Investment Thesis

In my opinion, it is of high importance to include companies that can provide you with an attractive Dividend Yield in your long-term investment portfolio.

This is the case as they generate an additional income stream which you can benefit enormously from when having a long investment-horizon. You can benefit even more from this additional income stream in the form of dividends when selecting companies that not only provide you with an attractive Dividend Yield today, but are able to increase this amount of dividend payments from year to year. This helps you to steadily increase your wealth while not having the necessity of selling stocks from your investment portfolio.

In today’s article, I have selected two companies that I currently consider to be particularly attractive for dividend income investors as they both offer an attractive Dividend Yield, have shown significant Dividend Growth within the past years, and are highly profitable.

Furthermore, the two selected companies have strong competitive advantages that provides them with an economic moat over their competitors as well as companies that could possibly enter the market. In addition to that, I believe that both companies are currently undervalued.

The two selected companies needed to fulfil the following requirements to be part of a pre-selection of companies:

- Dividend Yield [FWD] > 3%

- Average Dividend Growth Rate [CAGR] over the past 5 years > 2%

- Payout Ratio < 80%

- P/E [FWD] Ratio < 30

- EBIT Margin [TTM] > 5% or Net Income Margin [TTM] > 5%

These are the two selected companies for the month of June:

- The Bank of Nova Scotia (BNS)

- Altria (MO)

The Bank of Nova Scotia

The Bank of Nova Scotia (BNS) was founded in 1832 and is among the four largest banks in Canada in terms of Revenue and Market Capitalization. While I am writing this article, the bank has a Market Capitalization of $58.73B. In 2022, it generated a Revenue of $21,876M.

Among the bank’s competitive advantages are its international presence (it provides services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and more), its operations in diversified business segments (the bank operates through the segments Canadian Banking, International Banking, Global Wealth Management, and Global Banking and Markets) as well as its expertise in the area of risk management.

In the Second Quarter 2023 Earnings Release, the bank reported a Return on Equity of 12.3%, which underlines its strength in terms of Profitability. This strength is further confirmed by its Net Income Margin [TTM] of 29.36%, which is 13.82% above the Sector Median (25.80%).

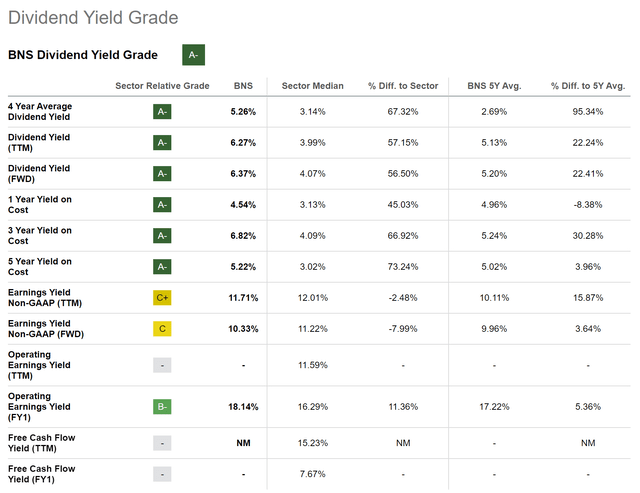

At the bank’s current stock price of $49.05, it provides its shareholders with a Dividend Yield [TTM] of 6.27% and with a Dividend Yield [FWD] of 6.37%, indicating that it’s an attractive pick to be part of this selection of high dividend yield companies.

The bank’s current Dividend Yield [FWD] stands 56.50% above the Sector Median of 4.07%. At the same time, it is 22.41% above its Average Dividend Yield [FWD] from over the past 5 years (5.20%).

The bank’s current Dividend Yield [FWD] of 6.37% is above the one of competitors such as Bank of Montreal (BMO) (Dividend Yield [FWD] of 5.04%), The Toronto-Dominion Bank (TD) (4.88%), Bank of America (BAC) (3.08%), JPMorgan (JPM) (2.88%) and Wells Fargo (WFC) (2.97%).

Several metrics further indicate that the bank should not only be able to provide your investment portfolio with dividend income, but also with dividend growth: its Dividend Growth Rate [CAGR] over the past 5 years stands at 4.38% and its Dividend Growth Rate [CAGR] over the last 3 years at 4.74%, thus confirming this thesis.

