value of Parabellum Acquisition Partners, LLC, the sponsor of Parabellum Acquisition Corp. (OTC:PRBM) is determined by our Valuation Committee and declined ~25% in the quarter. The main input that impacted value was a decline in the probability of successfully completing a de-SPAC transaction from 33% as of the end of Q4 2022 to 25% as of the end of Q1 2023. While a transaction with EnOcean GmbH was announced during the quarter, the financing environment worsened materially from the point of the announcement of the deal publicly to the end of the year and continued into Q1 2023. As of the end of Q1 2023, PRBM secured interest for ~$14-15 million investment from sponsors under terms that were publicly announced in mid-March 2023. PRBM contributed additional capital to the trust on March 31, 2023, to extend the life of the SPAC until the end of April 2023. While not an input to value as of March 31, 2023, on April 27, 2023, EnOcean notified PRBM that it elected to terminate the business combination agreement signed in November 2022. In the absence of a viable merger candidate and additional capital to fund further extensions of PRBM, the Board of PRBM voted to wind down operations and liquidate the entity.

At the sector level, how did the Fund perform versus the Russell Microcap Index in Q1 2023?

Institutional answer:

Here is the contributions to performance for the quarter for the Russell microcap index by sector:

|

Information Technology |

9.9 |

|

Consumer Discretionary |

6.6 |

|

Utilities |

6.1 |

|

Industrials |

5.8 |

|

Materials |

0.1 |

|

Energy |

-2.3 |

|

Healthcare |

-6.5 |

|

Consumer Staples |

-10.4 |

|

Financials |

-13.0 |

As we have said in prior letters, we tend to shy away from financials and healthcare sectors, so we generated positive alpha selection from being underweight those two sectors in the quarter. Our overweight in information technology also contributed to sector outperformance as the group was the best performing sector in the Russell Microcap Index. On the negative side, our underweight in utilities hindered our performance.

What I want to say:

It wasn’t enough that you asked me about what sectors contributed to our performance for the quarter, but now you want to know how our sector selection performed relative to the Russell Microcap Index? Could you have combined this question with the other sector question you asked above so that I’m not forced to get on my soapbox for a second time? I am sure you think we are highly intelligent for being underweight healthcare and financials, but honestly, as I said above, we have made very few investments in those areas over our six years so the decline in those areas had the unintended consequence of making us look smart! If you don’t mind, please remember this the next time biotech stocks rise, making healthcare an outperforming sector in the Russell Microcap Index and having us underperform as a result. It’s not that we will be “dumb” when that happens; it is simply not a group that offers what we believe to be great value based on our investment discipline. So, to repeat for the 1290th time: 180 makes concentrated investments with a Graham and Dodd value investment discipline and uses activism when appropriate to attempt to enhance our returns over time. Our near-term performance is going to be driven primarily from our stock selection in our biggest holdings: PBPB, SCOR, AREN, IVAC, CVGI, etc. When we embarked on our strategy six years ago, we told people that our success or failure would reside in our ability to identify inexpensive companies that are able to successfully engineer turnarounds in their businesses. With that singular focus, since we started, we generated a +243.5% gross total return versus +31.8% for the Russell Microcap Index. As we learned from 2022, we aren’t immune from having periods where we fail, but we know who we are as investors and who we aren’t. We aren’t top-down, macro investors who intentionally make sector bets. Do we have sector bets? Of course, we do. But to be clear, our sector bets are a byproduct of our individual stock picking and the valuations afforded to us in certain groups at certain times.

What is your outlook for the economic and market environment?

Institutional answer:

As taken from the Conference Board Economic forecast for the US economy, April 12, 2023, publication:

“The Conference Board forecasts that economic weakness will intensify and spread more widely throughout the US economy over the coming months, leading to a recession starting in mid-2023. This outlook is associated with persistent inflation and Federal Reserve hawkishness. We forecast that real GDP growth will slow to 0.7 percent in 2023, and then rise to 0.8 percent in 2024.

While consumer spending activity has cooled following a large spike in January, it has not fallen off as much as previously forecasted. Because of this we are raising our Q1 2023 real GDP forecast from 1.0 percent to 2.0 percent. However, we are simultaneously downgrading our forecast for Q2 2023 from -0.9 percent to -1.8 percent. This is partially due to base effects from the stronger Q1 data, but also the result of reverberations associated with the March banking crisis (see our analysis here). While the worst of the crisis appears to be over, we expect credit conditions to remain tight and sentiment among consumers and businesses to suffer due to the shock. At present, we do not expect the Federal Reserve to pause interest rate hikes until a terminal rate window of 5.25 to 5.50 percent is achieved in Q2 2023.

