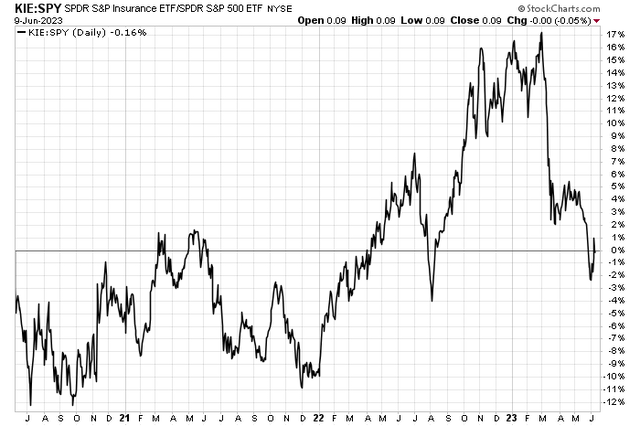

Insurance stocks were majors winners last year. 2023 has brought about a big trend change, though. The SPDR S&P Insurance ETF (KIE) has underperformed the S&P 500 by some 13 percentage points YTD, hallmarked by the March domestic regional banking crisis. The industry ETF took another relative leg lower in May as U.S. mega-caps dominated.

There has not been much of a relief rally in KIE vs SPY, but I see upside potential in one of the clearest winners in insurance: Unum Group (NYSE:UNM).

Insurance Stocks Injured in 2023: Unum Bucks The Trend

Stockcharts.com

According to Bank of America Global Research, UNUM, up 13% on the year, is a leading provider of disability income insurance and ranks among the world’s leading special risk insurers. Unum has a strong market share in the U.S. and U.K. Unum has a large legacy book of long-term care (LTC) and individual disability but has put these businesses in runoff. The company distributes via captive sales representatives, brokers, and sales consultants.

The Tennessee-based $9.0 billion market cap Insurance industry company within the Financials sector trades at a low 6.5 trailing 12-month GAAP price-to-earnings ratio and pays a 2.9% dividend yield, according to The Wall Street Journal.

In early May, Unum reported a solid EPS beat. With Q1 EPS of $1.87, earnings were better than expected while the insurer missed just modestly on revenue. Helping the stock, however, was management’s full-year 2023 guidance increase. After-tax adjusted operating income per share is now seen in the +20% to +25% range, up substantially from its prior +8% to +12% range.

Better than forecast results in its Group Disability and Supplemental & Voluntary segments drove profits. While interest rate sensitivity is a risk the Group Disability segment continues to deliver upside results while its valuation is attractive. In another bullish signal to the market, UNM raised its dividend by more than 10% just a few weeks ago.

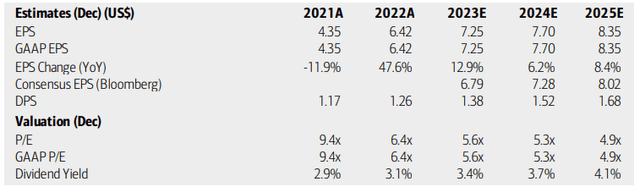

Speaking of valuation, analysts at BofA see EPS troughing near $6 this year. Per-share profits are then forecast to rise at a respectable rate in 2024. The Bloomberg consensus forecast is slightly more optimistic compared to the BofA projection. Dividends, meanwhile, are expected to rise to $1.44 despite some earnings volatility over the coming quarters. With a price-to-earnings multiple at exceptionally low levels considering upcoming EPS growth, I remain bullish on Unum. Investors are paid to wait given the roughly 3% yield, too.

Unum: Earnings, Valuation, Dividend Forecasts

BofA Global Research

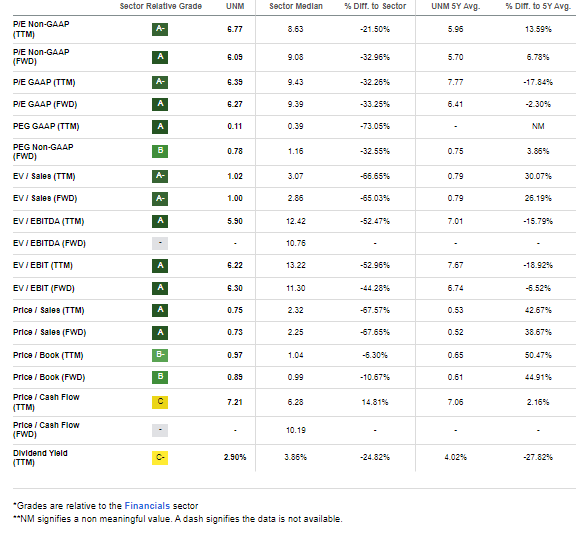

While UNM trades near its 5-year average forward P/E and PEG, those are at steep discounts to the sector medians. I assert that the firm warrants a multiple closer to that of the sector, so if we apply an 8 P/E and $7 of next-12-month EPS, then shares should trade near $56. Perhaps you could discount that slightly based on UNM’s P/E ratio history, but I like the outlook.

