Investment thesis

SLB (NYSE:SLB), known until its recent rebranding as Schlumberger, is the premier oilfield services (or OFS) firm. Despite the weakness in oil prices (CL1:COM) due to recession fears, the oilfield services spend hasn’t shown signs of slowdown. The long-cycle international and offshore markets are proving to be particularly resilient, even if U.S. shale may have to reduce activity with $70 oil/ $2 gas (NG1:COM).

OFS firms may also benefit from the growth in renewables as the technical expertise concentrated in the industry overlaps with alternative energy applications:

The global market for energy services companies will peak in 2025, reaching its highest revenue of $1 trillion owing to increased spending within the oil and gas industry as well as the branching out into other segments of the energy sector by service companies, according to a study published by energy market research firm, Rystad Energy.

Rystad Energy predicts the oil and gas services sector alone to account for over $920 billion per annum in revenue through 2028, driven by strong demand for services in the midstream sector including gas liquefaction and re-gasification.

For reference, OFS industry revenue averaged $740 billion per year during 2014-2021.

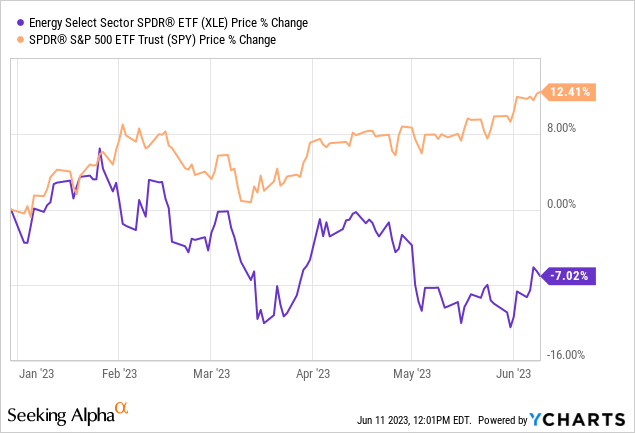

With its global footprint and heavy tilt to international and offshore, SLB is well positioned for the long-cycle boom. While my belief remains that smaller caps will ultimately generate more alpha during this cycle, as the largest service name – about 4% of the S&P 500 (SP500) energy sector (XLE) – SLB will probably be the first to benefit from new allocations to the sector. SLB’s stock is not cheap, at least based on static multiples, but the company is firmly in growth mode and is increasing both its revenues and margins while maintaining a technological edge over its competitors.

A super-cycle doesn’t mean super high prices

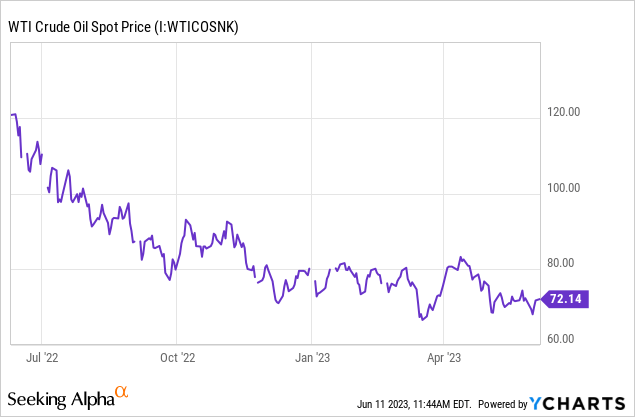

Since June 2022, oil prices have been trending down:

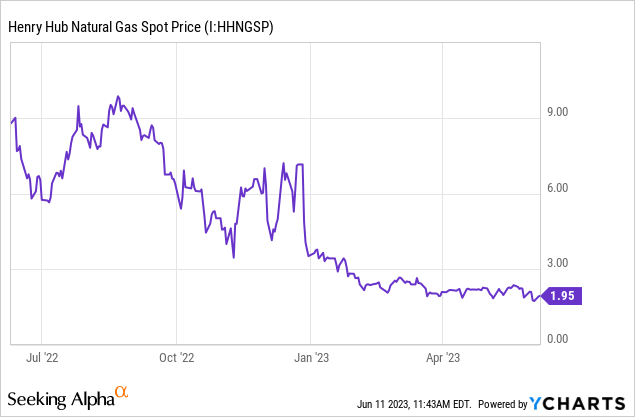

Natural gas also crashed:

The causes are well-known: Russia able to successfully redirect its oil flows, a warm winter and the recession fears, pressuring down prices through the paper markets.

