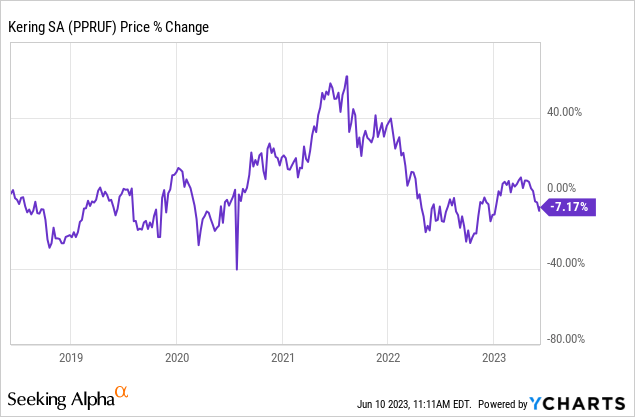

Kering (OTCPK:PPRUF) is one of the largest French conglomerates in the luxury industry, best known for owning Gucci. After rising more than 50% during the reopening in 2021, the stock is now even negative on a 5-year basis.

The market particularly dislikes Gucci’s flattening growth and a persistent weakness in China. Moreover, Kering has always been valued at a lower multiple than its peers: LVMH (OTCPK:LVMHF) due to its highly concentrated portfolio and more volatile returns. I don’t doubt that LVMH has historically been a better capital allocator and therefore deserves its premium. But the cheaper Kering gets, the more the negatives are priced in. In my opinion, Kering has several strong businesses and a convincing track record in growing each of these investments, which could pay off in the future.

Nevertheless, I believe that Kering is currently fairly priced as it deserves a higher margin of safety. Therefore, I am waiting to start a position, even though the share price has already fallen, and would probably stay with the industry leader: LVMH.

But let’s get started and see what Kering has to offer!

Business Model

As mentioned above, Kering is widely known for three luxury brands, including Gucci, Yves Saint Laurent and Bottega Veneta. In terms of Kering’s total sales, these “top 3” brands are responsible for about 75%, while the rest of the brands account for only 20%. The remaining 5% is derived from Kering’s eyewear and general corporate activities.

Kering classifies its remaining brands as “Other Houses” and rarely publishes brand-specific financials. Therefore, I will use Gucci, YSL and Bottega Veneta as examples of Kering’s ability to develop brands and to derive future prospects.

Kering’s Brands by Segment (Own Illustration)

Gucci

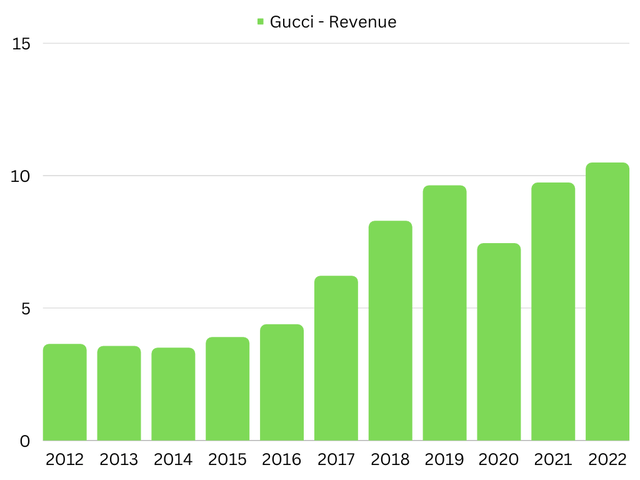

So let’s start with Gucci. The Italian manufacturer of fashion and leather goods is the flagship of Kering, with an EBIT margin of 35.60% in FY22, and a CAGR for its revenues of 11.17% over the past 10 years.

Gucci, Revenue in € billion, 2012-2022 (own illustration)

But a look at the last few years shows that the longtime growth driver is starting to flatten out. In the most recent Q1 FY23 results, Kering even reported just 1% YoY sales growth for Gucci, which is almost flat.