On inflation, we expect to see progress over the coming quarters, but the path will be bumpy. In Q2 2023, we forecast a large decrease in the reported year-over-year PCE deflator due to base effects. However, this does not mean the fight to tame inflation is over – far from it. We expect year-over-year inflation readings to remain at about 3 percent at 2023 yearend and that the Fed’s 2 percent target will not be achieved until the end of 2024.

Labor market tightness will moderate somewhat over the coming quarters but will remain elevated relative to previous economic downturns. This should prevent overall economic growth from slipping too deeply into contractionary territory and facilitate a rebound in early 2024.

Looking to 2024, we expect the volatility that dominated the US economy over the pandemic period to diminish. We forecast that overall growth will return to more stable pre-pandemic rates, inflation will drift closer to 2 percent, and the Fed will bring rates back below 4 percent. However, due to demographic challenges we expect tightness in the labor market to remain an ongoing challenge for the foreseeable future.”

What I want to say:

I have no idea. Actually, that’s not true. I absolutely do have an opinion, but I always have to answer the question against the backdrop of how the stock market has performed as a result of that outlook. I do not believe this environment is the end of the world. This is a return to a normal economic environment where rates are higher than 0%, and thus money isn’t free. I never thought it would take the Fed this long to remove itself from the quantitative easing and 0% Fed funds rate put in place during the 2008 sub-prime mortgage crisis. It is our view they were entirely too late to the party, and we view them as a lagging indicator in combatting inflation. It is almost comical how late they were, given they were still doing quantitative easing through buying bonds in February 2022. But we know that already, so I’ll stop criticizing and deal with where we are today. We have gotten to the point where the Fed has raised rates high enough that glass is being broken. Somehow, despite the Fed telling the whole world it was going to raise rates, banks like Silicon Valley Bank (SVB) failed to prevent a classic asset-liability mismatch. In an effort to attract technology and venture capital companies as clients, SVB provided favorable financing to such clients with the requirement that those entities kept substantial deposits with SVB. SVB used this cash to fund loans to the venture capital-backed companies, and bought massive amounts of long-term, higher yielding bonds, US treasuries, and, of course, mortgage back securities (MBS). Once rates started to rise, the value of most of those securities and other bonds had a precipitous decline; meaning SVB would take substantial losses if they had to sell to meet withdrawal requests. Which is exactly what happened. When venture capital financing is flowing, startup companies have a lot of cash to deposit and SVB was relying on that new capital to help manage withdrawals. What happens, though, when venture capital financing grinds to a halt? The flywheel stops and everyone on it gets thrown off violently. Low and behold, as rumors of the risks of SVB’s balance sheet started making the rounds on Twitter and other mediums of communication, customers and investors began to withdraw their capital forcing the company to sell its bond portfolio at significant losses. Textbook and classic “run on the bank” scenario. Signature bank has similar issues, and recently banks like PacWest and Western Alliance are under similar pressure with their ability to survive questionable.

Let’s look at where we are today. Housing sales have slowed, unemployment gains have slowed, inflation has eased from its highs, and many commodity prices are well off their highs. GDP declined sequentially from 2.6% in Q4 2022 to 1.1% in Q1 2023. This economy shows similar characteristics to 2008 (bank issues) and the 1970’s (high inflation). Spreads on CDS have been surging due to debt ceiling issues. Russia is still waging war with Ukraine, and who knows how that ends. China is flexing its muscles and concerns over a potential invasion of Taiwan are every-other-day stories. M2 money growth is shrinking, which signals a cooling off of the economy. We have $31 trillion of national debt and a looming debt ceiling issue. Congress feels broken. Did I miss anything on the seemingly never-ending list of things to worry about or did I capture it all? Depressing, isn’t it? That said, from its peak in November 2021, which is now 18 months ago, the Russell Microcap Index is down 37%. The market has been awful for a very long time already. Do you think the market has at least partially discounted all of the bad news listed above? Of course, it has. Markets are always moving well in advance of the news, so the question is what will take place six months from now? While we are not pollyannish about the world that we live in; we do look at valuations and feel we’re being afforded ripe opportunities to invest in what we believe are well run businesses with significant upside. The ten-year treasury is trading at 3.3% (down from 4.4%) because investors have concluded that the Fed has gone too far, and that economic weakness will cause the Fed to move from tightening to some sort of easing at some point in the foreseeable future.