The disappointment for oil bulls is understandable, especially as early 2022 was marked by bombastic forecasts from Goldman and others, calling for $200 oil. Pierre Andurand has infamously been even calling for $300 oil. The $200-$300 forecasts were probably never realistic to begin with, as supply and demand form a dynamic system, and demand would moderate way before these extreme price levels are reached.

So now that we are back in the $70-$80 range, after Saudi Arabia’s latest intervention that will take off the market an additional 1 million bbl/d during July, the sentiment is negative and energy stocks are underperforming:

While I am of the view that it won’t be long until we return to $90-$100 oil, the more fundamental point that gets lost between the current oil bear/bull narratives is that $70-$80 is actually a very positive environment for long-cycle investments. We haven’t had this price range since 2014 and we already see the tremendous impact it is making in the international and offshore segments.

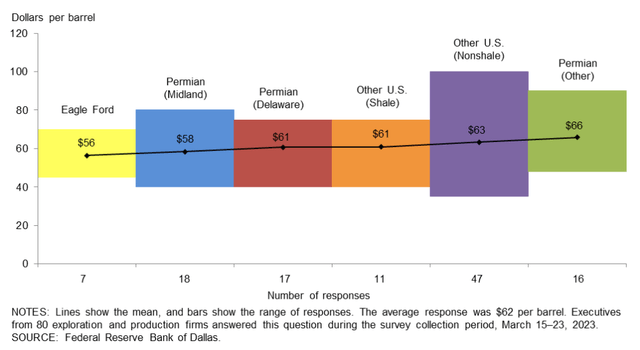

We do have to acknowledge that at $70-$80 oil not every boat will float. So if your bet was on a you-name-it ShaleCo or perhaps a junior exploration company, the current prices won’t do. The latest energy survey from the Dallas Fed arrived at shale full-cycle breakeven points north of $60:

Federal Reserve Bank of Dallas

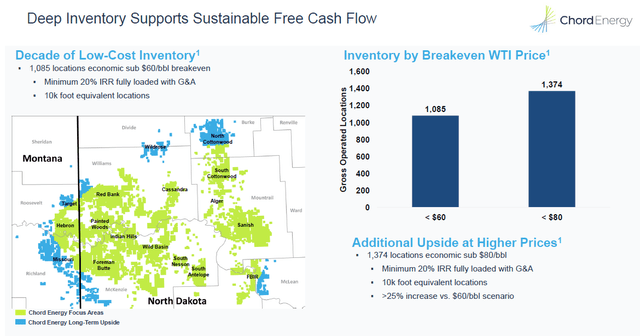

At least one shale player, Chord Energy (CHRD) openly touts its “low-cost inventory” in the $60-$80 range:

Chord Energy Presentation

Huh? At $70 oil these guys barely make any money. Sure, if oil reverts to $100, the high breakeven of these companies will also result in massive “torque,” so they could be a good speculative play in that sense.

Shale, as the principal short-cycle supply source, can also ramp up or down production more quickly so it can also respond faster to the pricing conditions. In fact, shale’s ultra-responsiveness is probably the main reason for the 2014-2021 under-investment in long-cycle projects. If each time prices rise, shale ramps up to match the extra demand, why invest in a deepwater project with 10-year payback?

It is only recently, when we have already started seeing the expansion limits of U.S. shale, that longer cycle investment has come back – and $70-$80 oil is enough to generate adequate returns for the operators and OFS providers alike.

Take, for example, Exxon’s (XOM) projects in Guyana:

Liza Phase 1, which produced first oil on 20 December 2019 less than five years after the first exploration well was drilled, one of the fastest ramp-up periods witnessed, breaks even at $35 per barrel Brent. That fell to $25 per barrel Brent for Liza Phase 2 which pumped first oil in February 2022. The Payara project which will come online during 2023 is forecast to have a breakeven price of $32 per barrel Brent, while the Yellowtail development is expected to break even at $29 per barrel Brent.

Petrobras (PBR):

Petrobras defines its base case scenario as oil at $55/bbl, while it considers oil at $35/bbl to be a stress case.

Fernando Borges, chief exploration and production officer at Petrobras, said the company’s breakeven price for its projects remains around $20/bbl.

