Investment thesis

Our current investment thesis is:

- JET has scale and capabilities in 3 of the 4 largest markets in its industry. The general market trajectory is strong, and product development is only improving this.

- JET is beginning a period of consolidation, as it seeks profitability and is looking to sell Grubhub. We believe this is the correct decision given the mismanagement thus far, and a potential buyer looks available.

- Our biggest concern is that the industry is value-destroying, with no clear sight of attractive profitability. In order for the service to be attractive, the extra cost to a consumer must be low, which is not possible currently at a profitable level.

Company description

Just Eat Takeaway.com N.V. (OTCPK:JTKWY) operates an online food delivery marketplace internationally. It operates 3 primary marketplaces, Just Eat (UK-based business acquired in 2020), Grubhub (US-based business acquired in 2021), and Takeaway.com (Europe based).

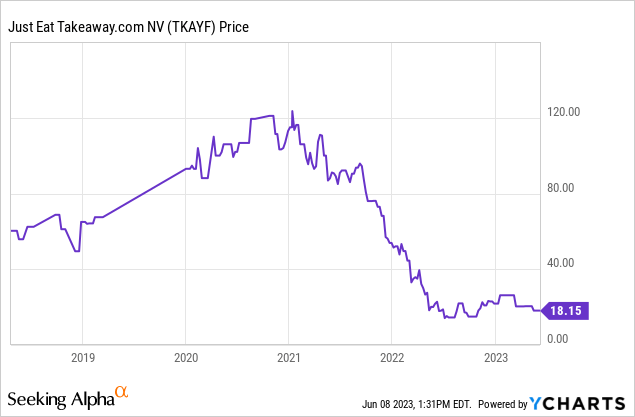

Share price

JET’s share price initially made impressive gains, driven by an aggressive expansion strategy that involved the acquisition of two large peers. This has subsequently soured as financial development has not panned out as expected.

Financial analysis

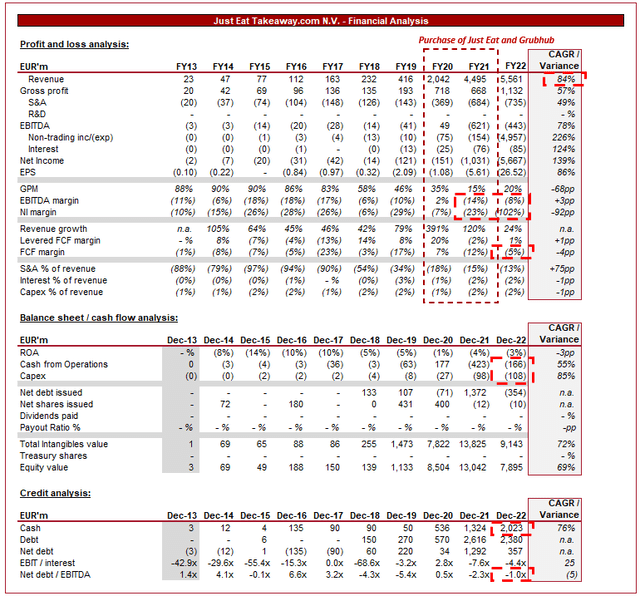

JET financials (Tikr Terminal)

Presented above is JET’s financial performance for the last decade.

Revenue & Commercial Factors

JET has grown revenue at a CAGR of 84%, much of which is the impact of JE and Grubhub. Prior to the acquisition, growth was strong, and this has continued in FY22, although to a reduced level.

The vast majority of JET’s revenue is defined as “Order-driven” (c.96%), primarily comprising commission fees and delivery charges. For this reason, JET is highly dependent on order volume, which means it is critical for the company to have a wide variety of options and cuisine on its platform. The difficulty here is that many of the larger food brands are either solely in-house or partner with a single delivery provider, locking out all others.

