Carlisle Companies (NYSE:CSL) has been a leading total return performance pick in both the diversified conglomerate and building products space on Wall Street over the past five years. Hundreds of items are sold through four divisions: Carlisle Construction Materials, Carlisle Weatherproofing Technologies, Carlisle Interconnect Technologies, and Carlisle Fluid Technologies.

The good news is the stock has severely underperformed over the past 6 months, perhaps opening a great opportunity to purchase shares. Operating margins on sales are much higher today than a decade ago, as the company has slowly divested non-core business lines. On top of this desirable financial position, returns on capital and assets continue to improve. So, I can argue the basic valuation of the stock, now below 10-year averages of underlying results, should be sitting nearer the high-end of any reasonable range.

Here’s why long-term investors may be wise to consider this name for inclusion in portfolio construction, especially if your goal is to achieve steady gains of +15% to +20% annually over the next 3-5 years.

The Business

Company products include single-ply roofing supplies, and warranted roof systems/accessories; thermoplastic membranes, insulation, plus engineered metal roofing and wall panel systems for commercial and residential buildings; high-performance waterproofing and moisture protection products, plus protective roofing underlayments; applied air/vapor barriers, sealants/primers and flashing systems, roof coatings, spray polyurethane foam and coating systems, block-molded expanded polystyrene insulation, engineered products, and premium rubber products.

Carlisle also manufactures optical fiber for commercial aerospace, military/defense electronics, medical device, industrial, and test and measurement markets; sensors, connectors, contacts, cable assemblies, complex harnesses, racks, trays, and installation kits, as well as engineering and certification services; engineered liquid, powder, sealants and adhesives finishing equipment; integrated system solutions for spraying, pumping, mixing, metering, and curing of coatings used in the automotive manufacture, general industrial, protective coating, wood, and specialty automotive refinishing markets.

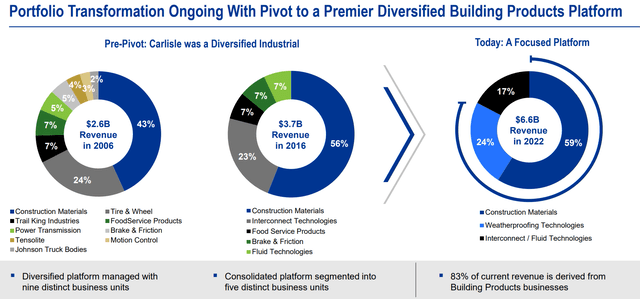

To say revenue generation comes from a diverse list of items may be something of an understatement. Nevertheless, the company has become more exposed to commercial building and home construction, for better or worse. You can review a March presentation slide below of the progress management has made in exiting lower margin, slower growth businesses, over the last 16 years.

Carlisle – March 2023 Presentation

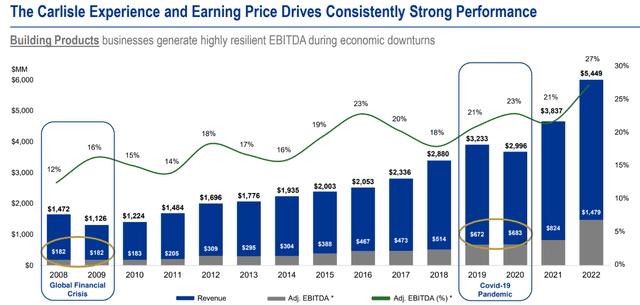

If there is any knock on the business model, it is the fact past and future recessions in the construction industry pull results lower for a spell. So, if you are worried about a deep recession later this year or next, avoiding a Carlisle position in entirely understandable. This worry is the main reason the quote has sharply underperformed the S&P 500 and other investments since late 2022. The current questions are how much lower should price fall to discount a recession, and what should the price be in a “soft landing” weakened-growth scenario for the global economy?

Carlisle – March 2023 Presentation

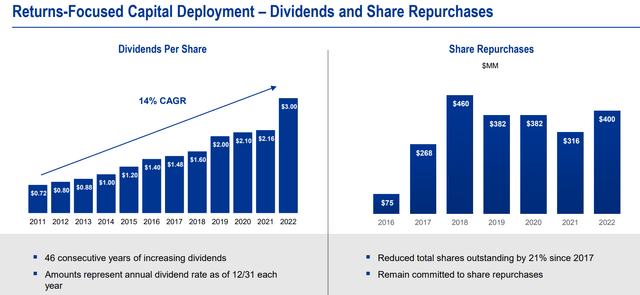

Graphs of the steady return of shareholder capital through dividends and stock buybacks are drawn below. For many investors looking for both stock price appreciation and income growth through higher dividends, Carlisle makes an excellent choice for the buy-and-hold crowd.

