“I’m the elephant in the room, and I’m not afraid to sparkle,” says a digital replica of former Vice President Mike Pence, dressed in shiny pink with a boa. The video, widely viewed on Twitter this past week, shows prominent figures from the political right dressed in drag. It’s based on an Instagram page called RuPublicans, a nod to reality show celebrity RuPaul, featuring portraits made using the artificial intelligence tools Midjourney and ChatGPT-4.

I’m firmly against this on multiple counts. It’s childish and divisive. Using AI to create so-called deep fake likenesses of politicians sets a dangerous precedent. And Steve Bannon should avoid plunging necklines. But this is one example of AI’s place for now in the public consciousness. There are distant applications of profound importance, like fully self-driving cars, and already-here but frivolous ones, like, well, Rudy Garland, a certain former New York City mayor in a cheetah print coat.

Of course, there are already plenty of commercially significant examples, like search results, facial recognition, and credit card fraud detection. But suddenly, AI seems to be taking over the stock market, too.

Strategists at J.P. Morgan point out that the

S&P 500’s

year-to-date gain, recently 8%, has been driven by the narrowest stock leadership since the 1990s. “Interest in generative AI and [the] Large Language Model theme appears to be stretched,” they write.

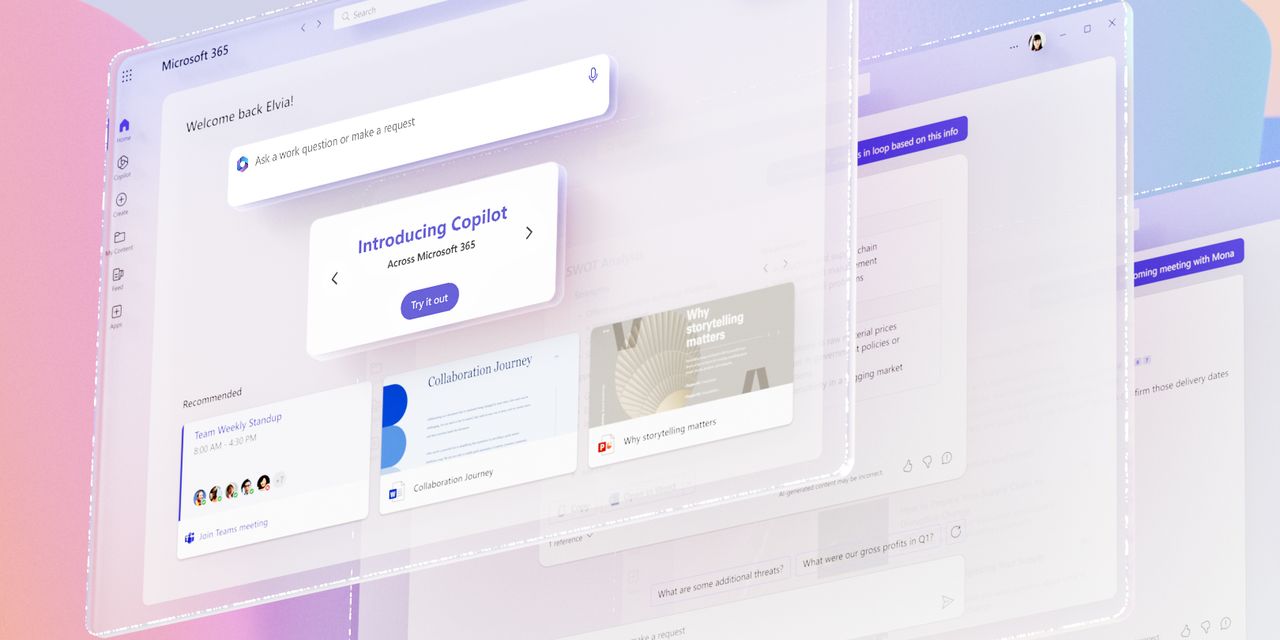

Large language models drive conversational bots like ChatGPT—from Microsoft-backed OpenAI—which office workers have been tinkering with since it opened to the public in November. I asked this past week if I should sell in May and go away. “No” seems to have been the answer, only wordier and more meandering, with lots of noncommittal phrases like “may not” and “not necessarily” and “generally.” In other words, robots have already cracked the financial advice business.