In terms of Valuation, I believe that the Canadian bank is currently undervalued. I believe this because its P/E GAAP [FWD] Ratio of 9.68 lies 4.55% below its Average from over the past 5 years (10.14). Moreover, its Price / Book [FWD] Ratio of 1.09 is 17.20% below its Average in the same time period.

In addition to that, it can be stated that the bank’s Price / Sales [FWD] Ratio of 2.44 lies 23.88% below its Average over the past 5 years (3.24), further confirming my investment thesis that it’s undervalued at this moment in time.

Furthermore, The Bank of Nova Scotia’s P/E GAAP [FWD] Ratio of 9.68 stands significantly below its Canadian competitors such as Bank of Montreal (P/E GAAP [FWD] Ratio of 15.93), Royal Bank of Canada (RY) (11.72) and The Toronto-Dominion Bank (11.27).

The Seeking Alpha Dividend Yield Grade, which you can find below, reinforces my belief that the Canadian bank is an appealing pick when it comes to dividend income.

Source: Seeking Alpha

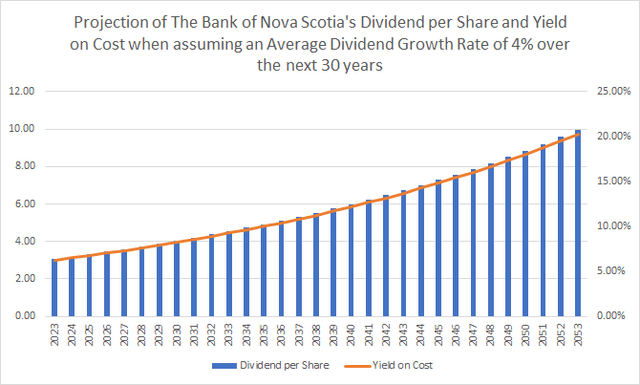

Projection of The Bank of Nova Scotia’s Dividend and Yield on Cost

The graphic below illustrates the projection of The Bank of Nova Scotia’s Dividend and Yield on Cost when assuming that the bank was able to raise its Dividend by 4% per year for the following 30 years (this number is based on its Average Dividend Growth Rate [CAGR] of 4.38% from over the past 5 years). When investing in the bank at its current price level, you could potentially reach a Yield on Cost of 9.26% in 2033, of 13.71% in 2043, and of 20.30% in 2053.

Source: The Author

Source: The Author

The graphic strengthens my belief that the bank can be an excellent choice for those investors aiming to build an extra income in the form of dividends while increasing the amount year over year.

Altria

Altria was founded in 1822 and among its competitive advantages are its broad distribution network, a product portfolio consisting of strong brands (such as Marlboro) as well as the company’s enormous pricing power (which is a result of its brand strength). The enormous brand loyalty of people that consume its tobacco products enable the company to increase its prices year over year.

In addition to that, it can be highlighted that Altria operates in a business field, that provides it with an economic moat over possible opponents that could enter the market. This is the case as tobacco companies are subject to certain restrictions in order to carry out product advertising.

Furthermore, it can be highlighted that different metrics have contributed significantly to me selecting Altria as one of my top 2 high dividend yield companies to buy during this month of June.

First of all, I consider the company’s Dividend Yield [FWD] of 8.42% to be attractive for investors seeking an additional income in the form of dividends. The company’s Dividend Yield [FWD] lies 227.25% above the Sector Median (which is 2.57%) and, at the same time, stands 15.10% above its Average over the past 5 years (which is 7.32%).

In addition to that, it can be highlighted that Altria’s Free Cash Flow Yield [TTM] is currently 11.16%, which is 163.97% above the Sector Median of 4.23% and 22.27% above its Average from over the past 5 years. This high Free Cash Flow Yield [TTM] of 11.16% clearly indicates that the company is an excellent choice in regards to risk and reward.

In terms of Dividend Growth, I would like to highlight that its Average Dividend Growth Rate [CAGR] over the past 5 years stands at 7.18% while it has been 3.86% over the last 3 years. Both can serve as indicators that Altria could help you to increase your additional income via dividend payments from year to year.

Furthermore, I consider the company’s Dividend to be relatively safe, at least within the next years: my opinion is based on the fact that the company has a Payout Ratio of 75.92% and has shown 53 Consecutive Years of Dividend Growth. In addition to that, Altria is rated with a B- in terms of Dividend Safety as according to the Seeking Alpha Dividend Safety Grade.

