Overview

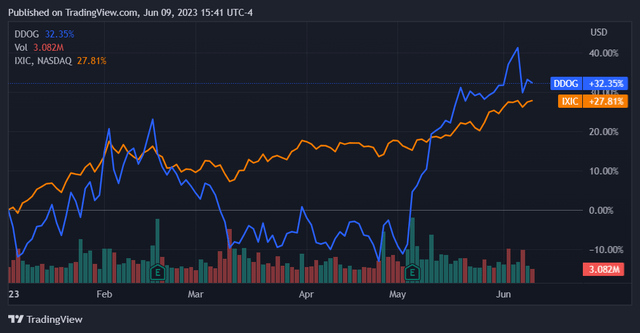

Datadog (NASDAQ:DDOG) is a leading software observability provider that continues to see momentum in its share price. After its latest earnings report, one in which it beat across both GAAP and non-GAAP metrics, DDOG stock has now climbed above the NASDAQ Composite in terms of YTD price return.

Seeking Alpha

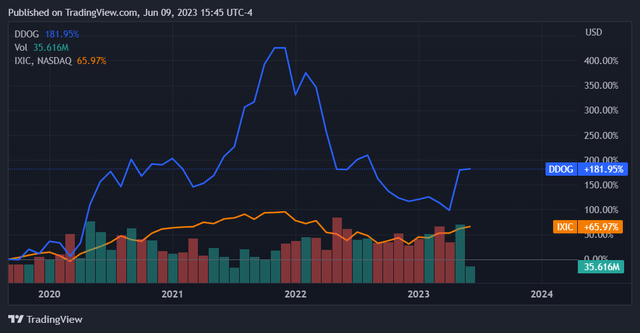

This is an extension of a history of outperformance from Datadog stock. Since its IPO in Q3 2019, it has generated a price return above the NASDAQ Composite. While not outperforming to the extent that it did throughout 2022, the stock’s price return has nonetheless maintained a premium above the index return throughout this time.

Seeking Alpha

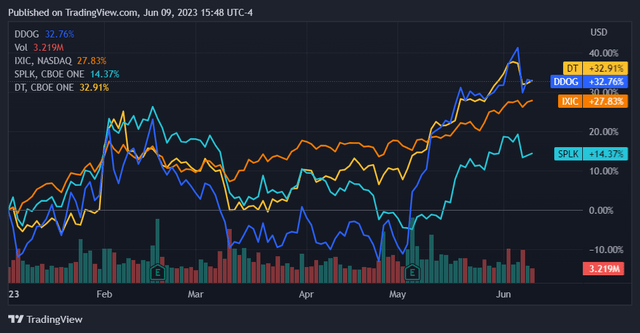

This has been a good stock to own. Of course, we must also consider how it has performed relative to its peers and not just the index at large. Datadog makes most sense to compare to other publicly traded companies focused primarily on software monitoring/observability; this includes Splunk (NASDAQ: SPLK) and Dynatrace (NYSE:DT).

While other firms do participate in this market, such as Cisco (NASDAQ:CSCO) and Amazon (NASDAQ:AMZN), these 3 companies are the ones that are focused primarily on this market and with software observability as their defining core competency. Here we can see that Datadog has performed roughly in line with Dynatrace this year, and that Splunk has been a notable laggard amongst the three.

Seeking Alpha

This article will focus on relative financials between Datadog and its two main competitors in the software observability space. This should present a clear picture of its fundamental positioning and valuation in order to determine whether the stock is still a good buy at current prices.

Datadog is currently the largest pure software observability player by market cap.

Seeking Alpha

Comparative Financials

The increasing complexity of software infrastructure and the continued utilization of cloud services architectures has created consistently increasing demand for advanced software monitoring solutions. For large-scale web-based applications, monitoring technology is critical to ensuring reliability while also getting a view into how data is flowing in real time. This trend is well reflected in growth rates for companies in the space.

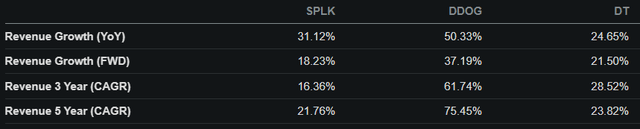

Comparing revenue growth rates across these three, we see that Datadog had the best revenue growth y/y and is also expected to have the best forward revenue growth across a 1-5 span. While all of these companies are growing at a brisk pace, Datadog’s numbers are well ahead of the pack; its 1-year forward growth rate is roughly double that of the other two and its 3-5 year CAGR is in another league entirely. It’s safe to say that Datadog is currently the fastest growing observability company at present.

Seeking Alpha

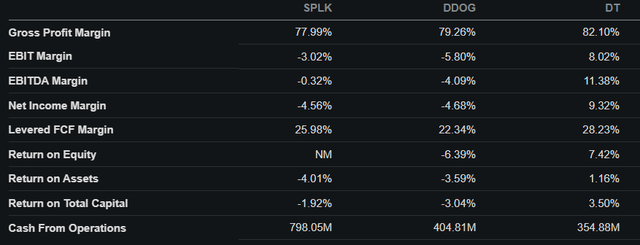

The profitability picture presents a different angle. Each of the companies has a similar gross margin of roughly 80%, but only Dynatrace is converting this into net income at present. Datadog and Splunk are both unprofitable. Furthermore, Datadog has the worst levered FCF margin out of the 3 as well as inferior cash from operations when we consider its size. With a market cap roughly double that of the others, Datadog is pulling in half the cash from operations that Splunk is while only being marginally ahead of Dynatrace.