I received a great piece of research from our friend David Klein at Cantor Fitzgerald, and it mimics our exact thoughts on the Fed and monetary policy:

“The issue the fed currently faces is with their monetary policy:

- Raising short-term rates is causing money market yields to rise, which is then pulling more money out of bank checking accounts into money market funds. Hence, raising rates further increases the chances of systematic risk in the financial system.

- Inflation is proving sticky as evidenced by CPI, PCE, ECI, Unemployment rate, and real time apartment rents rising again. Inflation is not close to the average 2% that they are trying to reach.

- This year’s fiscal deficit is tracking to be about $2 trillion which is adding money to private sector and supporting inflation.

- The fed balance sheet is still more than $4 trillion larger than pre pandemic and unchanged ytd.

- The economy is impacted by longer end yields which are now well below the fed funds rate and by historic proportions. Thus, the higher fed funds rates are not having the desired impact on inflation.

What our idea of increasing the pace of balance sheet reduction to $200 billion per month achieves:

- Increases the longer end bond yields as they are currently too low to achieve their inflation goals. Longer end bond yields are a significant driver for the economy and inflation and they are 160 bps lower than the fed funds rate.

- Close the inversion gap between the 10 yr and the fed funds rate in order to increase the effectiveness of the rate hikes on the economy to achieve their inflation goals.

- Reduce the size of the balance sheet quicker in order to reduce the money supply in the system. The balance sheet size is unchanged ytd and $4.3 trillion larger than pre pandemic. The money in the system from $2 trillion fiscal deficits and fed balance sheet is a major contributor to inflation. Reducing the money supply will help to bring down inflation and offset some of the fiscal deficit.

- Take advantage of current stability in markets and the economy to reduce the size of the fed balance sheet which is far too large. If they can do this, then the fed balance sheet can become a tool to be used as a buffer in the future if there is a downturn.”

To be clear, when we listen to companies like CVGI or ALTG talk about their business we don’t see an end-of-the world scenario. Each of those companies have reported strong results and provided healthy outlooks. Other industries in Silicon Valley and/or housing related are not providing similar outlooks. So, we have to be very particular about what we own as we think 2023 is going to result in a great variance of performance between industries. The Fed has succeeded in its attempt to curtail, but not eliminate, inflation and it is now in a very different place than it was when it started its restrictive policy initiatives over a year ago. That is potentially good for the psychology of the market.

At the end of the day, as we said in our last shareholder letter, our outlook is something like this:

- Our overall view is inflation has already peaked and the multitude of Fed rate hikes have already had a significant effect in lowering inflation.

- We believe we are already in some sort of a recession given real GDP declined for more than 2 quarters in a row.

- We do not believe we are headed for financial Armageddon like 2008 when we had $1.3 trillion of sub‑prime mortgage assets on the balance sheets of banks and insurance companies. Financial leverage simply doesn’t exist like it has in the past.

- We believe stock price valuations have significantly discounted dire economic outlooks that are not occurring currently and may never occur.

- We believe we are headed to a “normal” environment where the market can no longer rely on free money and the intravenous elixir of quantitative easing and 0% interest rates. Stocks will have competition from the bond market, and we expect multiples as a whole to contract. Bubbles will continue to be popped, and slower growth rates will inevitably occur.

- For the time being, and we believe rightly so, gone are the gold rush days where talking heads, financial thieves, and children pontificate endlessly on how “things have changed” and we are in “a new world order,” with these individuals arguing for an entirely new investment landscape.

NET ASSET VALUE PER SHARE

Our NAV increased this quarter from $6.32 to $6.52, an increase of 3.2%. Our Fund has three principal components to the variance in our NAV: our public and public-related portfolio, our legacy private portfolio, and our expenses. For the quarter, our public and public related portfolio companies increased our NAV by $0.31. Our remaining private portfolio reduced our NAV by $0.03. Operating expenses decreased NAV by $0.08.