And since the brand only accounts for about 50% of total sales, Gucci and its current challenges have a huge impact on the company as a whole. That is why the recent change at the creative helm of Gucci in the form of Sabato De Sarno could bring new momentum. The former Valentino designer replaced longtime creative director Alessandro Michele this year, ushering in a new era. Marco Bizzarri, Gucci’s president and CEO, writes about De Sarno:

I am delighted that Sabato will join Gucci as the House’s new Creative Director, one of the most influential roles in the luxury industry. Having worked with a number of Italy’s most renowned luxury fashion houses, he brings with him a vast and relevant experience. I am certain that through Sabato’s deep understanding and appreciation for Gucci’s unique legacy, he will lead our creative teams with a distinctive vision that will help write this exciting next chapter, reinforcing the House’s fashion authority while capitalizing on its rich heritage.

In contrast to Michele’s extremely playful eclecticism (mixing the most diverse ideas, forms and styles), De Sarno’s style is a return to the timeless and elegant style that has already helped the competition (e.g. Louis Vuitton, Hermès) to new growth impulses. Whether this change will also be successfully reflected in the figures remains to be seen as De Sarno will present his first collection in September this year.

In general, 2023 should be seen as a transitional year, the progress of which was recently commented on by Kering’s CFO, Jean-Marc Duplaix, as follows:

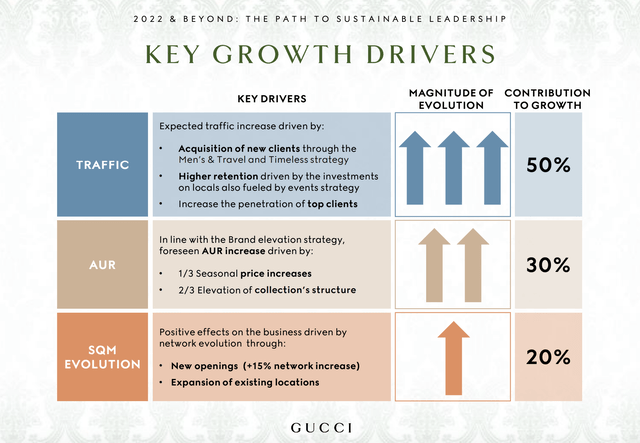

But if we take a step back and we look at what Marco presented a few years ago, what we presented recently, I think that we are delivering some of the parts of […] the journey. If I think about the elevation of the AUR with the contribution of mix and price increases, fundamentally compared to what we have presented during last Capital Market Day, we are there. We have not necessarily yet the traffic up or the traffic is up but not necessarily the volumes are back to positive territories. And we expect that along the year with the improvement […] in China, we should start to turn positive also in terms of volumes.

That said, the management seems to be relatively content with the current results of Gucci, regarding its contribution to the mid-term ambitions.

Mid-Term Ambitions of Gucci, since 2022 (Capital Market Day Presentation)

According to the strategy published in 2022, Gucci’s future growth will mainly be driven by an increased focus on men’s and travel product lines, while also capitalizing on iconic lines and enhancing high-end offerings. Therefore, it is promising to see that the price increases and collection changes are starting to pay off. However, 1% overall growth isn’t exciting and the successful implementation of the strategy remains to be seen.

But for now, let’s move on to the second most important part of the business.

Yves Saint Laurent

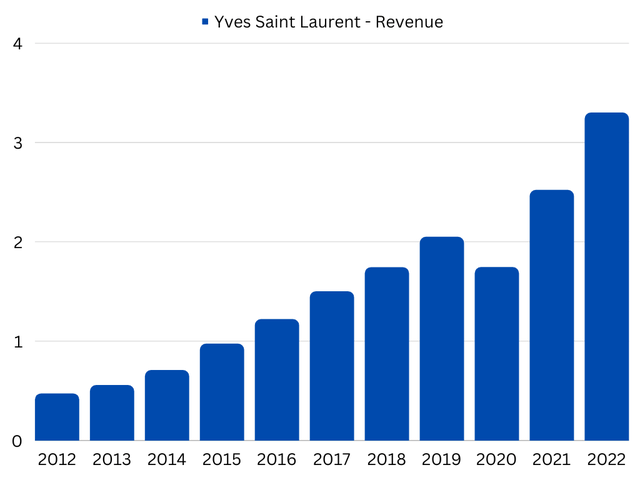

Yves Saint Laurent (YSL), the iconic French luxury brand, was acquired in 1999. Since then, YSL has grown into a jewel in Gucci’s shadow, compounding its revenues at an exceptional CAGR of 21.52% over the past 10 years.

