Few companies are able to transform their businesses successfully when industries change. While most corporations evolve, management teams usually find reinventing themselves to be difficult if not impossible.

One company that has finally been begun to move in the right direction after years of struggles is General Electric (NYSE:GE). This industrial leader has faced a lot of adversity over the last several decades, with the financial collapse in 2008 and then the recession in 2020 caused by Covid being the most recent crises to hit this company, but new CEO Larry Culp has made helped make need changes.

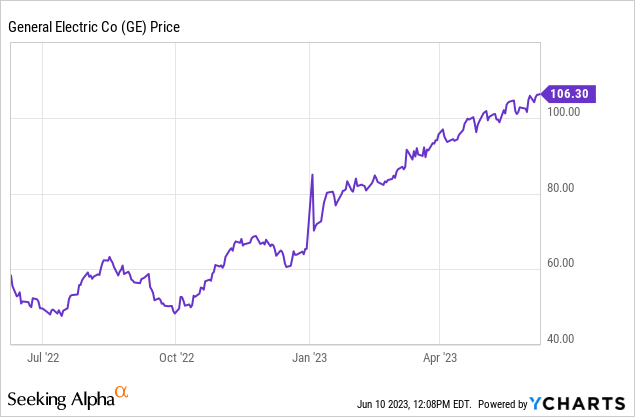

I last wrote about GE in my article in February of this year. I rated GE a buy primarily new CEO Larry Culp has finally taken steps to refocus the company’s business model on the stronger aerospace division, and also be the company was divesting from less profitable divisions such as the energy and power business. I also saw the stock has being undervalued earlier this year since the macroeconomic environment was still strong and the company also has a strong balance sheet. Today I am changing my rating to a hold. GE is up nearly 27% in the fourth months since I wrong about the company, and there are growing signs of a recession as well.

GE has significantly outperformed the S&P 500 and the broader indexes over the last year. The stock is up 82% since the middle of 2022, while the S&P 500 has only risen 7% during the same time period.

Even though new CEO Larry Culp has done a good job of refocusing GE’s core business on the strong aerospace division in my view, this industrial leader is a more cyclical company now. General Electric recently spun off the company’s health care division and retained just a 20% stake in this entity, which is GE HealthCare Technologies (GEHC). The company also plans to complete a divestiture from the company’s power division and digital business by spinning off these segments of the business into a new company call GE Vernova. General Electric will not hold any equity in GE Vernova have that part of the business is sold-off. The health care, power and energy division, were generally less cyclical than the company’s aerospace division.

Culp was right in my view to recenter GE’s business on the strong Aerospace business, but this decision also makes GE more vulnerable to business cycles. GE’s first quarter earnings report was strong, with management recently reporting total orders of $17.6 billion and revenues of $14.5 billion, with organic revenue growth of 17%. The company beat expectations on the top and bottom line, with revenue numbers coming in $1.03 billion ahead of expectations. Still, the company’s recent financial reports make clear General Electric’s future is now nearly entirely centered on the more cyclical aviation business.

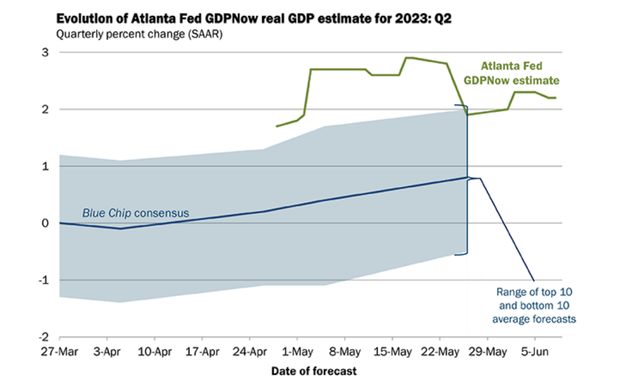

Signs of an extended economic slowdown are building. Business investment fell significantly in the first quarter of this year, housing prices are falling, and consumer spending has slowed as well. The current rate of inflation, at 4.9%, is also still nearly more than double the Fed’s stated target for price increases of 2%. There is also normally a delay of nearly 12 months between when rates are raised and the impact of this tightening on the economy. GDP estimates for the second half of this year have also been revised down in the last several months by economists.

