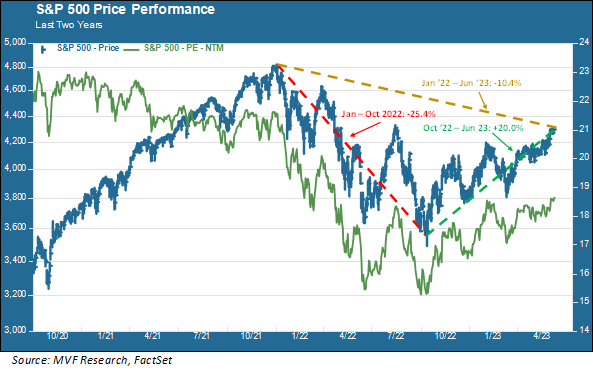

Let’s start with the good news. The “two cheers” in today’s headline are for the S&P 500 having clawed back gains of twenty percent from the low point of the index’s price trajectory reached in October last year. Twenty percent isn’t nothing. On Wall Street, in fact, a twenty percent gain is one of those magic milestone numbers signifying a transition from one thing to another, in this case from a bear to a bull. The chart below shows the market’s flight path since it last notched a record high back on January 3, 2022.

That’s the good news. The one cheer we have withheld from the celebration is the fact that the market’s progress to date from the October low still leaves us around ten percent (10.4 percent to be precise) below that January ’22 record high. We’ll offer a full-throated “three cheers” when the market hits that milestone, which in our opinion has a reasonably decent chance of happening within the current calendar year (remember that “our opinion” does not equate to anything remotely certain, and should not be construed as investment advice).

The Wall of Worry

Market pundits are fond of speaking of the “wall of worry” that stocks climb as they battle through the daily onslaught of risk factors. There have been plenty of those this year – the collapse of several prominent banks back in March, the ongoing tightening of credit conditions and the persistence of higher than desired inflation being prominent among them. In the past couple weeks the bond market seems to have changed its mind on the likelihood of near-term interest rate cuts by the Fed, leading to a narrative shift on monetary policy. Ahead of the FOMC meeting that concludes next Wednesday, the new consensus thinking is that the Fed may “skip” as opposed to “pause” – in other words, keep rates where they are for now, but likely raise them again for perhaps one final time in July. That’s a far cry from the consensus as recently as a month ago that June and July could see a Fed pivot to cutting rates.

All those things could still pour cold water on the stock market rally. So could a change of sentiment around that small number of megacap tech stocks driving the lion’s share of gains so far this year, as we discussed at length in last week’s commentary. This week, though, we have seen some tentative signs of life from other parts of the market that haven’t done particularly well this year, like value stocks and small caps. Perhaps a rotation is in the offing. Valuations in large cap tech stocks are expensive, but the market overall is still relatively moderately priced in comparison to recent historical levels, as shown by the next twelve months P/E ratio (green trendline) in the above chart). If the economy continues to surprise to the upside, e.g. ongoing resilience in the labor market and consumer spending, that could work to the benefit of some of those lagging sectors and asset classes.

Longer Cycles

What we should not assume, anytime soon, is that the market will be reverting to the patterns of the previous decade. Throughout the 2010s, downturns vanished almost as soon as they came into being. Remember the “Ebola crisis” of 2014? That consumed investors for all of two days before prices snapped back. Even the more substantial pullbacks of the decade – the near-default on the debt ceiling in 2011 and the attempted monetary tightening in 2018, both of which came within a whisper of that twenty percent bear market threshold – reversed and recaptured the previous record high within a matter of several months. Such are the tailwinds to risk assets provided by the lowest levels of benchmark interest rates in recorded history.

Those days are likely gone, for now at least. We expect to see longer cycles ahead, both for growth environments and for reversal periods like 2022. Does this mean that the bull market which officially started at this morning’s opening bell will have an extended run? Nobody knows, of course, but here’s hoping.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here