Yves Saint Laurent, Revenue in € billion, 2012-2022 (own illustration)

The brand is an excellent example of Kering’s ability to manage and expand its luxury brands over time by selecting and implementing the most appropriate growth strategy. Looking at the most recent quarterly results, the brand increased its sales by 9% year-on-year, driven by leather goods and ready-to-wear. As the brand was initially known for developing haute couture, the ready-to-wear lines are less trendy and more classic with discreet prints. And this strategy seems to be paying off, as the brand has successfully raised its price point and steadily increased its operating margin, which reached 30.90% in FY22.

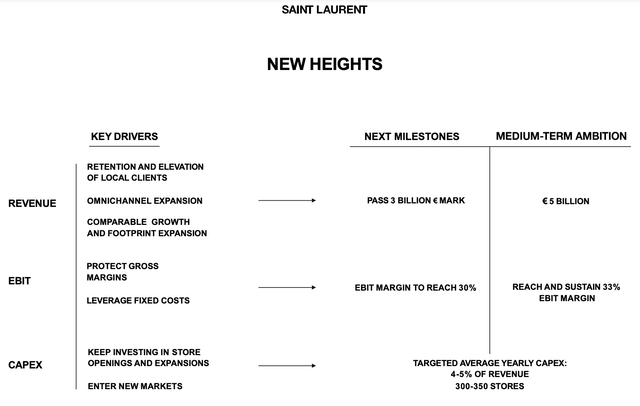

Outlook of Yves Saint Laurent, since 2022 (Capital Market Day Presentation)

That said, YSL achieved its short-term targets by ending FY22 with revenues of €3.3 billion and an operating margin above 30%. Looking ahead, management expects YSL to increase revenues to a level of around €5 billion and also to achieve and maintain an EBIT margin of around 33%.

All in all, things look very good for YSL, both now and in the future, not least because management has shown that it is capable of achieving the goals it has set.

Bottega Veneta

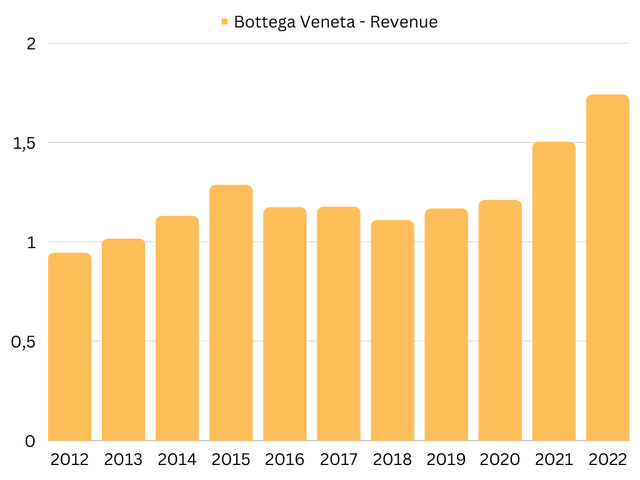

Finally, we come to the third pillar of Kering’s business: Bottega Veneta, the Italian luxury fashion and leather goods manufacturer founded in 1966. Since the acquisition in 2001, Kering massively improved the operating business of Bottega Veneta, although revenues only grew by 6.23% p.a. over the last 10 years.

