Policy path expectations

The FOMC is set to make the interest rate decision at the June meeting next week on Wednesday. Based on the Federal Funds futures, the market expects the Fed to:

- pause in June

- hike at the subsequent meeting in July by 25bpt to 5.25-5.50%

- pause in September

- cut in November by 25bpt back to 5-5.25%

- pause in December

- continued cutting in 2024 down to 3.50-3.75%

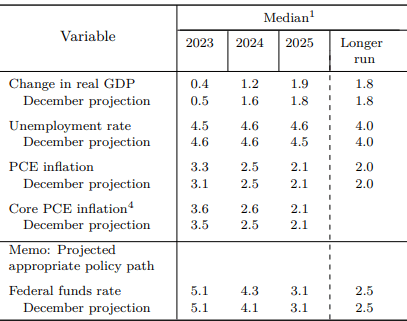

Updated Summary of Economic Projections

The Fed is also set to publish the quarterly Summary of Economic Projections. These were the projections from the March FOMC meeting:

The Fed SEP

The market expectations are now consistent with the Fed for 2023 at 5.1% expected Federal Funds rate. However, the market is still expecting deeper cuts in 2024 (3.66% vs 4.3%). Note, the Fed boosted the Federal Funds rate expectations from 4.1% to 4.3% at the March meeting.

At the March meeting, the Fed also 1) downgraded GDP growth for 2023 and 2024, and 2) upgraded core PCE inflation expectations for 2023 and 2024.

In other words, the Fed saw slower growth and higher inflation at the March meeting.

What will the Fed do and project next week?

If the Fed gets the same data as the public, the Fed will face the following:

- The May unemployment rate is at 3.7%, while the Fed’s projection for 2023 is 4.5% – not even close.

- The core PCE has been “stuck” at 4.6-4.7% since Nov 2022, with the increase in April from 4.6% to 4.7%, while the InflationNowcast sees it at 4.75% in May, and the Fed’s projection is 3.6% for 2023 – not even close.

Obviously, based on these two data points, the labor market is more resilient, and the core PCE inflation is much more persistent (sticky) than the Fed expected.

Thus, the Fed needs to hike next week at the June meeting, despite the market expectations of a pause.

Further, the Fed is likely to further upgrade the core PCE inflation expectations to 3.8% (based on the staff projections from the May meeting), and increase the expected Federal Funds rate expectations to 5.6%, which would also signal the hike in July.

Waiting for the lagged effect of the previous hikes

The Fed hiked from 0.1% in March 2022 to 5.1% in May 2023 – this has been one of the most aggressive interest hike cycles ever. In addition, the Fed has been shrinking its’ balance sheet, which increased the real interest rates and pushed the nominal 10Y yield higher.

Thus, the market and the Fed are waiting for the lagged effects of this monetary policy tightening on the economy. Thus, some Fed members prefer to pause now until more data becomes available.

The assumption is that higher short term interest rates would cause lower consumption, which would increase the unemployment rate modestly and gradually lower inflation. In addition, higher long-term rates would cause a modest correction in the housing market via the higher mortgage rates, which would also translate in lower consumption and lower inflation.

These are the real effects on market rates:

- The interest rate on a credit card increased from 14% in Feb 22 to 20% in Feb 23, which increased the monthly payment on 10K balance to be paid in 24 months from $480 to $508.

- The 60-month auto loan increased from 4.52% in Feb 22 to 7.48% in Feb 23, which increases the payment on a 30K loan from $560 to $600.

- The 30Y mortgage rate increased from 3.1% to 6.8%, which increased the $300K mortgage payment from $1281 to $1955.

So, let’s state the obvious, as long as people have jobs, they will continue to consume – the increase in the monthly payment is trivial, for the credit cards and auto loans.

Yes, housing is a problem, the increase in the mortgage payment is significant. But the sellers don’t have to sell as long as they have jobs, and the buyers can rent, which could actually boost the rent prices.

The point is, the lagged effects are delayed due to the resilient labor market. Thus, the Fed cannot pause until the damage to the labor market is obvious at the minimum 4.5% unemployment rate – and we are nowhere near that point.

Yes, there are signs that the labor market is weakening, the claims just spiked to 261K, and the temporary jobs have been declining. But, unfortunately, the Fed cannot stop until the damage becomes obvious – they have to see the actual monthly losses in jobs and the spike in the unemployment rate before declaring the victory over inflation.

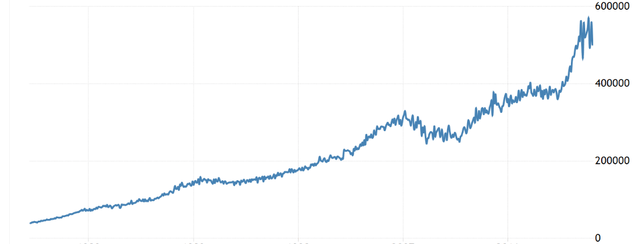

The wealth effect and the FOMO crowd

The Fed can manage consumption by inflating/deflating asset prices. The covid-related QE program inflated both housing and stocks, which contributed to the inflationary spike via the wealth effect.

Over the last year, the Fed has been trying to deflate asset prices by implementing a QT since March 2022 – that’s balance sheet contraction or a reduction in liquidity. So, what are the results:

- The average new home price spiked from 400K in 2021 to 550K in 2022, and now still above 500K, which is over 25% higher compared to 2021. Consequently, the consumer has a record home equity, and that’s boosting the consumption. The Fed has not been able to cause a meaningful decrease in home prices yet. A much deeper correction is needed to dent consumption and lower inflation.

