It’s easy to follow the crowd by picking up popular names in the AI space right now. Friends and colleagues may even toast you and engage in conversation with you on this supposed hot area.

However, following the crowd rarely makes for good investment decisions over the long run. With names like C3.ai (AI) and others in the space trading at nosebleed valuations, the recent tech rally is reminiscent of the tech bubble from two decades ago.

That’s why it pays to have a contrarian mindset and focus on moat-worthy names that have fallen out of favor with the market. This brings me to Disney (NYSE:DIS), which as shown below, continues to trade rather cheaply and has fallen by 11% over the past 12 months. In this article, I discuss why DIS is an undervalued pick for potentially strong total returns over the long run.

DIS Stock (Seeking Alpha)

Why DIS?

Disney is perhaps one of those companies that need little introduction. While it may be easy to characterize the company as being a media giant, it can also be characterized as being a streaming technology giant along, and a real estate company through its vast theme parks.

Judging from Disney’s lackluster share price performance, it would seem as if the company were struggling. However, that simply doesn’t appear to be the case, with revenue growing by 13% YoY to $21.8 billion during the fiscal second quarter. Moreover, free cash flow nearly tripled, from $686 million in the prior year period to $1.99 billion in the last reported quarter.

The strong results were driven in large part by impressive performance by the theme parks, which saw 17% YoY revenue growth. This played a big role in lifting the overall revenue, as the larger media and entertainment division grew revenues by just 3%.

Headwinds to Disney include challenges in the streaming segment, with Disney+ losing 4 million customers in the last reported quarter, landing at 158 million global subscribers. However, the customer losses were largely offset by a price increase of 13% in the U.S. and this greatly helped to narrow losses in the direct-to-consumer segment from -$887 million in the prior year period to -$659 million in the last reported quarter.

Looking ahead, theme parks may continue to be a bright spot for Disney. This is reflected by comments from management during last month’s JPMorgan (JPM) media conference, noting strong numbers in recent months from Asia, including Shanghai and Hong Kong Disney, the latter of which has seen a strong rebound in visitors from Mainland China. Management also noted the opening of Zootopia as being a potential big draw for visitors in Shanghai.

Moreover, it’s widely expected that Disney will acquire Comcast’s (CMCSA) stake in Hulu, making Disney a streaming powerhouse alongside ESPN+ and the aforementioned Disney+. Those who are cynical around the streaming segment may be ignoring the potential for an ad-tier to add high incremental value, as what streaming peer Netflix (NFLX) has seen. Disney’s CEO highlighted this strategy and what it could potentially mean for the company during the recent conference call:

We plan to launch our ad tier on Disney+ in Europe by the end of this calendar year, which will drive both increased inventory and revenue over the long-term. The truth is we have only just begun to scratch the surface of what we can do with advertising on Disney+.

And I’m incredibly bullish on our longer term advertising positioning. Meanwhile, the pricing changes we’ve already implemented have proven successful and we plan to set a higher price for our ad-free tier later this year to better reflect the value of our content offerings.

Disney has also seen success with live action versions of its classic cartoons, such as ‘Cinderella’ and ‘Beauty and the Beast’. As such, I would speculate that one day it would make a live action version of the enormously popular ‘Frozen’ movie, which could see plenty of success and revamp the franchise. Most recently, ‘The Little Mermaid’ has been a success for Disney, grossing $342 million globally so far against a budget of $250 million.

Meanwhile, Disney maintains a very strong A- rated balance sheet to realize its ambitions. It carries a staggering $10.4 billion in cash and equivalents, and while its net debt to EBITDA ratio of 3.0x level is somewhat high, I would expect for the leverage ratio to trend down with further debt paydown. Since October of 2020, Disney has reduced its total debt by an impressive $13.8 billion.

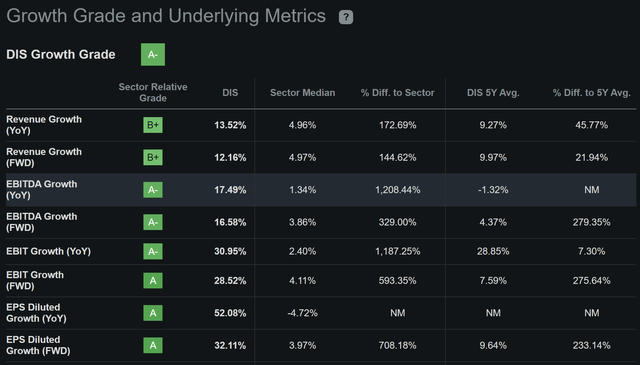

Lastly, while DIS doesn’t scream cheap at the current price of $91.93 with a forward PE of 23.1, I don’t find it to be expensive either. As shown below, DIS has had a historical 5-year EPS growth rate of 9.6%, and analysts expect 20% to 35% annual EPS growth in the 2024-2025 timeframe.

Seeking Alpha

While I believe the analyst estimates are on the optimistic side, I wouldn’t rule out EPS growth in the low-teens with the continued narrowing of streaming losses and growth in theme parks through favorable pricing and expected growth in number of visitors. As such, I believe a forward PE of 25 isn’t out of the question, resulting on a price target of $100, sitting comfortably below the consensus analyst price target of $120.

Investor Takeaway

Disney is an attractively valued long-term pick with a strong track record of success across business lines. With the company’s streaming segment poised to benefit from higher pricing and an ad-tier, and theme parks continuing to see strong demand, Disney appears well positioned for growth in the near term. As such, Disney at the current price may be a strong example of the “tried and true” over the “bold and new”, and could deliver potentially strong returns from the current price.

Read the full article here