Bottega Veneta, Revenue in € billion, 2012-2022 (own illustration)

During these years, the brand lost its appeal – especially in established European markets. The turnaround came with the hiring of Daniel Lee as creative director in the middle of 2018. Although sales still fell 5% that year, the previously unknown Lee put the brand back on the road to international popularity. According to the fashion magazine Harper’s Bazaar, Lee created the “new” Bottega Veneta by focusing on the simple and essential, just in time to appeal to fans of the “old Celine” look. The new Bottega created by Lee will be continued by the young creative director Matthieu Blazy starting in 2021. In particular, this means highlighting and reinterpreting the outstanding “Intrecciato Weave” – a special weave that is the basis of Bottega Veneta’s most famous pieces. This was also reflected in the numbers, as we can see in the chart, with sales growth of 16% YoY in FY22.

As a result, analysts were surprised by the company’s most recent earnings release, when it reported that sales for the first quarter were flat versus the prior year. According to the CFO Jean-Marc Duplaix, this was caused by the fact that the store network had not been expanded enough to take full advantage of current trends. This is especially true for the “quiet luxury” trend, which management believes is most evident at Bottega Veneta and Brioni. Nevertheless, investors should be patient and wait for the more comprehensive results for the first half of 2023.

For now, we can conclude that Bottega Veneta has successfully returned to growth through good personnel changes, a focus on iconic product lines and the upscale customer cohort.

Learning From The Brands And Their Development

In the case of all the brands presented, it is clear that Kering has always been able to position its brands for long-term, sustainable growth and to adapt them to the changing environment, thanks to good investments and strong brand management skills. It is therefore reasonable to expect that the “Other Houses” will continue to develop brands that will provide Kering with sustainable sales and growth. Kering’s track record of successful brand building also makes it an attractive partner for younger brands.

However, with Gucci still accounting for over 50% of sales, it’s reasonable that the valuation has declined relative to its peers. But from my perspective, I think Kering is capable of managing these challenges properly and should generally be able to find its way back to growth. That said, Kering will only be able to increase future shareholder returns at the same rate as its peers if it can reinvest its cash flows at the same profitable level.

So let’s take a look at Kering’s capital allocation!

Capital Allocation

Generally, a company has four ways of using its free cash flow, apart from filling the bank account:

- Reinvesting into the business

- Acquiring other businesses

- Repurchasing own shares

- Paying a dividend

In the following, I will focus on re-investments and acquisitions to see if Kering has a competitive advantage over other luxury holdings.

Reinvesting into The Business

Kering discloses its forward-looking strategy in the annual report as follows:

In an environment of ongoing economic and geopolitical uncertainty in the near term, Kering will continue to execute on its strategy and vision, in pursuit of two key ambitions: to maintain a trajectory of profitable growth resulting in high levels of cash flow generation and return on capital employed, and to confirm its status as one of the most influential groups in the Luxury industry.

Based on this statement, it seems reasonable to use the return on capital employed (ROCE) as the appropriate performance measure for Kering’s capital redeployment.

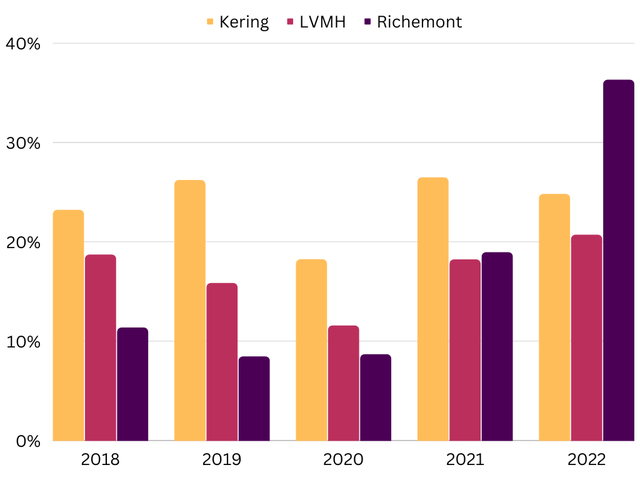

ROCE by company, 2018-2022 (own calc.)