|

Quarter |

1 Year |

3 Year |

5 Year |

Inception to Date |

|

|

Q1 2023 |

Q1 2022- Q1 2023 |

Q1 2020- Q1 2023 |

Q1 2018- Q1 2023 |

Q4 2016- Q1 2023 |

|

|

Change in NAV |

3.2% |

(33.5%) |

2.5% |

(17.7%) |

(7.1%) |

|

Change in Stock Price |

(4.7%) |

(26.5%) |

23.5% |

(9.9%) |

21.5% |

|

Russell Microcap Index |

(2.9%) |

(18.0%) |

60.8% |

15.5% |

31.8% |

|

Russell Microcap Value Index |

(5.2%) |

(16.6%) |

84.0% |

25.0% |

40.4% |

|

Russell 2000 |

2.7% |

(11.6%) |

62.1% |

25.7% |

44.0% |

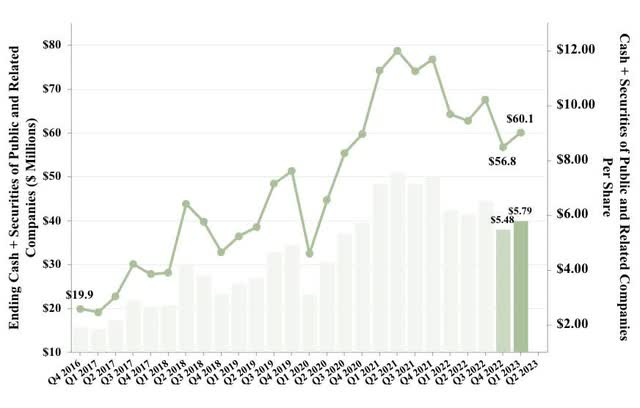

You are fully aware that our primary goal since we started has been to ensure that the bulk of our balance sheet be comprised of cash and public and public-related securities, which should allow our shareholders to value TURN’s holdings more easily. It also will allow for a discussion of opportunities to return capital to shareholders at some point. I would offer the following chart to provide some perspective on our performance over a longer period of time. And after a dismal 2022, we bounced back to start the year on a positive note both on an absolute and relative basis.

PUBLIC AND RELATED PORTFOLIO

In the chart below, you see our Q1 2023, one-year, three-year, and inception-to-date performance.

|

Quarter |

1 Year 3 Year 5 Year |

Inception to Date |

|||

|

Q4 2023 |

Q1 2022-Q1 Q 2023 |

1 2020-Q1 2023 |

Q1 2018-Q1 2023 |

Q4 2016- Q1 2023 |

|

|

TURN Public Portfolio Gross Total Return (Excluding SMA Carried Interest) |

5.7% |

(22.6%) |

45.5% |

87.1% |

222.5% |

|

TURN Public Portfolio Gross Total Return (Including SMA Carried Interest) |

5.7% |

(22.6%) |

55.3% |

99.4% |

243.6% |

|

Change in Stock Price |

(4.7%) |

(26.5%) |

(23.5%) |

(9.9)% |

21.5% |

|

Russell Microcap Index |

(2.9%) |

(18.0%) |

60.8% |

15.5% |

31.8% |

|

Russell Microcap Value Index |

(5.2%) |

(16.6%) |

84.0% |

25.0% |

40.4% |

|

Russell 2000 |

2.7% |

(11.6%) |

62.1% |

25.7% |

44.0% |

We have achieved a +243.6% gross total return since the inception of 180 versus +31.8% total return for the Russell Microcap Index which is a good period of time to evaluate whether or not we are good at what we say we are trying to do. The market for microcaps is filled with inefficiencies and asymmetric risk/reward characteristics. If you get your stock picking right, you can achieve outsized returns. Based on our research, we believe many of the individual companies we own have upside of 100% over a three-year period. We have permanent capital and the opportunity to take advantage of the current dislocation is easier for us because we don’t have to sell to service redemptions. It is our view that many names in our universe have been overly discounted (based on their valuations) as a result of the very bearish environment we are in. Our permanent capital allows us to make rational decisions on our investments, and we believe this is a distinct advantage in regard to our ability to generate returns greater than the indices over an investment cycle. We are never forced to sell unless we believe we should for analytical and investment process reasons. We have seen the benefits of having permanent capital during other periods of market dislocation during our six-year history, and we expect this period will be no different. I have seen a number of washouts over the last 35 years, and 2022, Q4 and December in particular, were amongst the most vicious I have ever seen. We have intentionally created a concentrated portfolio that has very low correlation to the broad indices. We are aware of the potential for episodic returns for our holdings, i.e., we believe we will get paid for most of our investments, we just can’t say when. 2023 is off to a better start as our +5.7% gross total return in Q1 compares favorably to the -2.7% decline for the Russell Microcap Index. We would normally discuss our individual stocks and their impact on our NAV in this section, but for this letter we did it above as part of the “Q&A”.

