A short squeeze, according to Wikipedia, is “an unusual condition that triggers rapidly rising prices in a stock or other tradable security. It occurs when a security has a significant number of short sellers, meaning lots of investors are betting on its price falling.”

The short squeeze starts as the price jumps higher and gains momentum as short sellers decide to exit the position and cut their losses.

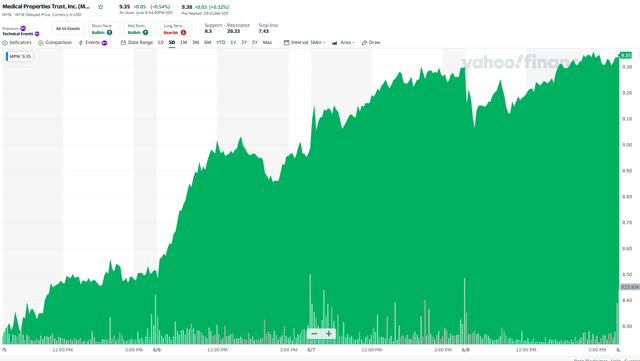

One battleground stock that has been on the “short list” for quite some time is Medical Properties Trust (MPW). I’ve written extensively on this REIT (latest article here) and it appears that there’s now momentum that could result in a possible “short squeeze”.

Yahoo Finance

Another highly sorted REIT is Digital Realty (DLR) and I’m in the process of writing a detailed update on the data center company now. Similar to Medical Properties, Digital Realty has taken on more debt and the short sellers are suggesting that a dividend cut is likely.

I’ll save that argument for my next article, since today I’m focused on another highly shorted name, Arbor Realty (NYSE:ABR)…

The Business Model

Arbor Realty is an internally managed mortgage real estate investment trust (“mREIT”) that specializes loan origination and loan servicing primarily for multifamily and single-family rental properties. The company was founded in 2003 and operates through two business segments: Their Structured Business and their Agency Business.

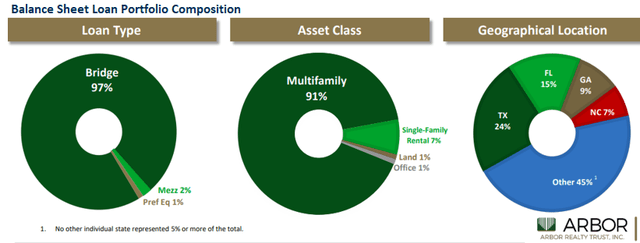

Through their Structured Business segment Arbor originates multiple types of loans that primarily consist of Bridge Loans, but also include mezzanine loans and preferred equity. By loan type, Bridge Loans makes up 97% of their balance sheet loans while Mezzanine Loans and Preferred Equity makes up 2% and 1% respectively.

By asset type, the vast majority of their loans are issued for multifamily properties at 91%, followed by Single-Family Rental at 7%, while land and office represent 1% each. Arbor’s average loan size is $19.1 million and their weighted average Loan-to-Value is 76%.

Bridge Loans are typically short-term financing that are secured by first mortgage liens which a borrower can use until long-term financing can be obtained. Borrowers often will use Bridge Loans to acquire and make improvements to the property or have the property stabilized in order to optimize lending terms on long-term financing.

In summary, ABR’s Structured Business primarily originates Bridge Loans for Multifamily properties.

ABR – IR

Agency Business

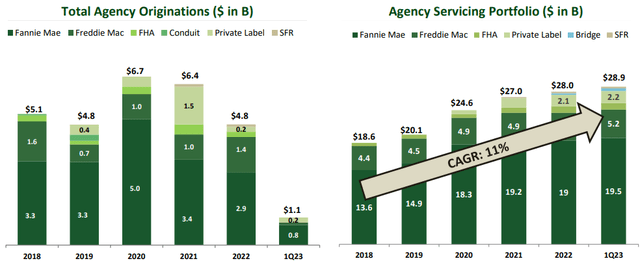

Through their Agency Business segment, ABR originates, sells and services mortgage loans for multifamily properties through government-sponsored enterprises (“GSEs”) such as Fannie Mae and Freddie Mac. Additionally, through their Agency Business, they originate and sell loans through the Housing and Urban Development (“HUD”) programs.

Arbor is one of the 25 lenders that are approved by Fannie Mae’s delegated underwriting and servicing (“DUS”) program and one of 22 organizations that are approved as a Freddie Mac multifamily lender. Arbor underwrites and sells these secured loans through the GSE and HUD programs and also sell loans through the conduit markets.

Their primary source of revenue through their Agency Business is derived from gains and fees obtained from originating and selling mortgage loans through the GSE programs but they also issue private label loans that are pooled together and then securitized and sold. Arbor retains the mortgage servicing rights on almost all the loans they originate and generate revenue through fees they receive from servicing the loans.

