I’ve written many articles on residential REITs lately and don’t plan to repeat myself in this one. By now you know that I’m bullish on rental apartments on both coasts as well as the Sunbelt. Today I want to cover a REIT which is represented in both of these markets and seems very well positioned relative to peers – Apartment Income REIT Corp. (NYSE:AIRC).

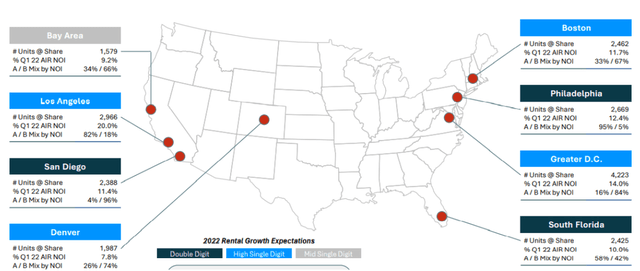

This is a relatively new REIT, formed only a couple years ago as a spin-off of Apartment Investment and Management (AIV). The REIT owns just over 23,000 units located across eight promising locations in the United States. These locations include Boston, Philadelphia, and DC on the East Coast, followed by Los Angeles, San Diego, and San Francisco on the West Coast and then Florida and Denver in the fast growing Sunbelt. As such the REIT is very well diversified across the country and represents a combination of a traditional coastal REIT and a more progressive Sunbelt REIT. As you know each of these regions has positives and negatives that mainly have to do with the supply and demand equation. Having exposure to both is nice, although investors could easily achieve the same by combining two other REITs, so the question is what makes AIRC special (I’ll try to answer that below). In terms of allocation to individual markets, Los Angeles is the biggest market with a 20% exposure, followed by DC at 14%, and then closely followed by Philadelphia and Boston between 11% and 12%. Denver is the smallest market and accounts for 7.8% of total NOI.

AIRC

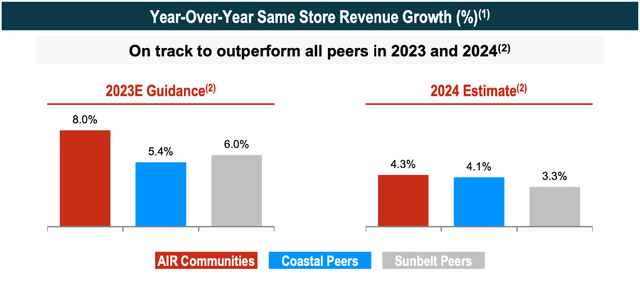

What makes the company interesting and quite special is high forward revenue growth and high margins relative to peers. In particular, same store revenues are expected to grow by 8% this year followed by 4.3% next year, both of which are significantly above coastal as well as Sunbelt peers.

AIRC

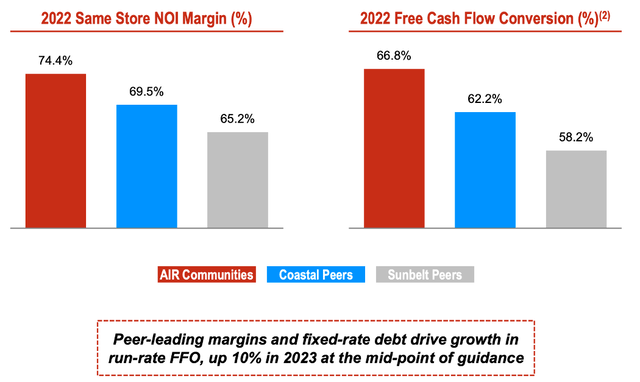

And frankly, the positives don’t end there as the company has had industry leading margins for 20+ consecutive quarters and expects this to continue with gross margins of almost 75% going forward, which is significantly above the 70% average for coastal peers and even more above the 65% average for Sunbelt peers.

AIRC

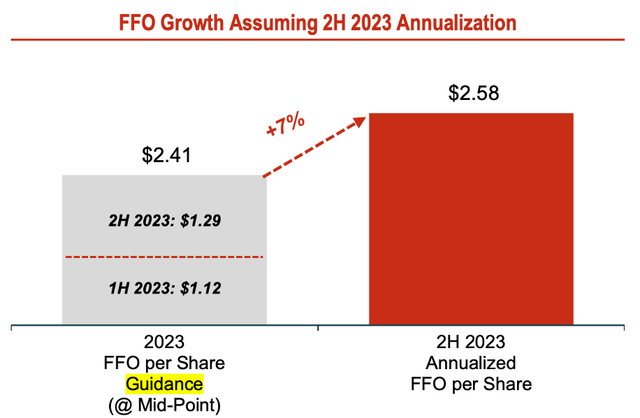

The combination of strong same store rent growth and high margins, as well as entirely fixed debt, the FFO per share is expected to grow by 10% in 2023 at midpoint of guidance. Although 10% is a slight slowdown from last year’s 11.2% growth, it’s still more than double the peer average of just 4% annually. If the company can achieve this growth, FFO per share should reach $2.41 by year end.

AIRC

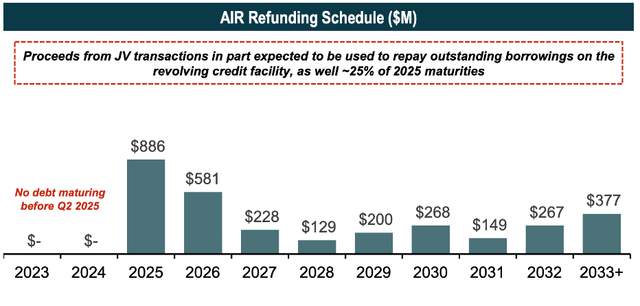

This strong growth is also underpinned by a very good balance sheet with $2 billion in available liquidity which is more than three times what peers have on average given their relative size. Notably, the company also has no debt maturing before Q2 2025 and no floating rate debt exposure. This means that it will not face any increases in net interest expense in the foreseeable future which, along with its high liquidity will put it in a really good position to grow.

AIRC

Dividend investors will be pleased with the $1.80 per share dividend which yields nearly 5% at today’s stock price and is therefore some 20% above the average yield on other residential peers. Going forward I expect the dividend to grow at about half the rate of FFO. That means an expected 5% increase in 2023 and another 2-3% in 2024. The reason I see it growing slower than FFO is a relatively high payout ratio – 80% on 2022 numbers and 75% on 2023 forward numbers, which management will likely want to bring down a little bit.

Despite being superior to peers on many levels, the company trades at a very reasonable valuation. In particular, the implied cap rate by today’s stock price stands at 5.9%, which is roughly in line with coastal as well as Sunbelt peers. The forward FFO multiple against 2023 expected FFO stands at just 14.9x, which is about 6-7% below the average multiple of 16x of its peers. And while some discount is likely justified due to the company’s smaller size and shorter history, AIRC is by no means expensive here, especially when you consider its very solid forward growth and industry-leading margins. I rate the company as a Buy here at $36.75 per share.

Read the full article here