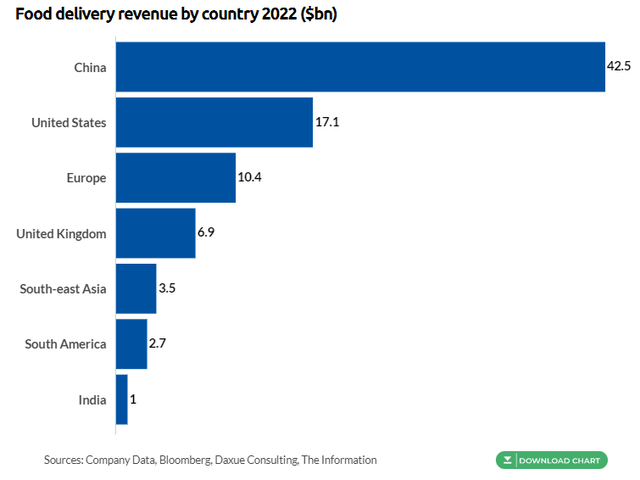

The online food delivery industry has experienced rapid growth in recent years, driven by changing consumer preferences and advancements in technology. Consumers are increasingly valuing the convenience proposition, substituting “take-out” meals and quick meals. The pandemic only served to accelerate this trend further, offering a once-in-a-lifetime opportunity to rapidly gain market share. JET’s strategy during this time was expansion, acquiring two businesses and focusing on customer acquisition. JET has a strong presence in 3 of the 4 largest markets.

Food delivery (Business of Apps)

Due to this increased popularity, we are seeing delivery apps increasingly utilized by restaurants. This has further supported the growth trajectory, as increased quality options convince consumers to use the service. Our expectation is for growth in app usage to increase further in the coming years, with Grandview Research forecasting growth of 10.3% to 2030.

The concept of cloud kitchens, also known as ghost kitchens or virtual kitchens, is gaining popularity. These kitchens are optimized for delivery-only operations, allowing restaurants to minimize costs to focus on customer acquisition. This has attracted more customers as the number of options across cuisines increases, as well as the number of affordable options.

We also see the groceries expansion as a key opportunity for the business. Just Eat, for example, has expanded its footprint to over 2100 sites in the UK, from 200 the year prior. The key difference to the meal industry is that many of the groceries businesses already offer delivery. The value offered here is again convenience, as well as cost and speed. This is genuine value offered to consumers and is a natural transition from its current product.

Delivery apps are also introducing subscription and loyalty programs to enhance customer retention and incentivize repeat orders. These programs often offer benefits such as free or discounted deliveries, exclusive offers, and rewards points that can be redeemed for future orders. This also reduces the volatility of revenue, creating a portion of recurring revenue. Just Eat’s largest competitor, Deliveroo (OTCPK:DROOF), offers such a service. The difficulty we have seen so far is that companies are struggling to offer sufficient value to consumers. Deliveroo, as an example, has seen uninspiring uptake in its service.

Moat

As we touched on previously, consumers are driven by the options available on apps. With JET’s wide variety of outlets and its brand image, the company is positioned well to continue its expansion both within nations and globally.

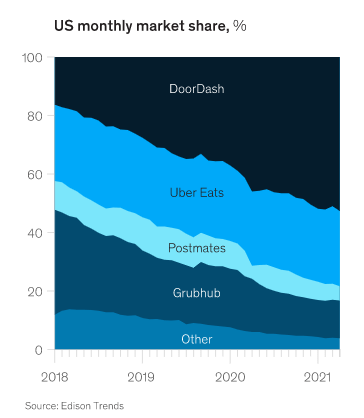

This does not wholly protect the company, however, as Grubhub has experienced a noticeable decline in market share within the US. Competition remains high and consumers have shown a willingness to switch apps based on options and price. It remains critical, for this reason, that JET continues to partner with leading restaurant brands and maintains competitive pricing.

Grubhub

Despite initially gaining market share in the US, Grubhub has subsequently fallen behind outside of its key NY stronghold, with a c.9% share of the market (DoorDash (DASH) 65%, Uber Eats (UBER) 23%). This, alongside a lofty purchase price, has led to pressures to sell the business.

US market share between 18-21 (Edison Trends)

JET announced last year that it would begin exploring just this. However, 1 year later, the business has yet to see anything materialize, stating market conditions are hindering its efforts. Amazon (AMZN) acquired a stake in the business (2%) in Jun22, with the option to increase its ownership to 15% depending on performance indicators. This involved the incorporation of Grubhub into the Prime eco-system, a natural complementary offering in our view (recently extended).