Trading Economics

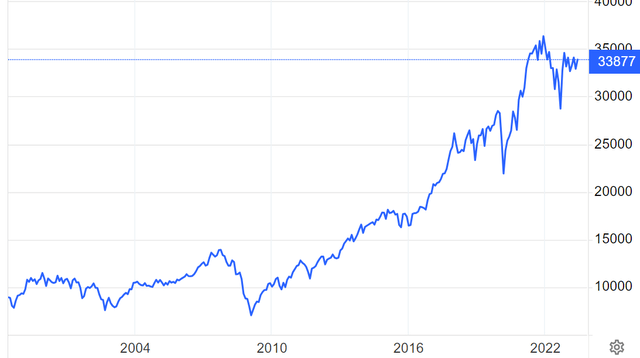

- The stock market corrected in 2022, but recently it bounced within the reach of the new all-time highs. The Fed has not been able to cause a deep correction in the stock market, either. The media is celebrating the “new bull” market, and analysts are raising the targets. Here is the chart of Dow Jones Industrials (DIA):

Trading Economics

The point is the Fed has been unable to burst the asset price bubbles, which is keeping the labor market resilient and inflation sticky via the wealth effect.

Thus, the Fed cannot pause until there is obvious damage to the financial markets. The FOMO speculators have challenged the Fed and ridiculed the “hawkish” rhetoric. To be fair, the Fed has been flirting with the “dovish pivot” since May 2022. The market is confident that behind it all, there is a dovish Fed ready to reinflate the bubble. The Fed has no credibility.

The Fed pause in June can trigger a massive FOMO rally. Why not? The Fed will has paused, the labor market is strong, and the economy is still growing. Soft landing. Except, inflation could come back with vengeance once the base effects are removed. And then what happens? More hikes, much deeper recession, bubble and bust.

Spotlight on homebuilders

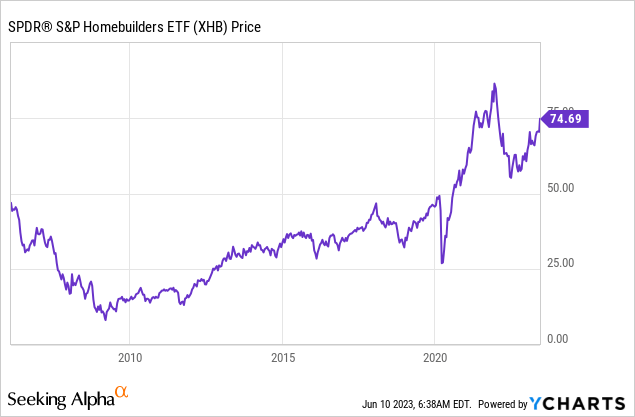

Homebuilders (NYSEARCA:XHB) are the most indicative of the current market environment, given the high sensitivity to short-term rates (for home improvement companies) and long-term rates (for actual homebuilders).

The homebuilder ETF XHB includes 36 companies, which include major homebuilders such as Pulte (PHM), building products companies such as Owens Corning (OC) and home improvement companies such as Floor & Decor (FND). Thus, this is a highly cyclical and interest rate sensitive sector.

Thus, from the macro level, given the Fed’s policy tightening, interest rate and QT, and the attempt to correct the housing prices, XHB should be in a deep drawdown. Yes, the price corrected in 2022, but it strongly bounced back in 2023, up 23% YTD, with new highs within reach.

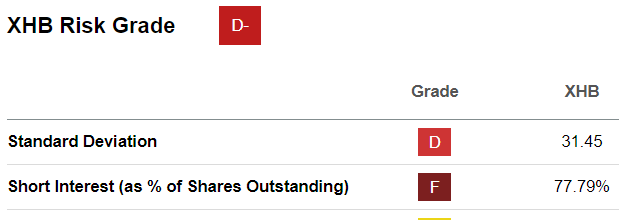

So, what’s pushing the homebuilders higher? I’m sure somebody could find a fundamental reason, such as home shortages. But one statistic will tell all – almost 78% of the shares outstanding are shorted. It’s obvious that XHB is vulnerable in this macro environment, and many are betting on the downside by shorting it.

Thus, XHB is a heavily shorted stock, and the recent bounce is likely just a massive short covering.

Seeking Alpha

More broadly, the entire market (SP500) is heavily shorted, and the recent rally is likely a massive short covering. But it’s the Fed who is allowing the bubble to inflate by flirting with a pause, and many investors will be “burned” when the bubble eventually deflates.

So, what should the Fed do?

The Fed needs to keep hiking until 1) there is obvious damage to the economy via the job losses, and 2) there is obvious damage to the financial markets until the asset bubbles deflate and the FOMO speculators are flushed out.

Pausing in June and waiting for the lagged effect makes no sense given the reflation in asset prices.

But, what the Fed will actually do is another story. We saw during the debt-ceiling debate that the policymakers don’t have any desire to disturb the financial markets. The US debt/GDP is heading towards 135% after the debt-ceiling deal, and there is a strong likelihood that Fitch will downgrade US debt by September. The market could be right, the Fed could be a “scared dove” and it might just pause in June.

As the key market implication, shorting this market, which includes SPX and XHB, is dangerous on the way up. Rather, wait to short on the way down if the Fed shows resolve in bringing inflation to 2%, if you are a trader. Otherwise, investors should be in 5+% Tbills. The FOMO paper profits must be realized, otherwise the paper profits could turn into real losses as the bubble deflates.

Read the full article here