ABR – IR

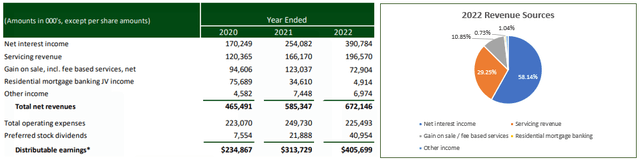

Arbor Financial Performance

Arbor’s total net revenue and distributable earnings have increased each year since 2020. In the last fiscal year, the largest percentage of their revenue was derived from net interest income at 58.14%, followed by servicing revenue at 29.25%. Gain on sales including fee-based services contributed 10.85%, while residential mortgage banking and other income generated roughly 1% of total revenues each.

ABR IR (compiled by iREIT)

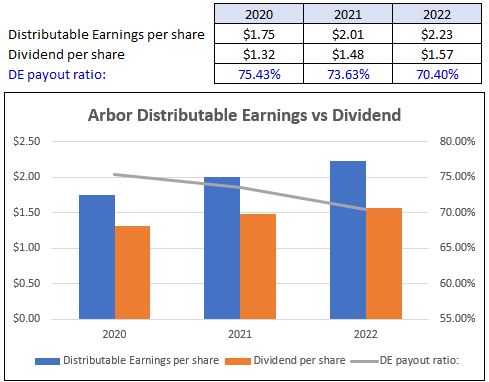

On a per share basis, both distributable earnings and the dividend have increased each year since 2020 as well. Arbor Realty has increased their dividend for 11 consecutive years and 11 out of the last 13 quarters.

Additionally, their dividend payout ratio when based on distributable earnings has improved since 2020 when it came in at 75.43% vs its payout ratio in 2022 of 70.40%.

ABR IR (compiled by iREIT)

Short Campaign by NINGI Research

NINGI issued a short report against Arbor Realty on March 14, 2023, making multiple accusations against ABR saying in “their opinion” Arbor hid a toxic portfolio of mobile homes in order to manipulate the stock price and avoid insolvency. According to NINGI, they hid this portfolio of toxic assets through real and fake holding companies for more than a decade.

Yahoo Finance

They claimed escrow funds had “evaporated overnight”, that several million dollars in maintenance for the portfolio was not accounted for, that Arbor would have been insolvent in 2011 if their portfolio was consolidated.

They also claimed that ABR’s financial statements from the last 12 years could not be trusted and that the board and the auditors “turned a blind eye” to the misstatements. There is a whole host of other accusations made against Arbor and many of them are confusing, which may or may not be intentional.

It goes on and on, but essentially what I got out of it is that Arbor Realty supposedly lied on their financial statements for over a decade, and the board and their auditor (Ernst & Young) were in on it. It would take a novel to refute all the accusations but let’s just use common sense to debunk the basic premise.

First off, there is no mention of who put together the “research report”.

Some may argue that just because we don’t know the author doesn’t mean the report isn’t true. However, I do think it matters who the author is, and I think it’s a red flag that they don’t include that information.

Is this an economics professor, or a CPA, or a CFA, or is it a person with a history of fraud?

What are their credentials?

What is their past track record?

Disclosing the author does matter…

Not only do they not disclose the author of the report, but they give very little information on who runs NINGI Research. When I went to the “about us” page, all it says is that they were founded in 2022, and after years of witnessing fraudulent behavior, NINGI Research decided to use its experience in the public interest.

What experience?

Who are these people?

Source: NINGI Research

So, we know nothing about the author and very little about NINGI Research other than they stand to gain if ABR’s stock price falls, assuming they still hold a short position.

What about Ernst & Young?

Ernst & Young is one of the largest accounting firms in the world. Reputation is everything to an auditor. Why would they “turn a blind eye” to all the misstatements over the past decade?

Why would they risk their reputation and the entire future of their firm to help Arbor stay solvent?

Why hasn’t any other research firm discovered all fraudulent behavior for more than 10 years, how did the SEC miss this for more than a decade?

Why haven’t charges been brought against Arbor and their auditor now that NINGI has come to the rescue?

What about Arbor Realty?

According to their most recent presentation, their senior management team has a significant ownership stake of 12%. Why would they want to permanently damage their company by lying on their financial statements for more than 10 years? Why would they want to go to jail over it?

ABR IR

Arbor Realty did not waste any time and came out with a press release the very next day saying that received the “purported research report” and that the report lacks merit and contains inaccuracies, misstatements, and misleading allegations.