This deal feels like an effort by Amazon to “test the water”. The company is gaining invaluable analytics and represents a “try before you buy” opportunity. On paper, we think it is a good deal for both parties. JET can focus on its key market, clearly mismanaging Grubhub during its time as its owner. Amazon gets a complementary business that supports the value proposition of Prime.

Questions remain, however, if this deal will actually be done and at what terms. With elevated rates and uncertain economic conditions, JET is unlikely to find a buyer willing to finance the deal, and no competitor is in a position to do so. JET incurred a EUR 3bn charge in FY22 alone, as well as a further EUR 1.6bn in relation to Just Eat. A lot of money has been lost with this transaction and Amazon will not be kind.

Economic & External Consideration

Current economic conditions represent a key risk to the business. We are seeing a slowdown in discretionary spending as inflationary pressures negatively impact consumers. Due to the period in which inflation has remained elevated, it is inevitable that even if inflation fell below 3% today, the impact would be felt in the coming months/years.

Due to the many alternatives to deliveries (which include saving on delivery and inflated prices by picking up), we expect delivery businesses to be noticeably impacted by this, with growth slowing. In FY22, orders (in m) declined 9% while GTV was flat.

Margins

JET’s margins have been volatile during the historical period, reflecting a mix of investment in growth and noise from acquisitions.

On an adjusted basis, EBITDA is positive but only marginally so. Management is guiding an improvement to single digits, but this remains underwhelming in our view.

The industry has been supported by the rise of the gig economy, with independent contractors working as delivery drivers. This has allowed delivery apps to minimize costs and focus on marketing. This said, we are seeing increased pressures to provide these individuals with benefits, with some suggesting they should legally become employees. Legislation should be continually monitored due to the risks around changes to JET’s cost base. According to McKinsey, The cost of delivery is unlikely to decline sufficiently, as “the economics of last-mile delivery remains challenging”. This is only worsened by the increasing expectations for speed (In order to maintain the biggest selling point, convenience).

The margin weakness is a reflection of what is a fundamentally broken industry. The majority of the delivery app businesses are loss-making, focusing on marketing spending, and are unable to materially increase their take rate due to the level of competition.

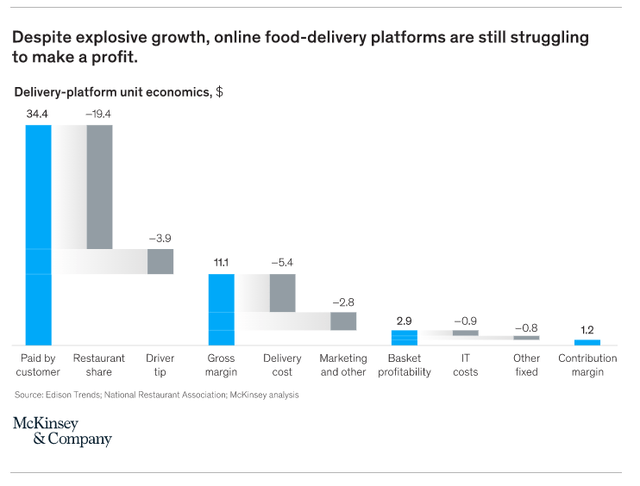

The following chart by McKinsey perfectly illustrates the issue the industry is facing.

Lack of profitability (McKinsey)

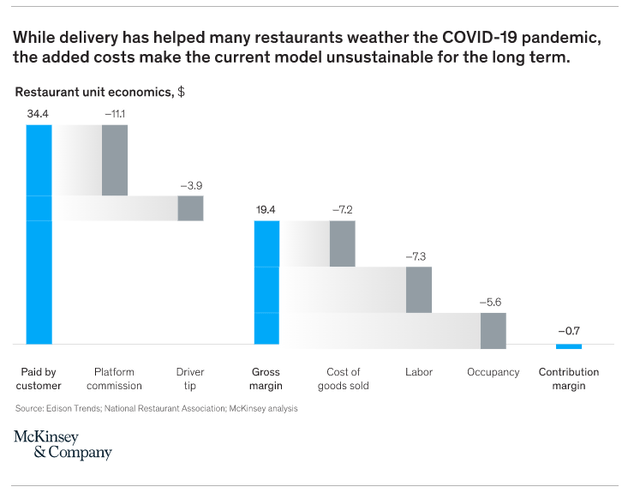

What has the potential to compound this is pressure from Restaurants to increase prices. As McKinsey’s research also shows, Restaurants are being squeezed on pricing, also, to a level that is not sustainable.