Carlisle – March 2023 Presentation

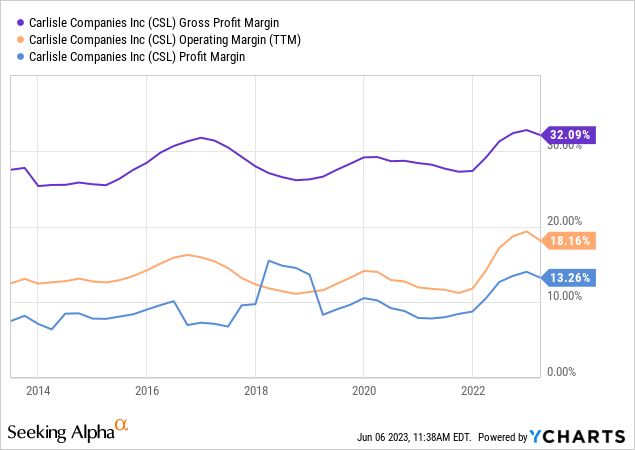

Again, as a function of divesting weaker businesses, the company’s gross, operating, and final net income margins on sales have reached modern records in 2022-23.

YCharts – Carlisle, Profit Margins, 10 Years

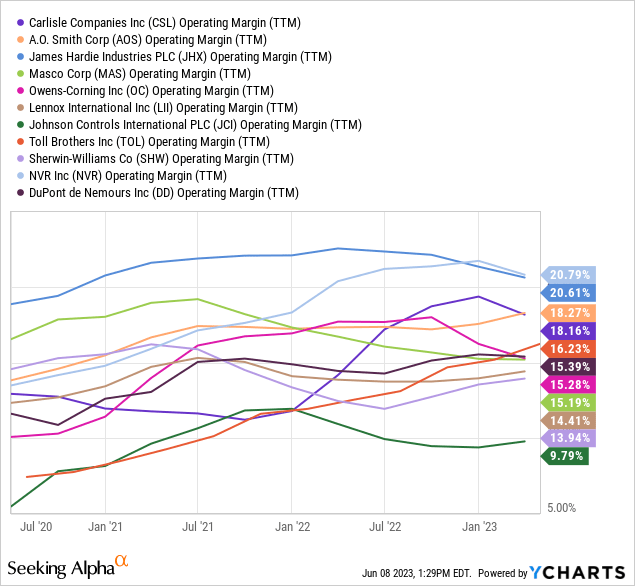

When we compare operating margins, for example, with peers and competitors in the building and construction marketplace, Carlisle scores quite well with an 18% setup. I have included A. O. Smith (AOS), James Hardie (JHX), Masco (MAS), Owens Corning (OC), Lennox (LII), Johnson Controls (JCI), Toll Brothers (TOL), Sherwin-Williams (SHW), NVR (NVR), and DuPont (DD) in my sort group.

YCharts – Carlisle vs. Building Product & Construction Peers, Trailing Operating Margin, 3 Years

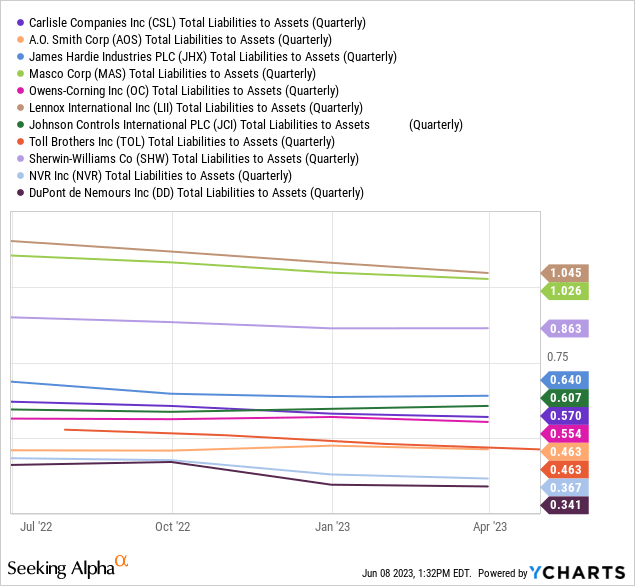

In terms of balance sheet strength, as a measure of total liabilities vs. assets, Carlisle is slightly less leveraged than the group average. This should allow margins to stay close to current levels, assuming a whopper economic recession is avoided.