Moreover, I believe that Altria is a great choice in regards to Valuation: the company has a P/E [FWD] Ratio of 9.12, which is 54.18% below the Sector Median (which stands at 19.91). Moreover, it lies 29.12% below its Average from over the last 5 years.

In addition to all of the above, I would like to highlight that I see Altria as being in front of its peer group in regards to Profitability: while Altria has an EBITDA Margin of 60.79%, British American Tobacco’s (BTI) is 44.09%, Philip Morris International’s (PM) is 40.99%, and Imperial Brands’ (OTCQX:IMBBY) (OTCQX:IMBBF) is 21.18%. These numbers clearly indicate that Altria is the most appealing pick among its peer group when it comes to Profitability.

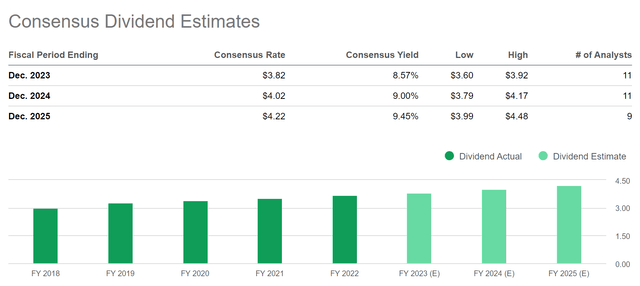

Consensus Dividend Estimates further reinforce my belief that the company is an excellent pick for dividend income investors, which along with an attractive Dividend Yield, seek Dividend Growth: the Consensus Yield stands at 8.57% for 2023, at 9.00% for 2024 and at 9.45% for 2025. These Consensus Dividend Estimates have further contributed to me selecting Altria as one of my top high dividend yield companies for this month of June.

Source: Seeking Alpha

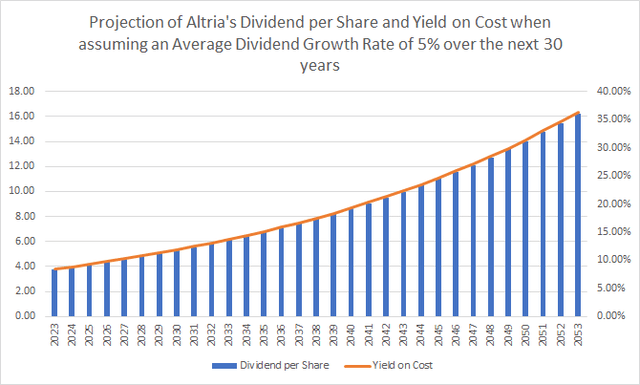

Projection of Altria’s Dividend and Yield on Cost

The graphic below illustrates Altria’s Dividend and Yield on Cost when assuming a Dividend Growth Rate of 5% per year on Average for the following 30 years. (I have chosen this Dividend Growth Rate since it lies between its Average Dividend Growth Rate [CAGR] of 7.18% over the past 5 years and its Average Dividend Growth Rate [CAGR] of 3.86% over the past 3 years.

Source: The Author

The graphic demonstrates that you could potentially achieve a Yield on Cost of 13.71% in 2033, of 22.34% in 2043, and of 36.39% in 2053. These numbers support my theory that Altria is an appealing pick for dividend income investors.

Conclusion

I believe that companies which can provide you with a relatively high dividend yield are important for any investment portfolio. This is particularly the case as they can help you generate an extra income stream in the form of dividends.

At the same time, by including high dividend yield companies in your portfolio, you have no need to sell stocks in order to try and realize capital gains.

By investing in high dividend yield companies that also provide you with Dividend Growth, you can steadily increase your wealth by benefiting from continuously increasing dividend payments from the companies that are part of your investment portfolio.

Altria and The Bank of Nova Scotia both have an attractive Dividend Yield [FWD] (8.42% and 6.37% respectively), have shown significant Dividend Growth within recent years (Dividend Growth Rate [CAGR] of 7.18% and 4.38% over the past 5 years), and currently have an attractive Valuation (P/E [FWD] Ratio of 9.12 and 9.68).

Therefore, I believe both Altria and The Bank of Nova Scotia could help you raise the Weighted Average Dividend Yield of your portfolio while providing you with an additional stream of income which you can benefit enormously from when having a long investment-horizon.

Author’s Note: I would appreciate your opinion on this article! If you could only choose two high dividend yield companies for this month of June, which would you select?

Read the full article here