All values are in CAD unless noted otherwise.

Pizza Pizza Royalty Corp (OTCPK:PZRIF) (TSX:PZA:CA) (“Royalty Corp”) earns royalty income tied to the gross sales of two quick service restaurant chains in Canada. It receives 6% from Pizza Pizza (primarily based in Ontario) and 9% from Pizza 73 (primarily based in Alberta) restaurants in the royalty pool. The pool is adjusted for the net new restaurant openings on the first of each calendar year. For 2023 the pool comprises 644 Pizza Pizza and 99 Pizza 73 locations, a net increase of 16 restaurants from the 2022 pool.

April of this year marked the introduction of the PZA Pizzeria restaurants in Mexico, with plans to have five operational locations by the end of 2023. Royalties from this source will be 12.5% and will commence in September 2024, 18 months from the first openings. With no immediate impact to the revenue, our analysis will focus on the domestic sources of income noted in the first paragraph of this piece.

The Royalty Corp holds a 76.1% interest in a partnership that owns the brands noted above and associated trademarks. The royalties, net of the partnership expenses, flow in the form of distributions to the Royalty Corp, which in turn distributes its net earnings to its shareholders. The corporation’s expenses are few, namely administrative, interest on debt and income tax.

Prior Coverage

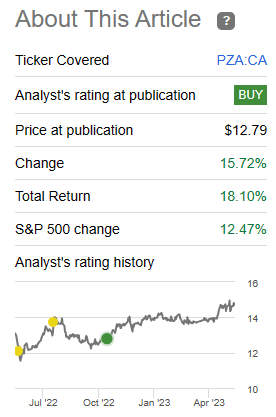

We have covered this company several times on this platform, with the most recent being in November of last year. While we are long term holders of the stock, we have at times advised against buying when we thought it was overvalued. In November though, we raised our buy under price and rated this royalty corporation as a buy.

At close to 14X next year’s estimated earnings, the company is just getting inside our buy zone. We would now put that number at under $13.00 per share. The irony here is that the company is relatively less undervalued considering the bargains that are popping up on both sides of the border. Our thesis is based on inflation moderating a bit from here and recession not offsetting nominal sales growth. Downside risk is if the recession turns out to be severe and Pizza Pizza moves to an 11X multiple. We’re still giving this a Buy as it trades currently at $12.80 per share, and we think investors will likely get a 10-11% total return over the next 12 months from here.

Source: Pizza Pizza: Mouthwatering Yield And Third Dividend Hike This Year

It delivered beyond our expectations and within a shorter timeframe.

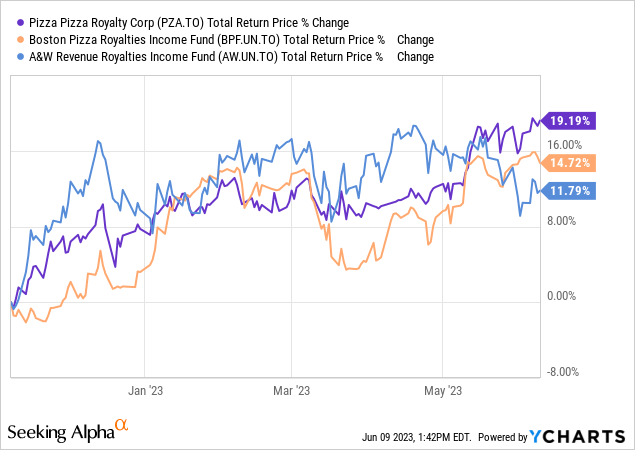

Seeking Alpha

Beating Boston Pizza Royalties Income Fund (OTC:BPZZF) and A&W Revenue Royalties Income Fund (OTC:AWRRF), the other two restaurant royalty plays that we follow.

It even beat the S&P 500 (SPY), with zero mentions of AI anywhere on its website. Trading at $14.78, it is well over the buy under price suggested in our previous piece. Let’s review the Q1 results to determine if another increase to our buy under price is warranted.

Q1-2023

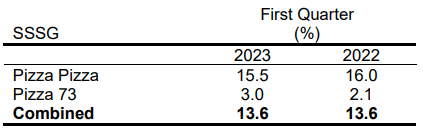

Year over year same store sales grew 13.6% with the Pizza Pizza Brand continuing to lead the charge.

Q1-2023 MD&A

We have called this royalty play an inflation hedge in the past, and one of the drivers of the same store sales increase was just that. The restaurants were able to pass on the labor and commodity cost increases to their pizza loving customers. To add to that, a few locations that were still closed last year due to pandemic related restrictions, were operational in 2023 further boosting sales. Point to note is that while the same store sales are higher than Q1-2022, they are lower compared to the balance three quarters of last year. This is in line with management expectations as the first quarter has generally been the slowest, with Q4 being the strongest.