YCharts – Carlisle vs. Building Product & Construction Peers, Total Liabilities to Assets, 1 Year

Valuation Story

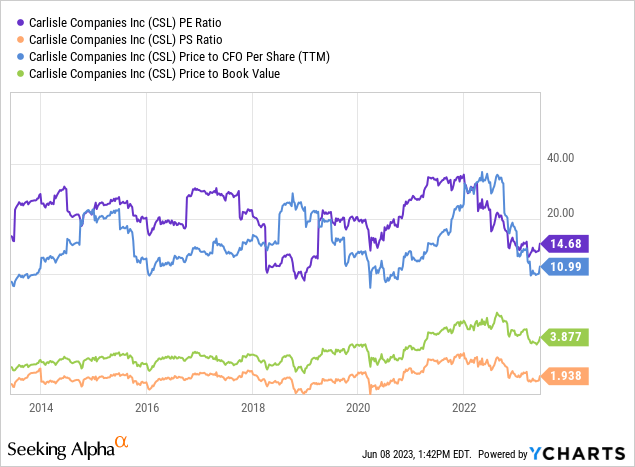

If operations are sound and margins high to rising, what should an investor pay to own a piece of the company? Well, the trailing valuation using basic ratio analysis is nicely below 10-year averages (except for price to book value). Price to earnings, sales, and cash flow are about as cheap as the 2020 pandemic valuation low right now.

YCharts – Carlisle, Price to Basic Fundamentals, 10 Years

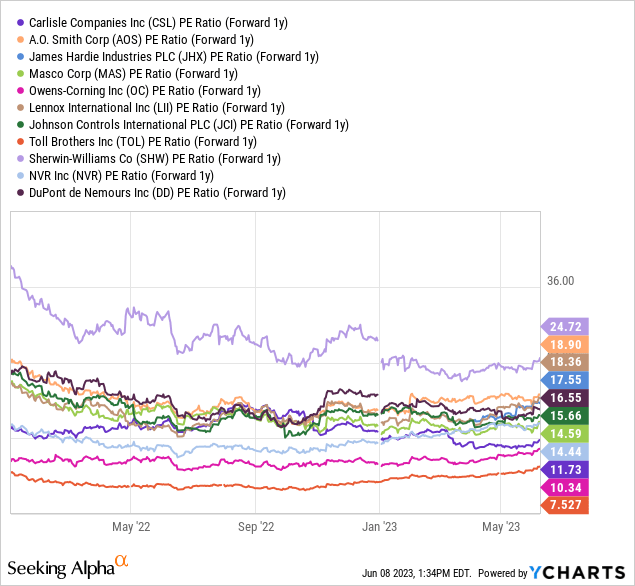

And, if we look ahead at forward 1-year analyst projections, Carlisle may be one of the biggest bargains in the peer group on expected earnings generation. At a multiple of 11.7x, shares are less expensive than the whole group except for lower margin, greater cyclicality picks Toll Brothers (home construction) and Owens Corning (less diversified focus on roofing and insulation).

YCharts – Carlisle vs. Building Product & Construction Peers, Price to Forward Projected 1-Year Earnings, Since January 2022

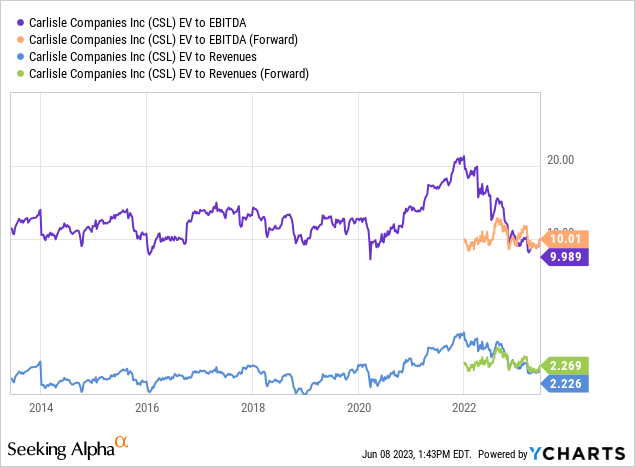

When we add debt and subtract cash from the total equity market capitalization, enterprise valuations look just as appealing for ownership. EV to sales of 2.2x is very near long-term averages, despite dramatically better operating margins than a decade ago. Plus, EV to EBITDA under 10x is approaching its lowest number over the last 10 years of 9x outlined in both January 2016 and March 2020. Plus, this ratio represents a real bargain vs. its 14x mean average on EBITDA and sharp discount from late 2021’s multiple of 21x.