LEGACY PRIVATE PORTFOLIO

180’s remaining private portfolio has only one material position, AgBiome. The total assets of our remaining legacy private portfolio are approximately $8.0 million, $5.5 million is AgBiome and $1.3 million are payments that we expect to receive from the sale of TARA Biosystems, Inc., to Valo Health, LLC. This past quarter we had a small markdown in AgBiome based solely on option-pricing-model inputs. Nanosys also negatively impacted our NAV by $0.04 per share, or approximately $398,000.

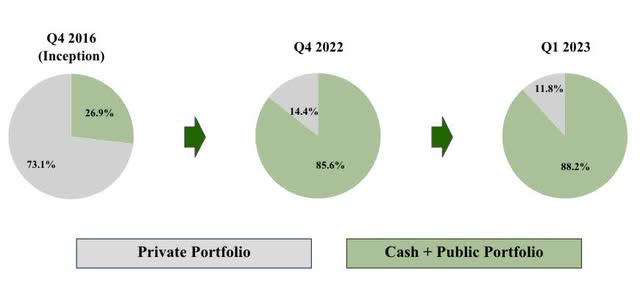

We have already transformed our business over the last five years away from the historical venture capital model and towards public and public-related securities. Our transformation started in June 2016, when I first joined the Board of Directors. At that time, our predecessor company’s balance sheet was comprised of 73% private assets and 27% net cash and public and related securities. Today, those percentages have flipped, and our public stocks now represent 88% of our assets versus 12% for the legacy private holdings. Because of the greater transparency in the value of our holdings, it would make sense to us that our stock should narrow the discount it trades to our NAV. When we first took over the management of 180, we were very clear about what we hoped to accomplish with regard to the mix of assets on our balance sheet, and I am pleased to report we have executed that strategy. We have cleared our decks as we head toward the future, and finally have the balance sheet mix we can utilize to create real value for our shareholders.

EXPENSES

For Q1 2023 our regular operating expenses equaled approximately $910,000 versus approximately $859,000 in Q1 2022. We will maintain a lean cost structure (outside of fixed expenses for being a public company) focusing our expenses on activities solely designed to enhance our investment performance or to increase our revenues from managing outside capital. Our management team and Board are acutely aware that we are in business to serve our shareholders. I personally own 639,956 shares of TURN. Daniel owns 223,250 shares. If you have come to know us since we took over the firm, we are not interested in wasting shareholder money on superfluous activities. The primary change from the prior year is the addition of Matt Epstein to the team. As mentioned in our last letter, Matt brings a fresh perspective and complementary set of skills to the team, and we are pleased to have him aboard.

As you may have noticed in our recent proxy materials, our Audit Committee and Board of Directors approved the appointment of EisnerAmper LLP as our independent auditor for our fiscal year ending December 31, 2023. While we greatly appreciate the opportunity to work with PricewaterhouseCoopers LLP as our auditor in past years, the simplification of our business provided an opportunity to revisit who we engage as an auditor, and we currently estimate this choice of switching to Eisner will lead cost savings of at least $100,000 in 2023, and likely more in future years. We have also reduced the size of our Board of Directors from four to three independent members. We thank Tonia Pankopf for her service as a member of TURN’s Board during the past three years and her understanding for us taking this cost-savings step. Lastly, we continue to look for additional opportunities to reduce our operating costs further, although as we have said historically, meaningful reductions in operating expenses as a percentage of net assets will come from growing net assets rather than further material cost reductions.

TURN/NAV: SUM OF THE PARTS

As of the end of Q1 2023, TURN traded at 77% of NAV with 88% of our assets now public and public related assets. Our securities of publicly traded and related companies, cash, and other assets net of liabilities were $5.75 per share. Our stock price was $5.03. If we receive 100% credit for the value of these assets net of liabilities, the market is ascribing a negative value of approximately $0.72 per share, or -$7.5 million, to our legacy private portfolio which has a fair value of $8.0 million. Again, $1.3 million of this $8.0 million is a payment from the sale of TARA to Valo, that we currently expect to receive in April 2024.

We have spoken for a long time about being in a position to return capital to shareholders. While we recognized the importance of permanent capital, we made a decision to start making purchases our share repurchase program to enact the purchase of a block of stock that was for sale. Buying a stock at $4.41 when NAV is more than 30% higher is accretive to our NAV, and such a repurchase should send a signal to every shareholder that we are serious about creating value for our shareholders. We find it remarkable that given all we have done to remake our balance sheet, we still trade at virtually the same discount to NAV that we had when the majority of our assets were in opaque private holdings. The cash outlay for this repurchase is less than 2.5% of our liquid assets, and we hope this is a message to shareholders that our share price is our number one priority.