UNM: Strong Valuation Metrics

Seeking Alpha

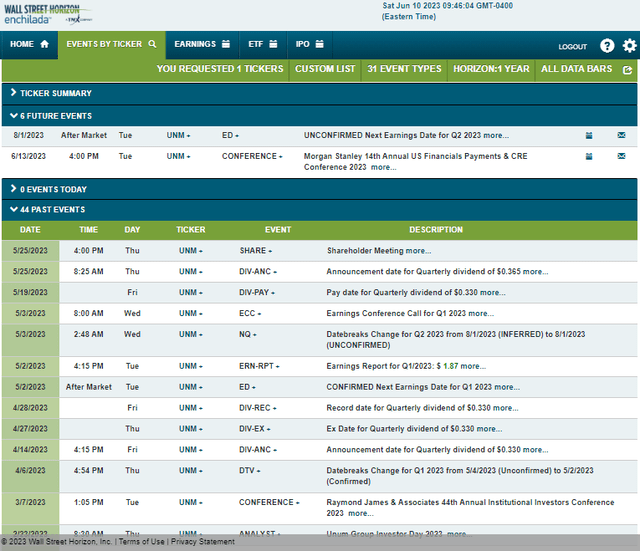

Looking ahead, corporate event data provided by Wall Street Horizon an unconfirmed Q2 2023 earnings date of Tuesday, August 1 AMC. Before that volatility catalyst, Rick McKenney, President, CEO, and Steve Zabel, EVP, CFO, are slated to present at the Morgan Stanley 14th Annual US Financials Payments & CRE Conference 2023 in New York City from June 12 to 14.

Corporate Event Risk Calendar

Wall Street Horizon

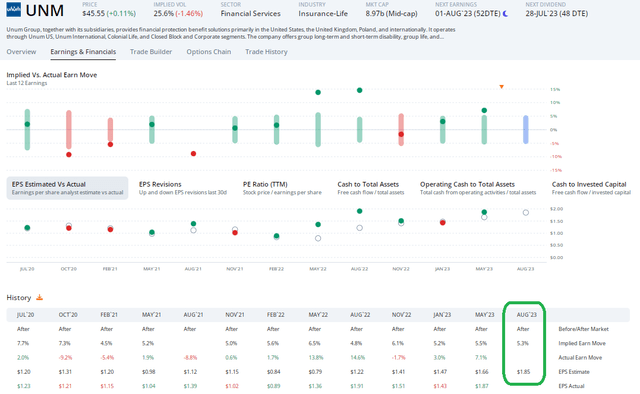

The Options Angle

Digging into the Q2 earnings report and its expectations, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $1.85 which would be a 3% drop from $1.91 of per-share profits earned in the same quarter a year ago. Unum has topped analysts’ expectations in five of the past six quarters, and the stock price has rallied post-earnings in six of the last seven instances. So, those are bullish historical trends.

This time around, the options market has priced in a modest 5.3% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the August report. Implied volatility is low right now – just 26% per ORATS – and shares have not budged much after earnings in the last three quarters, so going long the straddle here is not worthwhile in my view.

UNM: Positive Earnings Reaction History

ORATS

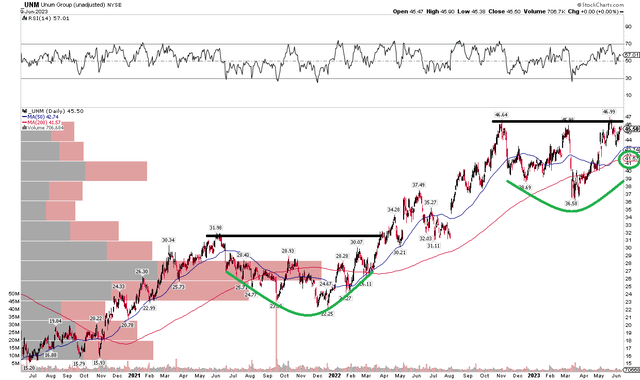

The Technical Take

UNM faked out investors around the regional banking crisis earlier this year. Notice in the chart below that shares broke down through $39 to fall under the rising 200-day moving average. An old gap from 2022 was not filled, however, and the bulls took the stock to all-time highs, albeit by a small margin, a few weeks ago.

Thus, the $46 to $47 range is key for UNM to bust through. A rally above that resistance zone would portend a measured move price target to about $57 based on the $10 range over the last 10 months. Long here with an expectation of a breakout above $47 looks good. Also notice how the long-term 200-day moving average is upward-sloping, further indicating that the bulls are in charge.

UNM: Eyes On A Bullish Upside Breakout

Stockcharts.com

The Bottom Line

I reiterate my buy rating on Unum. The stock remains undervalued while the technical setup appears poised for an all-time high before long.

Read the full article here