YCharts – Carlisle, EV to EBITDA & Revenue Stats, 1 Year

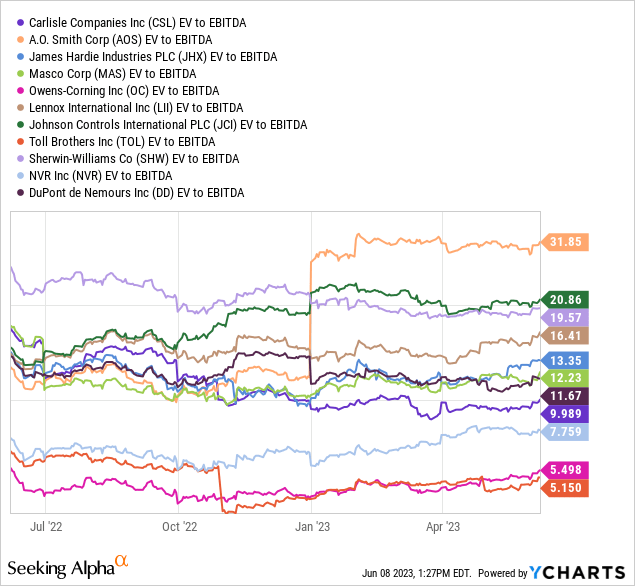

Enterprise value to EBITDA vs. the peer group is also the best setup outside of the same two cyclical names and another builder, NVR.

YCharts – Carlisle vs. Building Product & Construction Peers, EV to Trailing EBITDA, 1 Year

Technical Chart

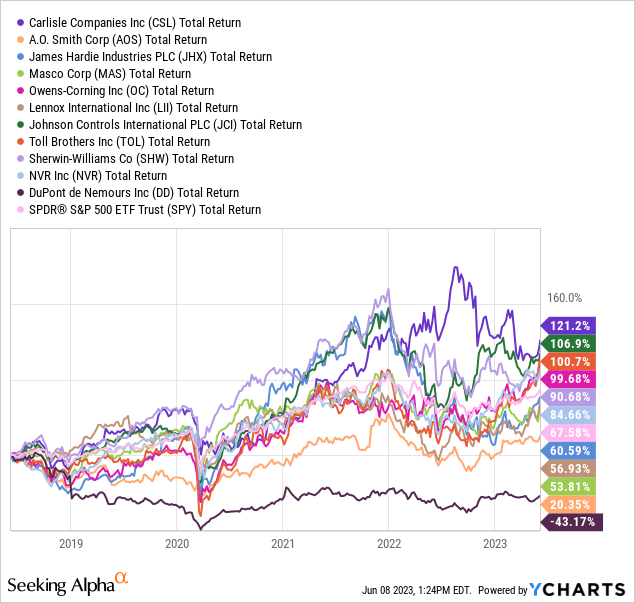

When we review both dividends received and share price appreciation, Carlisle has been a standout winner for investors over the last five years. Believe it or not, this investment has nearly DOUBLED the total return of the S&P 500 since 2018, without any exposure to the leading Big Tech sector.

YCharts – Carlisle vs. Building Product & Construction Peers, Total Returns, 5 Years

