Author’s Note: All funds in Canadian currency unless otherwise noted.

Investment Thesis

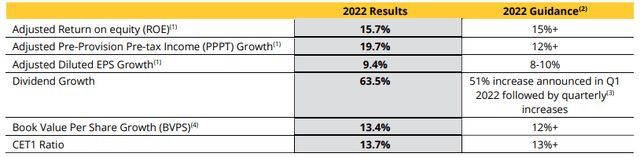

EQB Inc. (TSX:EQB:CA) is executing on an ambitious growth strategy that is generating significant value for shareholders. Canada’s “Challenger Bank” is returning vast amounts of capital to shareholders through an aggressive dividend growth program and share buy backs. This bank has focused on disruption and has found a successful niche in the Canadian lending market. In 2022, EQB grew its dividend by 63.5%. For 2023, the bank is guiding dividend growth of 20-25%. Benefiting from growing net interest margins and diversifying funding sources, EQB continues to achieve industry-leading ROE.

Company Profile

EQB is the seventh largest independent Schedule I Bank in Canada with approximately $105B in assets under management and assets under administration. EQB serves approximately 515,000 clients in Canada, largely without brick and mortar branches. Founded in 1970 as “The Equitable Trust Company” EQB, operates as “Equitable” or through its deposit facing online banking label “EQ Bank”. Both EQ Bank and Equitable Trust offer savings and GIC products to support EQB’s core Single Family Residential and Commercial lending business. EQ Bank, which was launched in 2016 to further diversify deposit sources, has grown to attract approximately 350,000 customers. With a market capitalization of approximately $2.5B, EQB trades on the Toronto Stock Exchange under symbol “EQB” and through its preferred issue “EQB.CA.C”.

Recent Results and Guidance

In the first quarter of 2023, EQB set a new company record with adjusted net income of $101.7M, a 10% boost over Q1 2024. Adjusted ROE of the quarter came in ahead of guidance at 16.9%. These results were supported by growth across multiple product lines and the integration of recent acquisitions.

2022 Results EQB (EQB Inc)

In the Q1 2023, EQB achieved net interest margin expansion of 5bp over Q4 2022. In the first quarter, this expansion drove net interest income growth of 8% over the previous quarter and 45% over the previous year. In the first quarter of 2023, EQB improved non-interest revenue by 71% over Q4 to represent 11% of total EQB revenue for the quarter.

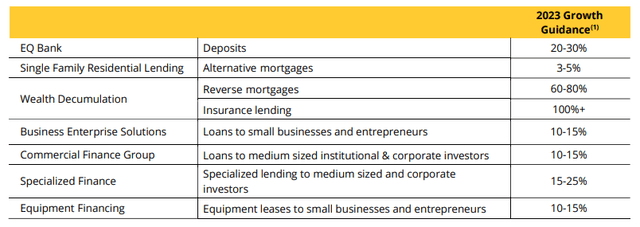

Looking at 2023, EQB is forecasting aggressive and broad-based deposit and loan growth across its portfolio. Notably, deposits at EQ Bank are expected to grow 20-30% over the year. EQB plans to expand by offering a new client card and commencing operations in Quebec, Canada’s second most populous province.

EQ Bank 2023 Growth Guidance By Segment (EQB Inc)

Targeted growth in insurance lending and reverse mortgages help to further diversify the bank’s funding sources. Consumer preferences to remain in an owned-home in old age combined with rising home values in Canada is a strong set up for solid growth in EQB’s reverse mortgage business.

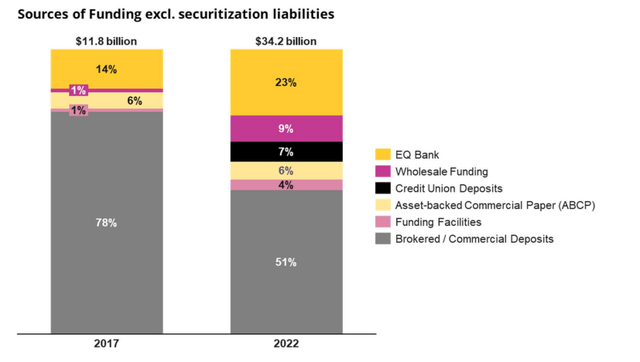

EQB Funding Sources (EQB Inc)

Concentra Acquisition

The 2022 acquisition of Concentra added $13.6B in assets under management and $38.6B in assets under administration. This tuck-in of what was the 13th largest Schedule 1 Bank in Canada, adds significant scale to EQB and further enhances produce offerings and diversification of funding sources. Concentra is the largest provider of wholesale banking and trust solutions in the Canadian market, supporting more than five million credit union members through over 200 Canadian credit unions.

As EQB integrates Concentra, the company expects revenue growth of 24%, while increasing net interest income contributions. In addition to improving and diversifying revenue, EQB anticipated $30M in annual cost synergies by the end of 2023. While the Concentra acquisition is expected to be single-digit EPS accretive on a pro forma basis in the first year, the 3.2 million additional shares issued as part of the transaction, resulted in adjusted Q1 2023 EPS of $2.62, a 1% year over year decrease.