And over the past 5 years, Kering has consistently been able to invest its cash at a high rate of return, averaging 23.79%, as shown in the chart above. Regarding the comparison with LVMH and Richemont (OTCPK:CFRHF), it’s important to note that the individual portfolios differ significantly in their product offerings. Therefore, we cannot conclude that Kering is the best capital allocator, but I really appreciate Kering’s consistency in this comparison. And the high returns also demonstrate the benefits of Kering’s concentrated and highly profitable portfolio.

In addition to the individual strategies of the key brands that we discussed earlier, we have a promising mix for the future growth of Kering’s brand equity.

M&A

Since the Pinault family has been consistently buying companies for more than 50 years, it seems natural to assume that future growth will come from inorganic growth, in addition to organic growth of the companies it already owns. But given that it takes several generations to build brands like Gucci and others, there are fewer and fewer acquisition targets that could impact Kering’s overall results.

In addition, Kering is currently facing several challenges to prepare the most important houses for future growth. Therefore, as mentioned above, Kering is likely to focus on improving the cost efficiency and ROCE of its existing houses in order to maintain constant cash flow generation. Having said that, investors shouldn’t get too excited about any major acquisitions in the near future.

Kering Eyewear

In recent years, however, Kering has demonstrated its belief in the eyewear segment by expanding its supply chain with French manufacturer UNT and its portfolio with the American eyewear brand Maui Jim and the Danish eyewear manufacturer Lindberg. During the earnings call for FY2022, Group Managing Director, Jean-François Palus, provided further details on the strategic ambitions for Kering Eyewear:

Regarding Kering Eyewear, we are very satisfied with the profitability but also and most of it primarily with the trajectory of revenue. And short term, we are very busy integrating Maui Jim and Lindberg and also leveraging on synergies, and Thomas you mentioned lenses. And now we are contemplating to use Maui Jim lenses into Gucci frames, which could happen quite shortly. Midterm, we want to expand Maui Jim and Lindberg geographically because we have a significant potential to tap markets in Asia, China and so on and so forth. And long term, we also have some other potentials like going for Lindberg going to sunglasses and conversely for Maui Jim going to prescription frames. So there will also be, in the long term, maybe some additions of new luxury brands but again, we are very much open and again, agile regarding Kering Eyewear.

I like the detailed explanation of management’s future plans for this business and the opportunities for synergies between new and existing brands. In addition, the ambitious plan for the smallest business segment reveals an amazing advantage of a decentralized operating structure. Otherwise, a single executive might focus on the largest segments because they could move the needle with much smaller changes.

Final Thoughts on Capital Allocation

On its way to becoming a pure play in luxury consumer goods, Kering made some excellent acquisitions, which it integrated and expanded very well. However, the pace of M&A has slowed and Kering has focused on strengthening its existing brand equity, despite minor acquisitions in eyewear.

This may be reasonable given that Kering’s luxury portfolio is relatively young compared to LVMH, which has owned brands such as Louis Vuitton since the merger in 1987. In my view, this is perfectly acceptable given the high returns on capital employed that Kering can generate with its existing brand portfolio. Having said that, this statement is only valid for as long as Kering has the ability to reinvest its cash flows. Given the discount that Kering receives from the market, analysts seem to think that Kering is running out of such opportunities. But the secular growth trends remain and continue to increase the market share of the most valuable luxury brands in the industry. Therefore, I would not be too pessimistic about Kering’s future in terms of capital allocation. Yet, in the short term, Kering may have to make more intensive investments to regain growth momentum if the key brands continue to flatten out.

Let’s now turn to Kering’s other key ambition, namely to improve its cash flow generation.

Cash Flows

In order to analyse a company’s ability to generate cash from operations, I focus primarily on its free cash flow. Despite the usual calculation (OCF – CapEx = FCF), I adjust the operating cash flow for changes in net working capital, the expenses for stock-based compensation and off-balance sheet financing. Using this approach, I try to get closer to the actual and sustainable cash generation of the business through the perspective of its owners.