Restaurant margins (McKinsey)

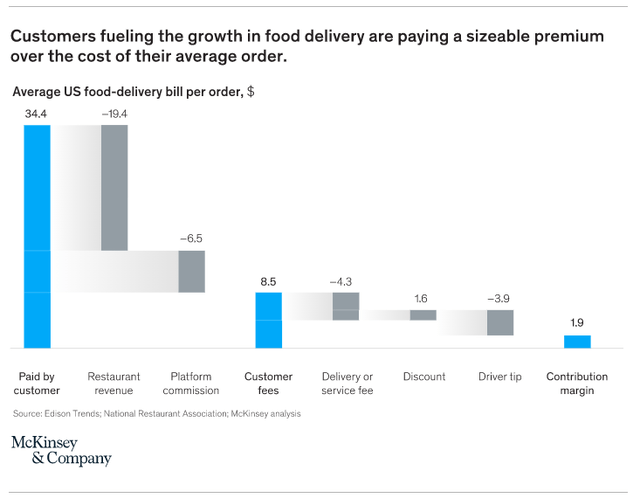

As if this isn’t enough, consumers are also being squeezed. There are many fees, and hidden fees, layered into the price paid by customers. JET is utilize clever marketing to compete against peers. Just Eat, for example, provides free delivery at many of its restaurants, yet the prices are substantially higher than what is found in the restaurant. Many consumers will be put off from consistent repeat purchases if the value proposition cannot be justified.

Customer financials (McKinsey)

Our assessment of the industry is that it is a financial mess. No party is winning, except for those receiving the substantial marketing spend, and maybe the drivers. Customers are squeezed to pay the restaurants, restaurants are squeezed to pay the drivers and fund marketing, and the delivery apps are loss-making to further fund marketing and cover overheads.

According to McKinsey “Delivery platforms are poised to generate profits at scale if they can unlock the logistics, operational requirements, and challenges of last-mile delivery”. Our view is that no business has managed to achieve this yet. They all remain in the rat race. We concur with McKinsey’s overarching assessment, although caveat that we think competition must decline. The market is not big enough for the number of players destroying each other’s profitability.

Balance sheet

Despite burning cash in recent years, JET remains well financed. The company has sufficient cash on hand to continue on its current trajectory, with no material debt due until 2024 (250m).

Valuation and Final Thoughts

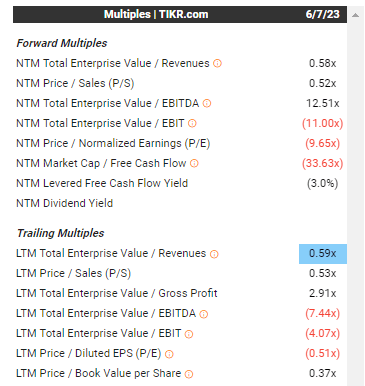

Valuation (Tikr Terminal)

JET is currently trading at 0.6x LTM revenue and 12.5x NTM Adj. EBITDA.

The sub-1x revenue value reflects the current sentiment of markets. There is little confidence around consistent profitability in the near term. This assessment looks very much warranted given the difficult trading conditions and lack of long-term outlook on how the industry will be.

Directionally, we like the business. Growth should be good and the scope for expansion is clear. Begin with food, expand to other things while innovating the overarching offering (such as Subscriptions, partnerships, etc), and continuing to offer convenience through technology.

The problem, however, is that the bottom line is a mess. We believe the route to profitability remains uncertain and is likely predicated on the development of the overarching business. Uber, for example, has developed a suite of products utilizing cross-selling and shared competencies/costs, Amazon is using Grubhub to increase the value of Prime, etc. As a standalone business, we struggle to see the value.

With this said, investors are assigning little value to revenue while there is potential for short-term price action. If a sale for Grubhub is agreed, or the adj. EBITDA of >200m is achieved, investors may perceive either or both as a positive development and price accordingly.

We see no evidence to suggest the stock is materially overvalued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here