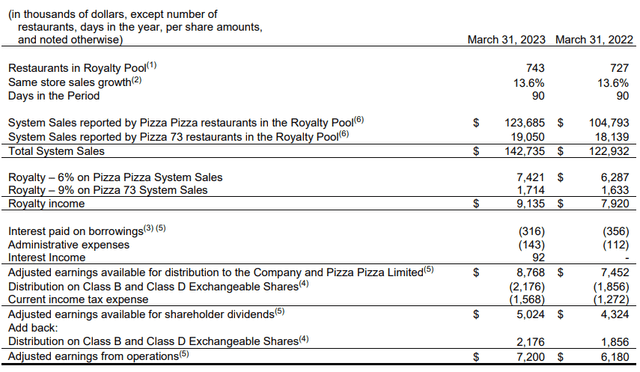

The overall year over year royalty numbers showed the same upward direction aided by the reasons noted above, higher number of restaurants in the pool, and strong promotional activities.

Q1-2023 MD&A

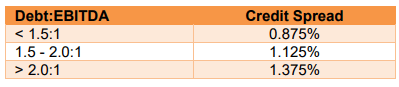

The higher administrative expenses are partly due to timing of the annual shareholder meeting expense, which was included in the Q2 numbers last year. Interest is paid on a $47 million non revolving credit facility. The rate is fixed via swaps at 1.81% until 2025 plus a credit spread. The credit spread is tied to the debt to the rolling four quarter EBITDA.

Q1-2023 MD&A

The improved EBITDA numbers led to a lower spread for Q1-2023 (0.875% versus 1.125%) and therefore the lower interest expense for the Royalty Corp.

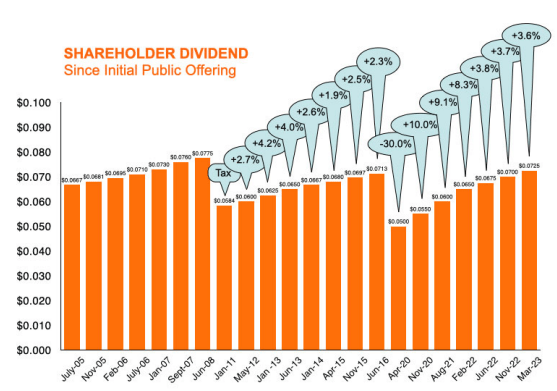

Dividends

The company has been on a dividend hike spree since the cut in April 2020.

Q1-2023 MD&A

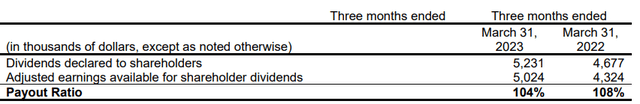

This is expected with the sales growth that we have witnessed with the ceasing of the COVID-19 related restrictions. The aim of Royalty Corps generally is to payout all of its earnings, after establishing a reasonable cash reserve. Q1’s payout was 104%,

Q1-2023 MD&A

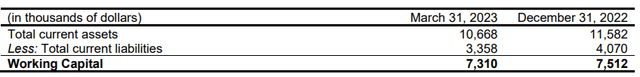

which was a function of the first quarter being slower than the rest of the year combined with the company policy of keeping the dividend amount the same on a monthly basis. The management expects this to even out over the balance quarters. The greater than 100% payout in Q1 resulted in a slight reduction in the working capital balance.

Q1-2023 MD&A

The management was not too concerned with the decrease and said so during the earnings call.

the Company believes that there is sufficient cash flow to service all obligations as they fall in and we will continue to monitor sales and royalty income to determine when additional dividends may be warranted.

Source: Q1-2023 Earnings Call Transcript

Valuation and Verdict

This Royalty Corp continues to deliver quarter after quarter and the most recent one was no different. The company has made up all lost ground on the back of price hikes and volumes have also been pretty solid. Coupled with strong dividend hikes, Pizza Pizza has put the doubters to shame. We are though reaching some key inflection levels. Canadian economy is beginning to feel the barrage of rate hikes including a “surprise” one this week. Household debt levels are high and a lot more Canadian mortgages are floating than in the US. So far a boisterous job market has allowed wage hikes to take the pressure off these increased interest costs. But we think that likely changes in the months ahead. The odds of Canada dodging a recession while we see US already within one (based on Q4-2022 and Q1-2023 GDI numbers) are slim to none. Pizza Pizza will feel this too and at present it is priced slightly on the higher side for our comfort at 15X expected earnings. You could overlook this multiple in a zero interest rate era, but with risk-free rates at 5%, we think a lower multiple is almost inevitable. The yield is 5.8% but Pizza Pizza will cut it immediately if earnings decline. They are not going to lever up to appease the dividend groupies. We are hence moving this to a “Hold/Neutral” rating. We would likely move to a “buy” under $13.00 and a “Sell” over $16.00.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here