CONCLUSION

Obviously, the lesson learned from last year is we won’t always get things right and we will underperform from time to time. I have never once shied away from talking about performance, whether it’s good or bad. I’m a big baseball fan. One of my happiest places in the world is standing on the sideline and watching my high school sophomore son play varsity baseball or his club games in the summer. I can’t get enough of watching him play or practice. Baseball is a game of failure. It is the ultimate individual game in a team setting. A great season is failing at the plate two out of three times. Standing on the mound and pitching when everyone is staring at you builds character. I think for myself, playing baseball day in and day out when I was a kid, I learned that that failure is inevitable. While failing absolutely guts me, somewhere along the way, I learned to embrace it for what it was. A chance to learn, to work harder, to practice harder. It was the time for me to put in the work so that if I was in a hitting slump, I could come out of it. Investing is the same, although success comes with a higher bar. We have always believed that investors will outperform if they are right two out of three times so long as the one time you are wrong doesn’t outweigh the two times you are right.

As I look at our share price, it is obvious that we have struggled to create value in the latest year. As a matter of fact, I would call that a failure. Part of the decline is a direct result of the book value decay we had last year due to weakness in the public markets coupled with write-downs in our private portfolio. But a share price that trades at $4.41 when our NAV as of the end of Q1 2023 was $6.52, and that NAV is now primarily comprised of publicly traded, liquid assets is, in our view, absolutely absurd. Perhaps part of the problem is the risk off environment we have found ourselves in since November 2021. Since TURN is similar to the small companies we invest in, are we really surprised at our performance? That said, if anyone thinks we sit around here twiddling our thumbs or don’t care about our share price, then you don’t know me, Daniel, or the rest of TURN’s Board. We have long talked about returning capital back to shareholders at some point, and our Board and management have decided that not buying our stock at this level of discount would be negligent. And so, and in addition to the block trade mentioned above, we will continue to use our $2.5 million share repurchase program to either be in the market every day or looking for blocks of stock to buy in volumes and trades as permitted under securities law. For the record, if this discount continues, we will reload and reload and reload until our share price better reflects the balance sheet we have created. Is that a sea change for us? YES IT IS. I didn’t leave running my friends and family fund to become the CEO of a company for a salary. I came first, to actually save the prior company from going to zero, and then with Daniel, to build a business where I would create wealth for myself, my family, and all of TURN’s shareholders through our share price appreciation. Harris & Harris Group was a broken business model that punished investors for years. I’m convinced that 180 is going to have a happy ending for our shareholders when this is all said and done, and our strategy will once again reward shareholders as it did from 2016-2021. We have never been more confident in our ability to grow our NAV and never been more confident in creating value for our shareholders. There won’t be any free lunches, and it will take a lot of good stock picking, but I’m convinced we have the opportunities in front of us that can lead to a much higher stock price than the one we have today.

The market for microcaps is filled with inefficiencies and asymmetric risk/reward characteristics. In a prior shareholder letter, if you remember, we wrote that one day we would laugh at the investor who thought they were so smart to sell PBPB to us at $4.50. They knew nothing and today the stock is close to 100% higher than it was when they sold. Let me conclude with how I started. If the interviewer asked me comment on TURN’s share price this is what I really want to say:

Just like with PBPB, I believe whoever is selling our equity at $4.41 is incompetent, has no long term vision, and, one day down the road, I believe you, my fellow shareholders, will look back with me and say thanks for the gift. How is that for a non-standardized, non-institutional answer.

Thank you for your continued support.

Kevin Rendino, Chairman and Chief Executive Officer

Forward-Looking Statements and Disclaimers

This shareholder letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company’s current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release. Please see the Company’s securities filings filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company’s business and other significant factors that could affect the Company’s actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The reference and link to any websites have been provided as a convenience, and the information contained on such website is not incorporated by reference into this shareholder letter. 180 Degree Capital Corp. is not responsible for the contents of third-party websites. The information discussed above is solely the opinion of 180 Degree Capital Corp. Any discussion of past performance is not an indication of future results. Investing in financial markets involves a substantial degree of risk. Investors must be able to withstand a total loss of their investment. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here