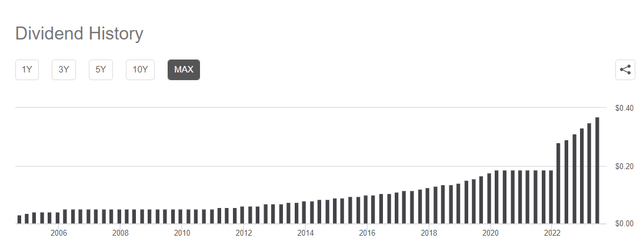

Dividend Growth

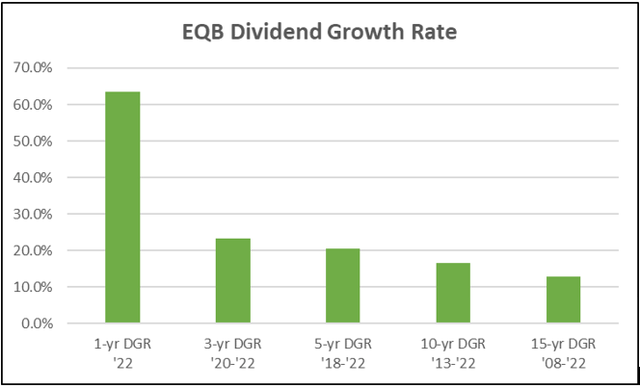

Following the 22-month ban on dividend increases imposed on the Canadian banks by the Office of the Superintendent of Financial Institutions during the pandemic, EQB wasted no time in increasing its dividend. Following a staggering 51% increase in Q1 2022, EQB finished the year with total dividend growth of 63.5%. The bank has recently reaffirmed its guidance of 20-25% dividend growth in 2023 as well as its other 2023 guidance targets. EQB’s most recently increased its dividend 5.7% to $1.48/share annualized, payable on June 30, 2023 to shareholders of record June 15, 2023. This follows a 6.1% increase to the quarterly dividend announced in February 2023 when the bank increased its quarterly payout from $0.33 to $0.35.

EQB Dividend History (Seeking Alpha)

While EQB has relatively low yield of 2.24%, the high rates and frequency of dividend increases has resulted in buy-and-hold investors earning high yield-on-cost positions with EQB. EQB’s 10-year yield-on-cost is 8.1%, which compares favourably to other banks including Toronto-Dominion Bank (TD), Bank of Nova Scotia (BNS) and Royal Bank of Canada (RY) with 10-year yield-on-cost of 9.14%, 7.18% and 8.78%, respectively. Over the long run, dividend growth rates matter more than current yield. Despite the 22-month freeze, EQB has posted a 10-year record of dividend growth of 16.6% annualized and a 15-year rate of 12.8% to 2022.

EQB Dividend Growth Rates (Graph Source: Author; Data Source: Dividend Growth And Investing)

With a dividend program initiated back in 2004, EQB has continuously paid a dividend for 18 consecutive years. While the bank was mandated to freeze its dividend between March 2020 and November 2021 by regulators, EQB has never had a dividend cut. EQB’s TTM dividend payout ratio of 16.7% provides a long run way for the bank to continue with dividend increases. In the company’s 2022 Investor Day presentation, EQB suggests the dividend per share by 2027 could be $4.00 based on the company’s historical EPS growth. This rate would represent a nearly tripling of the current dividend over the next 4 years.

In addition to boosting its dividend, EQB has also been returning cash to shareholders through its normal course issuer bid. EQB intends to purchase a maximum of 1.15M common shares and 0.29M of its preferred shares representing, approximately 3.8% and 10%, respectively, of the public float.

Risk Analysis

Equitable is well capitalized with a CET1 ratio of 13.7% at the end of 2022. For Q1 2023, EQB reported provisions for credit losses of $6.2M, compared to provisions of $7.8M in Q2 2022, signaling improving risk expectations. Total allowance for credit losses is equivalent to 0.19% of balance sheet lending for the quarter.

As interest rates continue to increase in Canada, investors have been watching the banking industry’s lending exposure to commercial real estate. For EQB, multi-unit mortgages account for approximately 80% of total loans, while commercial office lending is <1% of EQB’s total loan portfolio. Of these commercial loans, >67% have credit insurance and the average LTV is 59%. EQB has further mitigated its interest rate risk by focusing on short duration loans, with a one-year term as a target duration.

In November 2022, DBRS Morningstar upgraded the ratings of EQB Inc. to BBB from BBB (low). This move follows continued progress on diversifying funding sources, including substantial growth in direct-to-consumer deposits through EQ Bank. Individual consumer deposits with EQB are insured through federal deposit insurance. A high volume of small deposits helps to reduce concentration exposure. This diversification has allowed EQB to shrink the portion of brokered/commercial deposits from 78% of deposits in 2017 to 51% by the end of 2022.

Investor Takeaways

EQB has a broad-based growth profile with the bank advancing its deposit and loan strategies. With a reasonable consensus forward P/E of 6.34X, it is a reasonably priced growth story. EQB’s dividend growth history and outlook are both impressive. The bank’s low payout ratio and 2023 guidance of dividend growth of 20-25% set up EQB to return significant capital to shareholders. While EQB’s current yield is low, its impressive dividend growth rate has resulted in a 10-year yield on cost that surpasses Canada’s larger and more mature banks. At current levels, EQB provides a great opportunity for dividend growth investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here