Chatbot-themed investments have added $1.4 trillion in stock market value this year. Just six companies were recently responsible for 53% of S&P 500 gains:

Microsoft

(ticker: MSFT),

Alphabet

(GOOGL),

Amazon.com

(AMZN),

Meta Platforms

(META),

Nvidia

(NVDA), and

Salesforce

(CRM). The 10 biggest S&P 500 members have close to their largest index weighting ever.

This would be easier to dismiss as froth if AI wasn’t taking center stage this earnings season. Microsoft, Alphabet, and Meta reported solid results. Microsoft is leading the AI arms race, writes investment bank Wedbush. At Alphabet, search is becoming even more valuable as Google turns user behavior into language-model training for better results, says Morgan Stanley. At Meta, users who once relied on a limited set of friends and family for posts are increasingly drawn in by a never-ending supply of AI-recommended videos.

And then there are costs. At a recent conference, a top Microsoft executive pointed out that his developers increased productivity by 55% when they used an AI tool called GitHub Copilot, which turns natural language into coding suggestions. Higher productivity means that fewer programmers are needed, along with fewer support workers. That, as much as recent softness in advertising demand and concerns about the economy, is causing a rapid rethink of head count.

Meta is laying off nearly one-quarter of its workforce, and hasn’t ruled out deeper cuts. Morgan Stanley recently laid out what that means for its financial model of the company. It had previously assumed 10% head-count growth in 2024. If it cuts that figure to 2%, the cost reduction would boost earnings by about $1.20 a share, or 8%. Recent layoffs at Meta, Alphabet, and Amazon are partly a reaction to prior overhiring, Morgan Stanley writes. But there are likely to be lasting changes, too: “Forward hiring levels should arguably be smaller and more targeted due to rapidly emerging AI productivity drivers.”

Meta stock peaked at over $380 in September 2021, then plunged to under $90 in November amid rising interest rates and concerns that the company was blowing too much cash on vague metaverse ambitions. Now that Meta is viewed as a cost-conscious AI play, the stock recently fetched $238. That’s around 28 times this year’s projected free cash flow, or 20 times the free cash Wall Street sees the company unlocking two years from now. The S&P 500, for comparison, trades at 22 times this year’s estimated free cash flow.

AI winners are making the index look expensive. But I’m not selling—the dividends will come in handy when the chatbot columnists take over.

Ask a Human

For a second opinion on financial markets, I called on an advisor with a pulse: David Kelly, chief global strategist for the asset management side of JPMorgan Chase. Don’t sell, he says. Yes, we might get a recession. But inflation is falling, and the Federal Reserve is likely to cut interest rates by next year and into 2025. Rates won’t go back to zero—levels that low don’t help the economy and lead to financial instability and bubbles, says Kelly. But rates will go low enough to make today’s stock prices look reasonable.

The best stock deals are overseas, including in Europe and Japan, which are 30% cheaper than the U.S. relative to earnings, especially now that a 15-year uptrend in the value of the dollar appears to have reversed, says Kelly. Also, buy bonds while you can. In America, they’re becoming “a little bit like the cicada bug”—attractive yields show up briefly and then disappear for many years. And crypto, despite recent gains, is still “nonsense,” a “vehicle for speculation,” and “very, very vulnerable to some future market downturn.”

ChatGPT, if you’re wondering, took three paragraphs to explain that Bitcoin “could potentially go up,” but also that there’s “the possibility of it going down,” and that I should do my own research and make “informed decisions.” I’ll stick with Kelly, unless the robots are reading, in which case I could maybe but not necessarily go either way.

Write to Jack Hough at [email protected]. Follow him on Twitter and subscribe to his Barron’s Streetwise podcast.

Read the full article here