A Chart showing changing GDP forecasts (Blue Chip Economic Indicators and the Blue Chip Financial Forecasts)

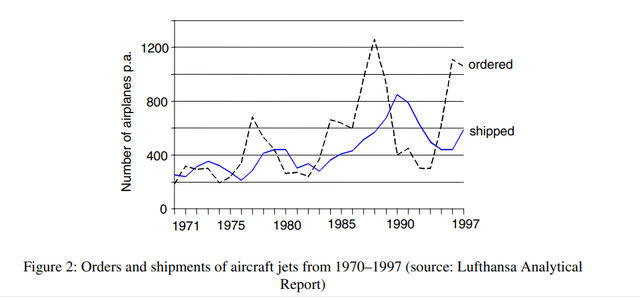

The aviation business is typically an industry that is more cyclical. Commercial travel usually comprises approximately 5% of GDP, and during previous recessions industrial companies in this industry did see significant cancellations in orders by the Airlines. Rising rates and falling oil prices will also likely make airlines less likely to upgrade their fleets. Orders can be both delayed or cancelled, and the cost to finance these purchases has also risen significantly over the last year with rates rising.

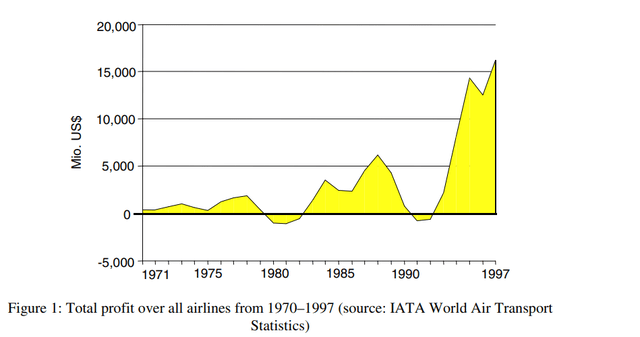

A chart showing Airline profits during the business cycles ( IATA World Air Transport Stats) A Chart showing orders for new Aircraft during business cycles (Lufthansa Analytical Report)

Airline profits and new orders for planes have typically been predictably cyclical, and with the Fed likely to remain hawkish with inflation still well above Powell’s stated goal of 2%, the Central Bank isn’t likely to pause the current rate cycle right now.

This is why General Electric looks fairly valued at the current share price given the growing macroeconomic headwinds. The company currently trades at 16.69x projected forward EBITDA, 22.57x likely forward EBIT. GE’s 5-year average valuation is 17.17x projected forward EBITDA and 21.64x likely forward EBIT. Most analysts also revised earnings estimates for GE down in March when the many economists were projected a potentially severe recession, but the company still trades at premium to the average 5-year valuation when looking at several metrics. A further deterioration in the macroeconomic data and continued rate increases pose significant risk to GE’s more cyclical business model, and the current share price is likely pricing in only a slight slowdown in growth.

There is a case for investors to continue to bullish on General Electric. If the economy were to avoid a significant slowdown or the Fed were to pause rate increases, GE wouldn’t likely see significant cancellations in orders. Supply also remains tight in the oil market, if energy prices only fell slightly many airlines would likely still be incentivized to continue to upgrade their fleet to be more fuel efficient.

Still, GE’s stock has nearly doubled in the last year. While, Larry Culp has provided needed leadership for General Electric, and the company is well-positioned for the long-term, the business is also more cyclical now as well. With growth slowing and rates still rising, GE is likely to only see minimal upside from current levels in the current economic environment over the next year.

Read the full article here