Seeking Alpha

Datadog has a ways to go with profitability. In contrast to it being the market leader on growth, I would certainly consider it a laggard when it comes to generating profits and cash flows. This is sensible as it is funneling resources into continuing to grow. I am hesitant to read too far into this, but investors should be aware that Datadog still needs to cross the threshold into profitability and should be traded with that in mind.

Seeking Alpha

At its latest quarterly diluted EPS of -$0.27 and operating income of -$104M, breakeven should be no more than one or two quarters out. Datadog is evidently further along the path to profit than Splunk is. The robust margins of the observability business indicate that the company should have no problem becoming profitable.

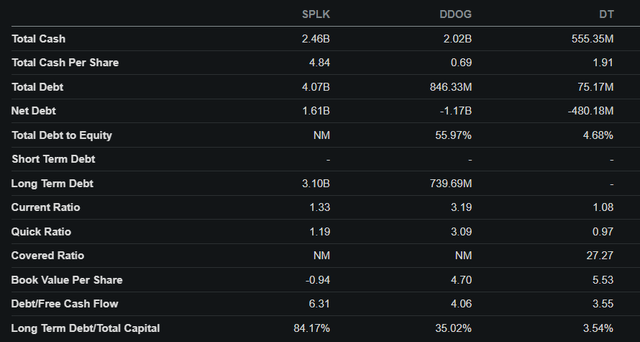

Looking over at these companies’ balance sheets, we see that Datadog is relatively well-positioned. Overall, it appears to have the best balance sheet out of the three. It has the best net debt position and the best leverage ratios.

Seeking Alpha

While Dynatrace is less levered overall, Datadog’s strong liquid asset base more than compensates for the difference here. On the other hand, Splunk appears highly leveraged relative to the other two and is the only one with a negative book value per share. Since both Splunk and Datadog are pushing to profitability, I think Datadog is in a better position to capture economic gains due to its balance sheet.

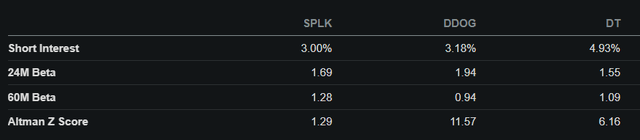

Overall, comparing the balance sheets gives me confidence that Datadog has the foundations that it needs to continue growing while having the freedom to improve unit economics. Its financial strength can be corroborated by taking a quick look at its z-score, an indicator of financial resilience. Here Splunk is in risky territory, while Dynatrace can be considered healthy and Datadog can be considered exceptional. Interestingly, short interest percentages do not appear to neatly reflect the relative balance sheets across these firms; this indicates a potential disparity in relative valuations.

Seeking Alpha

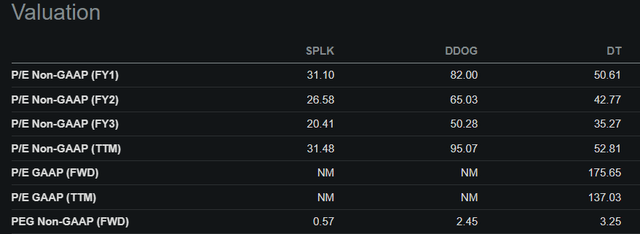

Looking into valuations further, we see that this is indeed the case. Datadog is trading at a significant premium across the board, including trailing twelve months non-GAAP earnings as well as forward expected earnings for the 3 years ahead. This stock reflects its growth expectations and is priced well into the future.

The interesting metric here is the PEG ratio, which accounts for P/E multiplied by the forward EPS growth rate for each of these firms. Here Splunk looks quite cheap overall, while Datadog also appears relatively cheap as compared to Dynatrace. While Datadog’s P/E multiples are still higher than those of Dynatrace for the three years ahead, its lower PEG indicates that its growth thereafter is underpriced. This indicates to me that Datadog stock is not as overpriced as it may seem from a buy-and-hold perspective.

Seeking Alpha

Overall, the picture here is nuanced. However, it is also clear that Datadog is the leading player in several key respects.

Risks

The risk here is that Datadog can’t meet growth expectations. This is a growth stock and is priced as such. Its current price reflects a valuation that it won’t ‘grow into’ for more than 3 years. A slowdown in the cloud monitoring/observability market, or Datadog’s business in particular, would compress growth rates and subsequently erase some of its growth multiple.

Conclusion

Overall, I like what I see with Datadog. It has the best balance sheet in the space while also having the best revenue growth metrics; this is an excellent combination to have. While the stock’s price already reflects this reality, I think that it is still a good buy for the long term.

As Datadog continues to grow at these brisk rates, it will likely maintain a significant growth premium in its shares, pulling expected future growth forward into current share price as we see in the present. It is also on the cusp of profitability and will likely see its trading multiple benefit further as it crosses this threshold. Being the largest pure observability player already, all of this puts Datadog in a position to continue leading its market. I’m calling it a buy for investors with a five to ten year horizon.

Read the full article here