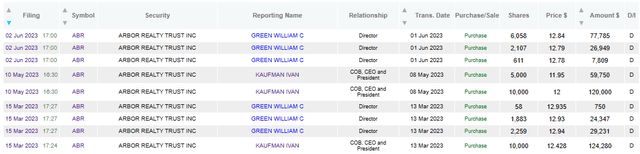

Additionally, the CEO and director of Arbor Realty went on a buying spree since the NINGI report was released. It doesn’t seem like they are too concerned about the accusations made by NINGI.

Source: Dataroma

What about the market?

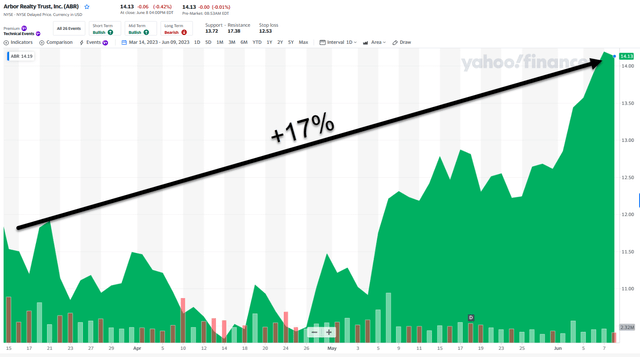

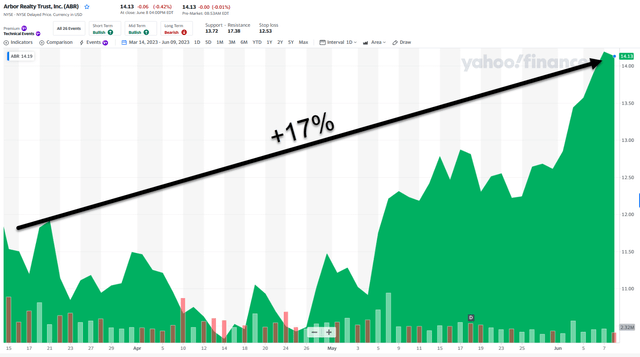

On March 14, the day the NINGI report was released, ABR’s stock opened at $13.98 and closed at $12.12 for a decline of approximately 13%, but since that time the stock has recovered to $14.13 per share, higher than before the report was released.

It does not seem like the market is in agreement with NINGI Research in its assessment that ABR will have a median downside of 52%, or a worst case scenario that the stock will have a downside of 67%.

Yahoo Finance

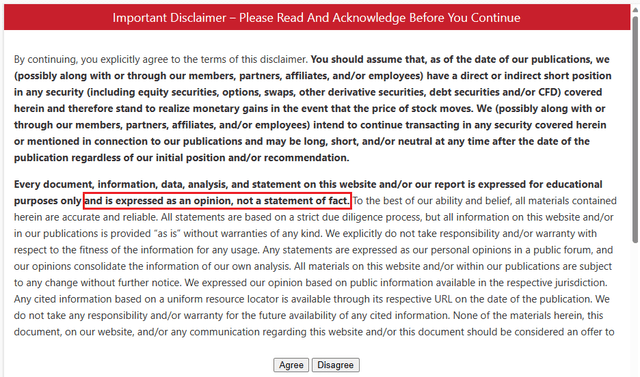

This seems to me like the short report got the attention due to the severity of accusations, rather than the merits behind their claims, of course this is just my humble opinion. Below is the disclaimer that pops up when you go to their site.

Source: NINJI Research

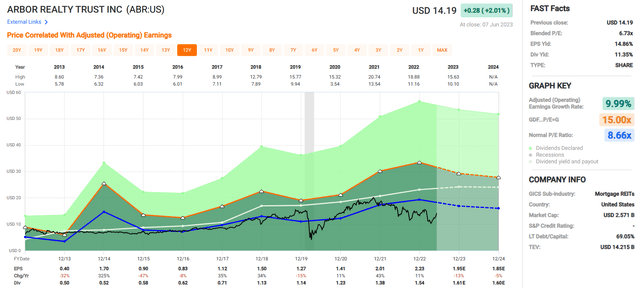

Arbor Realty Trust’s adjusted operating earnings have an average growth rate of 9.99% since 2013 and they have increased their dividend by an average of 20.41% over the same period.

They pay an 11.35% dividend yield that is well covered by their distributable earnings and are currently priced at a P/E of 6.73x which compares favorably to their normal P/E ratio of 8.66x.

In our opinion, we believe that the report issued by NINGI was superficial and intelligent REIT investors who did not get spooked by the allegations are certainly entitled to take a victory lap. At iREIT we rate ABR a Tier 2 rating.

FAST Graphs

I plan to interview Arbor’s CEO in a few days for iREIT on Alpha members.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here