For Kering, the calculation (based on FY22) looks like this:

| in € million | |

| Operating Cash Flow | 4,278 |

| – Stock-based Compensation | 45 |

| – Change in NWC | -902 |

| – Lease Liabilities | 824 |

|

= Adjusted Operating Cash Flow |

4,311 |

| – Net CapEx | -1,070 |

| = Free Cash Flow | 3,241 |

A closer look at the adjustments above reveals that the usual free cash flow would be significantly lower due to increases of net working capital. In the corresponding earnings call, CFO Jean-Marc Duplaix commented on the changes in net working capital as follows:

Most of the difference [in the free cash flow] came from operating working cap, which had been quite low as a percentage of sales in 2021 and was more in line with industry average in 2022. The change is mostly related to inventory levels as a consequence of the weaker sales trend at the end of the year. This being said, our inventories are healthy.

So the increase in NWC was mainly due to higher inventory level. As I recognized this inventory development in my last article on Richemont, it seems correct that these increases are a current industry-wide trend. However, due to the seasonality of working capital changes, I would argue that a more meaningful cash flow is obtained by subtracting these changes.

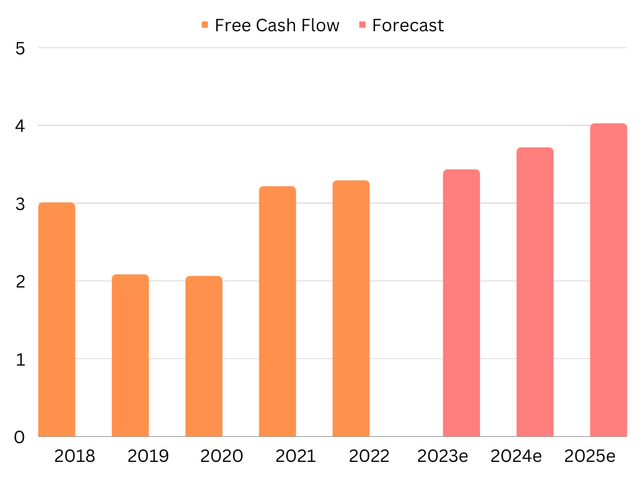

If we apply this calculation to the last 5 periods, we get a free cash flow CAGR of just 2.81% per year, which is quite disenchanting at first, but mainly due to a one-time tax settlement in Italy in 2019 and the impact of the pandemic in 2020. Both after a very strong year for Kering in 2018 (+36% YoY for operating cash flow).

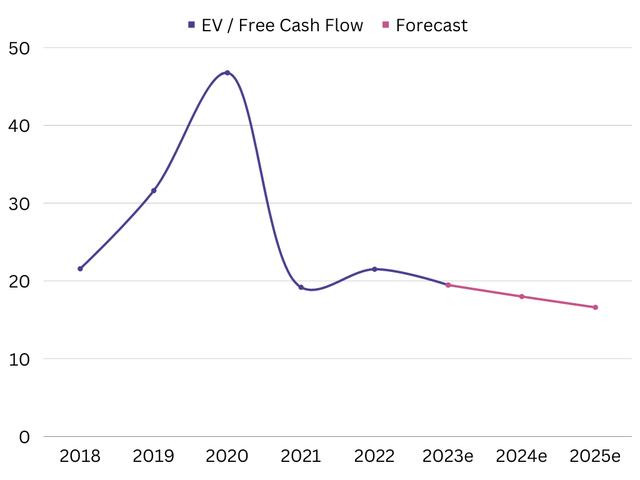

Free Cash Flow, 2018-2025e, in € billions (own illustration)

On average, Kering has been able to generate a free cash flow margin and cash conversion of around 16% and 47% respectively, which are both below the current levels of Richemont and LVMH. However, if we apply the obtained conversion rate to the analysts’ estimates for Kering’s EBITDA, we can see that Kering is expected to grow its free cash flow at a CAGR of 9% until 2025. Compared to the estimated revenue growth of 6.75% per year, this would mean that Kering will increase its profitability in terms of cash flow, contributing to the goals set by management.