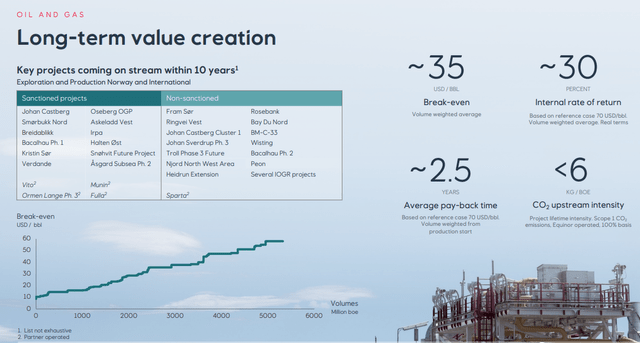

Equinor (EQNR) boasting $35 breakeven:

Equinor Corporate Presentation

The macro bottom-line

The current oil price environment isn’t supportive of investments with $60-$80/bbl breakeven. However, I expect investments with $35/bbl breakeven to continue full speed. These projects tend to be in the international or offshore segment and will be supportive of OFS providers which have the requisite footprint and technological capability. This is especially true in times when the OFS industry is making at best modest expansions of its own capacity, which pushes up utilizations and pricing.

Here is the take of SLB’s CEO, Olivier Le Peuch:

[We] maintain a constructive multiyear growth outlook. Through the first quarter, the resilience, breadth, and durability of the upcycle have only become more evident…To begin, the underlying demand, investments, and activity during this cycle are resilient, despite short-term economic and demand uncertainties. The combination of energy security, the initiation of long-cycle projects, and OPEC’s policy, sets the conditions for a de-coupling of the activity outlook from short-term uncertainties.

Indeed, energy security remains a top priority for most countries, and is driving structural investments that are governed primarily by national interests. The extent of these investments is resulting into a broad-ranging growth outlook, comprised predominantly of resilient long-cycle projects in the Middle East, the international offshore basins, and in gas projects.

So $70 oil may bad for U.S. shale or OFS providers with too much short-cycle exposure (although, again, not everyone is in the same boat as I have argued here, here and here). However, long-cycle investments haven’t been impacted.

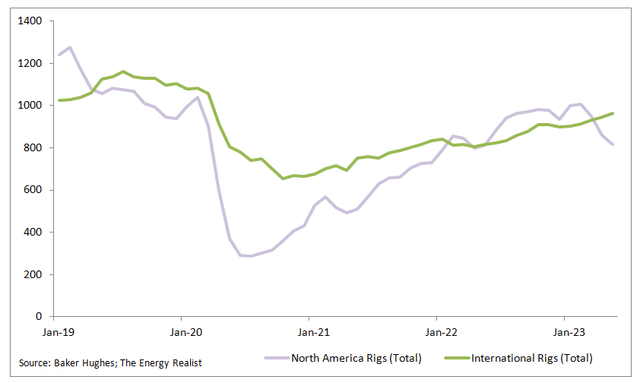

Much has been made lately of declining rig counts in the U.S. which are driven by shale activity; however, international rigs are still trending up:

Baker Hughes; The Energy Realist

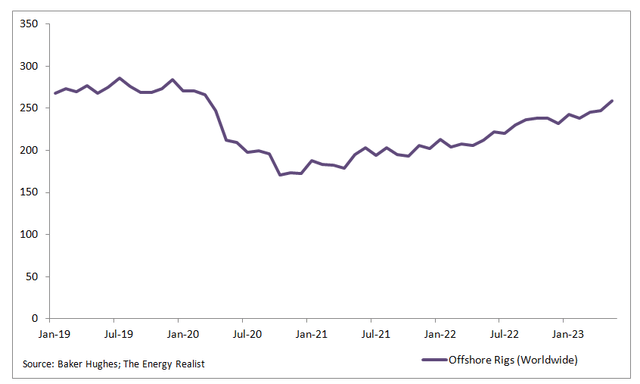

Let’s also look at the offshore rig count that has been less in the spotlight:

Baker Hughes; The Energy Realist

Still trending up. It is also interesting to note that both international/offshore rig counts are less volatile than U.S. shale rigs – perhaps reinforcing the long vs. short-cycle bifurcation.

SLB to benefit from the long-cycle trend

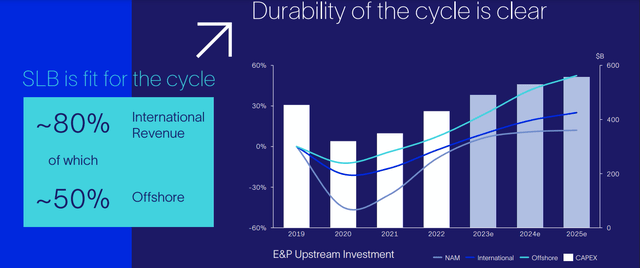

The strength of SLB is the tilt of its portfolio to international and offshore markets:

SLB Presentation

With 80% international exposure/50% offshore, SLB doesn’t need to worry as much about what happens to U.S. shale. The capex forecast also suggests that offshore and international will continue growing faster than North America land at least until 2025.