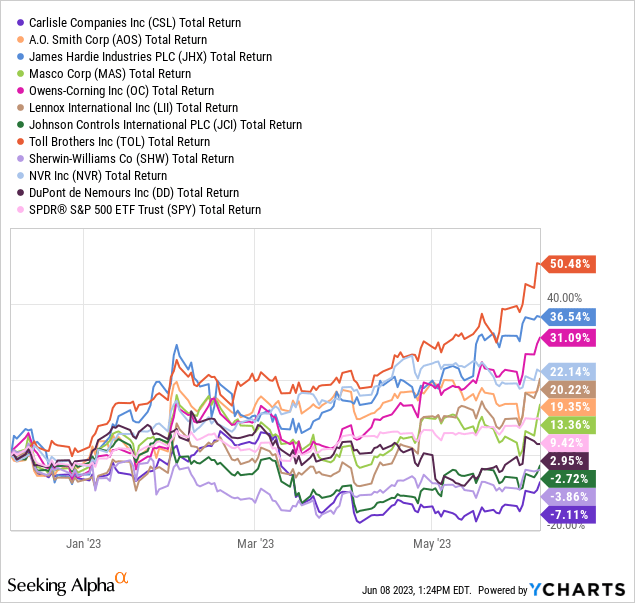

Nevertheless, Carlisle’s strong performance vs. the entire market and peer group has been shaved some over the latest 6-month period. In fact, Carlisle has flipped the script into the largest loser for shareholders since December.

YCharts – Carlisle vs. Building Product & Construction Peers, Total Returns, 6 Months

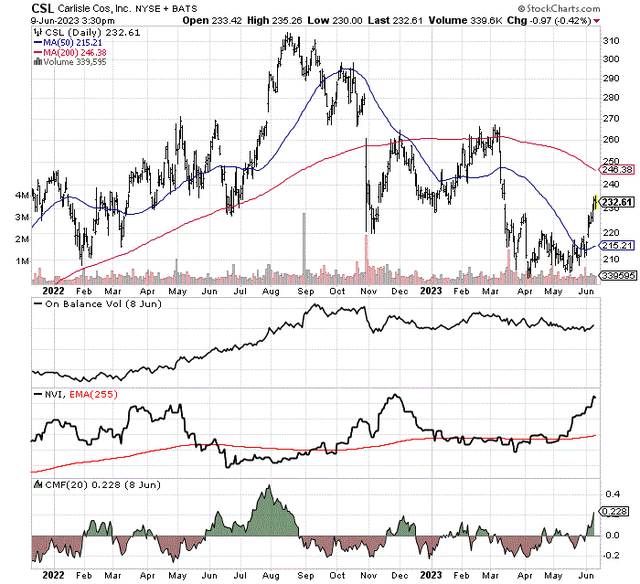

So, where is the stock headed going forward? My view is “outperformance” may resume in the second half of 2023, especially if a recession is avoided. Supporting this view, On Balance Volume trading on the technical chart has not declined materially from its September price peak above $313. This indicates very little net money has been taken out of the stock, despite its price dip.

Some aggressive buying has returned since May. You can see the dramatic jump in the Negative Volume Index over the last couple of weeks on the 18-month chart below. Essentially, plenty of buyers are using price weakness to buy shares after big volume days. In addition, the 20-day Chaikin Money Flow indicator just reached its highest reading since August.

Lastly, the 50-day moving average has turned higher and a price gap around $232 in March has been closed. I am thinking any new price strength next week would be a great sign that a reversal is underway.

StockCharts.com – Carlisle, 18 Months of Daily Price & Volume Changes

Final Thoughts

Is Carlisle a screaming buy or a terrific bargain idea today? No, but often blue-chips reach bottoms in subtle fashion, and zigzag higher again when you least expect it. Absent absolutely rotten business performance news in the last half of the year, I project the share price will wander higher in a bullish fashion, back to major price resistance in the $260 to $270 area. That’s where a number of price gaps higher and lower, plus the “shoulders” of a head-and-shoulders top took place over the past 12 months.

If the economy actually recovers next year, and demand for Carlisle building products grows, all-time highs above $313 could be coming in 12-18 months. From $233 a share now, such would deliver a +40% to +45% total return. Not bad from a safer conglomerate idea.

What’s the downside? For sure, a deep recession could push price under $200, maybe all the way to $170. Using a theoretical 5% drop in sales and 10% decline in EBITDA, the valuation at $170 would approximate the lowest ratio on net enterprise value since 2013. Considering all the operating margin/return improvements over the last decade, further price erosion would be difficult to sustain, in my view.

I rate shares a Buy, with potential upside of +45% over the next 12 months vs. downside of -30%. Not a spectacular initial reward/risk setup, but one tilted toward further gains after 2024. If the economy grows faster, Carlisle should create nice returns for owners over time. Remember, if the Fed can get inflation under control later in 2023 (2% to 3% YoY), a multi-year period of falling interest rates on new home and building construction loans could propel Carlisle business results.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here