I mentioned that Kering is underperforming the other European luxury stocks in this comparison. While both have benefited significantly from the reopening and strong customer demand, Kering has remained relatively flat and also needs to increase its spending to address current obstacles. It seems that there is an ongoing level of uncertainty that makes it more difficult to estimate future cash flows, although I must highlight the company’s consistent margin levels in the past.

Valuation

In order to value Kering, I’ll use the free cash flow, as calculated above, in relation to the total enterprise value. My assumption for this approach is that I probably won’t be able to calculate a comprehensive DCF model as accurately as Wall Street, therefore I’m following Warren Buffett’s approach:

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

So let’s see, what PPRUF has to offer for us at the moment:

EV/FCF Ratio, 2018-2025e (own illustration)

Unlike most other luxury companies, Kering’s share price has never really rallied, but has also fallen along with most of its peers. Currently, Kering is trading at around €504 (=$542) per share, giving it a market cap of €62.14 billion and an enterprise value of €69.58 billion. Therefore, using the calculated free cash flow of €3.24 billion, we see that investors can currently start a position at 21.47x EV/FCF. Excluding the outliers in 2019/2020, Kering’s multiple is close to the historical average, which is somewhat unsurprising given that the share price and recent free cash flow have stagnated compared to levels 5 years ago.

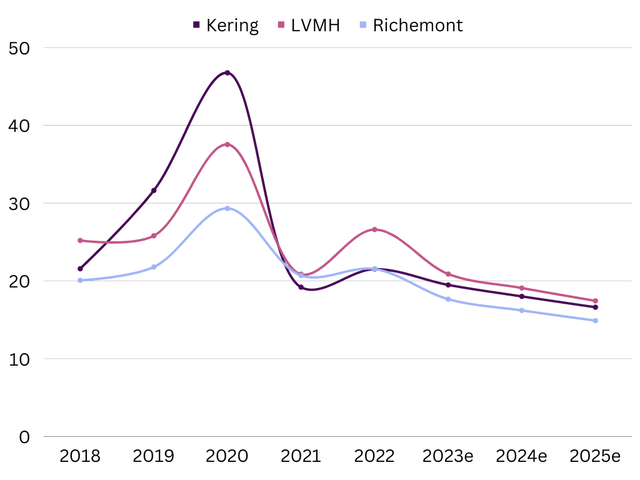

Peer Comparison, EV/FCF, 2018-2025e (own illustration)

Relative to the above-mentioned peers, Kering currently seems attractively valued, as Richemont (OTCPK:CFRHF) and LVMH (OTCPK:LVMHF) trade at EV/FCF multiples of 21.51 and 26.58, respectively.

But the “discount” seems appropriate in my opinion due to a higher level of uncertainty, strategic headwinds and an overall higher level of risk due to less diversification and dependence on a single brand.

While Richemont is starting to earn a premium by demonstrating to the market its strong financials and successful transformation, Kering seems to be moving in the opposite direction. Therefore, I would argue that the current valuation still leaves room for further disappointments, although the overall outlook for Kering seems promising.

Conclusion

Let’s recap what we’ve learned so far. Kering is one of the most valuable luxury companies in Europe and has a very successful track record, resulting in a portfolio of market-leading luxury brands, most notably Gucci. In addition, the company has been able to generate consistently strong cash flows and strong returns on capital.

However, with key brands currently facing individual challenges, historical valuation levels are crumbling. Investors fear the growing uncertainty of Kering’s concentrated portfolio and punish the fact that Kering has underperformed its peers in terms of operating metrics in recent years.

In my view, Kering’s current share price of around $542 does not price in all the current headwinds and does not offer an adequate margin of safety. Therefore, investors should keep PPRUF on their watchlist and could think about taking a position when the pessimism is priced in. For now, I am also on the sidelines and would probably prefer to add to my position in LVMHF, as I am willing to pay a well-deserved premium for lower risk and more compelling capital allocation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here