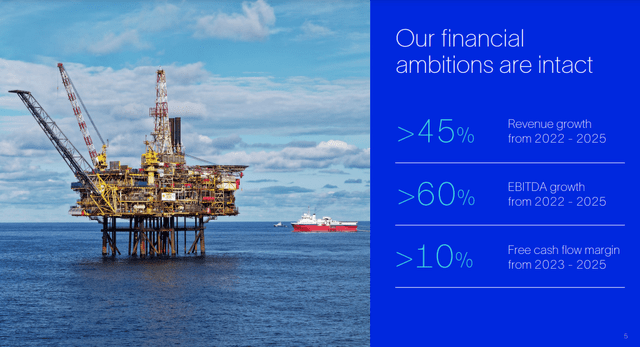

The company expects the trend to drive significant increases to revenue and EBITDA:

SLB Presentation

EBITDA is growing faster than revenue, implying improved profitability too. For the next few years, SLB is projecting FCF margins of 10%.

Don’t forget the energy transition either

OFS firms are fundamentally engineering companies that have continuously adapted their technological offering to the needs of the oil and gas industry. Historically, this has been mostly about drilling deeper and longer wells in harsher conditions. However, in the future the energy transition may also call on SLB’s expertise. Some areas where the company already participates include:

- Geothermal applications, including the acquisition of GeothermEx back in 2010;

- Carbon capture, utilization and sequestration;

- Methane emissions management;

- Digital solutions to design and de-risk hydrogen production systems;

- Digital solutions, AI and automation to accelerate site assessment for offshore wind projects.

While for now oil and gas applications drive the majority of revenue, to Rystad’s comments cited earlier in the article, it doesn’t mean it will stay that way in the future. The OFS companies may well end up outlasting the oil and gas industry itself.

Valuation and risks

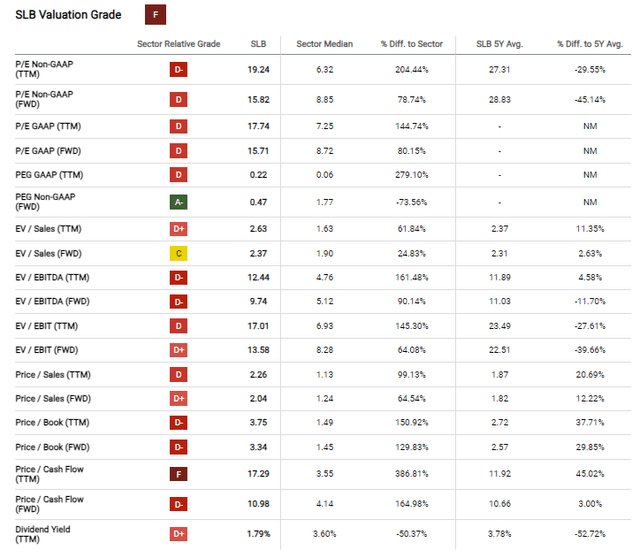

SLB is not cheap:

Seeking Alpha

However, the company looks a lot better when adjusted for growth.

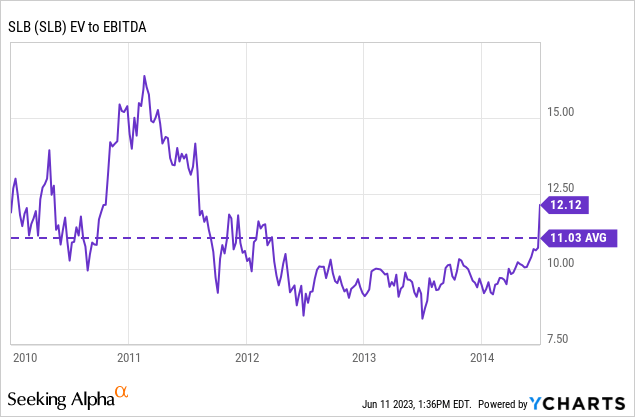

During 2010-2014, SLB averaged 11x EV/EBITDA:

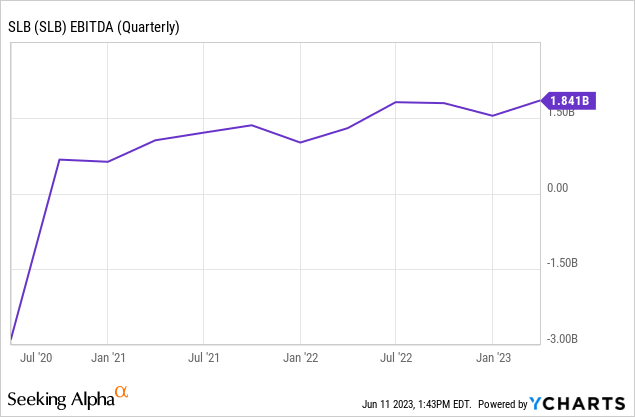

The latest TTM EBITDA is about $6.4 billion and SLB sees 60% growth through 2025 which would put it at close to $10 billion. I think that would be consistent with a $100 to $110 billion enterprise valuation. Based on where the capital structure is now, by my calculation that is consistent with +40% upside for the equity holders, putting the stock at $66.

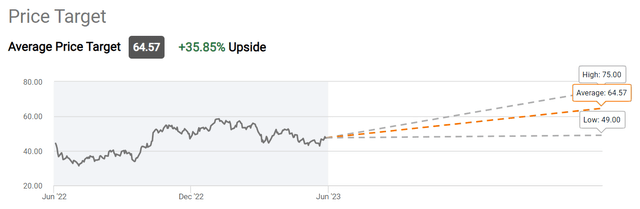

This happens to come very close to the average Wall Street target:

Seeking Alpha

In terms of risks, I don’t see the upward EBITDA trend reversing:

The main risk is probably a multiple compression due to further deterioration in the sentiment toward energy. That may also be seen as a buying opportunity, though, depending on your perspective.

Would a crash to $40-$50 oil be a problem? Yes, absolutely. But with the latest OPEC events and commitment from Saudi, I don’t think it is very likely that we get there.

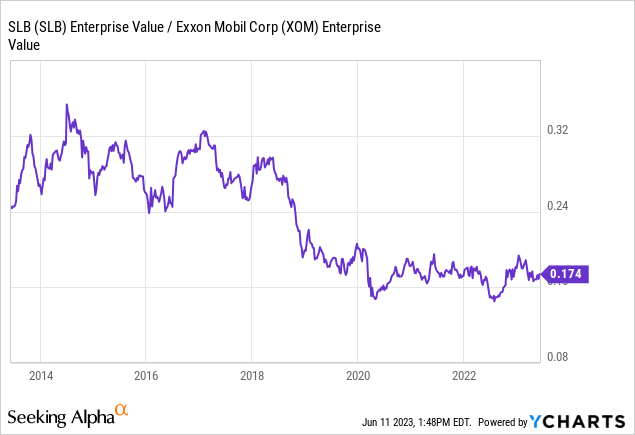

One final chart I find interesting is the historical SLB to XOM enterprise value ratio:

Compared to where we were as recently as 2018, the market valued SLB much better relatively to Exxon. The ratio rebounded a bit around January 2023 but is down again since then. My feeling is that over the next years the ratio may move back in SLB’s favor.

Takeaway

Day-to-day, SLB trades mostly on the oil price, as do exploration and production companies. However, as I have argued before, the relationship between services companies and the price of oil isn’t as simple.

E&P revenues will rise as long as the prices rise, with the greatest marginal impact on the profit line occurring close to the breakeven cost. On the other hand, for OFS companies, what matters more is that oil remains above some minimum level that ensures continued demand for their services.

If oil were to hit $200 or $300, all energy companies would go up, and the highest cost/highest leveraged ones will gain the most. However, with $70-$80 oil, it really matters who you are and what you do.

For a Chord Energy with perhaps $80 breakeven, the higher the oil rice, the better, and $70 isn’t high enough. However, for a SLB, it’s less relevant if we’ll get to $100 or $200 oil, but more crucial whether we can stay at least at $70-$80 as long as possible.

SLB’s client base are the whales who develop offshore projects with $35/bbl breakeven cost. They’ll do exactly the same whether oil is $70, $100 or $200. What is key here is the long-term price stability given we are talking about projects with potentially 10-year development cycles and not so much how high we go this year or next.

As the largest OFS provider with tilt to long-cycle international and offshore projects, I think SLB will do well. Even though the company isn’t cheap, in my view the growth and the quality of the business model justify a look at this potential investment.

Read the full article here